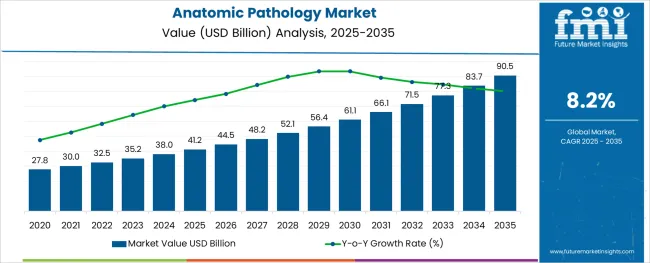

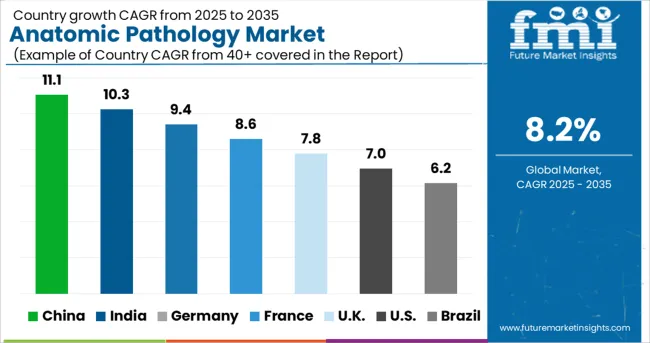

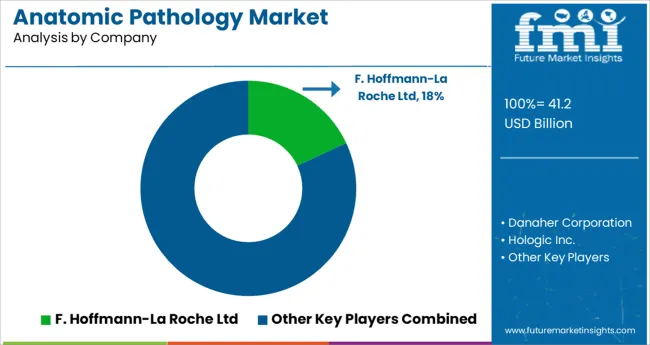

The Anatomic Pathology Market is estimated to be valued at USD 41.2 billion in 2025 and is projected to reach USD 90.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

The anatomic pathology market is undergoing notable expansion as healthcare systems prioritize early detection, tissue-based diagnostics, and personalized treatment planning. The increasing incidence of cancer and chronic illnesses has led to rising demand for biopsy evaluations, immunohistochemistry, and molecular pathology services.

Institutions are investing in digital pathology infrastructure, artificial intelligence for image analysis, and lab automation to streamline diagnostic workflows and enhance accuracy. Clinical decisions are increasingly reliant on integrated pathology insights, especially in oncology, where histopathological interpretation directly informs therapeutic strategies.

Furthermore, public and private healthcare entities are expanding pathology laboratory networks to support growing diagnostic volumes and reduce turnaround times. As innovations in slide scanners, AI-assisted diagnosis, and companion diagnostics advance, future growth is expected to be driven by scalable service models and precision pathology solutions that support data-rich, patient-centric care across both developed and emerging healthcare markets.

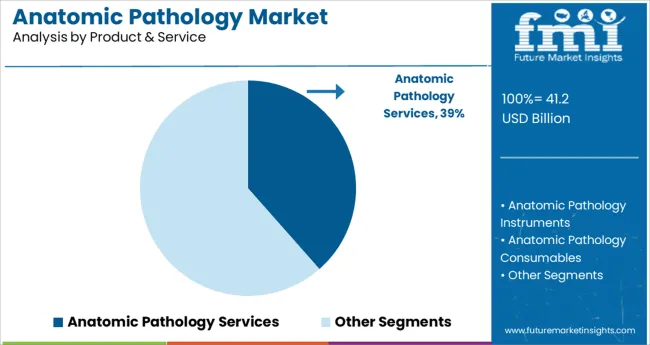

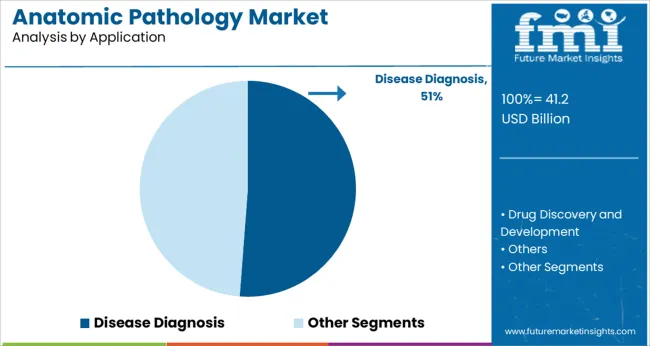

The market is segmented by Product & Service, Application, and End User and region. By Product & Service, the market is divided into Anatomic Pathology Services, Anatomic Pathology Instruments, and Anatomic Pathology Consumables. In terms of Application, the market is classified into Disease Diagnosis, Drug Discovery and Development, and Others.

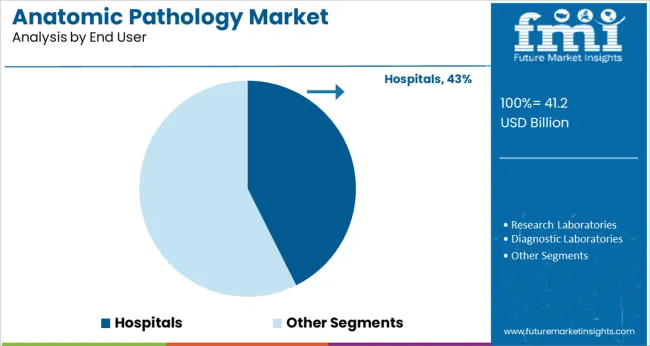

Based on End User, the market is segmented into Hospitals, Research Laboratories, Diagnostic Laboratories, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Anatomic pathology services are projected to account for 38.5% of the market’s revenue in 2025, establishing this as the dominant product and service category. This leadership has been driven by the consistent demand for laboratory-based tissue diagnostics in routine clinical practice and specialized disease assessment.

Service offerings including tissue processing, staining, and diagnostic interpretation have remained fundamental to disease classification and treatment selection. The rise of personalized medicine and the increasing complexity of biomarker analysis have reinforced the need for expert pathologist-led diagnostic services.

Moreover, the scalability of service models, particularly those integrated with hospital networks and reference labs, has expanded accessibility in both urban and regional healthcare systems. The emphasis on quality assurance, accreditation, and compliance with diagnostic standards has further supported sustained investment in pathology services.

Disease diagnosis is expected to contribute 51.2% of the anatomic pathology market revenue in 2025, making it the leading application area. This dominance is attributed to the central role of pathology in confirming clinical suspicions, guiding treatment plans, and monitoring therapeutic response.

Diagnostic applications span a wide spectrum of conditions, from cancer and autoimmune diseases to infectious and degenerative disorders, thereby maintaining high procedural volumes. The increased adoption of minimally invasive tissue sampling and image-guided biopsies has boosted the frequency of pathology tests.

Additionally, advancements in immunohistochemistry and molecular techniques have enhanced diagnostic accuracy, driving deeper integration of pathology services within clinical care pathways. The growing preference for early and definitive diagnosis has ensured that disease identification remains the primary driver of pathology testing volumes.

Hospitals are anticipated to hold 42.6% of the anatomic pathology market revenue in 2025, maintaining their status as the largest end user group. This is due to the centralization of diagnostic and therapeutic decision-making within hospital systems, where pathology labs play a vital role in multidisciplinary care.

Hospitals typically manage high diagnostic volumes from inpatients, surgical procedures, and outpatient clinics, making on-site or integrated pathology services a necessity. The expansion of hospital-based cancer centers, transplant units, and specialized departments has elevated the demand for rapid and accurate pathology reporting.

Investments in digital pathology, lab automation, and staff training within hospitals have further enhanced workflow efficiency and diagnostic precision. Additionally, regulatory emphasis on turnaround times and quality control in hospital diagnostics has reinforced the institutional role of anatomic pathology in delivering comprehensive, outcome-oriented care.

| Particulars | Details |

|---|---|

| H1, 2024 | 8.21% |

| H1, 2025 Projected | 8.20% |

| H1, 2025 Outlook | 7.80% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 40 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 41 ↓ |

The comparative analysis and market growth rate of global anatomic pathology market as studied by Future Market Insights, will show a negative BPS growth in H1-2025 outlook as compared to H1-2025 projected period by 40 BPS, and, a negative BPS growth is expected in H1-2025 over H1- 2024 duration with 41 Basis Point Share (BPS).

The key developments in the market include the design of Biophotonics in pathology to describe various types of imaging methods available. This factor has enforced the factor of pathology and radiology to converge towards a more holistic approach to diagnostic imaging, thus playing as a major driving factor for growth of the market.

The market observes a decline in the BPS values owed to the decreased flexibility in work force staffing, when compared with general service providers such as laboratories, high operational costs and overheads with each unit of subspecialty operating, and a greater need for trained staff, among others.

Several new approaches, such as cryoelectron tomography, holographic tissue dynamics spectroscopy, cellular magnetic resonance imaging, exotic material lensing, and photoacoustic tomography are further set to propel the market growth over the coming years.

The global demand for anatomic pathology products and services is projected to grow at a healthy CAGR of 8.2% during the forecast period between 2025 and 2035, totaling over USD 90.5 Billion by 2035.

Factors such as the rising prevalence of cancer and other target diseases, growing demand for personalized medicine, escalating need for early diagnosis of chronic diseases, surge in R&D activities, and introduction of favorable reimbursement policies are driving the anatomic pathology industry growth.

Anatomic pathology has become one of the most commonly used techniques for the detection and management of diseases like cancer. It allows pathologists to determine the cause and effect of particular diseases by analyzing tissues and organs during biopsies and other medical procedures.

The rapid surge in cancer cases across the globe is providing a major impetus to the growth of the anatomic pathology market and the trend is likely to continue during the forecast period.

According to the American Cancer Society, it is estimated that the global cancer burden is expected to grow to 27.5 billion new cancer cases and 16.3 million cancer deaths by 2040. This will create immense demands for advanced diagnostic technologies and treatment approaches, thereby expanding the anatomic pathology market size.

Furthermore, advancements in anatomic pathology instruments will significantly aid in improving the anatomic pathology market share during the forecast period.

Leading anatomic pathology manufacturers are continuously focusing on introducing advanced digital products such as specimen tracking systems (STS), to empower anatomical pathologists to accurately diagnose diseases and make confident treatment decisions.

Additionally, growing awareness, increasing healthcare expenditure, escalating cancer research, and a rise in the use of biomarkers during illness diagnosis will boost the anatomic pathology market growth during the forthcoming years.

Based on the aforementioned factors, FMI’s latest report on the anatomic pathology market forecasts the global anatomic pathology market to expand at 1.88X by 2035.

Despite its optimistic stance, the global anatomic pathology market is facing various obstacles that are challenging its growth to some extent. Some of these obstacles include the availability of refurbished anatomic pathology equipment, frequent product recalls, and the adoption of alternative diagnostic techniques.

Today, various refurbished anatomic pathology devices such as tissue processors, microtomes, and staining systems are available from LabX (US), Rankin Biomedical Corporation (US), Swerdlick Medical Systems (US), and AL-TAR (US).

The availability of these refreshed anatomic pathology products is expected to negatively impact the revenue of companies selling branded anatomic pathology devices.

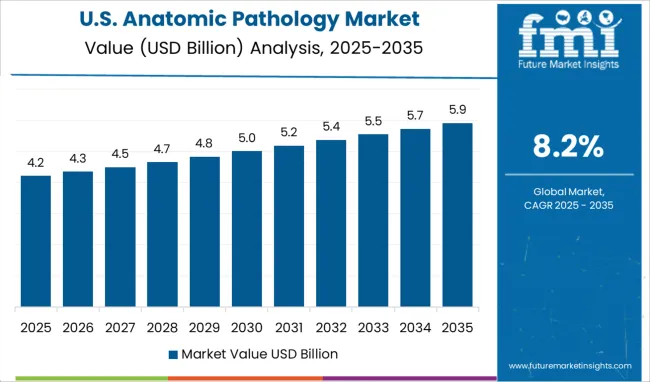

Rising Investments in Research and Development Creating Space for Anatomic Pathology Market Growth in the USA

As per FMI, the USA is expected to account for a significant share of the global anatomic pathology market through 2035, owing to the rising prevalence of cancer, high research, and development funding, availability of favorable reimbursement policies, increasing adoption of pathology imaging systems, surge in anatomic pathology labs, flourishing human anatomical models market, and strong presence of leading anatomic pathology m market players.

Over the years, the USA has become a global leader in medical research. The country annually spends billions of dollars on research and development to advance personalized medicine and reduce the burden of chronic diseases. For instance, the National Institutes of Health (NIH) alone spends about USD 41.7 billion annually on medical research for the American people.

Similarly, a rise in the number of new anatomic pathology product launches and approvals will improve the anatomic pathology market share of the USA during the forecast period.

Availability of Advanced Pathology Devices and Increasing Number of Anatomic Pathology Service Providers Spurring Growth in the Germany Anatomic Pathology Market

With the rising prevalence of chronic diseases and the availability of advanced pathology devices, the anatomic pathology market in Germany is expected to grow at a strong CAGR during the forecast period between 2025 and 2035.

As the burden of cancer and other chronic diseases across Germany continues to rise, medical institutes and government organizations are putting various efforts to tackle the situation. They are increasingly investing in advanced diagnostic technologies to improve diagnostic screening and reduce healthcare burden. This is creating a conducive environment for the anatomic pathology industry growth in the country.

The European anatomic pathology market, spearheaded by Germany and the UK is expected to account for 25.7% of the global market share.

Demand for Anatomic Pathology Services to Remain High Throughout the Forecast Period

As per FMI, the anatomic pathology services segment is likely to account for the largest share of the global anatomic pathology market during the forecast period, owing to the rapid surge in cancer cases, availability of favorable reimbursement for diagnostic tests, and increase in the number of anatomic pathology service providers worldwide.

Disease Diagnosis Segment to Contribute Most to the Global Anatomic Pathology Market

Based on application, the global anatomic pathology market is segmented into disease diagnosis, drug discovery and development, and others. Among these, the disease diagnosis segment accounted for the largest share in 2024, and is likely to grow at a relatively higher CAGR during the assessment period, as per the latest anatomic pathology market trends.

This can be attributed to the rising incidence of cancer and other chronic diseases, the growing need for early diagnosis of these diseases to initiate proper treatment, and various initiatives launched by the government to facilitate diagnostic screening of chronic diseases.

Similarly, the expansion of the cancer tissue diagnostics market and advancements in tissue diagnostics will support the growth of this segment during the forthcoming years.

Demand for Anatomic Pathology Products and Services to Remain High in Hospitals

Based on end users, the anatomic pathology market has been segmented into hospitals, research laboratories, diagnostic laboratories, and others.

As per FMI, the hospital segment held the largest share of the anatomic pathology market in 2024 and the trend is likely to continue during the forecast period, owing to the rising number of patient visits to hospitals, growing awareness among people regarding the importance of early diseases diagnosis, and rapid increase in the number of hospitals worldwide.

Some of the leading anatomic pathology providers include Laboratory Corporation of America Holdings, F.Hoffmann-La Roche AG, Quest Diagnostics Incorporated, Sakura Finetek USA, Inc., Cardinal Health, Inc., BioGenex, NeoGenomics, Bio SB, and Agilent Technologies.

Players like Roche have become global leaders in solutions for anatomical pathology labs to diagnose cancers. They are continuously investing in research and development to advance personalized healthcare and integrate digital tools in anatomic pathology. For instance,

Similarly, various leading players are adopting strategies like new product launches, acquisitions, mergers, partnerships, and collaborations to gain a competitive edge in the global anatomic pathology market. For instance,

Future Market Insights latest report provides a detailed anatomic pathology market forecast for a period of 8 years (2025 to 2035). It examines how advancement in anatomic pathology is revolutionizing the disease diagnosis and drug discovery services markets

The report is intended to enlighten customers with significant details about market shaping factors including drivers, restraints, emerging opportunities and latest anatomic pathology market trends.

While developed nations like the United States, Germany, and the United Kingdom remain at the top of the ladder, factors pushing anatomic pathology industry growth across emerging economies such as India and China have been thoroughly discussed.

FMI also illustrates how rise in chronic diseases and increasing investments in R&D will expand the global anatomic pathology market size during the forthcoming years. Besides this, it offers insights into leading anatomic pathology manufacturers and their growth strategies.

The Anatomic Pathology Market Analysis Includes:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historic Data Available for | 2020 to 2024 |

| Market Analysis | billion for Value |

| Report Coverage | Market forecast, company share analysis, competition intelligence, DROT analysis, market dynamics and challenges, and strategic growth initiatives |

| Key Segments Covered | Product & Service, Application, End User, Region

|

| Key regions covered | North America (USA, Canada, Rest of North America); Latin America (Brazil, Argentina, Mexico, Rest of Latin America); Western Europe (Germany, UK, France, Rest of Western Europe); Eastern Europe (Russia, Spain, Rest of Eastern Europe); South Asia Pacific (China, India, Japan, Malaysia, Thailand, Indonesia, South Korea, Rest of South Asia & Pacific); Middle East & Africa GCC Countries (Turkey, Israel, Rest of MEA); Rest of the World (Oceania, Africa, South America)

|

| End User | Hospitals, Research Laboratories, Diagnostic Laboratories, Others

|

| Key companies profiled | Laboratory Corporation of America Holdings; Quest Diagnostics Incorporated; Sakura Finetek USA; Inc.; F.Hoffmann-La Roche AG; Cardinal Health; Inc.; BioGenex; NeoGenomics; Bio SB; Agilent Technologies |

| Customization & pricing | Available upon request |

The global anatomic pathology market is estimated to be valued at USD 41.2 billion in 2025.

It is projected to reach USD 90.5 billion by 2035.

The market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types are anatomic pathology services, anatomic pathology instruments and anatomic pathology consumables.

disease diagnosis segment is expected to dominate with a 51.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anatomic Pathology Track and Trace Solution Market Size and Share Forecast Outlook 2025 to 2035

Human Anatomical Models Market

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Pathology Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cellular Pathology Market Analysis – Size, Share & Forecast 2025 to 2035

Digital Telepathology Market is segmented by Application and End User from 2025 to 2035

Quantitative Pathology Imaging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Veterinary Digital Pathology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA