The Global Animal Feed Alternative Protein Market is dispersed, with large agribusiness corporations, specialty protein firms, and new-generation biotech companies competing for market share. Large agribusiness companies like Cargill, ADM (Archer Daniels Midland), and DuPont account for a total market share of 40.4%, boasting robust supply chains, advanced ingredient processing, and wide distribution networks. Specialty protein producers like Ingredion and Roquette Freres command 13.2% of the market share, with an emphasis on microbial and plant protein feeds. Fresh players in the single-cell and insect-based protein markets like Puris Proteins, The Scoular Company, and Darling Ingredients command 46.4% and are leading the charge in the use of sustainable sources of proteins for livestock and aquaculture feed. The top five command nearly 50% market share, and emerging protein solutions and biotechnology advancements keep redefining competitive landscape.

Explore FMI!

Book a free demo

| Market Structure | Top Agribusiness Firms |

|---|---|

| Industry Share (%) | 40.4% |

| Key Companies | Cargill, ADM, DuPont |

| Market Structure | Specialized Protein Suppliers |

|---|---|

| Industry Share (%) | 13.2% |

| Key Companies | Ingredion, Roquette Freres |

| Market Structure | Insect & Single-Cell Protein Innovators |

|---|---|

| Industry Share (%) | 46.4% |

| Key Companies | Puris Proteins, The Scoular Company, International Flavors & Fragrances (IFF), MGP Ingredients, Darling Ingredients |

The animal feed alternative protein market is moderately consolidated, with big agribusiness companies dominating bulk supply, and insect and microbial protein pioneers dominating sustainability and new ingredient applications.

Plant protein (35%) leads owing to price, availability, and nutritional reliability, with Cargill, ADM, and Roquette Freres providing soy, pea, and wheat protein concentrates. Insect protein (28%) is growing in poultry and aquaculture feed, driven by Darling Ingredients and The Scoular Company. Fish meal substitutes (19%) are gaining traction owing to overfishing issues, where IFF and MGP Ingredients concentrate on algae- and fermentation-based proteins. Single-cell proteins (12%) are increasing in high-protein, digestible animal feed, with DuPont investing in microbial fermentation technologies. Other sources (6%), such as seaweed and mycoprotein, are increasing in specialty animal nutrition.

Poultry (31%) dominates as alternative proteins offer cost-effective, high-protein nutrition for broilers and layers, supplied by Cargill and Puris Proteins. Swine (25%) utilizes fermented plant protein for gut performance and growth, in which ADM and Roquette Freres are the leaders. Aquaculture (18%) increasingly depends on insect and microbial proteins, with MGP Ingredients and IFF providing fish meal alternatives. Cattle (18%) is favored by fiber-rich plant proteins and algae-derived nutrition, serviced by The Scoular Company. Equine (8%) depends on gut-friendly, digestible plant protein, where Ingredion provides pea and oat protein blends.

The Global Animal Feed Alternative Protein Market is experiencing high growth with concerns for sustainability, increasing protein prices, and the need for high-nutrient livestock feed solutions. Firms are turning into insect-based, single-cell, and plant-based proteins to improve livestock performance, gut health, and environmental impact reduction.

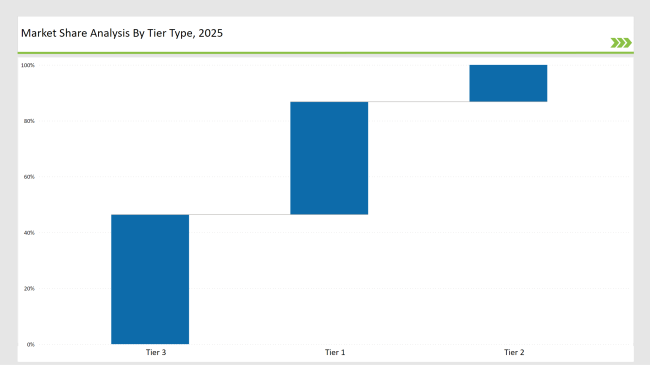

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 40.4% |

| Example of Key Players | Cargill, ADM, DuPont |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 13.2% |

| Example of Key Players | Ingredion, Roquette Freres |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 46.4% |

| Example of Key Players | Puris Proteins, The Scoular Company, IFF, MGP Ingredients, Darling Ingredients |

| Brand | Key Focus |

|---|---|

| Cargill | Expanded black soldier fly protein production for poultry and aquafeed. |

| ADM | Developed low-starch plant protein blends, reducing dependency on soybean meal. |

| DuPont | Launched fermentation-based protein solutions to enhance gut microbiota in livestock. |

| Ingredion | Strengthened pea and oat protein processing, improving pellet stability in feed. |

| Roquette Freres | Invested in algae-based fish meal replacements to reduce aquaculture’s environmental footprint. |

| Puris Proteins | Increased high-fiber protein feed production, catering to swine and cattle nutrition. |

| The Scoular Company | Introduced freeze-dried insect meal, targeting premium livestock nutrition. |

| IFF | Created probiotic-enhanced single-cell proteins, supporting gut health in poultry and swine. |

| MGP Ingredients | Strengthened fermented fish meal alternatives for sustainable aquaculture feed. |

| Darling Ingredients | Developed mycoprotein-based animal feed, improving protein digestibility in ruminants. |

The application of black soldier fly larvae, mealworms, and cricket protein will grow with mounting regulatory approvals across North America and Europe. Insect farming facilities will be ramped up in cost-efficient and high-protein feed substitutes by companies such as Cargill and The Scoular Company.

Microbial fermentation will be employed in the manufacture of highly digestible protein substitutes, which will be led by biotech-enabled single-cell proteins from DuPont and IFF. The proteins will function as replacers for fish meal and soybean meal, lowering the environmental footprint of traditional feed production.

With the increasing focus on marine resource conservation, companies like MGP Ingredients and Roquette Freres will develop algae-based protein powders and fermented mycoprotein to provide high-omega and nutrient-dense feed solutions for aquaculture and livestock.

Alternative protein uptake will gain momentum in Asia, Latin America, and the Middle East, where increased meat production and feed sustainability issues are fueling demand for insect meals, fermented protein, and plant-based feed. ADM and Ingredion will increase production bases to satisfy demand in price-sensitive markets.

Governments will enact stricter regulations on feed sourcing, traceability of feed, and carbon footprint management. Darling Ingredients and Puris Proteins will be at the forefront of certified sustainable protein feed manufacturing, guaranteeing compliance with animal feed safety and sustainability regulations in North America, the EU, and APAC regions.

Key companies include Cargill, ADM, DuPont, Ingredion, Roquette Freres, and Puris Proteins, leading plant-based and insect-based protein supply.

Alternative proteins include insect meals, plant-based proteins, fish meal substitutes, and single-cell microbial proteins.

Sustainability concerns, rising fish meal prices, and the need for high-protein, low-cost animal feed solutions are driving demand.

Fish meals are being replaced with insect proteins, algae-based feeds, and microbial protein sources, ensuring sustainable aquaculture growth.

Poultry and swine feed are rapidly adopting plant and insect-based proteins, while aquaculture is shifting toward algae and microbial proteins.

Fermentation enhances protein digestibility and bioavailability, ensuring higher nutrient absorption for livestock and fish farming.

Annatto Food Colours Market Trends - Natural Pigments & Industry Growth 2025 to 2035

Algae Fats Market Trends - Sustainable Fat Innovations 2025 to 2035

Cocoa Market Analysis by Type, Process, Nature, Application, and Region through 2035

Crude Sulfate Turpentine Market Analysis by Product Type, Source, Processing Method, Application, and Region through 2035

Confectionery Ingredients Market Analysis by Types, Form, Source, and Region through 2035

Corn Wet Milling Services Market Analysis by Equipment, Type, Application, End Products, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.