The animal theme parks industry will develop consistently from 2025 to 2035 as demands for wildlife experience and recreation continue to rise for families. Theme parks are entertaining and educational facilities based on a live animal theme.

Theme parks have become tourism centers as international tourists and domestic tourists throng to them. Development is driven by rising disposable income, tourism infrastructure development, and growing emphasis on conservation efforts in order to raise awareness of biodiversity.

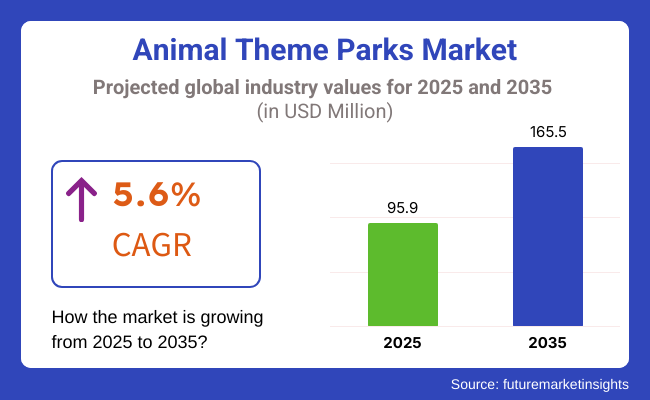

Animals 2025 theme park industry was around USD 95.9 Million. It will be USD 165.5 Million in 2035 with a 5.6% compound annual growth rate (CAGR). It is propelled by new park construction, redevelopment of the old ones, and investments in newer rides like virtual safaris, interactive animal encounters, and green feature rides. The sector also benefits from partnerships with conservation societies and charitable groups to bolster their environmental and educational integrity.

North America is also one of the top zones of the animal theme park industry. The United States and Canada both have some of the best-established and venerable animal parks. Industry players in the region are constantly bettering themselves with advanced features such as augmented reality experiences, interactive exhibits, and high-tech enclosures.

Additionally, North American parks are serving as role models by introducing conservation programs, where the popularity aspect is used to support wildlife rehabilitation and research programs. The twin game of entertainment and conservation keeps the region at the top in the market.

The European animal theme park sector is characterized by its conservation and sustainability orientation. The top theme parks in the UK, France, and Germany are characterized by their large-scale breeding programs, collaborations with international conservation organizations, and educational efforts.

Tourists come to visit Europe's mature infrastructure and unique animal exhibits featuring mostly endangered or rare animals. Aside from this, animal parks' environment education programs and environment tours by the government's subsidies have a guarantee to lead to longer periods of future expansion of the parks to that which their extended national and overseas travel appeal can be guaranteed.

Asia-Pacific region is witnessing extremely fast growth in the business of animal theme parks due to the fast-growing middle class population, increase in disposable incomes, and shift in consumer choice towards family-oriented outdoor entertainment activities.

China, Japan, and South Korea are heavily investing in massive-scale animal parks with a one-of-its-type theme. Locally or regionally available species have a tendency to offer the anchor attraction for the parks. Apart from this, Asia-Pacific parks are using digital technologies to enrich visitors' experiences, such as mobile apps for guided tours, interactive displays, and live feeding of animals broadcasted over the web.

Animal Welfare Regulation and High Operational Cost

High operational costs, stringent animal welfare regulations, and changing public perceptions of captive wildlife attractions are challenges for the animal theme parks market. The social and care requirements of a large parks, like feeding, vet care and habitat maintenance, are many and require a lot of money. Moreover, legal frameworks such as the Animal Welfare Act, CITES, and local wildlife protection laws place strict requirements on how animals are treated, conserved, and used ethically within theme parks.

If you are focusing on older data ⎼ the landscape of both animal rights and conservation ethics is rapidly evolving, so consumer perceptions of animal-based entertainment will be forced to change too. Before we lose sight of the real issues, parks should focus on building advanced habitat enrichment programs, ethical conservation initiatives, and transparent animal welfare policies that support sustainability goals commensurate with public trust.

Growth of Interactive and Conservation-Driven Experiences

The increasing focus on conservation education, wildlife-centric experiences, and sustainable practices creates immense growth potential for the Animal Theme Parks Market. Visitors are increasingly demanding interaction with animals in ethical and immersive ways, spurring demand for open-habitat safari parks, virtual reality (VR) wildlife encounters and educational conservation engagement.

As the enhanced experience of terrestrial wildlife through augmented reality (AR) and artificial intelligence (AI) continue to grow in engineering excellence, theme parks are also trying to capitalize on new technology to deliver an equally engaging experience without relying on live animals.

Also, the adoption of green initiatives like solar-powered animal enclosures and water-saving habitat maintenance is revolutionizing the field. The future animal theme parks will be led by companies specializing in providing ecological experiences, utilizing AI for animal monitoring, and promoting local wildlife saves.

In particular, a steady growth in the Animal Theme Parks Market was seen between 2020 and 2024 owing to the increase in tourism, and growing eco-tourism activities and investments to improve animal welfare. These included habitat-based enclosures, AI-assisted veterinary care and digital engagement platforms that would improve the experience of visitors and align with changing ethical norms.

But fears about animal welfare, operational sustainability, and changing public attitudes toward keeping wildlife in cages hampered market growth. Instead, companies began ending exploitative attractions, partnering with conservation organizations, and increasing educational outreach programs to reflect industry standards that were changing.

The future of wildlife photographing tourists up through 2025 and beyond into 2035- all commercial aspects of wildlife tourism- will enter a new evolution driven by immersive, augmented, and virtual wildlife tourism photography; immersive digital connections in content streaming; expect AI, VR, and simulation modelling to have their roles in animal behaviour modelling, zoo design, and park operations that will be driven or consumer zed.

Fully interactive digital wildlife parks, robotic animal computer simulations, and conservation-based eco-resorts will revolutionize how visitors learn and connect with their surrounding nature. Finally, developments in biotechnology will enable more robust non-invasive monitoring approaches for the health of captive species, reducing captive sensor challenges, and tropical welfare.

Modern animal theme parks will also implement a range of novel designs, from block chain-based wildlife tracking and AI-enhanced visitor personalization to carbon-neutral parks. Sustainable technological integration, eco-tourism, and conservation-cantered business models will push forward the evolution of the industry, and the companies that truly embrace these areas of growth will be the leaders of tomorrow.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Well-preserved within animal welfare and conservation frameworks |

| Technological Advancements | Growth in habitat-based enclosures and digital visitor engagement |

| Industry Adoption | Increased investment in ethical wildlife tourism and open-range enclosures |

| Supply Chain and Sourcing | Dependence on traditional animal feed and habitat infrastructure |

| Market Competition | Dominance of traditional zoo-based theme parks |

| Market Growth Drivers | Demand for ethical animal experiences and immersive conservation education |

| Sustainability and Energy Efficiency | Initial adoption of solar-powered enclosures and waste-reduction programs |

| Integration of Smart Monitoring | Limited use of AI-driven animal health tracking and visitor behaviour analysis |

| Advancements in Wildlife Engagement | Use of traditional animal exhibits and live feeding shows |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-based animal welfare monitoring, eco-certification & ethics tourism enforcement |

| Technological Advancements | Development of AI-powered conservation analytics, VR wildlife encounters, and robotic animal exhibits. |

| Industry Adoption | Expansion into fully digital wildlife parks, AI-monitored conservation reserves, and immersive eco-tourism. |

| Supply Chain and Sourcing | Shift toward sustainable, locally sourced animal diets and energy-efficient habitat management. |

| Market Competition | Rise of conservation-first, technology-driven wildlife experience providers offering sustainable tourism alternatives. |

| Market Growth Drivers | Increased investment in AI-driven conservation, interactive eco-resorts, and sustainable animal tourism models. |

| Sustainability and Energy Efficiency | Full-scale implementation of carbon-neutral animal theme parks, water-efficient habitats, and regenerative tourism practices. |

| Integration of Smart Monitoring | AI-based wildlife protection, block chain-enabled species tracking, and real-time visitor engagement analytics. |

| Advancements in Wildlife Engagement | Introduction of robotic wildlife simulations, personalized AR-enhanced tours, and digital-first conservation storytelling. |

The proliferation of the United States animal experience industry has been exponential owing to escalating interest in interactive natural locales, burgeoning investments in faunal safeguard initiatives, and robust demand for detaining attractions. Popular destinations such as Disney's Animal Kingdom, SeaWorld, and San Diego Zoo Safari Park continue fascinating millions each year with engaging exhibits observing a diversity of creatures thriving naturally.

This dramatic pivot toward sustainable destinations and digital experiences virtually bringing wildlife encounters into people's homes is reinventing the landscape significantly, with facilities investing heavily in augmented and virtual reality exhibits involving remote rehabilitation procedures observed from afar, glimpses behind the scenes of rangers caring for injured animals, and interactive tours highlighting ongoing conservation efforts.

Additionally, the emergence of innovative virtual possibilities for patrons globally to engage with rehabilitation programs in real time through livestreamed activities have heightened worldwide participation in preserving wildlife.

Projections foresee that with ongoing investments in innovative wildlife attractions combining sustainability with technology and the robust growth of domestic ecotourism, the strategic expansion of experiential United States animal destinations will progressively develop into the imminent future as these parks reinvent themselves for today's conservation-minded guests and generations to come with a shared mission of harmonizing compatibly with the natural world.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

London Zoo, Longleaf Safari Park, and Chester Zoo have prospered greatly in recent times owing to the British public's growing passion for ethical travel experiences that blend education and delight. Support from the UK government through backing of sustainable tourism projects has aided additional growth in this domain.

Advancements in zoo keeping practices and wildlife management have enabled these institutions to provide fully immersive experiences that give visitors opportunities to actively aid ongoing work to safeguard endangered species through creative participation.

New technologies now permit certain parks to incorporate guests in novel fashions, including interactive virtual tours of habitats and live camera views of activities. Meanwhile, AI-powered analysis of visitor engagement and behaviour patterns furnishes useful data to aid protection of vulnerable populations. Moreover, Britain's firm commitment to eco-friendly travel and strict laws regarding animal care have guided sector progress toward a model centered around principles of education, ethics, and hands-on conservation work

With rising investments in environmentally-sound tourism options and constant innovation focused on cultivating engaging yet respectful digital connections to the natural world, the prospects for animal theme parks in the United Kingdom seem bright. As this segment of the market strengthens ties with scientists and diversifies offerings to appeal to a variety of learning styles, steady growth can be anticipated in the coming years as conservation tourism gains prominence.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.3% |

The European animal park sphere is observing continual development, powered by robust demand for eco-friendly travels, mounting administration investments in protection-dependent attractions, and increasing global tourism. Nations like France, Germany, and Spain are headed locations for safari parks, ocean parks, and hands-on zoos, welcoming record numbers of guests annually.

The EU’s focus on sustainable travel and principled creature care rules is advancing investments in rehabilitation-centered and conservation-driven creature diversions. However, some argue these policies do not go far enough to ensure the well-being of the animals.

In addition, enhanced visitor involvement technologies integrating VR creature encounters and AI-powered directed trips designed for full immersion are improving visitor experiences but raise ethical questions about animal welfare.

With firm policy help and burgeoning curiosity in maintainable wildlife travel, the animal attractions within the EU are anticipated to develop steadily. New expansive attractions with expansive natural enclosures allowing animals considerable space and choices for movement, resting, and engaging with their environment are particularly appealing.

However, critics point out that no enclosure can truly replace an animal's natural habitat. The wide variety of experiences ensures diverse interests are catered to, though animal rights activists push for non-exploitative alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.5% |

The Japanese animal theme park landscape has undergone notable transformations owing to evolving guest priorities, a focus on edutainment, and innovations in technology.

Visitors' burgeoning interest in actively engaging with exotic creatures as well as supporting global conservation initiatives has bolstered attendance at prominent self-drive reserves such as Asahiyama Zoo, Ueno Zoo, and sprawling Fuji Safari Park-all of which invested substantially in digital solutions to educate visitors and fund wildlife protection worldwide with intricately planned exhibits and immersive experiences.

Simultaneously, directives from the Japanese government aimed at cultivating eco-tourism and safeguarding the welfare of unusual species. Such policies stimulated the emergence of sustainable wildlife havens and experiences involving marine animals that benefit both amusement and learning through creative programs and educational shows.

Moreover, Japan's renowned robotics expertise and ground-breaking work integrating artificial intelligence into interactive encounters with animals and virtual simulations of wildlife-two advancements that could dramatically reshape the entire sector should they engage guests in new ways.

With continued investment in technology-driven attractions and tourism that blend entertainment with environmental education in a seamless fashion, analysts foresee that the Japanese animal theme park industry will experience steady, considered growth and evolution for the foreseeable future as customer values and technological capabilities continue evolving in tandem at a rapid pace, though sustainability remains a key priority.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

Esteemed wildlife preserves in South Korea have risen to immense popularity due to improving immersive experiences and an increased societal focus on conservation. Everland's imaginative Zootopia and Seoul Grand Park's expansive natural habitats hold prominent positions as leading attractions offering diverse opportunities to encounter various animals and gain environmental knowledge.

Visitors are captivated through innovative applications of advanced technologies such as artificially intelligent monitoring of crowd patterns and augmented reality enhancing exhibits with vivid renderings of habitats. Furthermore, a widespread understanding of the importance of compassionately treating creatures pushes facilities to adopt principled philosophies centered on protection and preservation.

Meanwhile, continual contributions to imaginative virtual safaris and a burgeoning interest in activities cultivating ecological understanding indicate that the animal theme park sector will sustain steady progress. Establishments dedicated to providing enjoyable and educational entertainment while safeguarding inhabitants and their surroundings appear well-positioned to thrive.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

The ocean animal theme parks and terrestrial animal theme parks are the largest segments in the animal theme park market, as the global tourism trend continues to prioritize interactive wildlife experiences, conservation awareness, and eco-friendly attractions.

These encampment-like animal parks are vital for informing visitors on marine and terrestrial biodiversity, providing conservation efforts for endangered species, and animal-driven recreation experiences, thus serving as a main-stay across family travel, educational tourism and eco-tourism sectors.

Ocean animal theme parks and interactive marine experiences are among the hottest new attractions on our bucket lists, complete with marine animals and aquatic entertainment. Unlike regular zoos, these parks primarily feature marine species, including dolphins, whales, sea lions and sharks and often include conservation and education programs in their exhibits.

The increased interest of tourists in visiting marine life attractions is mainly driven by an interest in underwater ecosystems and aquatic biodiversity, and has led to the more widespread use of sophisticated designs of ocean-themed parks to help operators focus on visitor experience and conservation-oriented experiences. Research suggests that oceanic-animal spectacles draw millions of visitors every year and help drive the regional tourism economy.

The market growth has been bolstered by rising demand for more immersive underwater tunnels and glass-domed aquariums with close encounters with marine life, providing leading to wider adoption of ocean-themed exhibits in new theme park developments. Moreover, AI-enabled marine life observation enabled through real-time habitat detection and automatic feeding schedules has increased adoption and animal welfare while fostering the need for sustainability in marine park operations.

Interactive interactions, including those with dolphins and whales throughout trainer-led educational programs, alongside marine conservation awareness programs, have enhanced market growth, ensuring greater alignment with responsible wildlife tourism initiatives. Employing augmented reality (AR) and virtual reality (VR) experiences such as digital underwater explorations and simulated deep-sea journeys have further cemented market growth by providing enhanced visitor interaction and convenience for viewers globally.

However, ocean animal theme parks face challenges from ethical concerns over the treatment of captive marine animals, high operational costs associated with maintaining large aquatic habitats, and increasing environmental regulations regarding marine animal welfare despite its benefits in entertainment, marine conservation education, and tourism revenue generation.

Emerging innovations in AI-based ocean animal habitat and ecosystem replication, robotic ocean animal displays, and sustainable open-sea enclosures are ¡Improving engagement, ensuring ethical treatment, and enhancing environmental sustainability, securing long-term growth of ocean animal theme parks in global heavily-trafficked market.

