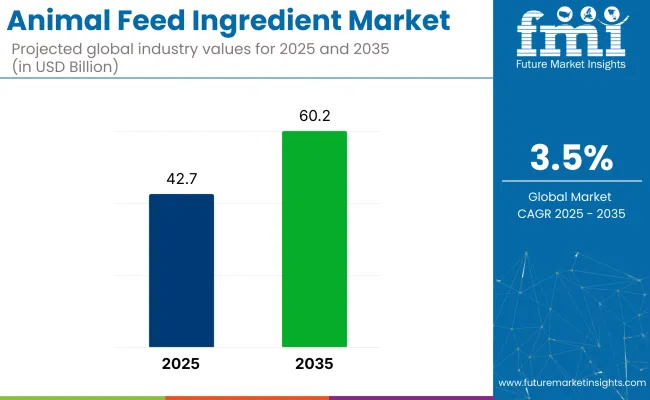

The global animal feed ingredients market was valued at approximately USD 42.7 billion in 2025 and is projected to reach USD 60.2 billion by 2035, expanding at a steady CAGR of 3.5%. This growth trajectory underscores the increasing role of feed ingredients, particularly protein-based components, in meeting the nutritional requirements of livestock, poultry, and aquaculture systems.

As the demand for high-quality protein from meat, eggs, and dairy products rises globally, animal feed ingredients become increasingly indispensable in ensuring the optimal health, growth, and reproduction of farmed animals.

The animal feed ingredient market plays a significant role within its parent markets. Within the animal feed market, feed ingredients account for 30-35% of the total market, as these ingredients are the foundation of animal nutrition. In the agricultural ingredients market, the share of product is estimated at around 10-12%, as various agricultural products are used for both human consumption and animal feed.

In the livestock and poultry market, feed ingredients contribute about 40-45%, as they are critical to ensuring the growth and health of livestock and poultry. In the pet food market, feed ingredients make up approximately 8-10%, as the demand for nutritious pet food continues to rise. In the agricultural chemicals market, feed ingredients account for around 2-3%, due to the use of chemicals for preservation and nutrient enhancement.

A primary driving factor behind the market's expansion is the global shift towards more intensive animal husbandry practices. As the world population continues to grow, the demand for animal-based food products has surged, particularly in emerging economies such as China and India, where rising middle-class populations are contributing to greater consumption of meat and dairy.

In these regions, the demand for efficient animal feed is crucial to support livestock productivity. China, with its large-scale livestock sector, is projected to remain the most lucrative market, given its substantial contribution to the global feed market. National policies favoring domestic feed formulation further boost the market in this region. The rising consumption of animal protein in emerging economies is a significant factor driving the demand for high-quality feed ingredients.

APHIS’ NADPRP is set to provide up to USD 16.5 million in FY 2025 funding to boost disease preparedness, early detection, biosecurity, and emergency response in livestock, poultry, equine, sheep/goat, and aquaculture sectors

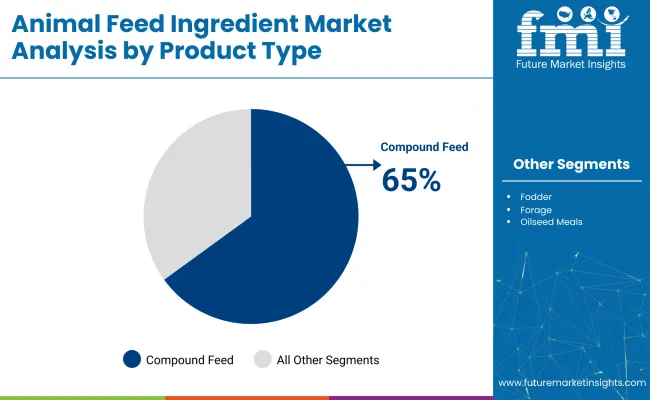

The compound feed segment leads the market, driven by its role in providing balanced nutrition for livestock and poultry. Plant-based proteins dominate demand due to their cost-effectiveness and sustainability, while the poultry segment remains the largest, fueled by the rising global demand for meat and eggs.

The compound feed segment is the dominant player in the animal feed ingredients market, accounting for 65% of the total market share in 2025. This dominant position is driven by the increasing reliance on compound feed in both the livestock and poultry industries, where it plays a critical role in providing balanced and nutritionally complete diets for animals.

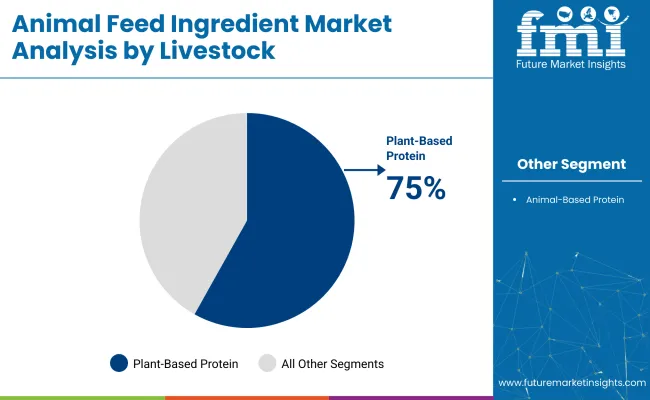

The plant-based protein segment dominates the market, accounting for a significant share of 75% in 2025. This dominance is driven by the widespread availability and cost-effectiveness of plant-based protein sources such as soy, wheat gluten, and corn gluten meal, which are extensively used in animal feed formulations.

The poultry segment holds the largest market share in the market, accounting for approximately 45% of the total market in 2025. This dominance is driven by the global demand for poultry products, including meat and eggs, which are staples in many diets.

Rising Demand for Animal Protein

The global increase in the consumption of animal protein is a major driving force behind the growth of the market. As the world population grows and disposable incomes rise, particularly in emerging economies, there is a greater demand for meat, dairy, and egg products. This has led to intensified livestock farming and the need for higher quality and more efficient animal feed.

With animal protein becoming a key dietary source, the market for feed ingredients, especially those used in poultry, swine, and ruminant farming, continues to expand. As such, the need for balanced and nutritious feed solutions remains critical for supporting the productivity of these industries.

Cost Efficiency drives the Market

As awareness around environmental impacts increases, the demand for more feed options, including plant-based proteins and novel protein sources like insect meal, is rising. The volatility of raw material prices, particularly for animal-based protein, has prompted producers to seek more cost-effective alternatives.

This shift towards plant-based and alternative protein sources is driven by both the need to reduce environmental impact and the rising pressure on producers to maintain profitability while meeting global food production demands. The integration of such sustainable practices is expected to continue influencing market dynamics.

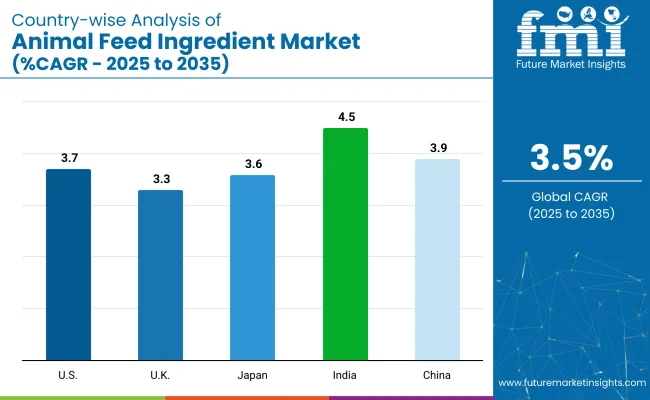

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.7% |

| UK | 3.3% |

| Japan | 3.6% |

| India | 4.5% |

| China | 3.9% |

India’s momentum is driven by its rapidly expanding poultry, dairy, and aquaculture industries, coupled with rising demand for high-quality feed ingredients. China follows closely, with a projected 3.9% CAGR, supported by government initiatives promoting sustainable farming and increasing demand for feed in its growing livestock sector. In contrast, developed economies such as Japan (3.6%), the United Kingdom (3.3%), and the United States (3.7%) are expanding at a steady 0.95-1.03x rate.

The United States leads the demand for feed ingredients, driven by the livestock and poultry industries, focusing on feed efficiency and sustainability. Japan benefits from advancements in specialized, high-performance feed ingredients for poultry and aquaculture. As the market grows and adds over USD 200 million by 2035, both high-growth regions like India and China and stable demand from OECD countries will shape its trajectory.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The USA animal feed ingredient market is estimated to grow at a CAGR of 3.7% during the forecast period. This growth is primarily driven by the country's large-scale and highly advanced livestock industry, which produces a substantial amount of meat, poultry, dairy, and eggs. The USA is the largest producer of animal feed globally, and its demand for high-quality feed ingredients continues to rise as the population grows and consumption patterns shift towards protein-rich diets.

The push towards more efficient and sustainable feed solutions, coupled with technological advancements in feed formulations, has significantly impacted the market's expansion. The USA is also leading in terms of feed innovation, as major players invest in R&D to improve feed efficiency and reduce environmental impacts.

The UK animal feed ingredient market is projected to grow at a CAGR of 3.3% from 2025 to 2035. The growing demand for animal protein, particularly in poultry and pork, is a significant factor in the UK's feed market expansion. The country has a well-established livestock farming industry that is focused on high-efficiency feed solutions to support its growing population.

The shift towards sustainable and natural feed options is gaining ground as consumers demand cleaner, more eco-friendly products. Advancements in technology are making it easier to produce customized feed for specific animal needs, further driving market growth. The UK government’s focus on sustainable agriculture practices and policies supporting animal welfare also boosts the demand for feed ingredients that meet these standards.

Japan’s animal feed ingredient market is expected to grow at a CAGR of 3.6% between 2025 and 2035. This growth can be attributed to the country's strong emphasis on high-quality food production and efficient animal farming practices. Japan is a significant importer of animal feed ingredients, with demand driven by the need to support its poultry and livestock industries.

The country's aging population and the shift towards more health-conscious eating habits are influencing the increased consumption of high-protein foods such as poultry and pork, which in turn increases the demand for high-quality animal feed.

Technological innovations in feed formulations, such as functional feeds that enhance animal health and productivity, are also a major driver of growth. Furthermore, Japan’s commitment to sustainability and eco-friendly practices in agriculture encourages the adoption of sustainable feed alternatives, including plant-based proteins.

The Indian animal feed ingredient market is poised to grow at a CAGR of 4.5% during the forecast period, driven by increasing demand for protein-rich foods and the expansion of the livestock sector. India’s growing middle class and changing dietary preferences are driving the consumption of poultry, dairy, and meat products.

This, in turn, has led to increased demand for animal feed ingredients, particularly those that support the rapid growth of the poultry and dairy industries. With India being one of the largest producers of milk, the demand for dairy feed is also a major market driver. The shift towards sustainable feed options, such as plant-based proteins, is gaining traction in response to global environmental concerns. The government’s focus on modernizing agriculture and improving livestock productivity is expected to further bolster the market.

China’s animal feed ingredient market is estimated to grow at a CAGR of 3.9% from 2025 to 2035. As the world's largest producer and consumer of meat, particularly pork, China has a massive demand for animal feed ingredients to support its extensive livestock sector. The country’s growing urbanization and rising disposable incomes are contributing to increased demand for animal-based protein, particularly in poultry and swine.

China’s government has been implementing policies that promote feed industry modernization and sustainability. The country is increasingly adopting plant-based proteins and novel feed ingredients to reduce the reliance on traditional animal-based proteins, which are subject to price volatility. The growing focus on improving feed efficiency and productivity, alongside efforts to enhance sustainability in agriculture, is set to drive continued growth in the feed ingredients market.

The animal feed ingredients industry is driven by both established players and emerging innovators focused on enhancing feed quality and efficiency. Leading companies like DuPont, ADM, and DSM are at the forefront with their advanced feed solutions, which cater to the growing demand for high-protein and sustainable feed options.

Mosaic Company and BurconNutrascience Corporation specialize in plant-based protein innovations, offering alternatives that meet the increasing need for eco-friendly feed ingredients. Alltech, Hamlet Proteins, and J.R. Simplot Co. continue to lead with research-backed feed additives and specialized formulations aimed at improving animal health and productivity. In addition, companies like CHS, BRF, and DSM contribute to the market with their diverse feed products that support the expanding livestock and poultry industries.

Recent Animal Feed Ingredients Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 42.7 billion |

| Projected Market Size (2035) | USD 60.2 billion |

| CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in metric tons |

| Product Type Analyzed (Segment 1) | Compound Feed, Fodder, Forage, Oilseed Meals, And Animal-By-Product Meals. |

| Source Analyzed (Segment 2) | Animal-Based Protein And Plant-Based Protein. |

| Applications Analyzed (Segment 3) | Poultry, Ruminants, Swine, Aquatic Animals, Other Animals (Pet Animals, Birds, And Reptiles), Research And Biotech, And Biocatalysts. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | DuPont, Mosaic Company, Burcon Nutrascience Corporation, ADM, Alltech, Hamlet Proteins, DSM, CHS, J.R. Simplot Co., and BRF. |

| Additional Attributes | Dollar sales, market share by product type and application, key growth regions, competitive landscape, pricing trends, regulatory factors, and emerging opportunities. |

The industry is segmented into compound feed, fodder, forage, oilseed meals, and animal-by-product meals.

The segments include animal-based protein and plant-based protein.

The industry finds applications in poultry, ruminants, swine, aquatic animals, other animals (pet animals, birds, and reptiles), research and biotech, and biocatalysts.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 42.7 billion in 2025.

It is forecasted to reach USD 60.2 billion by 2035.

The industry is anticipated to grow at a CAGR of 3.5% during this period.

Plant-based Protein are projected to lead the market with a 75% share in 2035.

Asia Pacific particularly India, is expected to be the key growth region with a projected growth rate of 4.5%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Animal Feed Ingredients Market Report – Trends & Innovations 2025-2035

Nutritional Ingredients in Animal Feed Market Trends - Growth & Industry Forecast 2025 to 2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA