The shifting arena of Animal-Based Pet Protein is relied upon to encounter consistent development somewhere in the range of 2025 and 2035, driven by expanding pet proprietorship, developing interest for high-protein pet eating regimens, and developing mindfulnesses of pet sustenance.

Creature-based proteins, including chicken, meat, fish, sheep, and peculiar proteins like venison and duck, are fundamental for muscle development, insusceptible well-being, and general prosperity in pets. The pattern toward top of the line, crude, and freeze-dried pet sustenance is additionally energizing the interest for high-quality, reasonable creature proteins in pet nutritious support.

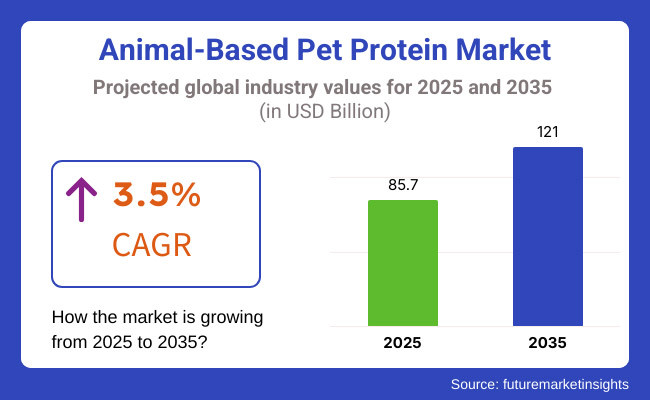

This market is anticipated to achieve USD 85.7 billion out of 2025 and is relied upon to develop to USD 121 billion by 2035, enlisting a CAGR of 3.5% over the figure time frame. The ascent of inherently fitting crude sustenance (BARF) eating regimens, expanded spotlight on high-protein pet equations, and advances in pet sustenance handling innovations are reshaping the business scene.

Moreover, supportability worries and moral sourcing of creature proteins are driving creations in human-grade pet nourishment and substitute protein sources, for example, bug-based and fabricated meat proteins.

Explore FMI!

Book a free demo

North America dominates the Animal-Based Pet Protein Market due to elevated pet possession rates, swelling demands for premium pet nourishments, and robust retail dispersal routes. The United States and Canada lead the area as a consequence of the developing anthropomorphization of animals, inflating disposable incomes, and heightening cognizance of pet dietary well-being.

The uncooked and freeze-dried pet nourishment section is experiencing speedy progress, with animal proprietors opting for high-protein, minimally handled diets for their animals. Companies in North America are concentrating on human-grade and ethically resourced proteins for example grass-fed beef, free-range chicken, and fish caught in the wild.

Moreover, veterinary-recommended high-protein regimens for weight administration, muscle maintenance, and hypoallergenic pet nourishment formulations are further propelling demands for premium animal proteins.

Europe controls a considerable portion of the Animal-Based Pet Protein Market, as nations including Germany, the United Kingdom, and France pave the path in organic pet foods manufacturing, sustainable sourcing tactics, and beneficial pet nutrients. Strict policies from the European Union on pet nourishment safety and constituent visibility are promoting more extensive acceptance of high-quality, responsibly obtained animal proteins in animal diets.

Furthermore, local legislation stimulates innovation from producers as they seek novel ways to satisfy the criteria while fulfilling pet requirements. Younger pet owners particularly prioritize sourcing transparency and welcome varied sentence structures within descriptions.

The unconventional protein section, comprising venison, rabbit, and insect-based proteins, is achieving expanding reputation as pet house owners search for hypoallergenic and various protein assets for pets with meals sensitivities. Moreover, the upward push in grain-unfastened and uncooked pet meals formulations is using call for extremely digestible and bioavailable animal proteins.

Sustainability issues also are shaping the market, with eco-mindful pet owners opting for certified organic and ethically farmed protein assets. Some pet owners even choose locally sourced proteins to lessen the environmental impact of transporting animal feeds over long distances.

The Asia-Pacific region is expected to see the highest rise over the coming years in the Animal-Based Pet Protein Market, fueled by climbing pet adoption, surging discretionary incomes, and a rising comprehension of pet nourishment. Nations including China, Japan, South Korea, and India are emerging as pivotal markets, with a booming pet food industry and an expanding preference for high-protein sustenance.

In China, with its rapidly expanding middle class and premium pet food sector, there is strong demand for diets high in protein, functional pet victuals, and individualized pet nutrition plans. Japan and South Korea, known for inventive pet food formulations, are taking the lead in freeze-dried and air-dried high-protein victuals for pets. India’s quickly increasing urban pet population is driving requirement for commercial pet nourishment with enhanced protein substance and veterinary-configured sustains.

The ascent of local pet food brands, expanded e-commerce infiltration, and the accessibility of specialized protein-rich pet victuals are accepted to drive market development in the locale. Administration activities supporting pet care, pet food & pet nutrition mindfulness and improved pet healthcare are adding to the expanding selection of high-quality animal-based protein sustains.

Challenges

Supply Chain Disruptions and Sustainability Concerns

One of the major hurdles in the Animal-Based Pet Protein Marketplace is unstable supply chains and fluctuating prices in raw substances, especially meat and fish-founded proteins. Local climate switch, geopolitical uncertainty, and business restrictions have an effect on the accessibility and price of high-quality animal proteins. Further, considerations over sustainability, moral sourcing, and carbon emissions from livestock manufacturing are influencing client tastes and regulatory insurance policies.

The emergence of various pet protein assets, together with plant-based and cultured meat proteins, presents a competitive challenge to conventional animal-based pet proteins. Moreover, expanding purchaser awareness approximately pet meals allergens, processing techniques, and component fine is pushing pet meals producers to adopt transparent labeling and stricter first-class manipulate measures.

Additionally, the instability in sourcing has led manufacturers to examine replacements like plant-based totally and lab-grown options. Meanwhile, client call for transparency has pressured manufacturers to investigate shorter and greener provide chains domestic and nearby.

Opportunities

Functional Proteins and Human-Grade Pet Nutrition

Despite various difficulties, the Animal-Based Pet Protein Market presents considerable development opportunities. The increasing demand for useful pet foods, enhanced with collagen, omega-3 fatty acids, and premium quality amino acids, is propelling advancement in pet protein formulations.

The rise of gourmet pet food, featuring top cuts of meat, untamed caught fish, and organic chicken, is gaining traction as pet proprietors search for bistro-quality sustenance for their pets. What's more, developments in pet food handling innovations, including air-drying, freeze-drying, and extrusion strategies, are improving protein degradability, rack stability, and dietary retention.

The developing fame of crude, high-protein, and biologically fitting eating regimens is motivating pet food organizations to investigate novel protein wellsprings, including bunny, duck, venison, and game meats, tending to pets with sensitivities and processing disorders. Moreover, expanding ventures in insect-based and lab-developed creature proteins for pet nourishment are anticipated to make maintainable and eco-amicable options in contrast to conventional meat-based pet sustenance.

Between 2020 and 2024, the animal-based pet protein market saw significant growth, driven by rising demand for premium formulations supporting pet health. Pet humanization, premium foods, and understanding species diets drove higher consumption of meat, fishmeal and organ proteins. Owners chose high-protein, grain-free and raw diets, prioritizing chicken, beef, lamb, salmon and novel proteins including venison and rabbit.

By 2025 through 2035, transformative changes will arrive with bioengineered proteins, lab-grown meats and customized nutrition through AI. Fermentation will allow clean, high-protein animal ingredients produced with lower environmental impact and enhanced digestibility. CRISPR will genetically optimize nutritionally enhanced animal sources, decreasing dependence on conventional meat production while maintaining essential amino acids for pets.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter pet food safety regulations, ingredient traceability, and protein quality mandates. |

| Technological Advancements | Growth in freeze-dried proteins, hydrolysed meat sources, and grain-free formulations. |

| Industry Applications | Used in kibble, wet food, raw diets, and high-protein treats. |

| Adoption of Smart Equipment | Minimal AI use in protein formulation and pet diet customization. |

| Sustainability & Cost Efficiency | Concerns over meat sourcing sustainability, environmental impact, and deforestation-linked livestock production. |

| Data Analytics & Predictive Modeling | Use of basic pet diet analytics and protein digestibility studies. |

| Production & Supply Chain Dynamics | Challenges in meat price fluctuations, raw material availability, and ethical sourcing. |

| Market Growth Drivers | Growth fueled by pet humanization trends, demand for high-protein diets, and functional nutrition awareness. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-based ingredient verification, AI-powered compliance tracking, and bioengineered protein regulation frameworks. |

| Technological Advancements | Lab-grown pet proteins, CRISPR-enhanced animal protein sources, and precision fermentation-derived meat ingredients. |

| Industry Applications | Expanded use in AI-personalized pet diets, functional protein supplements, and longevity-enhancing formulations. |

| Adoption of Smart Equipment | AI-driven pet nutrition optimization, real-time metabolic tracking, and smart pet food dispensers. |

| Sustainability & Cost Efficiency | Carbon-neutral animal protein sourcing, upcycled meat by-products, and AI-optimized ingredient sustainability assessments. |

| Data Analytics & Predictive Modeling | AI-powered predictive pet health modeling, personalized amino acid profiling, and blockchain-enabled ingredient traceability. |

| Production & Supply Chain Dynamics | AI-enhanced supply chain logistics, decentralized lab-grown protein production hubs, and blockchain-secured ethical meat sourcing. |

| Market Growth Drivers | Future expansion driven by bioengineered proteins, AI-powered personalized pet nutrition, and sustainable meat production innovations. |

The flourishing American Pet Protein Market has seen steady development propelled by expanding pet possession, developing interest for high-protein pet eating regimens, and developing shopper inclination for top of the line pet nourishment. As indicated by the American Pet Products Association, the quantity of proprietors spending on nutritious, meat-based pet sustenance has expanded enormously, particularly among canine and feline keepers.

Pet nourishment producers zero in on premium creature protein wellsprings, for example, chicken, steak, fish, and lamb. Freeze-dried and crude pet nourishment have picked up notoriety due to their supplement thick textures. What's more, dynamic pet nourishments enhanced with collagen, omega-3 unsaturated fats, and probiotics are driving new items.

Administrative offices like the FDA and AAFCO actualize stricter quality and wellbeing principles for creature based pet proteins. This urges straightforwardness in acquiring and fixing fixings. Altogether, request for top of the line, solid eating regimens has upheld steady development in the United States pet nourishment business.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.7% |

The United Kingdom is witnessing a growing pet protein market as pet owners increasingly seek nutritious and sustainable diets for their animal companions. Fueled by heightened awareness of pet nutrition and demands for raw and grain-free formulations, the market is experiencing premiumization trends according to the Pet Food Manufacturers' Association. Owners want assurance that foods contain ethically-sourced, human-grade ingredients to nourish their pets.

Complementing staple proteins like chicken and beef, novel meat sources such as venison, rabbit and duck are diversifying pet food recipes as manufacturers explore alternatives. At the same time, concerns for sustainability motivate businesses to use conscientiously reared animal proteins. The national government also facilitates this evolution through statutes ensuring pet welfare and health regulations are followed. Regulations compel makers to choose digestible, quality protein sources that benefit pets in both body and conscience.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.3% |

The Animal-based Pet Protein Market in the European Union is growing steadily due to increasing demand for high-protein pet diets, the rise of specialty pet food brands adhering to strict regulations, and owners seeking customizable nutrition. The European Pet Food Industry Federation rigorously enforces high safety and nutritional standards for animal-derived proteins.

Germany, France, and Italy particularly prefer natural, high-meat formulations. Breed-specific diets incorporating hydrolysed proteins aid sensitive pets, driving demand for protein-rich blends.

Additionally, the expansion of fresh and wet foods boosts procurement of quality animal proteins like poultry, fish, and organ meat. Adopting sustainably sourced, traceable meat ingredients reflects concerns for responsible production in an evolving industry.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.5% |

The rapidly growing Japanese pet food market has been fueled by pet humanization and demand for premium products containing top-quality animal proteins. Pet parents increasingly select diets emphasizing functionality and health, such as formulations supplemented with concentrated protein sources and precisely balanced amino acid profiles. The Ministry of Agriculture, Forestry and Fisheries has championed rigorous quality and safety regulations for pet nutrition, advocating the incorporation of top-cut meats, fish and poultry.

Furthermore, the proliferation of fresh and chilled pet food alternatives has stimulated requirements for minimally processed offerings brimming with robust, nutritious proteins. Meanwhile, specialized pet retailers have capitalized on these proliferating preferences by broadening selections of responsibly sourced cuts and whole-food ingredients for cats, dogs and other animals.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

South Korean Animal-based Pet Protein Market is experiencing healthy growth, driven by the boom in pet keeping, growing demand by consumers for value-added and niche pet nutrition, and governmental supervision of the quality of pet foods. The Ministry of Agriculture, Food, and Rural Affairs of South Korea is actively encouraging efforts to promote premium, high-quality pet foods, which are also high-protein foods.

South Korea's expanding pet food market is experiencing a shift towards high-protein, grain-free, and freeze-dried diets with upscale meat sources including duck, lamb, and fish. Direct-to-consumer pet food companies as well as online businesses are becoming increasingly popular with customized, high-protein pet meal plans.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

The Animal-Based Pet Protein Market is growing with advancing pet humanization trends and more awareness of pet species-appropriate high-protein diets. For all product categories, dry pet food and wet pet food reign supreme as these products provide nutritive value, ease of handling, and acceptance across different nutritional needs of animals.

Dry Pet Food Leads Market Demand Due to Cost-Effectiveness and Convenience

Dry pet food dominates the market owing to its affordability, longevity on shelves, and easy handling. Composed of chicken, beef, lamb and fish proteins, crunchy morsels furnish balanced sustenance, indispensable amino acids, and high digestibility, making it a preferred choice for canines and felines.

Pet guardians favor dry fare for its convenient serving, portion regulation, and ability to support dental well-being by reducing plaque accrual. What's more, high-protein, grain-free morsels enriched with probiotics, omega-3 fatty acids, and useful ingredients are gaining fame, especially for pets with explicit dietary demands such as weight administration or joint backing.

In spite of its advantages, lower moisture content and palatability problems for finicky eaters remain issues. To tackle this, manufacturers are introducing freeze-dried raw additions and enhanced meat-based taste profiles, ensuring both relish and nutritional balance.

Wet Pet Food Gains Popularity for Its High-Protein Content and Hydration Benefits

Wet pet nourishment is the subsequent-largest section, pushed by its elevated protein focus, remarkable palatability, and dampness substance. It is particularly gainful for felines and more seasoned pets, who require delicate surfaces and extra hydration to back kidney capacity and digestive wellbeing.

Premium sodden pet nourishment formulations regularly incorporate genuine meat pieces, organ meats, and broth-based formulas, offering a common sustaining encounter for pets. Additionally, constrained fixing and single-protein soaked nourishment choices are ascending sought after for pets with sustenance sensitivities or digestive awkwardness.

In spite of higher expenses and more limited time span contrasted with dry nourishment, wet pet sustenance proceeds with developing in prevalence because of shopper interest for top notch, high-meat-content arrangements. Creative energy in preservative-free canned nourishment and maintainable bundling arrangements are additionally adding to business sector development.

The demand for animal-based pet protein is primarily driven by dog and cat owners, who prioritize species-appropriate, protein-rich diets for muscle maintenance, weight control, and overall pet wellness.

Dog Segment Dominates as High-Protein Diets Support Energy and Muscle Growth

The canine nourishment segment keeps control over the most noteworthy offer available, as creature proprietors consistently pursue elevated protein formulations to uphold dynamic ways of life, development, and general wellbeing. Pups require adjusted protein admission from wellsprings, for example, chicken, fish, beef, and lamb to support muscle quality and vitality levels.

Huge breed and extraordinarily dynamic canines advantage from protein-wealthy dry sustenance, freeze-dried crude eating regimens, and elevated protein treats, which advance joint wellbeing, perseverance, and processing. What's more, puppy explicit elevated protein eating regimens enriched with DHA and fundamental amino acids are turning out to be progressively normal as shoppers acknowledge the significance of early sustenance for long haul wellbeing.

In any case, expanding worries about sensitivities and processing affectabilities have driven interest for novel protein wellsprings, including duck, venison, and rabbit, just as constrained fixing, grain-free plans. Endurance extends as pet proprietors search out extraordinary alternatives, still hoping to give their pets the nourishment important for wellbeing and energy. The future guarantees new proteins and formulations created with wellbeing as the essential target rather than restricted fixings or patterns.

Cat Segment Expands as Protein-Rich, Meat-Based Diets Gain Popularity

Cats, as obligate carnivores wired by nature, crave high-protein victuals sourced from meat to sustain vibrant well-being. The cat food industry has seen expansion as caregivers opt for biologically pertinent nourishments rich in protein-whether dry or wet-centered around authentic animal ingredients such as chick, fish, and liver.

Top-tier brands enhance fare with nutrients shown to aid gut health, coat condition, and urinary functioning-including taurine, omega fats, and probiotics. In addition, freeze-dried raw cuisine and grain-free, protein-dense kibble appealing to guardians mindful of wellness are finding favor.

While cost stays a consideration curbing some, the momentum toward premium victuals of quality composition and ethical derivation will likely continue propelling industry gains.

The flourishing Animal-Based Pet Protein Market is propelled by pet owners pursuing premium, biologically fit diets and protein-packed sustenance for their furry familiars. Demand has been fueled by owners personifying pets more, craving top-notch nutrition guaranteeing health, and seeking formulations stocked with muscle-mending protein.

Suppliers aim to meet this need through sustainable sourcing, ground-breaking protein picks, and formulations with superb digestibility. Key players investing in novel freeze-dried proteins, raw-diet recipes, and purposeful animal-derived ingredients encompass global pet food powerhouses, specialty additive manufacturers, and meat masters, altogether advancing innovations to please evolving client and companion needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Mars Petcare | 18-22% |

| Nestlé Purina PetCare | 15-19% |

| Hill’s Pet Nutrition (Colgate-Palmolive) | 10-14% |

| The J.M. Smucker Company | 8-12% |

| Blue Buffalo (General Mills) | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Mars Petcare | Produces protein-rich wet and dry pet food with real meat, poultry, and fish under brands like Royal Canin, Pedigree, and IAMS. |

| Nestlé Purina PetCare | Specializes in high-protein kibble, grain-free options, and premium animal-based pet nutrition with brands like Purina Pro Plan and Beyond. |

| Hill’s Pet Nutrition | Develops science-backed pet food with high-quality animal proteins for therapeutic and wellness-based diets. |

| The J.M. Smucker Company | Manufactures meat-first pet food and treats, including freeze-dried and raw-based protein formulations. |

| Blue Buffalo (General Mills) | Offers high-protein diets with deboned meat, freeze-dried raw protein, and grain-free pet food options. |

Key Company Insights

Mars Petcare (18-22%)

Mars dominates the animal-based pet protein market with wet and dry pet food made from high-quality animal proteins, emphasizing nutritional balance and breed-specific formulations.

Nestlé Purina PetCare (15-19%)

Nestlé Purina specializes in premium high-protein pet food, integrating real meat, fish, and poultry ingredients into functional and performance-based pet nutrition.

Hill’s Pet Nutrition (10-14%)

Hill’s offers therapeutic diets with high-quality animal proteins, focusing on veterinary-approved formulations for pet health and wellness.

The J.M. Smucker Company (8-12%)

The J.M. Smucker Company develops raw and freeze-dried protein pet food, catering to the growing trend of ancestral and biologically appropriate diets.

Blue Buffalo (6-10%)

Blue Buffalo emphasizes high-meat, high-protein pet food with premium animal ingredients, supporting natural and grain-free pet nutrition.

Other Key Players (30-40% Combined)

Several pet food manufacturers and ingredient suppliers contribute to advancements in animal-based protein formulations, sustainable sourcing, and specialty pet diets. These include:

The overall market size for the Animal-based Pet Protein Market was USD 85.7 Billion in 2025.

The Animal-based Pet Protein Market is expected to reach USD 121 Billion in 2035.

Increasing pet ownership, rising demand for high-protein pet food, and growing consumer preference for premium and organic pet nutrition will drive market growth.

The USA, China, Germany, France, and Brazil are key contributors.

Dry product segment in type is expected to lead in the Animal-based Pet Protein Market.

Yeast Extract Market Analysis by Type, Grade, Form, and End Use

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.