Widely adopted by the market, terrestrial animal theme parks are a prominent trend in wildlife conservation tourism, wildlife safari and themed jungle adventure sightseeing activities, attracting fresh interest for an increasing number of visitors who want to have educational interactions with land animals while in theme parks that serve nature. In contrast to traditional zoos, these facilities highlight expansive, open-range areas with naturalistic animal environments, emphasizing improved welfare and more engaging experiences for visitors.

Terrestrial animal theme parks are also witnessing demand due to the increasing popularity of eco-friendly safari parks, jungle-themed wildlife attractions, and guided tours, night safaris, and interactive feeding experiences, which are increasingly sought by eco-conscious travellers who favour sustainable and ethical wildlife encounters. Research shows that wildlife-based tourism accounts for more than 20% of global theme park revenue, assuring destinations with a focus on rural or conservation to maximize social and economic benefits.

Growth in open-range safari theme parks, with zoo-approved animal feeding sites and drive-through jungle experiences, has reinforced market demand and high adoption of naturalistic animal park concepts. Real-time animal behaviour analysis and automated habitat management powered by AI technology have further increased adoption, paving the way for better conservation practices and animal welfare.

Room for Adventure Wildlife Experiences: Themed adventure attractions are developing treehouse lodges, jungle obstacle courses, and interactive animal shows that have provided a great impetus for market growth providing more engagement within the realm of experience-based wildlife tourism.

Conservation-based wildlife exhibits and endangered species breeding programs aided by visitor-funded rewilding activities have strengthened market growth, aligning the market with the requirements of global biodiversity preservation initiatives.

Although relatively inexpensive, terrestrial animal theme parks struggle with limited habitat spaces, ethics of captive animals, and higher costs to maintain active habitats. Yet ground-breaking AI projects like smart wildlife enclosures, autonomous feeding and healthcare systems, and AI powered eco-tourism platforms increasing efficiency, adaptability, and ethical considerations for those experiencing them means that terrestrial animal theme parks can continue to thrive and evolve.

Two key market drivers are the children and adult visitor segments, as animal theme parks continue to customize interactive wildlife attractions, immersive learning experiences, and adventure-driven activities to cater to visitors of all ages.

The kids’ segment has grown to become one of the most engaged visitor profiles for animal theme parks with the introduction of hands-on learning experiences, kids’ friendly animal encounters and conservation and education programs. Animal theme parks - unlike amusement parks, animal theme parks welcome a younger audience by offering interactive wildlife experiences to evoke curiosity, empathy, and environmental awareness.

Adoption of child-focused animal attractions has gained traction amid the rising demand for interactive and animally feeding experiences at petting zoos - encompassing safe animal interaction experiences and educational-led presentations that are child-friendly as parents and educators can often lean toward hands-on learning experiences. Studies show that 60% of families are attracted to animal theme parks with interactive learning components, indicating stronger visitor retention in the family tourism market.

The increase in animal parks and their themed adventure play, including nature-inspired climbing structures and interactive storytelling zones, assures good engagement of the younger audience and thus enhances market demand.

The introduction of AI-enabled educational apps such as augmented reality with wilderness exploring and gamified learning modules has further helped the adoption to grow steeply, ensuring better accessibility and interactive learning for kids.

Conservation-based children’s programs have developed to optimize market growth while better aligning with efforts in environmental education. The adoption of sensory-friendly wildlife exhibits through low-noise animal encounters and interactive touch pools for kids who have sensory sensitivities has further cornered the market by promoting inclusivity in wildlife-themed travel.

Though children-focus animal theme parks have been found to be beneficial for education, interaction with wildlife and environmental conservation awareness, they do face challenges of seasonal visitor demands, rise in liability concerns related to the safety of the children including increase in maintenance cost for hands-on exhibits.

Emerging innovations of AI-powered kid-friendly online safety monitoring, interactive digital conservation education, and immersive, storytelling-cantered wildlife encounter experiences are increasing efficiency, engagement, and educational impact to support continued market growth for animal-themed lands targeted to children.

This segment for adult visitors has seen robust market penetration which encompasses eco-focused tourism, and wildlife adventures with a mix of luxury wildlife hotels, as adults search for conservation and adventure-based travel experiences. In contrast to those focused on children, safari-style wildlife encounters, conservation experiences, and high-end accommodation are more in demand from adult tourists in animal.

Rich travellers have increasingly adopted theme park experiences oriented to adults, with package features including curated animal tracking and private balconies overlooking passing wildlife, as the number of guest experiences offering kir-focused journeys have increased amidst a stable of guided safari guests across Africa.

Market demand has been bolstered further with the proliferation of Wildlife Photography Tours, involving expert-led animal tracking and conservation discussions at nature spaces, leading to increased adoption of educational adventure travel in these animal parks.

Additionally, AI and smart tourism apps with real-time animal migration updates and tailored itineraries have increased this adoption, enabling better visitor engagement and conservation purposes. The introduction of immersive after hour’s wildlife experiences such as night safari and nocturnal animal and viewing tours has maximized market upticks, ensuring more flexibility in off-peak tourism scheduling.

Adult-focused animal theme parks may find success in eco-tourism, luxury travel, and conservation-driven experiences, but they are also faced with high operational costs for premium experiences, environmental impact concerns for animal-keeping and breeding programs such as captive breeding or conservation programs, and ever-increasing competition from alternative adventure tourism destinations such as wineries, hiking trails, and eco-lodges.

Emerging concepts such as AI-driven tracking for personalized wildlife encounters, carbon-neutral certified conservation lodges, and block chain-backed wildlife sponsorship programs are benefitting sustainability, visitor engagement, and ethical tourism models, positively impacting the adult-focused animal theme park industry's growth trajectory.

The animal theme parks market is growing as there is a rising demand for experiential tourism, awareness of wildlife conservation and family-friendly entertainment. Firms had their eyes set on AI-powered visitor experiences, immersive animal experiences, and sustainable wildlife management to improve guest experience, education, and ecological importance.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Disney’s Animal Kingdom (Walt Disney Company) | 15-20% |

| SeaWorld Parks & Entertainment | 12-16% |

| San Diego Zoo Wildlife Alliance | 10-14% |

| Chimelong Safari Park | 8-12% |

| Everland Zoo (Samsung C&T Corporation) | 5-9% |

| Other Parks (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Disney’s Animal Kingdom | Develops immersive safari experiences, AI-powered wildlife conservation initiatives, and educational eco-tours. |

| SeaWorld Parks & Entertainment | Specializes in marine animal exhibits, interactive aquariums, and AI-integrated animal welfare programs. |

| San Diego Zoo Wildlife Alliance | Operates wildlife conservation parks with immersive experiences, research-driven animal care, and interactive digital exhibits. |

| Chimelong Safari Park | Provides large-scale safari tours, exotic animal encounters, and interactive conservation education programs. |

| Everland Zoo (Samsung C&T Corporation) | Offers theme park-integrated animal attractions, AI-powered visitor engagement, and advanced veterinary care solutions. |

Key Company Insights

Disney’s Animal Kingdom (15-20%)

Disney dominate the animal theme park segment, aspiring to be the first choice for the most multi-faceted wildlife experiences, AI-based wildlife protection programs and sustainable tourism platforms.

SeaWorld Parks & Entertainment (12-16%)

Known for its focus on the conservation of marine animals and interactive aquatic exhibits, SeaWorld is committed to educating visitors and caring for marine life in an ethical manner.

San Diego Zoo Wildlife Alliance (10-14%)

San Diego Zoo’s innovative wildlife conservation projects maximize guest learning and animal experience

Chimelong Safari Park (8-12%)

From large-scale safari tours to exotic wildlife attractions, Chimelong reflects high-level breeding programs of rare species.

Everland Zoo (5-9%)

The traditional zoo, Everland Zoo creates interactive animal exhibits and themed attractions, facilitating AI-assisted monitoring of guests and animal welfare.

Other Key Players (40-50% Combined)

Several animal-themed parks, safari experiences, and wildlife conservation centers contribute to next-generation immersive tourism innovations, AI-driven wildlife management, and sustainable Animal Park operations. These include:

The overall market size for Animal Theme Parks Market was USD 95.9 Million in 2025.

The Animal Theme Parks Market is expected to reach USD 165.5 Million in 2035.

The demand for the animal theme parks market will grow due to rising consumer interest in wildlife experiences, increasing tourism activities, growing emphasis on conservation and education, and advancements in interactive and immersive attractions, driving higher visitor engagement and revenue generation.

The top 5 countries which drives the development of Animal Theme Parks Market are USA, UK, Europe Union, Japan and South Korea.

Ocean and Terrestrial Animal Theme Parks Drive Market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Revenue Model , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Revenue Model , 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Revenue Model , 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Revenue Model , 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Eastern Europe Market Value (US$ Million) Forecast by Revenue Model , 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: South Asia and Pacific Market Value (US$ Million) Forecast by Revenue Model , 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: East Asia Market Value (US$ Million) Forecast by Revenue Model , 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 42: East Asia Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Middle East and Africa Market Value (US$ Million) Forecast by Revenue Model , 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 48: Middle East and Africa Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Revenue Model , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Revenue Model , 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Revenue Model , 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Revenue Model , 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 25: Global Market Attractiveness by Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Application, 2023 to 2033

Figure 27: Global Market Attractiveness by Revenue Model , 2023 to 2033

Figure 28: Global Market Attractiveness by Booking Channel, 2023 to 2033

Figure 29: Global Market Attractiveness by Tourist Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Revenue Model , 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Revenue Model , 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Revenue Model , 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Revenue Model , 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 55: North America Market Attractiveness by Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Application, 2023 to 2033

Figure 57: North America Market Attractiveness by Revenue Model , 2023 to 2033

Figure 58: North America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 59: North America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Revenue Model , 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Revenue Model , 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Revenue Model , 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Revenue Model , 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Revenue Model , 2023 to 2033

Figure 88: Latin America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Revenue Model , 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 101: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 102: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 103: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 104: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) Analysis by Revenue Model , 2018 to 2033

Figure 107: Western Europe Market Value Share (%) and BPS Analysis by Revenue Model , 2023 to 2033

Figure 108: Western Europe Market Y-o-Y Growth (%) Projections by Revenue Model , 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 113: Western Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 114: Western Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 115: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Revenue Model , 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Revenue Model , 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 131: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 135: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 136: Eastern Europe Market Value (US$ Million) Analysis by Revenue Model , 2018 to 2033

Figure 137: Eastern Europe Market Value Share (%) and BPS Analysis by Revenue Model , 2023 to 2033

Figure 138: Eastern Europe Market Y-o-Y Growth (%) Projections by Revenue Model , 2023 to 2033

Figure 139: Eastern Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 143: Eastern Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 144: Eastern Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 145: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Revenue Model , 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Revenue Model , 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 162: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 164: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 165: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 166: South Asia and Pacific Market Value (US$ Million) Analysis by Revenue Model , 2018 to 2033

Figure 167: South Asia and Pacific Market Value Share (%) and BPS Analysis by Revenue Model , 2023 to 2033

Figure 168: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Revenue Model , 2023 to 2033

Figure 169: South Asia and Pacific Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 173: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 174: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 175: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Revenue Model , 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Booking Channel, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Tourist Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Revenue Model , 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 191: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 192: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 193: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 194: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 195: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 196: East Asia Market Value (US$ Million) Analysis by Revenue Model , 2018 to 2033

Figure 197: East Asia Market Value Share (%) and BPS Analysis by Revenue Model , 2023 to 2033

Figure 198: East Asia Market Y-o-Y Growth (%) Projections by Revenue Model , 2023 to 2033

Figure 199: East Asia Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 203: East Asia Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 204: East Asia Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 205: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Revenue Model , 2023 to 2033

Figure 208: East Asia Market Attractiveness by Booking Channel, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Tourist Type, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Revenue Model , 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 221: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 222: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 223: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 224: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 225: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 226: Middle East and Africa Market Value (US$ Million) Analysis by Revenue Model , 2018 to 2033

Figure 227: Middle East and Africa Market Value Share (%) and BPS Analysis by Revenue Model , 2023 to 2033

Figure 228: Middle East and Africa Market Y-o-Y Growth (%) Projections by Revenue Model , 2023 to 2033

Figure 229: Middle East and Africa Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 234: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 235: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Revenue Model , 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Booking Channel, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Tourist Type, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Animal Theme Parks Market Share

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA