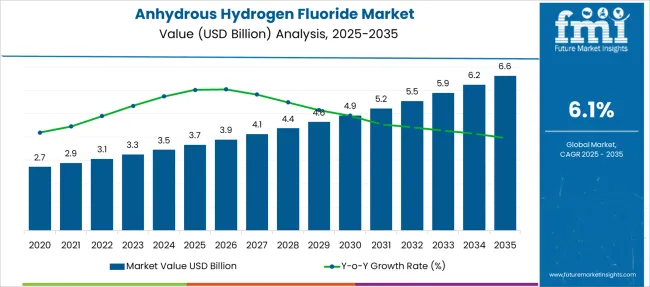

The Anhydrous Hydrogen Fluoride Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 6.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Anhydrous Hydrogen Fluoride Market Estimated Value in (2025 E) | USD 3.7 billion |

| Anhydrous Hydrogen Fluoride Market Forecast Value in (2035 F) | USD 6.6 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The anhydrous hydrogen fluoride market is witnessing sustained demand growth due to its critical role in fluorine chemistry, industrial processing, and electronics manufacturing. Increased usage in the production of high-performance fluorinated compounds has been a key factor supporting volume expansion.

Regulatory shifts promoting the substitution of harmful substances with advanced fluorinated materials have further strengthened market momentum. Growth in semiconductor fabrication, aluminum processing, and fluorinated refrigerants has also contributed to heightened consumption across core end-use sectors.

As industries push toward higher purity standards and specialized performance materials, the demand for anhydrous hydrogen fluoride continues to rise. The market outlook remains positive due to innovation in downstream fluorochemical production and the strategic importance of this compound in multiple industrial applications.

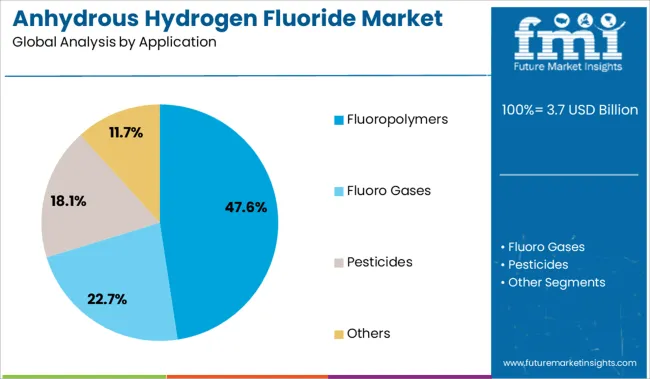

The market is segmented by Application and region. By Application, the market is divided into Fluoropolymers, Fluoro Gases, Pesticides, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fluoropolymers segment is expected to account for 47.60% of total market revenue by 2025 under the application category, establishing it as the leading segment. This is driven by growing demand for lightweight, chemically resistant, and thermally stable materials across automotive, aerospace, and electronics industries.

Anhydrous hydrogen fluoride is a key precursor in the synthesis of fluorinated monomers used in the manufacture of fluoropolymers. Increasing preference for non-stick coatings, high-purity tubing, and insulation applications has led to sustained consumption of these materials.

The expansion of electric vehicles and high-speed communication technologies has further fueled the need for fluoropolymer-based components. As manufacturers scale up production to meet performance and compliance standards, the fluoropolymers segment continues to dominate application demand within the anhydrous hydrogen fluoride market.

The global anhydrous hydrogen fluoride market grew at a CAGR of 3.7% from 2020 to 2025, as per Future Market Insights, a provider of market research and competitive intelligence. During the anticipated period, rising consumer demand for the benefits of these materials is predicted to drive up the anhydrous hydrogen fluoride market demand.

Anhydrous hydrogen fluoride is now more in demand than ever before since it is a necessary ingredient in the production of several fluorine-containing compounds. These compounds are used in many things, including kitchenware and automobiles.

Teflon, a fluoropolymer, is widely utilized in a range of applications including semiconductors, domestic cookware, textiles, electrical appliances, and vehicles due to its high thermal stability, superior chemical resistance, as well as efficient electrical qualities. Such benefits are expected to boost the demand for anhydrous hydrogen fluoride globally during the forecast period.

Rising consumer goods demand being produced from anhydrous hydrogen fluoride materials to accelerate industry growth

Anhydrous hydrogen fluoride is used to make a variety of fluorine-containing compounds. The strong demand for consumer goods materials made from anhydrous hydrogen fluoride may help the sector thrive.

Furthermore, the growing use of anhydrous hydrogen fluoride in a variety of contemporary applications is expected to boost sales. Furthermore, the growing usage of gas in the production of aluminum, electrical components, high-octane gasoline, fluorescent light bulbs, plastic goods, medicines, refrigerants, and herbicides is likely to drive up anhydrous hydrogen fluoride demand. These reasons might propel the anhydrous hydrogen fluoride market forward.

Wide application of fluoro gases to boost the demand

The widespread usage of fluoro gases in the production of HFCs, CFCs, and HCFCs used in refrigeration equipment, ventilation, heating, and air-conditioning (HVAC) systems, self-chilling beverage cans, and defrost systems supports the expansion of the anhydrous hydrogen fluoride market.

Vapor compression systems are the dominating technology for commercial, residential, as well as mobile air conditioning and refrigeration. Furthermore, due to the ease and ample availability of huge amounts of raw resources such as fluorite, producers of anhydrous hydrogen fluoride are increasing their production facilities internationally. Thus, during the projection period, it is predicted that the global market for anhydrous hydrogen fluoride would grow as a result of such factors globally.

Strict Regulation on the usage of these products will hinder Market Growth

Hydrogen fluoride is being consumed by a number of commercial and industrial products. Hence, when the gas is released directly into the air, it causes harmful environmental impacts. Such factors have led to the formation of strict government laws on the usage of these products.

Other declining reasons include the limited availability of fluorspar. The production of hydrogen fluoride is anticipated to decrease as fluorspar supplies decline. Also Even at low concentrations, hydrogen fluoride gas can irritate the respiratory system, nose, and eyes. High concentrations of hydrogen fluoride inhaled, together with skin contact, can result in irregular heartbeats and fluid accumulation in the lungs, which can lead to death. Such elements are predicted to impede market expansion from 2025 to 2035.

Demand for Chemicals and Presence of key players to propel the Regional Demand

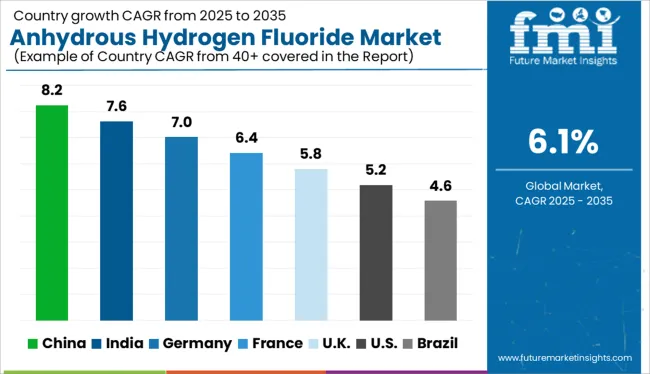

North America is predicted to expand with a revenue share of 29.5% in 2025 and is the fastest-growing market for anhydrous hydrogen fluoride, with a 6.1% CAGR from 2025 to 2035. This is justified by the region's abundance of chemical makers. The USA produces the most anhydrous hydrogen fluoride in North America due to the area's developed chemical sector and the expanding production capacity of significant firms like Solvay S.A.

The demand for chemicals used in metal extraction and metallurgical applications has increased in the USA. Over the projected period, it is predicted that this would eventually help the anhydrous hydrogen fluoride business in the USA flourish. Due to the simple and sufficient access to huge quantities of raw materials like fluorite, the production of fluorochemicals has significantly increased in the USA, supporting the market's expansion.

As a result, producers of anhydrous hydrogen fluoride are moving and expanding their facilities to the USA. The market for anhydrous hydrogen fluoride is expanding in the country as a result of the USA's rising demand for electrical goods like air conditioners and refrigerators.

Increased usage across various sectors will boost the demand during the forecast period

With a 42% revenue share in 2025, Asia Pacific is anticipated to dominate the anhydrous hydrogen fluoride market. This is due to an increased demand for anhydrous hydrogen fluoride from the region's application industries, particularly the consumer goods, electronics, and automotive sectors. The expansion of these businesses in the area is attributed to the region's growing population as well as its inhabitants' rising standard of living.

In Asia Pacific, the laws governing the manufacturing and use of fluorine-based chemicals are weak, which encourages end-use businesses to produce and employ anhydrous hydrogen fluoride, fueling the product market's explosive expansion. Anhydrous hydrogen fluoride is commonly used in the manufacture of stainless steel, aluminum, and alloy for pickling and descaling different metals, so the rising mining-related activities in nations like China and India due to the abundance of mineral ores will ultimately boost the market in the region.

Due to the region's abundance of enormous agricultural lands and rising food demand, the pesticides, as well as crop protection business, is one of the fastest expanding sectors in the Asia Pacific. Since most pesticides created are fluorine-containing substances like hydrogen fluoride, this is pushing the demand for anhydrous hydrogen fluoride in nations like China and India with a global CAGR of 5.6% during the forecast period.

The fluoro gases segment will gain the Dominant Market Share

In 2025, the fluoro gases application category is anticipated to dominate with a 64% revenue share. This is due to their broad range of industrial uses, which include air conditioning systems, commercial refrigeration, as well as industrial refrigeration.

Due to their numerous advantages, these gasses are likewise becoming more and more popular worldwide. Some of the biggest sources of fluoro gas emissions are stationary refrigeration, and heat pump (RAC) equipment. HFCs are now used in several portable and permanent fire extinguishers and fire protection systems. HFCs are now used in mobile air conditioning in vehicles and small vans. Fluorogases are also used in other air-conditioned and chilled modes of transportation.

In the electronics and aerospace sectors, for example, cleaning agents containing F-gasses are employed on component surfaces. Fluorogases are used in a wide variety of specialized applications, including the manufacture of magnesium, various foams, and high-voltage switchgear. Such factors are expected to boost segmental growth during the forecast period.

The fluoropolymers segment of the anhydrous hydrogen fluoride market will become significant

The fluoropolymers segment will be the fastest-growing segment during the forecast period with a 5.7% CAGR. In the year 2025, this segment is predicted to acquire almost 48% of the market share.

A class of plastics composed of fluorine and carbon are referred to as fluoropolymers, which are fluorocarbon-based polymers. Fluoropolymers are commonly utilized in the automobile, electronics, semiconductor, and home appliance sectors as well as in common household products because of their unique, non-adhesive, and low-friction properties. In terms of electrical performance, chemical resistance, heat resistance, and weather resistance, fluoropolymers perform better than conventional polymers. Therefore, during the course of the predicted period, these benefits will fuel segmental growth.

To satisfy the rising demand from the end-use sectors, the manufacturers are more concerned with growing the anhydrous hydrogen fluoride manufacturing capacity. These firms continuously conduct Research and Development operations to provide a variety of high-quality product lines.

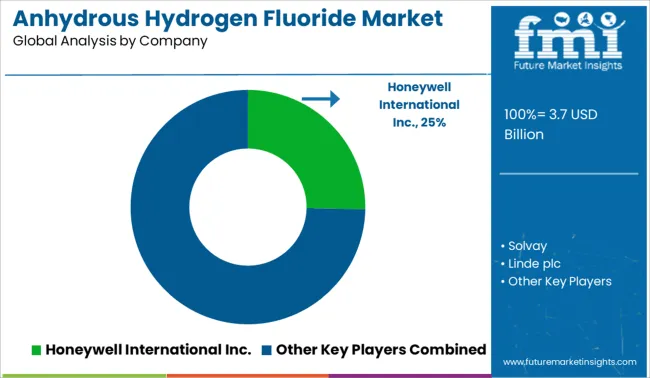

Some of the prominent players in the global anhydrous hydrogen fluoride market are Honeywell International Inc., Solvay, Linde plc, Arkema, Lanxess, Navin Fluorine International Limited, Fubao Group, Foosung, Co Ltd, Fluorchemie Dohna GmbH, Fluorsid S.p.A., and Derivados del Fluor SA.

Some of the prominent developments of the key players in the market are:

The global anhydrous hydrogen fluoride market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the anhydrous hydrogen fluoride market is projected to reach USD 6.6 billion by 2035.

The anhydrous hydrogen fluoride market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in anhydrous hydrogen fluoride market are fluoropolymers, fluoro gases, pesticides and others.

In terms of , segment to command 0.0% share in the anhydrous hydrogen fluoride market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anhydrous Milk Fat Market – Growth, Dairy Applications & Market Trends

Anhydrous Caffeine Market

Lanolin Anhydrous USP Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA