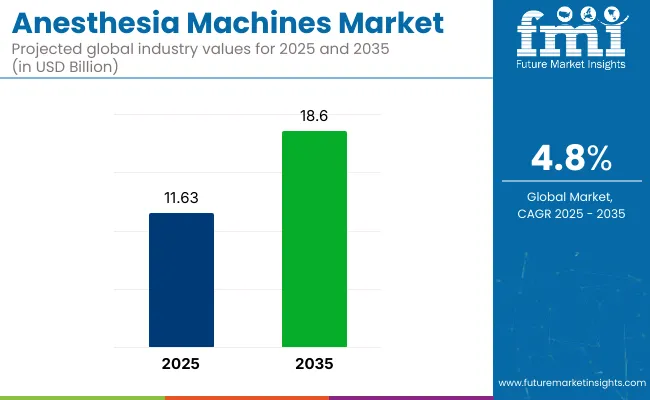

The Anesthesia Machines Market is estimated to reach USD 2,098.3 billion by 2025. Between 2025 and 2035, the market is expected to grow at a CAGR of 6.2%, reaching a total value of USD 3,829.2 billion by the end of the assessment period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2,098.3 billion |

| Industry Value (2035F) | USD 3,829.2 billion |

| CAGR (2025 to 2035) | 6.2% |

The anesthesia machines market is witnessing robust progression as procedural volumes increase globally, driven by elective surgeries resuming post-pandemic disruptions and continuous growth in ambulatory surgical centers.

Regulatory emphasis on patient safety, coupled with the need to reduce perioperative complications, has elevated the adoption of integrated workstations equipped with advanced ventilation modes and automated gas delivery systems. Innovations in low-flow anesthesia and the integration of digital interfaces are fostering efficiency gains and compliance with environmental protocols to limit anesthetic gas emissions.

The future outlook is shaped by heightened procedural demand in emerging economies, infrastructure upgrades in secondary care hospitals, and replacement cycles in developed markets. Industry stakeholders are expected to leverage strategic collaborations and portfolio diversification to strengthen their footprint, reflecting a favorable growth trajectory over the next decade.

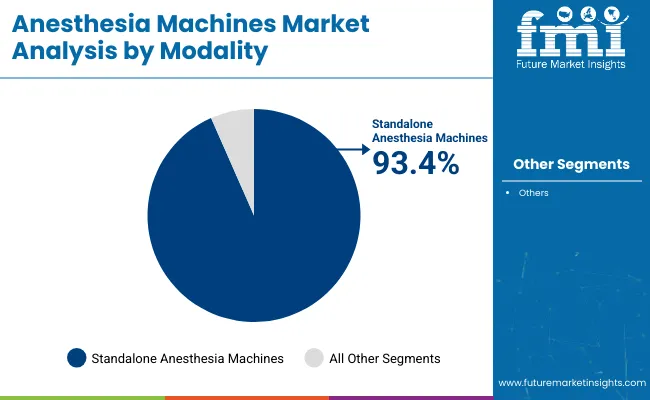

In 2025, standalone anesthesia machines are projected to account for 93.4% of the total revenue in the anesthesia machines market. This segment’s dominance can be attributed to the machines’ versatility, reliability, and wide adoption across both surgical and critical care settings.

Standalone anesthesia machines are preferred due to their comprehensive features, including integrated ventilation, monitoring capabilities, and the ability to deliver precise dosages of anesthetic gases. Their high demand is driven by their ability to meet the varying needs of different surgical specialties, such as neurosurgery, orthopedics, and cardiac procedures. Additionally, the ease of use and minimal setup time have made these machines the standard in hospitals and surgical centers.

The growth in elective surgeries, coupled with the increasing demand for advanced anesthesia systems that enhance patient safety and optimize anesthetic delivery, has further contributed to the segment's rise. Furthermore, ongoing innovations in machine design, such as more user-friendly interfaces, enhanced patient monitoring, and the integration of electronic health records (EHR), have solidified the position of standalone anesthesia machines as the preferred choice in modern healthcare environments.

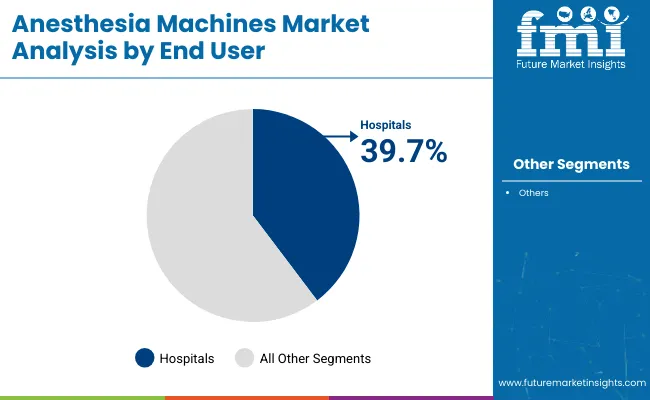

Hospitals have retained the largest share that is 39.7% of anesthesia machine procurement as procedural volumes continue to climb across general surgery, orthopedics, and oncology. Centralized procurement policies and budget allocations have been structured to replace legacy equipment with workstations that integrate ventilation, hemodynamic monitoring, and electronic recordkeeping.

This investment pattern has been reinforced by regulatory mandates for perioperative safety and adherence to emission control guidelines. The consolidation of surgical services into high-capacity centers and the increasing prevalence of complex procedures requiring advanced anesthesia management have strengthened demand.

The consistent inflow of patients undergoing elective and emergency interventions has also underpinned utilization rates and accelerated the replacement cycle of installed machines. This convergence of policy, procedure complexity, and capacity expansion has ensured hospitals remain the leading end-user segment.

Shift toward Compact Systems to Bolster Sales

The market is witnessing transformative trends, with a strong shift toward compact, portable, and digitally integrated systems. The adoption of artificial intelligence (AI) and real-time patient monitoring features is enhancing clinical decision-making and safety.

Minimally invasive surgeries and outpatient procedures are also boosting demand for lightweight and mobile devices. Moreover, the integration of machines with electronic health records (EHRs) and telemedicine platforms is improving workflow efficiency and patient outcomes. These trends reflect a broader move toward smarter, more patient-centric anesthesia delivery systems.

Steep Maintenance Costs May Deter Demand

Despite strong demand, the market faces several constraints. High acquisition and maintenance costs of advanced systems limit adoption, especially in cost-sensitive markets. Regulatory hurdles and the need for extensive clinical testing can delay product approvals and entry into new regions.

Moreover, a shortage of skilled personnel and the need for user training pose challenges, particularly for facilities adopting sophisticated digital systems. These factors collectively slowdown market penetration and scalability in underdeveloped healthcare settings.

Rising Surgical Volume to Bolster Adoption

Key drivers propelling the market include the rising volume of surgeries, aging populations with chronic conditions, and the expansion of ambulatory surgical centers worldwide. Technological innovation, such as automation and closed-loop systems, enhances accuracy and reduces human error, improving patient safety.

Additionally, government initiatives to modernize healthcare infrastructure and increase access to surgical care in developing nations further fuel market expansion. Strategic collaborations between hospitals and device manufacturers are also boosting adoption and innovation.

Strict Regulations May Impede Uptake

The major hindrance in the market is the stringent regulatory requirements and lengthy approval processes. Compliance with safety and performance standards set by authorities such as the USA. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other regional regulatory bodies can delay product launches and increase development costs.

These regulations require extensive clinical testing and documentation, which can be time-consuming and expensive for manufacturers. As a result, smaller companies and startups may find it difficult to enter the market or innovate rapidly, limiting overall market growth and the introduction of novel technologies, especially in highly regulated regions.

| Countries | CAGR (2025-2035) |

|---|---|

| United States | 7.4% |

| Germany | 4.5% |

| France | 4.2% |

| United Kingdom | 4.0% |

| Japan | 3.8% |

The USA market is the largest and most mature market globally, driven by its advanced healthcare infrastructure and high surgical procedure volumes. The USA anesthesia machines market is poised for a robust CAGR of 7.4% between 2025 and 2035. Growth is driven by substantial investments in medical technology and the presence of leading global manufacturers.

Strict regulatory frameworks, including oversight from the FDA, ensure the widespread use of high-quality, safe anesthesia equipment. The increasing integration of electronic health records (EHR) and real-time patient monitoring systems is adding a layer of digital sophistication to machines, enhancing both functionality and safety.

Additionally, the growing preference for outpatient surgeries and the expansion of ambulatory surgical centers are fueling demand for portable and efficient machines. These devices are favored for their mobility and ability to improve workflow in fast-paced surgical environments. Technological advancements, particularly in automation and connectivity, are further optimizing patient outcomes and clinical efficiency.

Overall, the USA market continues to lead globally due to its innovation, regulatory strength, and high standards of patient care, making it a focal point for continued growth and development in the anesthesia equipment industry.

Germany's anesthesia machine revenues represent one of the most developed in Europe, with a CAGR of 4.5%, reflecting steady and sustainable growth driven by regulatory rigor and technological advancement. High surgical volumes and a national preference for quality medical technology support ongoing demand for machines.

Germany enforces strict regulatory standards, ensuring that only certified, safe, and high-performing equipment is used in medical settings. This has fostered demand for premium standalone and portable machines that offer reliability and precision.

The country is home to a well-established supplier base, including domestic manufacturers recognized for their engineering excellence and integration of advanced features like real-time monitoring and automation. These technologies enhance patient safety and operational efficiency. In addition, the rise in outpatient procedures and the expansion of ambulatory surgical centers are driving increased demand for compact, mobile anesthesia systems.

Germany’s aging population and the rising prevalence of chronic conditions requiring surgical care also support market growth. Overall, the combination of regulatory oversight, technological sophistication, and evolving care delivery models positions Germany as a mature and resilient market for anesthesia machines over the forecast period.

Product demand in Japan is characterized by its advanced healthcare infrastructure, aging population, and high surgical procedure rates. The Japanese anesthesia machines market is forecasted to grow at a CAGR of 3.8% from 2025 to 2035, reflecting moderate but steady growth. Japan’s regulatory environment is rigorous, requiring strict device certification and compliance with safety standards, which drives demand for high-quality, reliable standalone and portable machines.

The country’s demographic profile, with a rapidly aging population, leads to an increasing need for surgeries related to chronic and age-related illnesses, expanding the market further. Furthermore, Japan’s healthcare providers are progressively integrating digital health tools and real-time monitoring features into anesthesia devices, improving patient outcomes and operational efficiency. The trend toward minimally invasive surgeries and outpatient care is encouraging the uptake of portable machines.

The UK anesthesia machines market is expected to grow steadily at a CAGR of 4.0% from 2025 to 2035. The UK healthcare system, dominated by the National Health Service (NHS), emphasizes cost-efficiency, patient safety, and innovation, driving steady adoption of high-quality standalone and portable anesthesia devices.

The increasing volume of surgeries, particularly elective and outpatient procedures, supports demand growth. Regulatory oversight by the Medicines and Healthcare products Regulatory Agency (MHRA) enforces strict standards, ensuring device safety and efficacy.

These regulations encourage manufacturers to innovate and supply equipment integrated with advanced monitoring and digital capabilities. The growing trend towards minimally invasive surgeries and ambulatory surgical centers is further pushing the demand for compact and versatile machines.

NHS’s continued focus on modernizing operating theaters and improving patient outcomes reflects a moderate but sustainable growth path, supported by ongoing healthcare investments and regulatory alignment with European standards.

The market in France is among the most developed in Europe, supported by a comprehensive public healthcare system, high surgical procedure volumes, and increasing digitization of operating room equipment. The French anesthesia machines market is projected to grow at a CAGR of approximately 4.2% from 2025 to 2035, aligning with other mature Western European countries.

This growth is driven by a rising demand for high-quality, integrated anaesthesia systems equipped with patient monitoring capabilities and compliance with EU-wide medical device regulations (MDR). The French National Agency for Medicines and Health Products Safety oversees regulatory compliance, ensuring the safety and quality of imported and domestically produced anaesthesia machines.

The country's commitment to upgrading healthcare infrastructure, particularly in regional hospitals and outpatient clinics, fuels the demand for portable and advanced standalone units. Additionally, an aging population and the rise of chronic illnesses that require surgical intervention are creating sustained demand. The adoption of minimally invasive procedures and ambulatory surgical centers is increasing the need for compact, cost-efficient, and digitally connected anaesthesia solutions.

The portable anesthesia machines market is shaped by advancements in compact designs, integration of ventilator support, and enhanced patient safety features. Leading manufacturers are focusing on developing lightweight, modular systems that facilitate mobility across surgical suites and emergency settings. There is also a growing emphasis on incorporating advanced monitoring capabilities, including real-time gas analysis and electronic record integration, to improve perioperative care.

Strategic initiatives such as mergers, acquisitions, and collaborations are being pursued to expand geographic reach and strengthen product portfolios. Additionally, the rising adoption of portable solutions in ambulatory surgery centers and field hospitals is driving competition, prompting companies to innovate with battery-powered systems and intuitive user interfaces.

Key Development

In 2025, Dräger's Atlan® A350/A350XL Anesthesia Machines received an Innovative Technology Designation from Vizient. This recognition highlights the machines' improvements in patient safety, operational efficiency, and environmental sustainability, particularly through features that support low- and minimal-flow anesthesia to reduce anesthetic agent consumption and waste.

In 2025, ICU Medical reinforced its anesthesia and monitoring portfolio. Through strategic integration and innovations like advanced workstations (e.g., APUS x3, ADSII™), precise intubation systems, and hemodynamic monitoring, the company aims to enhance patient safety and efficiency in anesthesia and minimally invasive surgery, supported by global expansion and regulatory compliance.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2,098.3 billion |

| Projected Market Size (2035) | USD 3,829.2 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion |

| By Modality | Standalone Anesthesia Machines, Portable Anesthesia Machines |

| By End User | Hospitals, Surgical, Ambulatory Centres, Clinics, Nursing Facilities |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East, and Africa. |

| Key Players | DRE Medical, Maquet Getinge Group, GE Healthcare, Penlon, Inc., Dragerwerk AG, Mindray Medical International Limited, Spacelabs Healthcare, Philips Healthcare, Narang Medical Limited, Heyer Medical AG, Beijing Yi Shiheng Electronic Technology Co., Ltd., Beijing Aeonmed Co., Ltd., Infinium Medical, Inc., Supera Anesthesia Innovations, Dameca A/S |

| Additional Insights | Dollar sales by value, market share analysis by region, and country-wise analysis. |

In terms of modality, the industry is divided into standalone anaesthesia machines and portable anaesthesia machines.

In terms of end users, the industry is segregated into hospitals, surgical ambulatory centers, clinics and nursing facilities.

Key countries of North America, Latin America, Western Europe, Eastern, South Asia and Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global market is expected to reach USD 3,829.2 billion by 2035, growing from USD 2,098.3 billion in 2025 at a CAGR of 6.2%.

The portable anesthesia machines segment is projected to grow the fastest, with a CAGR of 6.2% from 2025 to 2035, driven by demand for compact and mobile surgical equipment.

North America leads with the United States growing at a CAGR of 7.4% and holding the largest market share due to its advanced healthcare infrastructure.

Major players include GE Healthcare, Drägerwerk AG, Maquet Getinge Group, Mindray Medical, and Philips Healthcare.

Portable anesthesia machines are increasingly preferred for their mobility, compact design, and ease of use in outpatient clinics, emergency settings, and ambulatory surgical centers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Anesthesia Breathing Bags Market Size and Share Forecast Outlook 2025 to 2035

Anesthesia Equipment Market Size and Share Forecast Outlook 2025 to 2035

Anesthesia Ultrasound Systems Market Analysis – Trends & Forecast 2025 to 2035

Dental Anesthesia Delivery Systems Market

General Anesthesia Drugs Market Insights – Trends & Forecast 2025 to 2035

Portable Anesthesia Systems Market Growth - Trends & Forecast 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Lathe Machines Market

Sorter Machines Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Stamping Machines Market Growth and Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA