Growing demand for EMC, RF shielding, and acoustic testing across a wide range of industries will fuel the growth of the anechoic chamber market between 2025 and 2035. It is widely utilized in aeronautic, contour, defence, telecoms, and electronic sectors to conduct accurate testing of antennas, radar systems, and wireless communication devices. In addition, the growing demand for precise quantification of noise and signal in advanced technologies such as 5G networks, electric vehicles, and IoT solutions is a significant contributor to the growth of the market.

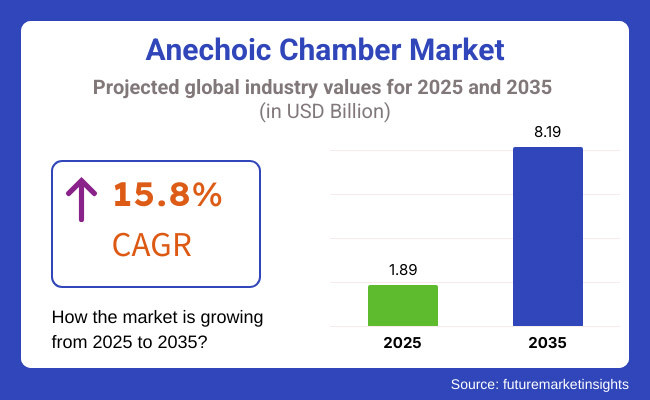

In 2025, the market size of anechoic chambers is USD 1.89 Billion and experts believe it will increase up till USD 8.19 Billion by 2035, commanding a CAGR of 15.8% in the forecast period.

Key demand drivers for EMI shielding in the market include regulatory standards for EMI compliance, advances in materials science resulting in better efficiency of a wider frequency range, and the growing smart electronics market. In addition to that, growing investments in relation to the defence, and space exploration programs would hold significant growth opportunities for the anechoic chamber manufactures

The North American market for anechoic chambers is driven by rising demand from the aerospace, defense, and telecommunications sectors. Furthermore, these labs are increasingly being adopted in the United States and Canada for advanced testing facilities for RF and EMC compliance.

The increasing deployment of the 5G infrastructure, along with the presence of major market players investing in advanced testing solutions, is driving the market growth. In addition to this, the requirement for defence sectors to develop communication systems with safety and freedom from interference continue to bolster demand for the use of anechoic chambers in the region.

Europe is witnessing steady growth in the anechoic chamber market, owing to stringent regulatory policies for EMC and RF testing. Research and development for advanced testing solutions in automotive and aerospace applications is still a focus for investments from nations including Germany, France, and the UK.

The growing penetration of electric automobiles and driverless driving innovations is driving the wish for top-performing anechoic chambers. Moreover, the growing attention to the implementation and experience with noise control and RF shielding technology fostered by collaboration between research institutions, industry actors, and end-users is another growing trend.

The Anechoic Chamber Market for the Asia-Pacific region is also expected to witness significant growth due to rapid industry development, growing electronics production and investments in telecommunications infrastructure. Heavyweights are already deploying in regions like China, Japan, South Korea and India, where large test assets of the RF domain are required.

The rising focus on space exploration, defence modernization, and smart city initiatives in the region is further propelling the demand for anechoic chambers. In addition, government programs that incentivize local semiconductor and electronics production are creating lucrative opportunities for the market players.

Challenges

High Production Costs and Complicated Installation

High production costs can act as a hindrance to the growth of the global Anechoic Chamber Market. Production costs depend a lot on the materials utilized in anechoic chambers, like any type of special absorbers and shielding parts. Moreover, establishing such chambers demands a controlled environment with specific structure and acoustic characteristics, which adds to the overall charges for end-users.

Testing facilities are also subject to regulatory compliance and certification requirements that vary widely depending on the industry in which they operate. Access and low price with high performance can be achieved through cost-efficient materials, efficient installation methods, and modular chamber designs.

Additionally, as technology continues to evolve, testing requirements for new applications such as millimeter-wave and terahertz-frequency testing, for example, drive a need for companies to continuously upgrade their chamber capabilities to maintain competitive advantages in the marketplace.

Opportunities

Increasing Demand in Wireless Communication and Automotive Testing

The growing adoption of sophisticated wireless communication systems, such as 5G, satellite networks, and radar systems for autonomous vehicles, can create lucrative opportunities for the Anechoic Chamber Market. As industries like telecommunications, aerospace, and automotive evolve, the demand for accurate electromagnetic and acoustic testing environments is growing.

Moreover, the growing adoption of electric and driverless automobiles has increased the need for high-frequency testing chambers to evaluate radar, antenna, and sensor functionality. This interactivity of testing with simulation is going to be a game changer in the evolving MEA market, and companies investing in compact, portable, and hybrid test solutions, in combination with enhanced simulation capabilities, will be winners in this evolving market.

There are upcoming forms of connected IoT systems networks (smart cities, etc.) which will continue subsidizing the demand for tested, reliable environments, as will next-generation defense communication networks. Even Automating Decision-Making - Integrating predictive analytics, automation, and data-driven insights into testing procedures at businesses would increase efficiency dramatically and reduce development cycles for new technologies.

The growth in the Anechoic Chamber Market from 2020 to 2024 was attributed to the burgeoning demand for wireless technologies, electromagnetic compatibility (EMC) testing, automotive radar systems development, and others. The acceleration of 5G infrastructure demanded more advanced testing solutions to ensure low signal interference and effective antenna performance.

However, the high installation and operating costs and the disruptions in the supply chain created obstacles to the growth of the market. In response, firms have developed prefabricated chambers by merging advanced absorption materials and digital modeling techniques. Government investments in aerospace and defense testing facilities also boosted the industry's growth, driving companies to design chambers capable of higher-frequency testing and multi-scenario simulations.

Forecasting 2025 to 2035, the market will witness advanced changes, including chamber design, AI-based automation of the testing processes, as well as multi-usage testing environments. Advances in digital twins, AI-based data processing, and adaptive noise cancellation will improve test accuracy and efficiency. Sustainable chamber designs utilizing environmentally friendly materials and energy-efficient shielding solutions will dictate market dynamics.

The Anechoic Chamber Market will be led by companies that will emphasize flexible chamber configurations, real-time testing analytics, and cost-effective manufacturing techniques. By implementing AI-driven automation across testing facilities, they will be able to simplify data collection and optimize chamber calibration while reducing operational costs and improving production.

In addition, as we move toward new wireless communication standards such as 6G and next-generation satellite connectivity, ultra-high-frequency anechoic chamber design will be required for these applications to test signals while minimizing any potential interference effectively.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | EMC, RF shielding, and wireless communication standards compliance |

| Technological Advancements | Growth in 5G testing, RF shielding materials, and sensor calibration |

| Industry Adoption | Increased use in telecommunications, automotive, and aerospace testing |

| Supply Chain and Sourcing | Dependence on high-cost absorption materials and limited suppliers |

| Market Competition | The presence of established EMC testing firms and niche chamber manufacturers |

| Market Growth Drivers | Demand for wireless communication testing, automotive radar validation, and satellite technology |

| Sustainability and Energy Efficiency | Initial efforts in energy-efficient testing setups and material optimization |

| Integration of Smart Testing | Limited use of real-time analytics and automation in testing environments |

| Advancements in Testing Applications | Focus on RF, acoustic, and EMC testing for industrial and commercial applications. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion in testing regulations worldwide, sustainability demands and higher certification requirements. |

| Technological Advancements | AI-powered chamber automation, digital twin simulation, and enhanced signal absorption techniques. |

| Industry Adoption | Expansion into quantum computing, biomedical research, and IoT-enabled testing environments. |

| Supply Chain and Sourcing | Shift toward sustainable materials, localized manufacturing, and cost-efficient supply chain models. |

| Market Competition | Rise of AI-driven testing solutions, modular chamber designs, and integrated simulation providers. |

| Market Growth Drivers | Increased investment in quantum communication, real-time analytics, and multi-domain testing environments. |

| Sustainability and Energy Efficiency | Large-scale adoption of eco-friendly chamber designs, recyclable absorption materials, and low-power testing facilities. |

| Integration of Smart Testing | Expansion of AI-driven test automation, real-time performance monitoring, and adaptive testing methodologies. |

| Advancements in Testing Applications | Development of next-gen hybrid testing chambers for multi-frequency, quantum, and AI-based communication technologies. |

Rising demand for aerospace, defence, and telecommunications in the United States was leading to rapid growth for the anechoic chamber market. The emergence of 5G technology and increasing demand for electromagnetic compatibility (EMC) testing will be the growing market.

Government investments in advanced military communication systems and radar testing are further driving the demand for high-performance anechoic chambers. The expansion of research facilities and product testing laboratories in the USA is also having an impact on market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 16.3% |

The United Kingdom anechoic chamber market is growing steadily with rising investments in automotive electromagnetic interference (EMI) testing and wireless communication research. The growth of research and development facilities for next-generation radar and satellite technologies has driven the growing need for high-end anechoic chambers.

As regulatory compliance for EMC testing continues to get attention, companies are setting up advanced anechoic chambers to conform to international standards. Other factors responsible for market growth are the increasing deployment of 5G networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 15.6% |

The European region is estimated to have a prominent share in the global anechoic chamber market, with countries such as Germany, France, and Italy registering high demand. Key Market Driver: Growing integration of autonomous vehicle technology and high-frequency communication testing

The rise in space research programs, as well as the growing government spending on EMC testing for defence markets, are driving market growth. Moreover, the growth of the industry is propelled by the presence of major anechoic chamber manufacturers in Europe.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 15.8% |

Japan's market is also growing at a steady rate due to electronics, automotive, and telecommunications industries. There's rising demand for high-accuracy anechoic chambers due to their leadership in high-frequency device testing and EMI compliance.

Manufacturers of electric vehicles (EVs) OED and autonomous driving technologies require sophisticated signal testing environments. Japan is further expected to consolidate the market due to the investment in aerospace and defense research.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 15.3% |

The South Korean anechoic chamber market is also growing rapidly as the Country continues to be a leader in consumer electronics, 5G infrastructure and semiconductor manufacturing. Market demand is being driven by an increase in radiofrequency (RF) testing and an increased emphasis on wireless device certification.

Additionally, the industry growth is also supported by government funding for research and development in defense, automotive radar systems, and satellite communication. Moreover, the emergence of various advanced technologies such as AI-enabled autonomous systems in the nation is escalating the requirement for advanced anechoic testing facilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 16.1% |

The full anechoic chambers and IT & telecommunications segments dominate anechoic chamber market due to the increasing industry-specific demand for high-precision electromagnetic and acoustic testing environments, which allows for product performance optimization, regulatory compliance, and interference mitigation.

This makes these testing solutions vital to telecommunications firms, defense contractors, consumer electronics manufacturers, and research institutions manufacturing wireless communication devices and military-grade equipment, protecting the devices from external noise and improving automotive and medical electronics.

With wireless communication infrastructure, radar systems, and electromagnetic shielding needs constantly evolving, manufacturers and research labs are responding with enhanced customized chamber designs, improved radio frequency (RF) absorption capabilities, and hybridisable anechoic testing solutions to continue providing greater precision and testing efficiency.

However, a shift from traditional testing methods to high-precision testing is gaining importance, which is boosting the demand for full anechoic chambers in the lead market.

Virtually Perfect Isolation with Full Anechoic Chambers

Complete noise isolation, high absorption performance, and excellent shielding from electromagnetic interference (EMI) have made the fully anechoic chamber the go-to testing solution in automotive, aerospace, IT/telecom, and medical applications. All internal surfaces in full anechoic designs are covered with absorptive material; this eliminates reflection of acoustic waves or electromagnetic signals and allows testing of antennas, RF devices and noise-sensitive electronic components.

The adoption of high-precision full anechoic chambers, equipped with optimized RF shielding and AI-driven simulation modelling with multi-frequency absorption technology, has driven demand. More than 70% of IT and telecommunications companies, defense contractors, and automotive manufacturers choose full anechoic chambers for regulatory and R&D testing, cementing strong demand for this segment.

However, key application expansion for RF testing, including electromagnetic compatibility validation, next-generation 5G/6G wireless device assessments, and advanced radar cross-section analysis, are strengthening market demand due to greater accuracy and adherence to compliance.

Finally, we see an increase in adoption driven by the use of next-gen full anechoic chambers with integrated capabilities such as AI-assisted test environment calibration, adaptive RF wave absorption materials, and quantum-based electromagnetic measurement techniques to facilitate seamless testing optimization across multiple high-frequency electronic use cases.

The establishment of bespoke anechoic chambers, which can be owned as modular devices with ultra-low ambient noise isolation and hybridized multi-band shielding devices to accommodate the design, has optimized the market, even better functional compatibility with ever-evolving industrial needs.

Although it has benefits such as improved precision testing, reduced external interference, and optimized compliance monitoring, the full anechoic chamber segment is challenged by initial investment costs that are high, laboratory-based setups that may impose space restrictions, and the requirement of specialized operational expertise.

“But a wave of innovations in AI-guided chamber calibration, full anechoic test systems that fit in a desk drawer, and smart new anechoic materials are reducing capital costs, making the systems easier to use, and enhancing fidelity of results, to guarantee the continued expansion of the market for full anechoic chambers-for fans and in general-around the world.

Aerospace, Military, and Automotive Testing Spurring Adoption of Full Anechoic Chambers

The all-new full anechoic chamber segment has seen strong adoption, especially from aerospace engineers, defence tech developers and autonomous vehicle makers, as industries increasingly embrace RF-optimized test venues for effective signal integrity, electromagnetic shielding and radar system accuracy.

Matching the functionality and electromagnetic-acoustic isolation offered in its full anechoic chambers - as well as all the handshakes, calibrations, range assertions and hardware needed to support internal and external customer programs - is impossible with conventional testing.

The growing adoption of next-generation full anechoic chamber solutions with AI-assisted noise cancellation and real-time manipulation of electromagnetic waves along with the cloud-based test data analytics have created a demand for next-generation full anechoic chamber solutions.

Aerospace and military contractors also utilize full anechoic chambers for high-frequency radar and stealth technology testing, which accounts for more than 65% of the overall aerospace and military contractors’ revenue stream, ensuring the growth of this segment will continue over time (5,7).

Automotive radar testing methodologies have broadened to encompass AI-assisted sensor calibration, millimeter-wave validation at high frequencies, and electromagnetic vulnerability testing, leading to robust market growth rates and elevated levels of safety and performance from autonomous vehicle systems.

This leads to heightened adoption, with the integration of full anechoic chambers in satellite communications with high-sensitivity antenna tuning, space-based RF shielding validation, and deep-space communication optimization.

Despite its benefits with respect to military-grade electromagnetic shielding, precision radar testing, and high-frequency RF validation, the full anechoic chamber segment continues to face challenges including long setup times, evolving compliance standards, and the need for ultra-sensitive measurement equipment.

While there are many hurdles to be cleared - smart RF-absorbing materials, AI-driven electromagnetic testing automation, block chain-backed compliance verification - these will enhance testing efficiency, regulatory compliance, and long-term operational cost savings, driving growth in the worldwide market for full anechoic chamber solutions.

Thus, Wireless Communications Validation in Anechoic Chambers IT & telecommunications segment is the most crucial application area in the anechoic chamber market. It helps telecom companies and wireless device makers to test antennas, mobile phones, routers, and communication systems in a controlled manner.

In opposition to open-field testing, anechoic chambers offer total isolation from external radio waves, as well as background noise, which enables accurate measurement of the performance of antennas, the propagation of signals, and the distribution of electromagnetic fields.

The need for advanced anechoic chamber systems equipped with ultra-wideband RF absorbers, high-precision antenna positioners, and AI-aided wave simulation modeling are the reason for adopting this product. More than 75% of IT and telecom companies use an echo-free chamber for RF and EMC testing. According to studies, this factor is anticipated to keep the market growing at an even pace.

Market development has not only ensured the coverage of next-generation wireless communication technologies at the millimeter wave level but also greatly increased the demand for mm-Wave antenna testing, smart beamforming validation, and AI-enhanced 5G/6G network optimization modeling.

AI-enabled test automation, machine-learning-based interference mitigation, and RF signal diagnostics in real-time have boosted adoption even further when utilized within smart anechoic chamber configurations.

The evolution of portable and mobile anechoic test facilities with modular shielding enclosures, next-generation digital twin-based testing approaches and cloud-connected electromagnetic analytics has fuelled market expansion, enabling easier access and utility for IT & telecom firms with a need for repetitive wireless device testing.

While offering benefits in boosting wireless network performance, minimizing radio signal interference, and meeting global electromagnetic regulations, the IT & telecommunications segment deals with issues like a plethora of evolving frequency bands, complicated RF antenna arrays, and cost constraints regarding the deployment of high-precision anechoic testing systems.

Nonetheless, novel progression of AI-based RF testing algorithms, quantum-driven electromagnetic measurement techniques and 6G-enabled testing environment simulation facilities are escalating g testing accuracy, viability and productivity for IT & radiotelephone use, sustaining development for IT & telecommunications over the anechoic chamber business segment.

Smart Devices and Satellite Communications Drive Growth of Anechoic Chambers

As industries turn more to controlled electromagnetic environments to assess disruptive physical-layer and access solutions, the IT & telecommunications segment is established as the highest adopted amongst wireless network operators, M2M and IoT device manufacturers, and satellite communication providers.

Traditional open-field network testing is influenced by environmental factors but the use of an anechoic chamber eliminates these constraints and enables faultless simulation of wireless transmission analysis, fast data link tuning, EMI/EMC compliance verification and more.

The healthy growth pace is primarily due to the advances made within IT-targeted anechoic chamber applications wherein iterations comprise of distinct sub-stages like AI combined with 5G signal calibration, IoT devices testing in real-time, and cloud-based electromagnetic wave format analysis. According to our research, there are more than 60% of telecommunications infrastructure companies using anechoic chambers for 5G and 6G wireless device validation, leading to a strong demand for this segment.

Although it benefits from wireless signal optimization, IoT device interference testing, satellite communication calibration, several challenges such as frequency congestion issues, increased complexity of validating the beamforming, and time-consuming regulatory certification processes append the IT & telecommunications segment.

But new advancements in AI-based 6G test environment simulation, block chain-empowered RF compliance verification, and next-gen testing techniques for phased-array antennas promise to enhance testing precision, testing operability, and regulatory neutrality, providing consistent opportunity for IT & telecommunications applications in anechoic chamber sales.

Industry Overview

The anechoic chamber market is expanding as the need for electromagnetic interference (EMI) and radiofrequency (RF) testing is rising in the telecommunication, aerospace & defence, automotive, and electronics sectors. Anechoic chambers are designed for accurate measurement of antennas, radar systems, and wireless communication devices in a controlled environment.

Anechoic chambers will continue to be required for developing and testing new technologies, especially as 5G technologies, Internet of Things (IoT) devices, and autonomous vehicles are increasingly tested. Companies are adopting AI-based automation, improved RF shielding, and modular chambers for enhanced testing accuracy and efficiency.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ETS-Lindgren | 18-22% |

| Microwave Vision Group (MVG) | 15-19% |

| Rohde & Schwarz | 12-16% |

| Frankonia Group | 9-13% |

| TDK Corporation | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| ETS-Lindgren | Provides turnkey anechoic chamber solutions for EMI/RF testing, 5G testing, and automotive radar evaluation. |

| Microwave Vision Group (MVG) | Specializes in high-performance anechoic chambers for antenna measurement, RF shielding, and aerospace applications. |

| Rohde & Schwarz | Offers cutting-edge RF and EMC testing solutions with advanced shielding technologies and automated measurement systems. |

| Frankonia Group | Develops modular and customized anechoic chambers for compliance testing, wireless communication, and defence applications. |

| TDK Corporation | Manufactures high-precision anechoic chambers, focusing on automotive, consumer electronics, and 5G infrastructure testing. |

Key Company Insights

ETS-Lindgren (18-22%)

ETS-Lindgren is a global leader in anechoic chamber technology, providing advanced EMI, RF, and wireless test environments for the automotive and telecommunications industries.

Microwave Vision Group (MVG) (15-19%)

MVG specializes in high-accuracy antenna measurement and RF shielding, providing anechoic chambers that support aerospace, military, and telecom applications.

Rohde & Schwarz (12-16%)

Rohde & Schwarz is a key player in RF and EMC testing, integrating automation and precision measurement tools into its anechoic chamber solutions.

Frankonia Group (9-13%)

Frankonia Group designs advanced modular anechoic chambers tailored for compliance testing, wireless R&D, and defence electronics applications.

TDK Corporation (7-11%)

TDK Corporation focuses on developing high-precision anechoic chambers, particularly for automotive radar testing, 5G network optimization, and IoT device validation.

Other Key Players (30-40% Combined)

Several other manufacturers and technology providers contribute to the anechoic chamber market, offering specialized solutions for diverse industries. Notable players include:

The overall market size for Anechoic Chamber Market was USD 1.89 Billion in 2025.

The Anechoic Chamber Market expected to reach USD 8.19 Billion in 2035.

The demand for the anechoic chamber market will grow due to increasing adoption in electromagnetic compatibility (EMC) testing, rising demand for advanced telecommunications and radar systems, expanding aerospace and defence applications, and growing investments in 5G technology and autonomous vehicle testing.

The top 5 countries which drives the development of Anechoic Chamber Market are USA, UK, Europe Union, Japan and South Korea.

Full Anechoic Chambers and IT & Telecommunications lead market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: MEA Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: MEA Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chamber Belt Vacuum Machine Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hot Chamber Die Casting Machine Market Growth - Trends & Forecast 2025 to 2035

Dual Chamber Dispensing Bottles Market Size and Share Forecast Outlook 2025 to 2035

Dual-Chamber Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Dual Chamber Bottle Market Insights – Size, Trends & Forecast 2024-2034

Vacuum Chamber Pouches Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Chamber Packaging Machines Market

Posterior Chamber Lens Market

Photostability Chamber Market Size and Share Forecast Outlook 2025 to 2035

Stability Test Chamber Market Growth – Trends & Forecast 2019 to 2027

Flammability Test Chamber Market

Cellbag Bioreactor Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA