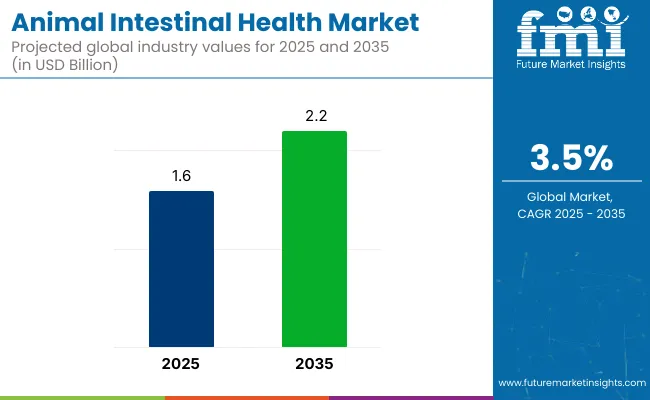

The global animal intestinal health market is valued at USD 1.6 billion in 2025 and is slated to reach USD 2.2 billion by 2035, which shows a CAGR of 3.5%.

| Metric | Value |

|---|---|

| 2025 Market Size | USD 1.6 billion |

| 2035 Market Size | USD 2.2 billion |

| CAGR (2025 to 2035) | 3.5% |

Growth will be driven by rising awareness regarding digestive health, reduced antibiotic use, and the integration of natural feed additives including probiotics, prebiotics, and postbiotics. Additionally, early-life nutritional interventions and the increasing use of lactic acid bacteria to stabilize gut microbiota are expected to accelerate market expansion.

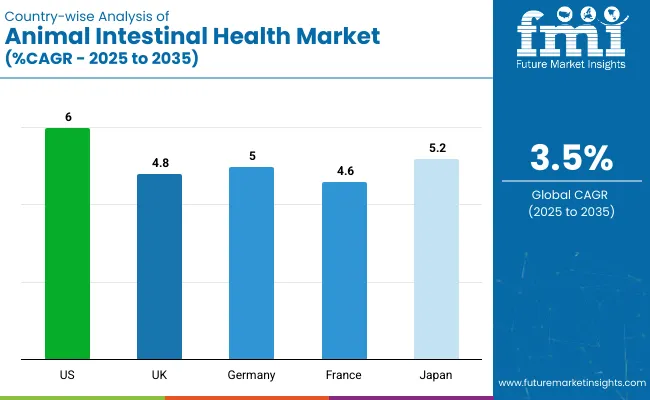

The USA is projected to grow at a CAGR of 6.0% through 2035, driven by advanced feed additive technologies and regulatory support. Germany follows with a CAGR of 5.0%, supported by its robust livestock sector and probiotic adoption, while France records a CAGR of 4.6% due to high dairy and poultry production.

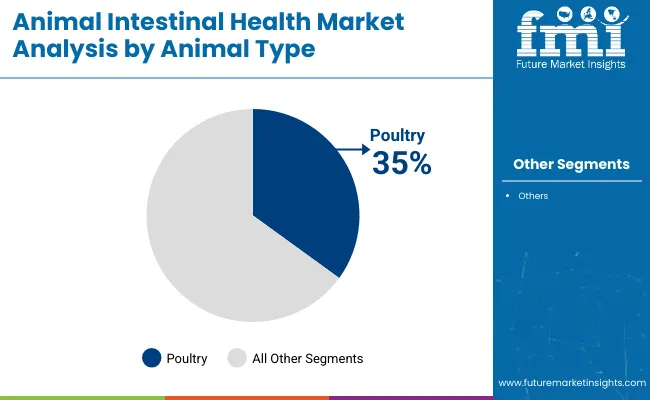

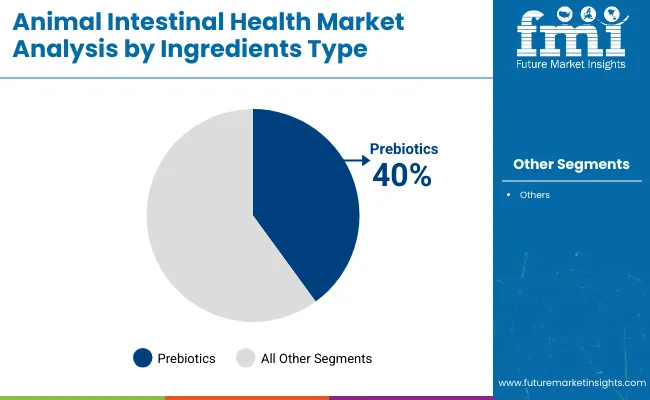

In terms of segments, poultry leads the animal type category with a 35% market share in 2025, driven by demand for efficient feed conversion. Prebiotics dominate the ingredient type segment, holding a 40% share due to their gut microbiota enhancement benefits.

In recent years, companies have driven major innovations to enhance animal intestinal health by focusing on precision nutrition and microbiome modulation. Evonik and Vland Biotech formed a joint venture in China to develop advanced probiotics that improve gut health in farm animals and replace antimicrobial growth promoters. In September, Boehringer Ingelheim acquired Saiba Animal Health AG to expand its pet digestive health portfolio and strengthen R&D capabilities.

Governments worldwide are reducing antibiotic use in animal feed to combat antimicrobial resistance. The European Union enforces strict bans on antibiotic growth promoters, while China promotes traditional herbal additives and microbiome-enhancing solutions in livestock.

The animal intestinal health market represents a niche segment within the broader animal nutrition market, which is part of the food and beverage industry. While its direct share in global food and beverage or chemicals markets is minimal, within animal nutrition, it accounts for approximately 10-15%, driven by rising demand for digestive health solutions in livestock and pets. When compared to the overall food and beverage market, its contribution remains below 1%, reflecting its specialized focus.

The animal intestinal health market segments include animal type, ingredient type, function, form, sales channel, and region. The animal type segment covers cattle, swine, poultry, canine, feline, equine, and others (fish, rabbits, sheep, goats, aquaculture). The ingredient type segment includes prebiotics, postbiotics, phytogenics, and enzymes.

The function segment comprises performance enhancers, weight management, digestive health, and immune boosters. The form segment includes powder, liquid, and tablets. The sales channel segment consists of veterinary hospitals or clinics, e-commerce or internet platforms, specialty stores, animal farms, modern trade, and retail pharmacies or supermarkets. The regional segment includes North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa.

Poultry remains the most lucrative segment in the animal intestinal health market, holding a 35% share due to its critical role in global protein supply.

Prebiotics lead the ingredients type segment with nearly 40% market share, driven by their widespread use in enhancing gut microbiota balance and overall digestive health in livestock and pets.

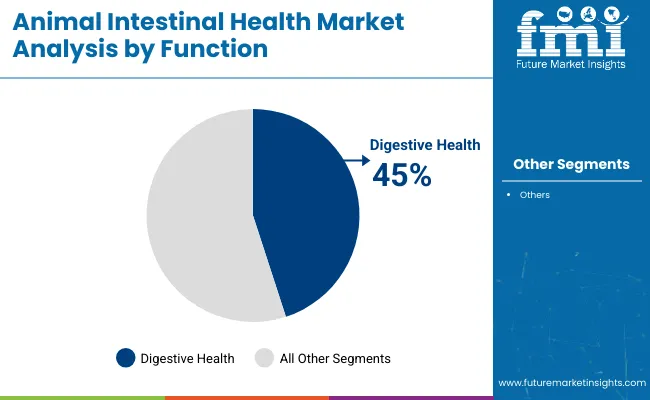

Digestive health dominates the function segment with a 45% market share, as it addresses core animal productivity and welfare needs.

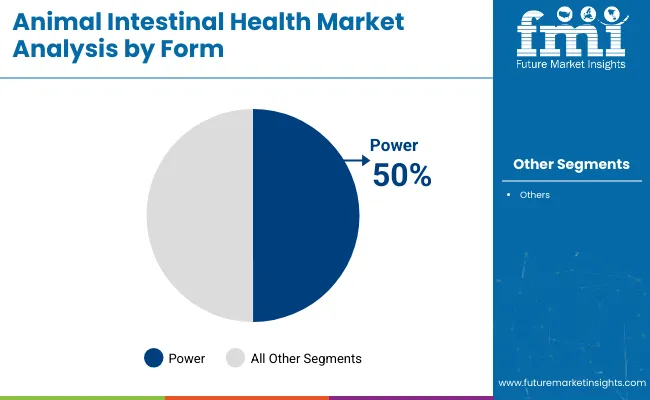

Powder formulations lead the form segment with a 50% market share, driven by their widespread use in livestock feed applications due to ease of handling, cost efficiency, and uniform mixing properties.

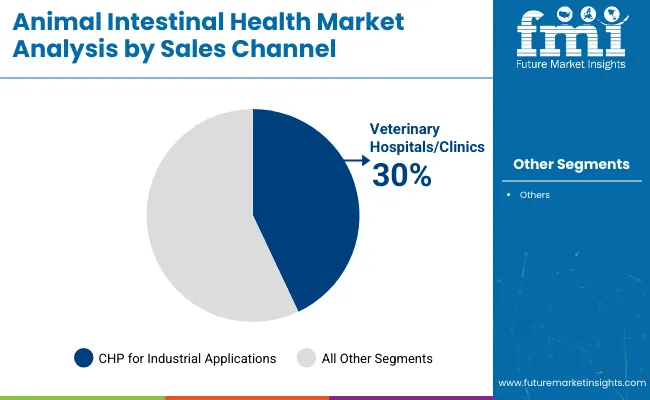

Veterinary hospitals/clinics dominate the sales channel segment with a 30% market share, as they remain the primary point for prescribing and distributing animal intestinal health products.

The USA leads with the highest CAGR of 6.0%, supported by its robust livestock sector, investments in precision nutrition, and antibiotic-free feed demand. Japan is projected to grow at a 5.2% CAGR, slightly higher than Germany’s 5.0% and France’s 4.6%, reflecting strong demand for premium animal nutrition and advanced feed technologies. The UK shows the slowest growth at 4.8%, driven by regulatory compliance and sustainability initiatives.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA animal intestinal health products revenue is projected to grow at a CAGR of 6.0% from 2025 to 2035.

Sales of animal intestinal health products in the UK are projected to grow at a CAGR of 4.8% from 2025 to 2035.

Animal intestinal health product demand in Germany is projected to grow at a CAGR of 5.0% from 2025 to 2035.

France’s animal intestinal health products revenue is projected to grow at a CAGR of 4.6% from 2025 to 2035.

Sales of animal intestinal health products in Japan are projected to grow at a CAGR of 5.2% from 2025 to 2035.

The market remains moderately consolidated, with tier-one companies such as Cargill, ADM, DSM, and Kemin Industries holding significant shares due to their extensive global presence, advanced product portfolios, and strong R&D capabilities.

Tier-two players like EW Nutrition, AB Vista, and AdvaCarePharma cater to niche regional demands with targeted gut health solutions. Top companies compete through innovation in probiotic and prebiotic formulations, strategic acquisitions to expand regional reach, partnerships with feed manufacturers, and sustainable product development.

Recent Animal Intestinal Health Industry News

In March 2025, EW Nutrition acquired majority stake in GREEN INNOVATION, a prominent firm in the gut health space to enhance its position.

In September 2024, Cargill announced the acquisition of two USA feed mills to boost its distribution and production capabilities.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.6 billion |

| Projected Market Size (2035) | USD 2.2 billion |

| CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Units |

| By Animal Type | Cattle, Swine, Poultry, Canine, Feline, Equine, and Others (Fish, Rabbits, Sheep, Goats, Aquaculture) |

| By Ingredient Type | Prebiotics, Postbiotics, Phytogenics, and Enzymes |

| By Function | Performance Enhancer, Weight Management, Digestive Health, and Immune Booster |

| By Form | Powder, Liquid, and Tablets |

| By Sales Channel | Veterinary Hospitals/Clinics, E-commerce/Internet Platforms, Specialty Stores, Animal Farms, Modern Trade, and Retail Pharmacies/Supermarkets |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Cargill, ADM, DSM, Kemin Industries, Adisseo, Kerry Group plc, Evonik Industries, AB Vista, AdvaCarePharma, EW Nutrition, Alltech, Boehringer Ingelheim, Dechra Pharmaceuticals, Novozymes A/S. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

As per Animal type, the industry has been categorized into Plant Cattle, Swine, Canine, Feline, Equine, and Others (Fish, Rabbits, Sheep, Goats, Aquaculture, etc).

As per species, the industry has been categorized into Nutrition, Prebiotics, Postbiotics, Phytogenics, and Enzymes.

This segment is further categorized into Performance Enhancer, Weight Management, Digestive Health, and Immune Booster.

This segment is further categorized into Powder, Liquid, and Tablets.

Veterinary Hospitals/Clinics, E-commerce / Internet Platforms, Specialty Stores, Animal Farms, Modern Trade, Retail Pharmacies / Supermarkets.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 1.6 billion in 2025.

The market is projected to reach USD 2.2 billion by 2035.

The market is expected to grow at a CAGR of 3.5% during this period.

Poultry leads the animal type segment with over 35% market share in 2025.

Prebiotics lead the ingredient type segment with nearly 40% market share in 2025 due to their benefits in gut microbiota balance.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Probiotic Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA