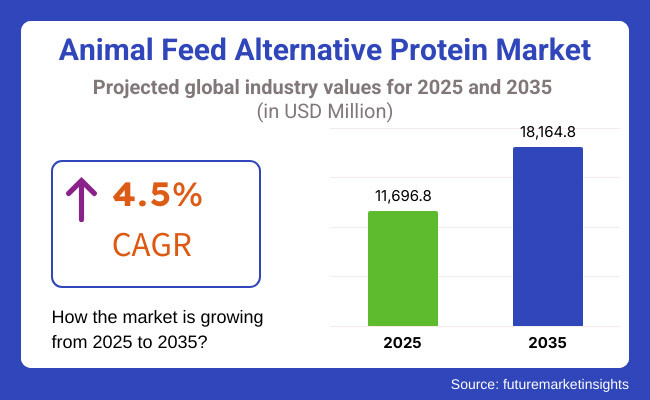

The Global Animal Feed Alternative Protein Market is projected to grow from USD 11,696.8 million in 2025 to USD 18,164.8 million by 2035, reflecting a CAGR of 4.5% during the forecast period.

The market keeps expanding at a steady rate due to increasing feed prices and rising needs for sustainable livestock nutrition while technology innovates protein alternative options. Alternative protein sources now gain broad acceptance because soymeal and fishmeal continue to rise in price and cause environmental concerns.

Fermented proteins and insect meal and plant-based proteins stand out as dominant ingredients in the feed formulations of the poultry and aquaculture sectors. Companies like ADM, Cargill, Novonesis, Ÿnsect, and Innovafeed are investing in single-cell protein fermentation, hydrolyzed insect proteins, and algae-based feed solutions to get better digestibility, improve the absorption of the nutrients, and optimize feed conversion rates (FCRs).

Besides, regulations in North America and Europe have been approved for using insect-based protein in poultry and swine feed which has fast-forwarded to commercialization.

Proteins of plant origin continue to take the lead in the market, thanks to the wide range of protein concentrates from peas, soybeans, and fava beans. The production of these isopropyl, enzymatic hydrolysis, and precision protein isolation to improve bioavailability and reduce anti-nutritional factors (ANFs). The emergence of the 'high-protein organic non-GMO choices' arising mainly from the consumer's choice is also an influential factor in this trend.

Insect-based proteins are being adopted rapidly, especially in monogastric livestock feed. France and the Netherlands are at the forefront, with companies like Ÿnsect and Innovafeed expanding the use of hydrolyzed insect protein in piglets and poultry starter diets. Industrialization of black soldier fly (BSF) larvae production is being initiated to achieve cost equivalence with traditional protein sources.

In the future, precision feeding, engineered protein solutions and circular economy protein upcycling will consider the main reasons for the market growth. With better protein efficiency, governmental support, and production rate increase, alternative feed proteins are going to be the major ingredients in animal and aqua feed all around the world.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H12024 | 4.2% (2024 to 2034) |

| H22024 | 4.8% (2024 to 2034) |

| H12025 | 4.4% (2025 to 2035) |

| H22025 | 4.7% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 4.2% in the first half (H1) of 2024 and then slightly faster at 4.8% in the second half (H2) of the same year.

The CAGR is anticipated to decrease somewhat to 4.4% in the first half of 2025 and continues to grow at 4.7% in the second half. The industry saw a decline of 32 basis points in the first half (H1 2025) and an increase of 42 basis points in the second half (H2 2025).

Fermented Protein Integration for Gut Health & Efficiency

Fermented protein sources, such as mycoproteins, bacterial proteins, and postbiotics, practically penetrate the animal feed alternative protein market replacing conventional protein sources with them. They are among the green protein producers that thrive because of their digestibility, immune-boosting properties and improved performance in feed conversion rates.

Livestock producers are particularly attracted to the replacement of soy and fishmeal by fermented proteomic sources as part of the effort to prioritize gut microbiome health. Companies like Calysta, Unibio, and Novonesis are venturing into precision fermentation for the production of highly bioavailable single-celled proteins. The emphasis is on the reduction of anti-nutritional factors (ANFs), the improvement of the amino acid balance, and the enhancement of fiber fermentability.

Other manufacturers are also working on postbiotic feed solutions, utilizing fermented yeast extracts and bacterial metabolites to enhance the animal''s resilience against infections. They are: the shrimp, poultry, and aquaculture sectors, the majority of which are lead users, while the dairy and pet food sectors lag with potential prospects. The market impact encompasses an increase of feed efficiency and a decrease of antibiotic use.

Regulatory Push for Insect Protein in Poultry & Swine Feed

The adoption of insect protein is gaining speed because of the regulatory approvement of the use of the protein in Europe and North America. As a result, the insect protein is no longer limited to aquaculture but is also used in poultry and swine feeds. In 2021, the EU legalized the use of insect meal in poultry and pig feed, which urged Ÿnsect, Innovafeed, and Protix to scale up the black soldier fly (BSF) and mealworm production industrially.

These companies combine closed-loop farming models,automation,and vertical insect farms to make sure that their business is both sustainable and efficient. The high digestibility of insect protein means that it is a very attractive alternative to soymeal and fishmeal, especially in organic and antibiotic-free livestock farming.

Feed producers are also customizing amino acid compositions to meet specific livestock needs. The regulatory shift is the driver behind the big move to the insect feed protein space, which, in turn, is altering the supply chain of animal feed worldwide.

Algae-Based Omega-3 Protein as a Fishmeal Alternative

With the increase in the prices of fish caught from the wild and the decrease in their availability, algae enriched with omega-3 fatty acids (DHA & EPA) are becoming the norm in the aquaculture industry. Companies like Corbion, DSM, and Veramaris are, with their microalgae fermentation technology, pioneers in making high-protein sustainable fishmeal alternatives.

Boosting DHA, improving digestibility and optimizing algae strains for high protein content are the main targets. Algae-based feed solutions are highly beneficial for salmon, trout, and shrimp farming, which require high omega-3 levels for fish health and meat quality.

Manufacturers are now implementing single-cell algae proteins into their formulated feeds to cut marine resource reliance and enhance the nutritional efficiency of the aquaculture feed. The stabilization of the fishmeal supply chain and new aquafeed production techniques that are more environmentally friendly are some of the market outcomes.

Bio-waste Upcycling into High-Protein Feed Sources

The circular economy concept applies to the food and agriculture industry as much as it does to others. By using beer spent granules, potato protein, spent yeast, and oilseed meal residues, these functional protein feeds are made for livestock and aquaculture.

Companies such as Cargill, Alltech, and Nutreco are leading the charge with fermentation and enzymatic hydrolysis technologies to extract those proteins from the food and agricultural by-products. Their goal is to enhance protein digestibility, amino acid profiles, and nutrient bioavailability so that these ingredients become more viable.

This movement is not only aimed at cutting down the feed cost and lowering environmental pollution but also at creating circular economy solutions for the food and beverage industry. The use of biowaste-based proteins is expanding in poultry, dairy, and fish feed sectors, thus improving resource efficiency.

Protein Fractionation for Precision Animal Nutrition

Using enzyme processing and advanced fractionation, a manufacturers' ability to assort protein composition that fits specific animal species is increasing. This trend is most relevant for plant-associated protein sources such as pea, fava bean, sunflower, and rice proteins.

Firms such as ADM, DuPont, and Scoular are investing heavily in protein hydrolysis and fractionation technology that can increase solubility, digestibility, and amino acid profile. Thanks to these processes, both monogastric animals and ruminants, as well as aquaculture, will benefit from the tailored protein concentrates and isolates.

As livestock and aquafeed manufactures seek improved feed efficiency, increased animal growth rates, and healthier guts through more accurate Protein blend mixes, the market impact is noteworthy. The main concerns are related to the improvement of protein purity, antinutritional factors (ANFs) depletion, and process optimization techniques which are employed in the manufacturing process of feed that is highly functional.

Synthetic Biology & Gene-Edited Feed Proteins

By means of the advances made in synthetic biology and gene-editing animals with alternative feed sources, the classic protein sector is being restructured. CRISPR gene editing and fermentation protein processes are used for engineered microbes producing protein and improve resistance against insects and the nutrient absorption.

Companies like Calysta, Novonesis, and Unibio are leading the path of using single-cell proteins produced from methane and carbon dioxide fermentation, which is resource-effective and land-independent. The use of genetically improved yeast, fungal, and bacterial proteins and the like in aquaculture, and monogastric animal applications is taking off.

Processors are emphasizing the achievement of lower costs through enhanced protein quality and support for immune system health of animals through gut microbiota modulation. Proposals for agricultural reforms designed to tackle the climate crisis are also talking about regulatory feeds in addition to such innovations.

The Global Animal Feed Alternative Protein Market was marked by a period of extreme growth in 2020 to 2024, propelled by several factors including rising costs of animal feed, supply chain challenges, and the ever-growing need for sustainability.

The initial uptake was mostly in aquaculture and poultry, where plant-based proteins and insect meal made serious inroads because of good legislation and nutritious benefits. The fermentation-based protein production was the major thrust for the key players driving biowaste upcycling in the backdrop as a resource-efficient feed solution.

The 2025 to 2035 outlook for the market presents a bright picture that is characterized by rapid conversion in livestock segments, where the application of synthetic biology, single-cell proteins from methane and hydrolyzed insect proteins would be more.

The path for the above ventures to unfold will be via the trio of regulatory support, technological innovations, and the formation of global strategic alliances that will boost trade. Poultry and aquafeed will still be the forerunners with precise nutrition and functional feed additives being the driving force of the long-term growth in alternative feed proteins.

The Global Animal Feed Alternative Protein Market is very much concentrated and the players that are major in the field are Tier-1 companies which include ADM, Cargill, DuPont, Novonesis, and Nutreco. These players dominate the market and own huge market shares along with advantages like vast production capabilities, cutting-edge research competencies, and an incredible global supply chain.

They have been focusing mainly on the scaling of microbial fermentation, precision fermentation, and high-efficiency plant protein extraction in order to lead the research and continue innovating. Additionally, they adopt strategic acquisitions and lobbying actions to persuade feed solution novel takeovers.

Companies such as Tier-2 players that make on insect-based proteins, algae-based proteins, and methane-feeding single-cell proteins like Ÿnsect, Innovafeed, Calysta, Unibio, and Corbion. These medium-sized companies center around technology innovation and the penetration of the local market, which leads them to cooperate with bigger feed producers very often. Their critical strength is the increase of the new protein grade especially when they lower the production cost.

The Tier-3 players are made up of start-ups and developing enterprises that are teeming with interest in additive, remoulding technologies, which includes precision gene-edited proteins, and the bio waste-upcycling process into protein-rich feed. These enterprises have lower production volumes, but they influence the market by procuring new functional feed ingredients and interfering with the traditional protein supply chains.

The following table shows the estimated growth rates of the top three countries. China, the United States, and France are set to exhibit high consumption, with CAGRs of 4.3%, 3.6%, and 2.9%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| China | 4.3% |

| United States | 3.6% |

| France | 2.9% |

The rapid transformation of the feed industry in China can be attributed to the use of methane-fed single-cell proteins (SCPs), which is the main alternative to soy and fishmeal. Natural gas fermentation to produce protein-rich feed alternatives is being used by the pioneer companies Calysta and Unibio, which consequently results in less land-required agriculture.

The push by the Chinese government for protein sources with low carbon is a way to confront the issue of high feed cost and the problem of food security. Wax-feed SCPs are being well absorbed and use amino acids very efficiently, thus they are the right choice for aquaculture, poultry, and swine.

Local companies are turning to bioreactor models for production scalability to reach the SCP targets. The new trend of sustainable and land-independent protein sources is expected to fuel the alternative feed protein market in China and methane-derived proteins will be a key in the feed supply chains decarbonisation.

The animal feed sector in the USA is using mycelium-based proteins, which are derived from fungi and can be produced by fermentation of microorganisms, to mitigate the environmental impact of predominant animal feed sources such as soymeal and fishmeal.

Markedly, companies like Meati Foods, Nature's Fynd, and ADM allocate significant investment towards the development of mycoprotein fermentation platforms, while also innovating by selecting the optimal strains of fungi that enhance livestock digestibility. These proteins are enriched with fiber and components that are not detrimental to animal health (ANFs), thereby positively affecting gut health and nutrient absorption in turkeys and dairy cows.

The introduction of mycelium proteins in ruminants feed, precision nutrition programs, contributes to enhancement in feed efficiency and decrease in methane emissions. The high-protein, hypoallergenic formulations in the pet food sector are also a driving force in adoption. Conclusively, the USA feed industry will be ramping up mycoproteins as they are leasing them, and alongside that, they will be making mycoproteins manufacturing capacity a core part of animal feed in the future.

The hydrolyzed insect protein trade is being led by France, which is also where the proteins are mainly designed for absorption by monogastric animals like pigs and poultry. Enzymatic hydrolysis is being refined by companies Ÿnsect and Innovafeed along the lines of solubility, digestibility, and bioavailability improvements of the insect meal.

Hydrolyzed insect proteins help by removing the chitin, thus improving the absorption of amino acids and are therefore very effective in starter feeds and high-performance diets. French feed companies utilize insect-derived peptides and hydrolyzed protein fractions in the diets of weaning piglets and broiler chickens, where the protein efficiency is crucial.

France is on a winning path in the hydrolyzed insect protein industry as they acquire the relevant licenses and at the same time, they set the ground for large-scale production to commence, thus addressing both the problem of food quality and animal performance.

| Segment | Value Share (2025) |

|---|---|

| Plant Based Protein (End Use Application) | 35% |

The alternative feed market for animal proteins continues to be dominated by plant-based proteins which is mostly attributed to their cost-efficiency, scalability, and consumer push for environmentally friendly animal farming. Soy protein, pea protein, and fava bean protein are the top three common sources which are used to formulate feeds enriched with high protein digestibility and balanced amino acid profiles.

Leading companies, including ADM, Cargill, and DuPont have come up with the idea of developing precision-extracted plant proteins in order to enhance nutrient absorption and feed efficiency. The protein solubility as well as the reduction of anti-nutritional factors (ANFs) has been achieved by enzymatic processing and fractionation methods.

Plant-based proteins have become more affordable compared to fishmeal and insect protein and are thus the most used ingredients in poultry, aquaculture, and dairy industries, which are also the highest consumers. The rise in the focus on non-GMO, organic, and allergen-free plant proteins additionally brings the rise in adoption, thus planting the plant-based feed sector as the leading segment of the global alternative protein markets.

| Segment | Value Share (2025) |

|---|---|

| Poultry (Livestock) | 31% |

The poultry farming business is the most significant and quickest growing domain in the alternative protein feed market, which is a result of the renewed global hunger for chicken meat and eggs. The sector reaps the benefits of high feed conversion efficiency (FCR) and short production periods thus needing high-protein, and cost-efficient alternatives.

Insect protein, fermented yeast, and plant protein concentrates are the crucial components of new formulations studied by companies like Nutreco, Novonesis, and Innovafeed in the attempt to treat gut, boost immunity, and promote growth rates. Hydrolyzed proteins and postbiotic feed additives are the new birds on the block that are optimizing nutrient bioavailability for broilers and layers.

The approval for insect meal in poultry diets in Europe and North America is a big boost to the market growth. Restructuring of the poultry sector with the use of alternative proteins that are sustainable and antibiotic-free marks a new age in feed formulations across the world.

The Global Animal Feed Alternative Protein Market continues to be heated up through competition, as manufacturers are using many strategies such as technological progress, collaborations, and environmentally friendly innovations to get an edge over others.

Major players in this sector including ADM, Cargill, Novonesis, Innovafeed, and Ÿnsect, are focusing on harnessing centralized fermentation proteins, insect cultivation, and extractions of plant proteins to deliver upon market demand. One of the big strategies is revealing products that have functional benefits- for instance, gut health enhancement, better digestibility, and increased protein efficiency.

The latest ones include Ÿnsect's hydrolyzed insect proteins for poultry and Calysta's FeedKind® single-cell protein for aquaculture. Furthermore, the companies are building supply chain partnerships in order to increase production capacity and reduce costs.

The recent approvals for the use of insect meal and microbial proteins in Europe and North America have accelerated the uptake of these proteins in poultry and pet food among others, thus maintaining the growth of the alternative feed proteins sector.

The Global Animal Feed Alternative Protein Market is expected to reach USD 11,696.8 million in 2025, driven by rising demand for sustainable feed solutions and increased adoption of plant-based, insect, and microbial proteins in livestock nutrition.

The market is driven by rising feed costs, sustainability concerns, regulatory approvals for insect and microbial proteins, and increasing demand for high-efficiency livestock nutrition.

Plant-based proteins (soy, pea, fava bean) dominate due to their cost-effectiveness, scalability, and established nutritional benefits in poultry and aquaculture feed.

Insect-Based Protein, Plant-Based Protein, Fish Meal Alternative, Single-Cell Proteins, Others

Poultry, Swine, Cattle, Equine, Aquaculture

Meal, Pellets, Liquid, Freeze-Dried

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

Calcium Caseinate Market Analysis by End Use Application and Functionality Through 2025 to2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

Children’s Health Supplement Market Analysis by Product Type, Application and Age Group Through 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.