Anodized titanium is used in multiple aerospace, medical, automotive, and consumer electronics applications due to its superior properties. Between the years 2025 to 2035, the anodized titanium market is predicted to grow at a massive rate, resulting in tenfold growth.

As a result, since titanium possesses numerous benefits, such as corrosion resistance, wear resistance, and charming aesthetic, titanium anodization offers a well-suited methodology for processing within high-performance uses. Market drivers include the growing utilization of anodized titanium as an innovative medium in several fields, owing to its low weight, durability, and biocompatibility.

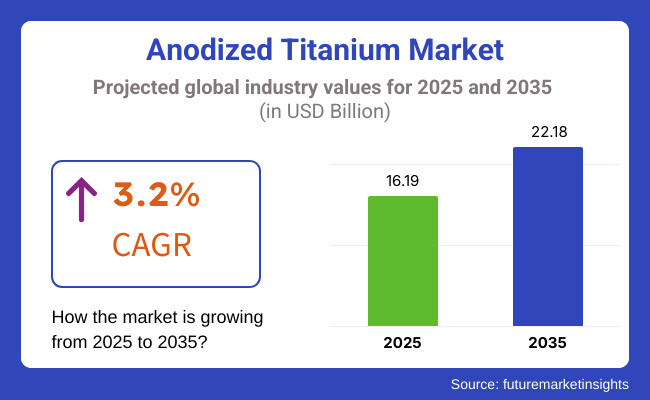

The market is estimated to reach USD 22.18 billion by 2035, growing at a CAGR of 3.2% in the 2025 to 2035 period. The growth is also said to be driven by innovation in anodizing technologies, colours and environmentally friendly surface treatments. Other applications as well as such coatings of potential decorative and functional use are supported by an accelerating demand.

North America dominates the anodized titanium market, owing to notable demand from the aerospace, medical and defence industries. The USA and Canada has top position in the global market due to high investment in advanced materials, strict quality standards and technological innovation.

Anodized titanium is also regarded as a lightweight and corrosion-resistant material, making it ideal for components such as fasteners and structural components in the aerospace sector of the light-weighting industry. Anodized titanium is used for medical implants, surgical instruments, and orthopaedic devices, requiring biocompatibility and wear resistance in the medical field.

The applications of anodized titanium are also growing in defence and military, with uses in protective equipment, armoured vehicles, and components of advanced weapons. The expanding consumer electronics industry further drives demand, with businesses using anodized titanium on cell phone casings, watches, and luxury accessories.

Germany, the UK, France, and Italy are some of the largest players in the automotive, aerospace, and industrial manufacturing markets in Europe which means Europe accounts for a significant share of the anodized titanium market. Anodized titanium is incorporated to enhance durability and performance in engine components and landing gear systems in the European aerospace sector.

To an even greater degree, the automotive industry is utilizing aluminium titanium for lightweight chassis components, decorative trims, and exotic exhaust systems. In line with sustainability policies in Europe, researchers investigate greener alternatives to electrochemical anodizing processes with lower energy and environmental impact. A growing medical device industry and increased use of titanium implants and prosthetics has driven demand for anodized surfaces that are biocompatible.

Asia-Pacific is projected to exhibit the fastest growth owing to swift industrialization and increase in health care expenditure, and expansion of the aerospace and automotive sectors. The market is segmented by Region (China, Japan, South Korea, India, and Rest of Asia) Titanium-based material are the primarily used in electronic, healthcare and defence sectors thus China and Japan are leading manufacturers.

Anodized titanium is used in the transportation industry to make Electric Vehicles (EV) and high performance cars, lighter and more efficient. The demands are most important in the medical field, where titanium-based implants, dental fixtures, and orthopaedic components are increasingly prevalent.

Moreover, the rising demand for coloured and anodized titanium parts such as wearable, smart devices, and premium electronic accessories in South Korea and China is projected to contribute to the expansion of coloured and anodized titanium industry due to the rise in consumer electronics market in these regions.

Challenge

High Initial Processing Costs

Anodizing titanium is equipment and skill-intensive; it is a precision process and requires a fair amount of trial and error to hone. For anodizing, this requires an initial capital investment for power intensive electrolytic systems, chemical baths and a platform for quality control. Moreover, the need for consistency in surface finish, coloration, and durability adds to the cost of process monitoring to keep operations running at a high level.

Cost challenges restrict market penetration: In price-sensitive industries where cost competitiveness is critical, market penetration remains a challenge, leading manufacturers to seek out cost-effective anodizing processes and greater automation solutions that enable greater scalability and lower cost structure.

Opportunities

Expansion of Medical Applications

Biocompatibility, corrosion resistance, and enhancing the performance of devices have further made the medical industry to build on anodized titanium for improving the longevity of implants. Anodized coatings can improve the wear resistance of orthopaedic and dental implants, as well as surgical instruments used in medical procedures, and limit allergic reactions.

The increasing need for sophisticated medical solutions, together with continuing innovations in biomedical coatings, is broadening titanium’s use in the medical sector. Studies are based on research regarding extensive optimization of the anodizing process, particularly specific anodizing parameters, to improve cell attachment, antimicrobial action, and implant efficiency, thus ensuring that anodized titanium is one of the advanced materials in the field of the biotechnology industry.

2020 to 2024: Growing Demand in Aerospace, Medical, and Consumer Goods

Between 2020 and 2024, the anodized titanium market expanded as the metal found its way into aerospace, medical, automotive, and consumer goods applications. There is also found wide application for anodized titanium in the form of complex custom surgical implants, aerospace parts, and high-end jewellery owing to versatile biocompatibility along with excellent lightweight and corrosion resistant properties.

Specialized simple anodized titanium for properties were used to improve corrosion resistance to ensure that surface hardness, wear and tear in important aircraft components. Similarly, anodization has been adopted by medical device manufacturers to enhance the biocompatibility and surface aesthetics of a variety of implants including orthopaedic screws, plates, and dental implants.

Due to its lustrous appearance, strength and hypoallergenic properties, anodized titanium became common in the jewellery and consumer electronics field. Anodized titanium has been used in the luxury watch and eyewear market and also for other decorative purposes due to the ability to create colourful, permanent surface finishes without dyes or coatings.

On the other hand, high processing costs and lack of awareness of merits of anodized titanium viscose were challenging for the market. Moreover, due to differences between anodization processes and the specialized equipment and know-how necessary for anodization, small manufacturers faced barriers to entry in the process.

Eco-Conscious Anodization Processes The market was also shaped by environmental factors, leading industries to seek eco-Friendly anodization methods that reduce waste, chemical, and energy consumption. The extensive research in aqueous electrolyte solutions and plasma electrolytic anodizing techniques created a light at the end of a tunnel for potential breakthroughs.

2025 to 2035: Technological Advancements, Sustainability, and Expanded Applications

From 2025 to 2035, presence of new anodization techniques, sustainability efforts, energy storage applications, and developments in nanotechnology will have a significant impact on the anodized titanium market.

This will fuel the adoption of newer anodization techniques such as plasma electrolytic oxidation (PEO) and micro-arc oxidation which improve coating uniformity, hardness, and functional performance. Such advances will strengthen titanium’s resistance to extreme heat, friction and chemical exposure, making it even more valuable for space exploration, military hardware and marine engineering.

The market will be defined by the theme of sustainability. And manufacturers will increasingly adopt water-based, non-toxic anodization processes that minimize hazardous waste and carbon pollution. Legislation to include closed-loop anodization systems and recyclable titanium alloys will comingle with preceding international environmental aspirations and encourage eco-friendly industries to participate.

In addition, the medical sector will remain a major growth driver, as anodized titanium will be utilized in next-gen implants, bioelectronics devices and prosthetics. Moreover, increased Osseo integration, infection resistance and enhanced healing with the use of artificial intelligence-powered customized Osseo integrated implants and surface modification techniques will be developed.

We would see emerging new avenues for anodized titanium, particularly in the energy sector. Anodized coatings based on titanium will improve performance in hydrogen fuel cells, batteries, and solar cells, promoting the renewable energy revolution.

With demand for lightweight, corrosion-resistant, and high-performance materials rising, anodized titanium will become essential for electric vehicles (EVs), high-speed rail, and advanced robotics. Digital manufacturing technologies such as 3D printing of anodized titanium components will also spur innovation, increases in design flexibility, and reductions in material waste.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Growing awareness of eco-friendly anodization techniques. |

| Technological Advancements | Early adoption of plasma-based anodization and nanostructured coatings. |

| Industry Adoption | High demand in aerospace, medical devices, and jewellery. |

| Sustainability Trends | Research on low-energy anodization techniques. |

| Market Growth Drivers | Increased demand for lightweight, durable, and corrosion-resistant materials. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability regulations, non-toxic electrolyte mandates, and closed-loop processing. |

| Technological Advancements | Advanced AI-driven anodization, micro-arc oxidation, and hybrid surface treatments. |

| Industry Adoption | Expansion into energy storage, EVs, AI-driven medical implants, and advanced robotics. |

| Sustainability Trends | Widespread adoption of zero-waste processing, recyclable titanium alloys, and carbon-neutral production. |

| Market Growth Drivers | Rapid innovation in biocompatible implants, hydrogen fuel cells, and high-performance coatings. |

The Anodized Titanium Market in the United States continues to dominate owing to the increasing demand from the Aerospace, Medical and Automotive sectors. The corrosion-resistant and biocompatible features of titanium, imparts for need of this material in medical implants, whereas the light weighted feature increases its adoption in the aerospace sector.

Furthermore, the increasing inclination towards durable and visually pleasing materials in consumer goods such as jewellery and electronics is accelerating the market growth. New anodizing techniques continue to make titanium both tougher and more attractive.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.1% |

Industrial manufacturing, defence, and healthcare applications are propelling the growth of anodized titanium in the United Kingdom. More and more titanium is used in biomedical applications; prosthetics especially, along with dental implants, as its strength and biocompatibility make it a natural fit. In addition, UK plans for advanced manufacturing techniques and sustainable material usage are further promoting market growth Furthermore, its use in architecture and luxury goods is fuelling its demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.0% |

Growth of German and Italian Industries Such as Automotive, Medical Devices, and Consumer Goods Demand for Anodized Titanium in the Anodized Titanium Market in the European Union Is Further Impeding.

Some high-performance automotive components are made of titanium due to its lightweight and durable nature, while its biocompatibility leads to its increasing use in medical implants and surgical instruments. The sustainable use of materials and advances in surface treatment technologies are some other factors contributing to the growth of this industry.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.2% |

Increasing adoption in electronics, automotive, and medical industries is driving the growth of the Japan Anodized Titanium market. Titanium has specific properties that make it an attractive material for luxury consumer electronics, such as smartphones and wearable devices. The country’s advanced manufacturing processes and emphasis on precision engineering also drive market growth. Rising demand for titanium-based medical implants due to the aging population also contributes to growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.3% |

In South Korea, there is a growing demand for anodized titanium due to its application in consumer electronics and automotive industries. A robust presence in semiconductor manufacturing and electronics innovation in the country is enabling the adoption of titanium components in high-tech products, it adds.

Moreover, rising adoption of titanium in electrical vehicles components and aeronautic applications are also aiding the market growth on ongoing basis. The growing need for lightweight and corrosion-resistant materials in the manufacturing of industrial machinery is also contributing significantly to the market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.4% |

As industries seek better corrosion resistance, aesthetic appeal, and increased durability for titanium-based components, the anodized titanium market shows no signs of slowing down. Titanium utilize an anodizing process that builds a controlled oxide layer on the surface with higher wear resistance, lower friction, and better colour customization without losing desirable lightweight and high-strength properties.

From aerospace and medical devices to automotive and consumer electronics, anodized titanium is trusted for its ability to take performance to the next level, whilst having a sleek and contemporary look. Besides, anodized titanium also has essential uses in medical implants and surgical instruments where sterility and longevity are crucial due to its innate biocompatibility.

Titanium Dioxide Leads the Market Due to Its Strong Protective Properties

The largest market share belongs to titanium dioxide due to high stability and good corrosion resistance and the formation of a strong anodized layer. Titanium dioxide is favoured by manufacturers in industry, aerospace and building works where there is a need for durability and resistance to environmental exposure.

In medicine, titanium dioxide coatings are used to increase the lifespan of implants through the creation of a biocompatible, non-reactive surface that reduces the risk of wear and allergic reaction. Its low thermal conductivity also makes it desirable for a host of high-performance engineering applications such as turbine blades, heat exchangers and sporting goods.

However, in some applications, titanium dioxide can be too expensive, with manufacturers investigating some of the above optimized anodizing techniques as well as using other titanium oxides.

Titanium Tetroxide Gains Traction in High-performance Applications

Titanium tetroxide is arising as a novel high-performance alternative owing to its outstanding conductivity and durability. Titanium tetroxide anodization is finding use in various industries including those involved in electronic components, aerospace coatings, and precision instruments to enhance energy and efficiency of the component and their longevity.

Titanium tetroxide is advantageous for electrochemical applications (i.e. fuel cells, batteries and biomedical devices), as its high electrical conductivity and chemical stability allow it to outperform conventional anodized coatings. Although it's not as large of a segment as titanium dioxide, continued research and improvements in titanium oxidation processes are predicted to increase its use in the years to come.

Wear Resistance Anodizing (Type-2) Enhances Durability in Industrial and Aerospace Applications

Type-2 (As Anodic Oxide) - Wear Resistance (Type-2) anodizing is the most common anodizing on the market because it dramatically enhances titanium wear resistance, hardness, & scratch resistance. This process makes use of high performance in aerospace, automotive, and manufacturing industrial applications where mechanical stress, abrasion, and harsh environments require improved material durability.

Type-2 anodizing is widely used in military tooling, aerospace parts, and high-performance automotive applications, where the increased hardness of the resulting surface improves wear characteristics and extends lifespan. Marine industries also utilize anodized titanium due to its resistance to corrosion, sap work, and also salt water in offshore equipment, propellers, and underwater structural components.

Type-2 anodizing provides a better surface protection, however manufacturers must always consider process costs and energy consumption in order to make large-scale productions more economical. Industries have begun to optimize wear-resistant anodizing techniques thanks to data innovations in plasma electrolytic oxidation and controlled electrolyte formulations.

Color Anodizing (Type-3) Gains Popularity in Consumer and Medical Applications

As per this anodizing types analysis report, colour anodizing (Type-3) is expected to grow notably in projected times, particularly due to demand for applications in consumer electronics, jewellery, medical implants, and architecture where customization and appearance are essential. This method enables manufacturers to produce bold, enduring colours without the need for typical coatings or dyes, resulting in fade-resistant and eco-friendly coloration.

In healthcare: when manufacturing surgical tools, orthopaedic implants or dental components, medical device manufacturers think outside the box with Type-3 anodizing. Luxury brands and consumer electronics companies also favour colour anodized titanium in wearables, smartphones, and premium accessories, to provide product differentiation and durability.

The fashion and automotive sectors reportedly require unique finishes, gradient colours, and iridescent coatings in their products, and so have a burgeoning need for Type-3 anodized titanium. But uniformity of coloration on relatively large batches is a technical challenge that motivates studies on electrolyte innovations and nanostructured surface modifications.

Industries like aerospace, medical devices, automotive, and consumer goods are increasingly requiring high-performance coatings that are lightweight, corrosion-resistant, and aesthetically pleasing, which is driving the growth of the anodized titanium market.

They would then spend more time on advanced anodizing techniques, custom colour finishes and durable coatings for extreme conditions. Formulating with new electrolytes for more consistent colour production and adopting greener anodizing processes that lower waste and energy consumption. Growing Performance Demands, the Market Is Well-Positioned for Consistent Growth

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Techmetals | 14-18% |

| TIODIZE | 12-16% |

| HPL Stampings | 10-14% |

| G & J Steel & Tubing | 8-12% |

| Light Metals Coloring | 6-10% |

| Leatherwood Manufacturing | 5-9% |

| Aalberts Surface Technologies | 5-9% |

| AOTCO Metal Finishing | 4-8% |

| SIFCO ASC | 3-7% |

| Electrohio | 3-7% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Techmetals | Develops high-performance anodized titanium coatings, specializing in precision aerospace, medical implants, and industrial applications. |

| TIODIZE | Pioneers proprietary titanium anodizing techniques, including TIOLON coatings for enhanced corrosion resistance and biocompatibility. |

| HPL Stampings | Provides custom anodized titanium components, catering to precision medical, aerospace, and electronics applications. |

| G & J Steel & Tubing | Manufactures tubular anodized titanium solutions, ensuring high-strength, lightweight performance for automotive and industrial sectors. |

| Light Metals Coloring | Specializes in custom anodized titanium finishes, offering decorative and functional coatings for consumer and medical industries. |

| Leatherwood Manufacturing | Delivers military-grade anodized titanium coatings, improving durability and wear resistance for defence applications. |

| Aalberts Surface Technologies | Focuses on advanced anodizing and surface treatment solutions, integrating protective coatings with increased thermal and corrosion resistance. |

| AOTCO Metal Finishing | Supplies high-purity anodized titanium coatings, catering to precision engineering and high-performance industrial sectors. |

| SIFCO ASC | Provides localized anodized titanium plating services, enabling selective surface enhancement for aerospace and high-end manufacturing. |

| Electrohio | Develops durable, colour-anodized titanium finishes, enhancing decorative and functional applications for various industries. |

Key Company Insights

Techmetals (14-18%)

Techmetals dominates the anodized titanium market, providing high-durability coatings for aerospace, medical, and industrial applications with enhanced corrosion resistance and colour consistency.

TIODIZE (12-16%)

TIODIZE innovates in proprietary anodizing techniques, offering TIOLON coatings that enhance wear resistance, thermal stability, and biocompatibility for medical and aerospace sectors.

HPL Stampings (10-14%)

HPL Stampings focuses on customized anodized titanium solutions, supplying precision components for medical devices, aerospace, and high-performance industrial applications.

G & J Steel & Tubing (8-12%)

G & J Steel & Tubing manufactures tubular anodized titanium solutions, improving strength, corrosion resistance, and lightweight performance for automotive and aerospace industries.

Light Metals Coloring (6-10%)

Light Metals Coloring specializes in decorative and functional anodized titanium coatings, offering custom colour finishes for consumer electronics, medical devices, and precision components.

Leatherwood Manufacturing (5-9%)

Leatherwood Manufacturing delivers military-grade anodized titanium coatings, focusing on enhanced wear resistance, extreme durability, and long-lasting protection.

Aalberts Surface Technologies (5-9%)

Aalberts Surface Technologies enhances titanium anodizing capabilities, providing custom coatings with improved thermal performance and corrosion resistance for high-end applications.

AOTCO Metal Finishing (4-8%)

AOTCO Metal Finishing specializes in high-purity anodized titanium finishes, meeting the needs of precision engineering and high-performance industrial markets.

SIFCO ASC (3-7%)

SIFCO ASC develops selective anodized plating services, offering localized surface enhancements tailored for aerospace and defence sectors.

Electrohio (3-7%)

Electrohio advances colour-anodized titanium solutions, integrating decorative and functional coatings for automotive, electronics, and industrial components.

Other Key Players (30-40% Combined)

Several companies contribute to advanced anodizing techniques, custom colour anodized finishes, and high-performance coatings. These include:

The overall market size for the Anodized Titanium Market was USD 16.19 Billion in 2025.

The Anodized Titanium Market is expected to reach USD 22.18 Billion in 2035.

The demand is driven by increasing use in aerospace, medical implants, consumer electronics, and automotive industries due to its enhanced corrosion resistance, durability, and aesthetic appeal.

The top 5 countries driving market growth are the USA, UK, Europe, Japan, and South Korea.

Titanium Dioxide is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Titanium Aluminide Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Titanium Tetrachloride (TiCl4) Market Size and Share Forecast Outlook 2025 to 2035

Titanium Powder Market Size and Share Forecast Outlook 2025 to 2035

Titanium Nitride Coating Market Size and Share Forecast Outlook 2025 to 2035

Titanium Aluminides (TiAl) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Titanium-Free Food Color Market Analysis - Size, Share & Forecast 2025 to 2035

Titanium Dioxide Color Market Trends - Applications & Industry Demand 2025 to 2035

Titanium Diboride Market Growth – Trends & Forecast 2024-2034

Titanium-Free Food Color Alternatives Market

Titanium Market

Titanium Dioxide Market

Aviation Titanium Alloy Market Analysis by Type, Application, Microstructure, and Region: Forecast for 2025 to 2035

Aerospace Titanium Market Size and Share Forecast Outlook 2025 to 2035

Free-from Titanium Dioxide Market Size, Growth, and Forecast for 2025 to 2035

Food Grade Titanium Dioxide Market Analysis by Dairy Products, Bakery and Confectionery, Sauces and Savoury products and Others Applications Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA