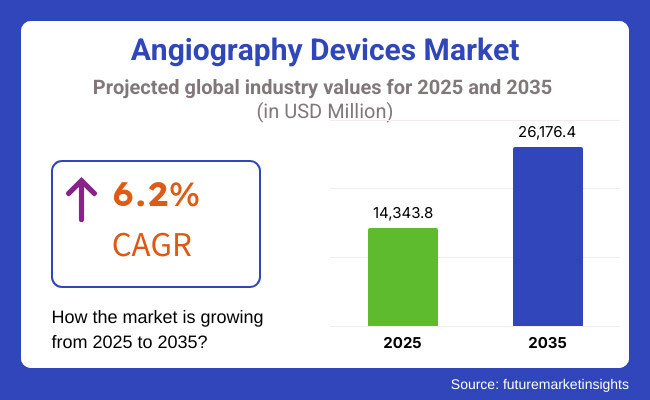

The angiography devices market is expected to reach USD 14,343.8 million by 2025 and is expected to steadily grow at a CAGR of 6.2% to reach USD 26,176.4 million by 2035. In 2024, Angiography Devices Market have generated roughly USD 13,506.4 million in revenues.

The angiography devices market is expected to get on its growth trajectory from 2025 onward until 2035 on the strength of increasing prevalence of a number of cardiovascular diseases, increasing demand for minimally invasive diagnostic techniques, and advances in imaging technology.

Among the most important factors driving the market growth are the expanding elderly population, increasing applicability of digital and interventional angiography systems, and continuous improvement in the catheter-based imaging technologies. Application of Artificial Intelligence (AI) and machine learning in angiography imaging also improves the efficiency of the diagnosis and the outcome of the procedures.

Nevertheless, high costs of the equipment, limited access to high-quality healthcare facilities in developing nations, and regulations may hold back the growth of this market. The development of portable and hybrid angiography systems coupled with increased investments in the healthcare infrastructure has created huge growth opportunities for market players.

Explore FMI!

Book a free demo

Because of the very high prevalence for cardiovascular diseases in North America with already established health care systems and substantial investment in imaging technologies, this region now holds the largest share of the global angiography equipment market.

The favorable reimbursement policies, growing preference for less invasive diagnostic methods, and presence of top medical device manufacturers mainly contribute to the dominance of the United States in the regional market. Nevertheless, adoption will be hampered by high costs of angiography equipment and stringent FDA regulations.

In angiography procedures, the integration of AI-based image processing with 3D imaging is enhancing patient outcomes and diagnostic accuracy, and is believed to be an expanding market driver. The increasing demand for cloud-based imaging platforms and hybrid operating rooms is also advancing angiographic procedures by enhancing workflow efficiency and collaboration.

Europe is a mature market for angiography equipment, supported by beneficial government healthcare policy, increased cardiovascular research grants, and an expanding geriatric population base. Germany, France, and the UK are some of the leading market adoption countries by virtue of strong demand for digital and robotic angiography systems.

Stringent medical device regulation under the European Medicines Agency (EMA) and steep procedural charges are some of the challenges. Increasing adoption of hybrid operating rooms and artificial intelligence-based image processing software is enhancing workflow efficiency and diagnostic precision.

Furthermore, hospital-medical technology partnerships to create emerging imaging products are fuelling innovation in the European market. The growing need to minimize radiation exposure and enhance patient safety is propelling the use of low-dose imaging systems that provide better image quality at lower health risk

The other drivers of the strong market growth of angiography devices in the Asia-Pacific region are growing healthcare spending, growing incidence of cardiovascular diseases, and a flood of advanced medical imaging devices. Of these, Japan, India, and China are the prime markets that have seen tremendous growth in the public healthcare infrastructure along with the manufacture of medical devices.

Still, installation of the devices is hindered by unstable regulatory environment, cost, and deficiency of a well-qualified healthcare provider. Diffusion of government programs to improve management for cardiovascular diseases and greater adoption of telemedicine and AI-based diagnosis would drive long-term market growth.

Cost-effective and portable angiography systems are also simplifying access in rural and underserved populations. The establishment of domestic medical device production capability and government-backed incentives for innovations in healthcare technology is also stimulating regional market growth.

Challenges

Regulatory Hurdles and Workforce Challenges Hindering Expansion of Angiography Devices

The angiography device market is riddled with challenges, including expensiveness in imaging systems, limited access in rural areas, and regulatory issues. Most health institutions in developing nations suffer the twin burden of affordability and infrastructural constraints inhibiting the adoption of advanced angiographic systems.

Furthermore, heavy regulatory approvals and long certification pathways for novel imaging modalities can delay market entry. Moreover, the lack of trained manpower in interventional cardiology and advanced imaging modalities also acts as a hurdle to market development.

On top of this, the delay in the adoption rate of procedures due to issues surrounding radiation exposure and safety of contrast agents also remains. The surge in demand for regular software updates, coupled with cybersecurity issues pertaining to cloud-based imaging solutions, remain other obstacles for both manufacturers and healthcare providers.

Opportunities

Driving Accessibility and Efficiency Through Advanced Imaging Technologies in Angiography

The convergence of image digitalization technologies is providing unlimited opportunities for growth in the angiography devices market. The innovations in mobile and portable angiography systems are escalating access particularly in low-resource geographies. Accelerated requirements for minimal access interventions and robotics-assisted solutions for angiogram processes see a surge in R&D work on next-gen imaging platforms.

Along those lines, strategic partnerships between healthcare providers and medical device companies are the surest avenue for accelerating cloud imaging solutions that enable real-time diagnostics and communications.

Government initiatives encouraging better early detection and management of cardiovascular diseases, too, are helpful in transmission of growth in this market. Value-based healthcare bending trends, along with the entry of predictive analytics in angiographic imaging, propel the efficiency and clinical outputs of interventions.

Increase in the Innovation and Development of 3D and AI-Based Angiography Imaging

The development of 3D imaging and AI applications for angiography imaging is revolutionizing the field, enhancing diagnostic accuracy, procedural efficiency, and patient outcome. Conventional techniques of 2D angiography carry limitations on depth perception; thus, 3D imaging is extremely helpful. It allows visualization of complex vascular structures and increases accuracy in diagnosis and surgical planning.

Artificially Intelligent Support for Image Processing in Angiographic Imaging can enhance imaging quality by providing automated image assessment, abnormality detection at a faster pace, and minimalization of human error. All of these factors combine to improve the diagnosis of clinical conditions such as stenosis, aneurysm, and embolism.

Moreover, the AI systems may furnish decision support in real-time in the setting of angiography so that radiologists and cardiologists may process large datasets and make decisions based on them rapid-fire, especially in emergency scenarios such as stroke or myocardial infarction.

Surge in the use of hybrid cath labs and robotic-assisted interventional procedures

Increased utilization of hybrid procedures/models, along with robotic assistance for interventional procedures: This is acceptable, as they help enhance rapidity of imaging acquisition and better rendering of the vascular morphology with less contrast agent use, thus improving safety and efficacy of procedure.

Robotic-assisted procedures, on the other hand, have revolutionized interventional angiography with enhanced opportunities for maximal catheter navigation with reduced complication concerns and greater consistency in procedural performance, especially for complex vascular interventional work. They enhance operator precision, lessen fatigue, and ensure reproducibility favourably impacting clinical outcomes.

Countries across the world are responding to the urgent need for patient safety and technology-led healthcare, thus enforcing medical device legislation with increasing stringency, having a special interest in angiography imaging systems.

Through these regulations, the safety, accuracy, and performance of the angiography machines shall be validated, ensuring that the machines that are marketed are the very best. Thus, medical device manufacturers have increased pressure to invest in quality assurance, compliance processes, regulatory approvals-this will further accelerate R&D spending in this area.

The numbers show that between 2020 and 2024, the emergence of the angiography devices market globally surged significantly in the cases where there was rising prevalence of cardiovascular diseases (CVD), advances in imaging technologies, and increase in requirements for minimally invasive diagnostic interventions.

The development in angiography systems such as X-Ray, Magnetic Resonance Angiography (MRA), and Computed Tomography Angiography (CTA), giving better imaging techniques and better patient outcomes, has also contributed to the increase.

Between 2025 and 2035 innovations in portable and wearable angiography systems for point-of-care diagnostics; developing healthcare infrastructure in developing economies for expanding access to advanced diagnostic technologies; demands for preventive medicine and early disease compassion are anticipated to drive the angiography procedure demand forward.

The maturing phase of the market will require the companies and the healthcare institutions for bringing forth much more innovations, regulatory approvals, and strategic partnerships to address the varying and increasing patient demands at a global level.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Policy Emphasis An emphasis has been put on the safety and efficacy of angiography devices, with great facilitation getting every means possible for the approval of innovative imaging systems by regulatory bodies. |

| Technological Advancements | Technological Advancement Among such advancements are the introduction of advanced diagnostic imaging to include X-ray, MRA, and CTA for an improved image of vascular structures, alongside. |

| Consumer Demand | Customer Demand Fortunately, increased awareness has led to a significant increase in demand for minimally invasive diagnostic procedures with fast and accurate results for earlier detection, thereby fostering a greater preference for personalized health solutions. |

| Market Growth Drivers | Market Growth Drivers Vascular diseases either grew or declined to a rhythm determined by age and reached their peak in 2008-it was as if thought of national currency diverging forever from commodities and goods |

| Sustainability | Sustainability The first step toward a sustainable degree of eco-friendliness is given: making sure that medical devices do not add to the environmental problem. When a general practice has been taken up by medical technology. |

| Supply Chain Dynamics | Supply Chain Dynamics Supply chains focus and operate for devices that have to be accessible in the hospitals and diagnostic centers; the chains should respect the well-established distribution network. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Acts of all-inclusive guidelines toward AI integration and relevant portability of portable angiography devices were taken order to standardized protocol and data security measures. |

| Technological Advancements | AI and ML development that look into addressing image analyses. Reconstruction of 3D imaging in this same scenario is developing point-of-care diagnostic device and wearable solutions. |

| Consumer Demand | Patients do not stand for any surprises if they can seek early detection and monitoring of cardiovascular conditions through advanced diagnostic tools. |

| Market Growth Drivers | Technological improvement in imaging systems--such as X-ray and MRI angiography--initially directed the vessel-related market towards massive resistance. |

| Sustainability | Manufacturers will see these eco-friendly practices included in their routines, for example, the use of recycled material, energy-saving, electro-less construction of electronic Equipments. |

| Supply Chain Dynamics | Using digital technology in the healthcare sector and increasing the transparency and efficiency of supply chains in allowing for quick delivery of assets to different healthcare settings, including those in remote and under-served areas. |

Market Outlook

The angiography devices market in the United States is presently riding on a wave of high demand. Heart-related diseases seem to be the main causative factor in this scenario. Patients suffering from coronary artery disease and stroke are in need of urgent and correct diagnosis, which means the availability of accurate angiography systems. The aged population is also on the rise, and being prone to heart conditions has altogether added to the demand for these devices.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

Market Outlook

Angiography machines in China are set to grow fast. This is happening because more people have heart problems. In addition, the healthcare system is improving quickly. As people get older and change their lifestyles, there is a big need for quick and accurate heart tests. This is leading to more cases of high blood pressure, obesity, and diabetes.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| China | 9.2% |

Market Outlook

The angiography device market in India is growing strong. The angiography device market in India is growing strong. With today's advancing times, many people are facing heart problems, which leads to high demand for health care and even improvements.

The sedentary lifestyle people these days live with poor dietary habits shows the increase in heart disease. Increasingly common nowadays are also diabetes and high blood pressure. All these things increase the need for better diagnostic tools, such as angiography systems.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| India | 8.4% |

Market Outlook

Cardiovascular diseases (CVD) due to see stable growth because of its well-established healthcare infrastructure and the increasing burden create Germany’s angiography devices market. Being a market with significant rampant advancement needs, the aging population of Germany-these with a high incidence of concurrent risk factors such as hypertension, obesity, and diabetes-is exerting pressure for advanced diagnostic and interventional imaging solutions.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.5% |

Market Outlook

The angiography devices market in Brazil has been adding up, as the burden of CVDs in the country and the policies employ to improve access to healthcare. An increased prevalence of risk factors, such as hypertension, diabetes, and obesity, is pushing a growing number of patients with advanced diagnosis and interventional needs.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.8% |

Computed Tomography Angiography (CTA) Devices Due to Due To Their Superior Diagnostic Capabilities and Growing Clinical Applications

Computed Tomography Angiography (CTA) devices are increasingly popular because of their non-invasive character, blood-vessel high-resolution imaging, and fast vascular diagnoses. They combine X-ray technology with contrast dye to offer excellent visual clues to blood vessel anatomy to help detect aneurysms, blockages, and various vascular anomalies.

The rising prevalence of cardiovascular diseases (CVDs), increasing preference for non-invasive diagnostic techniques, and advancement in multi-slice CTs such as 128 and 256 slice CT for improved image clarity are driving the demand for CTA devices.

Whereas North America and Europe are at the topmost places in CTA adoption, Asia-Pacific is expanding rapidly in this area with cardiac care facilities rapidly improving and the rising incidence of CVDs. The innovations of the future include AI-assisted CTA analysis for automated diagnosis, low-radiation-dose CTA, and portable CTA for emergency use.

Digital Subtraction Angiography (DSA) Devices Leading Due to High Diagnostic Accuracy and Superior Vascular Imaging Clarity

Digital Subtraction Angiography (DSA) devices are the present gold standards for real-time vascular imaging, especially in intervention cardiology and neurology applications. Not only do these systems provide high-contrast dynamic imaging by suppressing background structures, but they are also extremely vital for performing complex vascular interventions such as stenting, embolization, and aneurysm repairs.

A strong demand for minimally invasive procedures continues to drive demand for catheter interventions in increasing number, and this is being swayed by the growing adoption of hybrid operating rooms that integrate DSA with robotic-assisted interventions. North America and Europe have dominated in the use of DSA, but now the third-class hospitals and specialized cardiac centers in Asia-Pacific are seeing increased adoption.

Coronary Angiography is dominating into the Market Due to the High Prevalence of Cardiovascular and Neurovascular Diseases

Coronary angiography is the most commonly performed angiographic procedure to assess coronary artery disease (CAD), detect blockages, and provide guidance for percutaneous coronary interventions (PCIs) such as stent placements and balloon angioplasty.

Driving demand are the rising global burden of CAD, use of catheter-based interventions being favoured over open-heart surgery, and the increasing use of FFR-guided angiography for accurate diagnosis. The procedures are hugely supported by the presence of advanced cardiac catheterization labs and the development of AI-driven diagnostic tools in North America and Europe.

In the meanwhile, Asia-Pacific is growing more rapidly because of an aging population and expanding cardiac care facilities. Future trends include development towards AI-assisted real-time lesion assessment, the use of 3D-printed coronary artery models for pre-procedural planning, and ultra-fast angiography systems that will minimize the administration of iodinated contrast.

Cerebral Angiography is dominating into the Market Due to the Advancements in Minimally Invasive Techniques

Cerebral angiography is carried out to assess neurovascular illness like stroke, aneurysms, and arteriovenous malformations (AVMs). DSA, CTA, or MRA are frequently utilized methods of the test for imaging brain arteries with precision and for identification of abnormal findings.

The demand for cerebral angiography is heavily fueled by the rising incidence of stroke and neurovascular conditions, growth in endovascular thrombectomy techniques, and high investment in neuroimaging devices. Cerebral angiography largely takes the direction of North America and Europe, where the leading stroke-care centers use AI-powered stroke triage platforms, while the Asia-Pacific region is characterized by growth because of increased stroke awareness and government initiatives to provide wider neurovascular treatment.

Demand will be from stroke diagnosing algorithms using AI-assisted, real-time intra-operative cerebral angiography, and bioresorbable flow diversion stents for the treatment of the aneurysm.

The market for angiography devices is extremely competitive, fueled by rising cardiovascular disease incidence, imaging technology innovation, and the demand for minimally invasive treatments. Firms are investing in AI-driven imaging systems, mobile angiography solutions, and catheter-based technologies to stay competitive.

The market is influenced by established medical imaging companies, catheterization technology companies, and new digital health firms, all contributing to the changing landscape of angiographic diagnostics and interventions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GE Healthcare | 21.0% - 23.7% |

| Siemens Healthineers | 17.3% - 19.5% |

| Philips Healthcare | 12.2% - 13.9% |

| Canon Medical Systems | 9.1% - 10.7% |

| Boston Scientific | 30.3% - 32.1% |

| Other Companies (combined) | 21.4% - 23.7% |

| Company Name | Key Offerings/Activities |

|---|---|

| GE Healthcare | Market leader providing advanced angiography imaging systems with AI integration for precision diagnostics. |

| Siemens Healthineers | Specializes in state-of-the-art interventional imaging solutions, including robotic-assisted angiography systems. |

| Philips Healthcare | Develops high-resolution digital angiography systems with real-time imaging and dose reduction technologies. |

| Canon Medical Systems | Offers innovative angiographic X-ray imaging solutions for cardiovascular and neurovascular applications. |

| Boston Scientific | Provides catheter-based angiographic devices and contrast delivery systems for minimally invasive procedures. |

Key Company Insights

GE Healthcare

Every angle, in all directions, and through all passages, GE Healthcare is a force in medical imaging, making strides toward a future of diagnostic excellence. Not only does this company incorporate AI into its angiography systems, increasing clarity and decreasing the need for repeat scans, but it also works to streamline workflows for interventional procedures so that faster and more accurate diagnoses may ensue.

Focusing on digital solutions, GE Healthcare is setting up tomorrow's road for AI-based precision imaging in cardiovascular and neurovascular care.

Siemens Healthineers

Siemens Healthineers demonstrate leadership and innovation in interventional radiology, offering state-of-the-art angiography systems with advanced robotic-assisted capabilities. Advanced under the Artis series, Siemens's systems are high-precision imaging tools that assist physicians in complex cardiovascular and neurovascular interventions.

Workflow optimization is more efficient through automation with the aid of AI-based analytics developed and promoted by Siemens. With an ardent attitude toward innovations, Siemens Healthineers maintains the benchmark for therapeutic solutions guided by images.

Philips Healthcare

Philips Healthcare are highly respected for their ability to perform real-time imaging, ensuring excellent angiographic visualization while always prioritizing patient safety. The company excels in dose management technology geared toward maximizing patient protection from radiation without compromising image clarity.

Philips is constantly upgrading its digital angiography platform by incorporating AI and smart imaging tools to enhance accuracy in its procedures. The company's innovative spirit in image-guided therapy has established its position as a supplier of choice in interventional cardiology and vascular surgery.

Canon Medical Systems

Canon Medical Systems remains a strong force in the X-ray angiography arena and develops high-resolution imaging procedures for cardiac and neurovascular interventions. Advanced imaging technology design is core to Canon's philosophy, increasing diagnostic confidence and thus patient outcomes.

Canon's Alphenix angiography systems account for flexible workflow options and enhanced image quality to support clinicians in their minimally invasive interventions. Research and innovation are at the forefront of Canon's effort to push angiographic imaging for complex medical applications.

Boston Scientific

Boston Scientific is a key competitor in interventional cardiology specializing in catheter-based angiography solutions for vascular disease diagnosis and treatment. The company is developing innovative devices such as drug-eluting stents, guidewires, and intravascular imaging systems to improve procedural success in therapies.

Boston Scientific strongly advocates R&D and is continuously advancing minimally invasive cardiovascular interventions. The stronghold that it has built on its products ensures that the company has a sublime position in interventional cardiology and peripheral vascular treatment solutions.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The overall market size for Angiography Devices Market was USD 14,343.8 million in 2025.

The Angiography Devices Market is expected to reach USD 26,176.4 million in 2035.

Rise in Interventional Cardiology & Peripheral Vascular Procedures has significantly increased the demand for Angiography Devices Market.

The top key players that drives the development of Angiography Devices Market are GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems and Boston Scientific

Computed Tomography Angiography (CTA) Devices is expected to command significant share over the assessment period.

Magnetic Resonance Angiography (MRA) Devices, Computed Tomography Angiography (CTA) Devices, Conventional Angiography Devices, Digital Subtraction Angiography (DSA) Devices, Catheter Angiography Devices, Coronary Angiography Devices and Other Angiography Devices

Coronary Angiography, Pulmonary Angiography, Cerebral Angiography, Extremity Angiography and Renal Angiography

Hospitals and Surgical Centers, Diagnostics Centers and Academic and Research Institutes

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.