The world animal feed additives industry is organized into three categories in terms of the size and control of companies: multinational firms, regional giants, and niche players. Market-leading multinational firms such as Cargill, BASF, and DSM are at the top of the market and control approximately 55% of the entire market share.

They are so dominant because they have large distribution channels, have heavily invested in R&D, and have a wide range of products. Regional players, including Nutreco, Zinpro Corporation, and Evonik Industries, hold around 30% of the market. These players concentrate on local strategies and specialized feed solutions.

The remaining 15% of the market consists of small niche brands, which tend to specialize in natural or organic feed additives. In each segment, the leaders in the top five companies hold a significant portion of their segment, with 70% of the multinational segment and 65% of the regional leader segment. This implies a moderately consolidated market, with big companies being the leaders but still leaving space for smaller companies to expand.

Explore FMI!

Book a free demo

| Global Market Share, 2025 | Industry Share % |

|---|---|

| Top Multinationals (Cargill, BASF, DSM, ADM Animal Nutrition, Evonik Industries) | 55% |

| Regional Leaders (Nutreco, Zinpro Corporation, Novus International, Kemin Industries) | 30% |

| Startups & Niche Brands (Biomin, Delacon, Bentoli, Perstorp, P ancosma) | 15% |

The market is moderately consolidated, with multinational firms dominating the majority share, and regional and niche players adding to product diversity.

The Technological Additives (40%) are the largest category, which are critical to enhance feed stability, minimize spoilage, and improve feed texture. Preservatives like mold inhibitors and acidifiers are commonly used in poultry and swine feed to inhibit fungal growth and microbial contamination.

Emulsifiers are also gaining popularity within aquaculture, as they enhance the metabolism of fats from fish feed. Market leaders Cargill and Kemin Industries are leading in this segment and employ sophisticated processes to enhance efficiency in feeding.

Sensory Additives (20%) such as colorants and sweeteners are highly used in special livestock feed to enhance feed consumption, particularly in the case of young animals. DSM has led the way in innovation with the introduction of natural carotenoids to increase egg yolk pigmentation in poultry.

70% powdered feed additives are the most favored form as they are easily stored, have a long shelf life, and easily mix with dry feed. It is very much in demand in North America and Europe where massive poultry and dairy farms utilize economic feeding methods.

Granules account for 10%, a niche segment but a significant one, as it is used in high-performance animal feeds with higher stability in pelleted feeds. Mineral granules of controlled release are the products specialized by companies like Zinpro Corporation.

The world animal feed additives market in 2024 saw major breakthroughs fueled by innovation, sustainability, and strategic partnerships. Major producers concentrated on maximizing feed formulation for greater efficiency, minimizing environmental footprint, and responding to changing consumer preferences for antibiotic-free meat products. Alternative protein sources, including insect-based and algae-derived feed ingredients, contributed to diversifying feed composition.

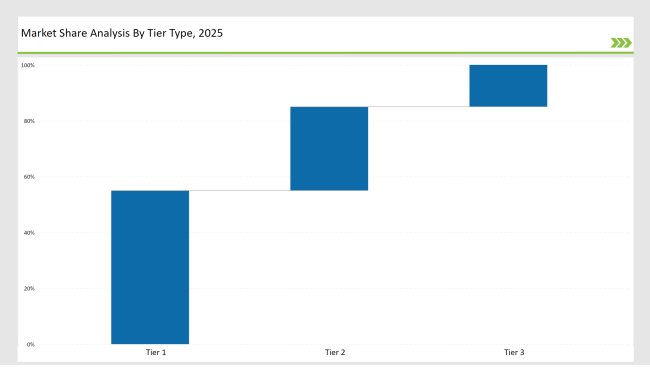

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 55% |

| Example of Key Players | Cargill, BASF, DSM, ADM Animal Nutrition |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Nutreco, Zinpro Corporation, Novus International, Kemin Industries |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 15% |

| Example of Key Players | Biomin, Delacon, Bentoli, Perstorp |

| Company Name | Key Focus or Initiative |

|---|---|

| Cargill | Investment in sustainable algae-based omega-3 feed |

| BASF | Enzyme-based additives for nutrient absorption |

| DSM | Methane-reducing cattle feed additives |

| Nutreco | Acquisition of alternative protein sources |

| Evonik Industries | Expansion of precision animal nutrition products |

| ADM Animal Nutrition | Dairy optimization partnership for feed efficiency |

| Novus International | Development of new probiotics for gut health |

| Kemin Industries | Launch of heat-stable lysine for poultry |

| Zinpro Corporation | Advanced trace mineral solutions |

| Alltech | Mycotoxin detection technology for safer feed |

Development of Alternative Protein Feed Sources: Considering growing sustainability concerns, producers will further invest in insect-based, algae-based, and single-cell protein to displace conventional soy and fishmeal feed sources, mainly in Europe and Asia.

Advancement in Precision Livestock Nutrition: Artificial intelligence and big data analysis will facilitate precision feeding solutions, cutting feed expenses and maximizing nutrient utilization. The USA and China are set to lead the technological transition.

Growing Demand for Organic and Non-GMO Feed Additives: Consumer demand for organic and antibiotic-free meat products will fuel the use of organic feed additives, with Latin America and North America experiencing the highest growth.

Adoption of E-commerce and Direct-to-Farm Sales Channels: Online B2B platforms will revolutionize traditional distribution, enabling small-scale farmers in Southeast Asia and Africa to access specialized feed solutions.

Regulation-Driven Reformulation of Feed Additives: More stringent environmental laws in the EU and North America will hasten the trend towards enzyme-based and probiotic feed additives at the expense of synthetic chemicals.

The market is led by Cargill, BASF, DSM, ADM, and Evonik Industries, controlling over 55% collectively.

Sustainability, precision nutrition, regulatory changes, and alternative proteins are major drivers.

Powder form leads the market with a 70% share, particularly in large-scale livestock operations.

Stricter environmental laws are shifting demand towards natural and enzyme-based additives.

Southeast Asia, Africa, and Latin America are key growth regions due to increasing livestock production.

Technological Additives (Preservatives, Emulsifiers, and Others), Sensory Additives (Sweeteners, Lutein, and Others), Nutritional Additives

Powder, Granules, Liquid

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.