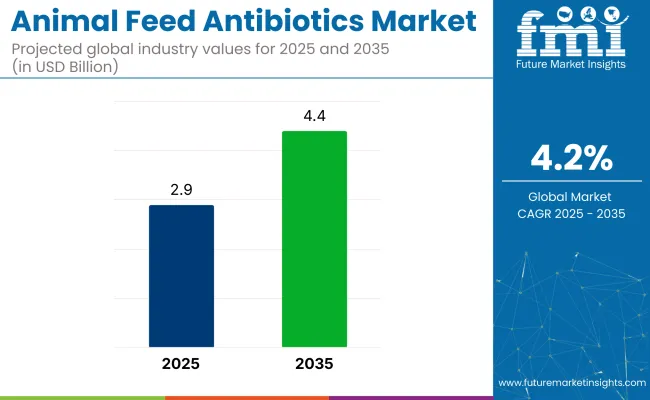

The global animal feed antibiotics market is valued at USD 2.9 billion in 2025 and is slated to reach USD 4.4 billion by 2035, reflecting a CAGR of 4.2%.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.9 billion |

| Forecast Value (2035) | USD 4.4 billion |

| Forecast CAGR | 4.2% |

Growth will be driven by increasing livestock farming, higher demand for animal protein, and advancements in antibiotic formulations that improve feed conversion rates. In addition, the rising focus on livestock health management and the prevention of infectious diseases will support market expansion, particularly in emerging economies where meat consumption is rising.

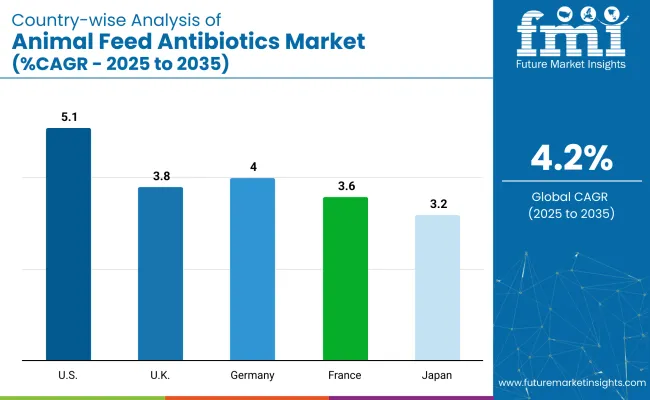

The USA is expected to grow the fastest in the market, with a CAGR of 5.1%, mainly due to its advanced livestock farming, high meat consumption, and strong investments in animal health solutions. Germany will follow with a 4.0% CAGR, driven by its strong livestock sector and focus on animal welfare and feed efficiency.

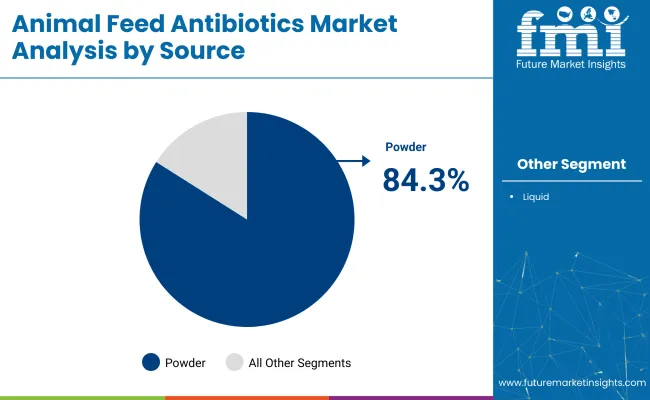

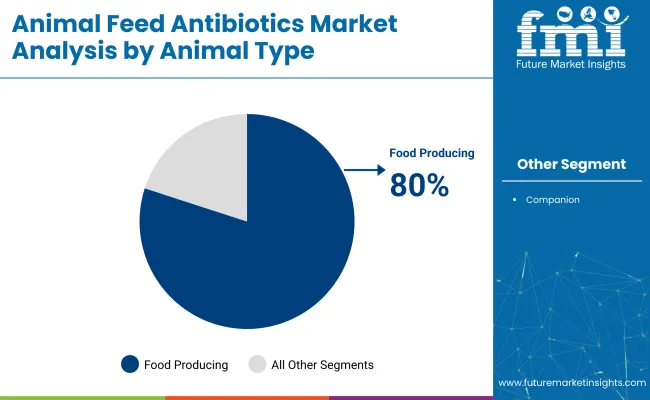

The UK is projected to grow at a CAGR of 3.8%, supported by steady demand for high-quality meat products.Food-producing animals will lead the animal type segment with and 80% market share, while powder will dominate the form segment with an 84.3% market share in 2025.

Strict government regulations have restricted the use of antibiotics as growth promoters in animal feed due to concerns over antimicrobial resistance impacting human health. Countries like China and members of the European Union have imposed bans and stringent policies limiting antibiotic use in livestock.

To comply with these regulations, companies are innovating by developing safer, species-specific antibiotics that are easily excreted without residue build-up. Recent advancements include biotechnology-driven natural antibiotic formulations and fermentation-based products that maintain feed efficiency while ensuring safety.

The animal feed antibiotics market holds a small but significant share within its parent markets. It accounts for approximately 5-7% of the overall animal feed market, given its specialized application in disease prevention and growth promotion. Within the animal nutrition market, its share is around 4-5%, as vitamins, minerals, and enzymes dominate

In the animal healthcare market, it represents about 3-4%, since vaccines and other therapeutics form larger segments. Within the feed additives market, animal feed antibiotics hold a substantial 10-12% share, highlighting their critical role in enhancing feed efficiency and livestock health despite tightening regulatory restrictions globally.

The animal feed antibiotics market segments include antibiotic type, form, animal type, sales channel, and region. The antibiotic type segment covers tetracyclines, penicillins, macrolides, sulphonamides, aminoglycosides, and others (lincosamides, fluoroquinolones, cephalosporins).

The form segment includes liquid and powder. The animal type segment incorporates food producing animals and companion animals. The sales channel segment consists of B2B and B2C. The regional segment includes North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Tetracyclines are the most lucrative segment, holding 35% market share, due to their broad-spectrum action, low cost, and wide use in livestock feed.

Powder form is the most lucrative segment, holding an estimated 84.3% market share. This dominance is driven by its ease of handling, long shelf life, and simple mixing with animal feed at farms and feed mills.

Food-producing animals are the most lucrative segment, accounting for over 80% market share. This dominance is driven by high antibiotic demand in poultry, swine, and cattle farming to prevent infections, promote faster growth, and improve feed efficiency.

B2B is the most lucrative sales channel, holding approximately 70% market share in 2025. This dominance is due to bulk purchases by feed manufacturers and large farms that buy directly from suppliers.

The global animal feed antibiotics market is growing steadily, driven by rising livestock farming, increasing demand for animal protein, and advancements in safe and effective antibiotic formulations.

Recent Trends in the Animal Feed Antibiotics Market

Challenges in the Animal Feed Antibiotics Market

Among the top countries, the USA shows the highest growth rate with a CAGR of 5.1% from 2025 to 2035, driven by advanced livestock farming and strong R&D investments. Germany follows with a 4.0% CAGR, supported by advanced nutrition practices and strict welfare standards.

The UK registers a 3.8% CAGR, reflecting balanced growth despite regulatory constraints. France records a 3.6% CAGR, driven by its large poultry sector, while Japan shows the lowest growth among these, with a 3.2% CAGR, due to stringent policies despite strong meat consumption.

This report covers an in-depth analysis of 40+ countries; the five top-performing OECD Countries are highlighted below.

The USA animal feed antibiotics market is poised to grow at a CAGR of 5.1% from 2025 to 2035. Growth will be driven by advanced livestock farming practices, rising meat consumption, and strict regulatory frameworks ensuring feed safety.

Animal feed antibiotics revenue in the UK is projected to grow at a CAGR of 3.8% from 2025 to 2035. Growth will be supported by efficient livestock production despite strict EU-aligned regulations.

The German animal feed antibiotics revenue is expected to grow at a CAGR of 4.0% from 2025 to 2035. Growth will be driven by advanced animal nutrition practices and a strong livestock sector.

Sales of animal feed antibiotics in France are anticipated to grow at a CAGR of 3.6% from 2025 to 2035. Market growth will be driven by a large poultry and swine farming industry.

The Japanese animal feed antibiotics market is expected to grow at a CAGR of 3.2% from 2025 to 2035. Growth will be supported by high meat consumption, especially poultry and pork.

The market is fragmented, with a mix of tier-one multinational companies and regional players competing based on pricing, innovation, distribution partnerships, and expansion strategies. Top companies focus on developing safer, residue-free, and species-specific antibiotic formulations to align with strict regulatory frameworks while maintaining market share.

Companies like Processing Company (MPC) and Green Farms Animal Feed Antibiotics compete by offering cost-effective formulations and expanding their distribution networks in emerging markets. Mauna Loa Nut Corporation, Hamakua Nut Company, and Suncoast Gold Animal Feed Antibiotics focus on niche product offerings and strengthening regional presence to cater to specific livestock segments.

Recent Animal Feed Antibiotics Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.9 billion |

| Projected Market Size (2035) | USD 4.4 billion |

| CAGR (2025 to 2035) | 4.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume (Metric Tons) |

| By Antibiotic Type | Tetracyclines, Penicillins, Macrolides, Sulphonamides, Aminoglycosides, Others (Lincosamides, Fluoroquinolones, Cephalosporins, and Polypeptides) |

| By Form | Liquid, Powder |

| By Animal Type | Food Producing Animals, Companion Animals |

| By Sales Channel | B2B, B2C |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Processing Company (MPC), Green Farms Animal Feed Antibiotics, Mauna Loa Nut Corporation, Hamakua Nut Company, Suncoast Gold Animal Feed Antibiotics, Nut Company (PTY) Ltd., Wondaree Animal Feed Antibiotics, Midway Limited, Marquis Animal Feed Antibiotics, Nutworks Australia, and MacFarms |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

As per antibiotic type, the industry has been categorized into Tetracyclines, Penicillins, Macrolides, Sulphonamides, Aminoglycosides, and Others.

As per form, the industry has been categorized into Liquid and Powder.

This segment is further categorized into Food-Producing Animals (Poultry, Swine, Aquaculture, and Ruminants) and Companion Animals (Canines and Equines).

As per sales channel, the industry has been categorized into B2B and B2C (Veterinary Clinics and Shops, Pharmacy Stores, and Online Portal).

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is projected to reach USD 4.4 billion by 2035.

Tetracyclines lead the market, holding around 35% share in 2025.

The market is projected to grow at a CAGR of 4.2%.

USA is expected to grow at the fastest CAGR of 5.1% during 2025 to 2035.

The powder form is likely to hold 84.3% market share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Animal Growth Promoter Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Digest Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Intestinal Health Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Microchip Implant Market Growth - Trends & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA