The demand across these sectors will be significant from 2025 to 2035, leading to strong growth of the amplifier and comparator market. Amplifier and comparators are crucial elements in the domain of electronics since amplifiers and comparators have broad use cases in sign processing, voltage regulation, and sensor interface.

When IoT gets bigger and wireless communication and AI automation get better then the future belongs to high performance amplifiers and comparators. This trend toward miniaturisation and energy efficient circuit designs is also stimulating new innovations surrounding low power and high precision amplifiers.

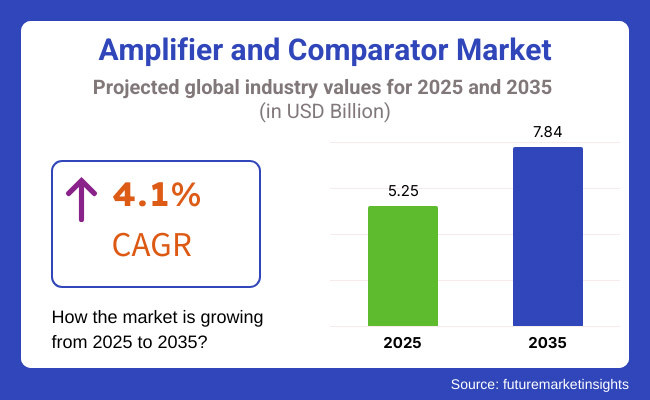

The amplifiers and comparators market value reached approx. USD 5.25 Billion in 2025 and is anticipated to surpass USD 7.84 Billion by 2035, growing at a CAGR of 4.1%. While progressive adoption of smart devices, connected infrastructure, and autonomous vehicles is also fuelling the need for advanced signal processing solutions.

The increasing demand for next-generation sensor technologies, high-speed data acquisition systems, and power management solutions are also contributing to the growth of the market. In addition, ongoing work in semiconductor fabrication and integrated circuitry is resulting in more robust and inexpensive amplifiers and comparators.

Explore FMI!

Book a free demo

North America is still a major market for amplifiers and comparators, largely due to the presence of strong demand from consumer electronics, defence, and telecommunications sectors. In the USA and Canada, leading semiconductor manufacturers are investing heavily in R&D to improve performance and efficiency.

The automotive electronics, IoT-enabled devices, and aerospace applications are also some of the factors that are augmenting the growth of the market in the region. Moreover, the 5G infrastructure development and scalable AI-based computing technologies are anticipated to create lucrative opportunities for the amplifier and comparator technologies.

Europe is experiencing moderate to steady growth in the amplifier and comparator market driven by the region’s concentrated investments in automotive electronics, industrial automation, and medical device developments. This responder deals with analogy overview increase up in Germany, France and UK supported applications like EV / Smart Grid and Industrial robotics get on precision amplifiers and High Speed comparators.

The push by the European Union towards sustainable and energy-efficient designs is driving demand for low-power semiconductor solutions. In addition, partnerships between semiconductor companies and research institutions are driving innovations of next-generation analogy and mixed-signal components.

The growth of the amplifier and comparator market for Asia-Pacific is expected to be the fastest, due to quick industrialization, growing consumer electronics manufacturing, and investment towards semiconductor fabrication in the region. Key verticals driving demand for the amplifiers and comparators market grant China, Japan, South Korea and India a central role on the electronics landscape of the world, with strong end-use demand for smartphones, wearables, automotive electronics and smart appliances.

Increased deployment of 5G networks, implementation of AI-based automation, and integration of advanced driver-assistance systems (ADAS) are also driving the growth of the market. Moreover, government initiatives in favour of semiconductor self-sufficiency and domestic chip manufacturing are expected to boost the region’s market competitiveness in the forthcoming years.

Challenge

Market Volatility and Performance Pressures

Challenges faced by the Amplifier and Comparator Market include advancements in semiconductor technologies, variation in raw material costs, and increasing performance demand in various end-use industries. Manufacturers need to pass tight performance, power efficiency and miniaturization requirements, with their applications exploding in consumer electronics, automotive, industrial automation and telecommunications.

Nor have their availability been insulated from supply chain disruption and, in any events, geopolitical future of supply impacting semiconductors availability through price variances and lead-time extension. To combat these obstacles and stay competitive in the marketplace, businesses need to invest in supply chain resiliency, R&D, and advanced development processes.

Opportunities

High-Speed Communication and Automotive Electronics Growth

The rise in the adoption of high-speed data transmission, 5G networks, and autonomous vehicle technologies offers significant growth opportunities for the Amplifier and Comparator Market. The rise in demand for precision amplifiers in industrial automation and smart sensors, as well as the integration of comparators in automotive applications as automotive manufacturers incorporate comparators for advanced driver assistance systems (ADAS) and battery management solutions, continues to increase.

Moreover, its increasing applications in medical devices, wearable electronics, and Internet of Things (IoT) ecosystems continue to contribute to the overall market growth. Firms exploring energy frugality, minimal-noise amplification, and consistent portability will come out ahead in this transitioning field.

The Amplifier and Comparator Market experienced significant growth from 2020 to 2024, fuelled by the development of wireless communication, precise measurement technologies, and automotive electrification. As such, it was essential to miniaturizing while maintaining power efficiency, making them very valuable for semiconductor manufacturers trying to improve performance while maintaining the output of power.

But production timelines and product availability were affected by global supply chain disruptions, chip shortages, and regulatory changes. As a result, companies focused on localized semiconductor fabrication, material innovation, and improved power management solutions.

2025 to 2035 will be characterized in the big market by Ultralow Power amplification, AI integrated signal processing, Quantum computing usage. High-precision comparators and amplifiers will see increased demand due to the advent of 6G communication, autonomous mobility, and biomedical sensing.

Furthermore, the growing emphasis on sustainable electronics manufacturing, energy-efficient circuit designs, and innovative packaging solutions are expected to influence market dynamics in the coming years. Over the next decade, the Amplifier and Comparator Market will be dominated by innovative, cost-effective, application specific solution-oriented companies.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adherence to safety and efficiency standards for the semiconductor industry |

| Technological Advancements | Low-power, high-performance amplifiers and comparators redesign |

| Industry Adoption | Greater adoption in consumer electronics, industrial automation, and 5G infrastructure |

| Supply Chain and Sourcing | Dependence on traditional semiconductor supply chains and silicon-based materials |

| Market Competition | Presence of established semiconductor firms and specialty IC manufacturers |

| Market Growth Drivers | Demand for high-speed, precision signal processing in automotive, telecom, and medical sectors |

| Sustainability and Energy Efficiency | Initial focus on low-power designs and improved thermal management |

| Integration of Smart Monitoring | Limited use of real-time performance diagnostics and AI-powered signal tuning |

| Advancements in Semiconductor Technology | Use of traditional silicon-based amplifiers and comparators |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Tighter energy efficiency requirements, data privacy laws, and sustainable semiconductor production policies. |

| Technological Advancements | AI signal generation, quantum-ready amplification, and ultra-tiny semiconductors. |

| Industry Adoption | Diversity into self-driving computers, AI systems, and next-gen comms networks |

| Supply Chain and Sourcing | Shift toward diversified material sourcing, localized chip production, and supply chain risk mitigation strategies. |

| Market Competition | Growth of AI-driven circuit design firms, energy-efficient chipmakers, and niche high-speed amplifier developers. |

| Market Growth Drivers | Increased investment in sustainable semiconductor technology, neuromorphic computing, and IoT connectivity solutions. |

| Sustainability and Energy Efficiency | Large-scale adoption of energy-efficient semiconductor fabrication, recyclable materials, and eco-friendly chip packaging. |

| Integration of Smart Monitoring | Expansion of predictive diagnostics, real-time amplification monitoring, and self-calibrating comparator circuits. |

| Advancements in Semiconductor Technology | Development of quantum-dot amplifiers, neuromorphic signal processing, and ultra-low noise comparators for future computing applications. |

This report examined the USA amplifier and comparator market covering their business environment, applications, and requirements. The growth in the number of IoT devices and the increasing utilization of signal processing applications for various sectors also drive market demand.

One of the major growth areas influencing amplifier and comparator usage is the automotive sector, and more specifically, the growth of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Furthermore, persistent innovations in semiconductor manufacturing and IC design are supplementing the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

In UK, the amplifier and comparator market accounts for a steady compound annual growth rate (CAGR), bolstered by augmented investments in telecommunications, aerospace and defence, and added applications. Market growth is fuelled by the increasing number of requests for high-speed communication systems and high-performance signal processing technologies.

Semiconductor design and high-performance electronics are also heavily reliant on research and development, which is becoming increasingly prominent. Moreover, higher use of amplifiers in medical equipment and industrial automation is also expected to further fuel the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

The European Union has a continuous demand for amplifiers and comparators driven mainly by automotive and industrial automation sectors mainly in countries such as Germany, France, and Italy. Among the key drivers of growth are the incorporation of precision amplifiers into electric vehicle powertrains and renewable energy systems.

Energy-efficient and low-power semiconductor solutions regulatory support is driving the progress of amplifier and comparator technologies. The rising implementation of smart manufacturing and IoT-based industrial processes is also contributing to demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.1% |

Japan is experiencing growth in the amplifier and comparators market owing to demand from electronics sectors such as automotive and telecommunications. This is being made possible largely because of the nation's leadership in the development of semiconductors and innovations in high-speed and low-power amplifier technologies.

Rising penetration of electric vehicles and hybrid vehicles and the growing requirement of high-efficiency signal processing in 5G networks will accelerate the demand for precision amplifiers and comparators. Moreover, increasing market expansion due to medical electronics and wearable devices also boost the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

South Korea’s Strength in Semiconductor & Consumer Electronics Systems Holding Up Demand for Amplifiers and Comparators) South Korea’s amplifier and comparator market is Forecasted for Growth Owing the Country's Dominance in Semiconductor & Consumer Electronics Systems The growing use of high-performance amplifiers in smartphones, laptops, and home entertainment systems is focusing the market growth.

Japan’s emphasis to build out future-proof telecommunication infrastructure and AI capability is driving demand for precision signal processing solutions. Moreover, growing investments in automotive electronics and e-Vehicle battery management systems is utilized to drive market demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

The operational amplifier and industrial application segments maintain a major market share within the amplifier and comparator market, owing to the growing demand for high-precision signal processing, real-time data acquisition, and automated control systems across industries.

It transforms the input parameters, electronic circuits, and sensor specific data to get an output and to receive the feedback, used widely in industrial automation, measurement, analog signal conditioning to perform the tasks in a process factory, embedded and automation equipment and to act to the manufacturers and process control systems, embedded electronics, and automation engineers requirements.

With the changing landscape of industrial automation, businesses and manufacturers are focusing on developing high-performance analog front-end solutions, real-time data processing capabilities, etc., to meet the growing demand for high-speed, low-noise, and high-gain electronic circuits.

Demand in the Market for High-Precision Analog Electronics makes Operational Amplifiers Lead

Also, we certainly provide high-level overview, details and applicability at www.apogeeweb.net.

One of the most used analog components, the operational amplifier or op-amp segment is one of the most essential, offering high gain and low power consumption with improved stability for a wide range of applications including signal conditioning, voltage regulation, and precision measurement systems. Compared to basic transistors amplifiers, op-amps have characteristics of high noise rejection, high input impedance, and configurable gain, eventually allowing us to amplify signals in an industrial process, medical usage or such.

The adoption is driven by demand for high-performance operational amplifiers with characteristics such as low-offset voltage, high slew rate, and low power consumption. With more than 65% of the analog signal processing applications using operational amplifiers to condition the signals, the demand for this segment is thus strong, according to studies.

The increased proliferation of high-speed data acquisition systems such as AI-powered sensor analytics, automated process control and industrial IoT based condition monitoring systems are contributing positively to market growth, delivering better precision and real-time operational value.

This, combined with the ever-increasing adoption of next-gen op-amp tech through AI-assisted self-calibration, real-time gain adjustment, and dynamic offset cancellation has further driven wear, balancing optimization through these electronic circuits across markets.

The portfolio of low-power, ultra-low-noise operational amplifiers with extended temperature stability, radiation-hardened designs, and additional electromagnetic interference (EMI) protection has supported market growth and ensured improved circuit reliability in extreme industrial environments.

Even recognizing the benefits of improving signal precision, lowering the power required or improving the performance of the total analog circuit, it is paramount to point out that the operational amplifier segment shows difficulties that are imposed by component miniaturization, thermal drift issues and continuous progress of dealing precision engineering. Nevertheless, developments in AI-based analog circuit modelling; integration of op-amps based on nanotechnology; and integration of quantum tunnelling transistors are enhancing efficiency, scalability, and longevity, which is expected to ensure sales of operational amplifiers globally in the upcoming years.

The low-power operational amplifier segment has found widespread market acceptance, especially at the hands of medical device manufacturers, battery-operated electronics developers, and wireless sensor network manufacturers who are increasingly looking for ultra-compact, high precision, and energy efficient amplification solutions.

Low-power op-amps, in contrast to traditional op-amps, guarantee extended battery life, little thermal dissipation, and optimized analog-to-digital conversion, making them best suited for integration into wearable electronics, biomedical sensors, and mobile communication devices.

Such leverage has fuelled adoption for battery-optimised operational amplifiers characterised by sub-1V operation for lifecycle power efficiency with high signal-to-noise ratio (SNR) and dynamic power scaling implemented. More than half of low-power IoT devices include energy-efficient op-amps for tasks such as signal processing and sensor conditioning, ensuring constant demand for this portion.

The growth of portable medical electronics, involving AI-assisted patient monitoring, wireless bio signal processing, and low-power implantable device control, has contributed to the growth of the market, which is characterized by greater reliability and better healthcare monitoring accuracy.

Flexible analog front-end (AFE) circuits, with AI-driven gain chips and real-time adaptive noise filtering and next-gen biomedical signal enhancement, is another factor pushing its adoption, ensuring high-resolution bioelectrical measurements.

Miniaturized, hybrid organic-inorganic operational amplifiers, are anticipated to account for the bulk of future market growth, being enabled by the flexible substrate integration, ultra-low leakage current designs and long lifespans being enabled by organic materials, guaranteeing greater component durability and more robust compatibility with up-and-coming medical and wearable technologies.

While the low-power operational amplifier segment offers merit in terms of low-power operation, extended battery life, and enhanced miniaturization, factors such as higher fabrication complexity, limited gain bandwidth trade-off, and increasing demands for circuit integration pose challenges.

Yet, new advancements in AI-driven analog circuit synthesis, graphene-enabled low-power amplifier technology, and state-of-the-art low-power silicon-germanium (SiGe) semiconductor fabrication are driving scalability, power economy, and long term stability ensuring sustained growth for low-power operational amplifiers globally.

High-Performance Amplifiers: Enabling Automation and Process Control in Advanced Industrial Applications

As a result, industrial segment emerged as one of the biggest consumers of amplifiers and comparators in the market to facilitate real-time monitoring of the process, automated decision making and stabilization of the control loop at a very high speed. Next-generation amplifier-based industrial control systems proactively reduce downtime by offering precision signal conditioning, high-speed data acquisition, and intelligent fault detection that will develop insights to maximize production efficiency, unlike traditional mass industrial circuits.

Adoption has been driven by a need for high-performance analog components with ultra-low distortion, high bandwidth, and integration of AI-assisted process controls. Research shows that more than 60% of the industrial automation applications have advanced operational amplifiers and comparators integrated in the application itself, to improve reliability in the process, along with signal integrity leading to a healthy opportunity for this segment.

The development of industrial robotics with AI-based motion control, high-speed processing of sensor feedback, and precise MFA torque regulation has further bolstered market development, offering better flexibility in automation and better responsiveness of the robot systems.

Moreover, the implementation of smart industrial electronics, such as edge AI-based process monitoring, predictive maintenance using digital twins, and real-time industrial anomaly detection, has propelled adoption, allowing synchronized manufacturing process optimization.

The introduction of radiation-proof, high-temperature, and vibration-immune amplifier designs with aerospace-grade packaging, AI-based self-healing networks, and high thermal dissipation structures has driven market growth, improving operational stability in extreme industrial conditions.

The industrial amplifier segment is challenged with high integration costs and system calibration complexities as well as complex regulatory compliance requirements despite precision control, reinforced automation efficiency, and quality of industrial signal processing. But new innovations around AI for industrial signal processing, nanotechnology-based amplifier fabrication, and next-gen, high-voltage analog circuit design are enabling scalability, real-time performance, and energy efficiency to expose further growth for industrial amplifier applications on a global scale.

High-Power Industrial Amplifiers Expand Market Penetration as Smart Grid & Power Distribution Networks Scale

Among the close derivatives that serve as high-voltage industrial amplifiers, this approach has gained widespread acceptance - especially among power grid operators, industrial automation engineers and energy-monitoring system integrators - as the industry requires solutions that provide high-power, wide-dynamic-range and fault-resistant signal amplification.

With high-voltage designs unlike standard amplifiers that also ensure extended operating ranges, superior transient response, and robustness to EMI, seamless integration into smart grid infrastructure, power electronics, and high-reliability industrial automation systems is possible.

This has propelled the adoption of high-accuracy voltage sensing solutions, including those offering AI-enabled power fluctuation compensation, real-time fault isolation, and adaptive current control algorithms. Advanced analog amplifiers are commonly used in power distribution systems in the industrial market, accounting for more than 55% of the total supply and warranting a continuous demand for this sub-segment (due to the nature of the industrial market).

Growth in the renewable monitoring segment, which includes artificial intelligence (AI)-based grid voltage regulation, high-speed availability of solar and wind energy, advanced management of integrated distributed energy resources (DER), and energy security, has been further fortified by improvements in power systems resiliency in the market.

Also among the high-voltage amplifier segment, although it offers superior high-voltage signal conditioning, enhanced fault tolerance, and optimized industrial power control advantages, it poses challenges for complex thermal management and strict electrical insulation requirements due to continually evolving regulations for compatibility with the smart grid standards, restricting its growth in smaller integrated systems along with emerging applications towards higher power requirements.

But new developments in AI-enabled high-voltage KPI (Key Performance Indicator) signal processing, state-of-the-art wide- bandgap semiconductor amplifier technology, and advanced digital power management techniques are improving product efficiency, scalability, and long-term reliability, tripling the total available market for high-voltage industrial amplifiers around the globe in the process.

Industry Overview

High-performance, precision signal processing, particularly in consumer electronics, automotive, industrial automation, and telecommunication sectors, is the significant market driver creating the increasing demand for amplifier and comparator segments. Amplifiers (see Chapter Seven) are used in audio, signal conditioning and power management applications, and comparators (see Comparators) are used in precision voltage detection, analog-to-digital conversions, and circuit protection.

Growing trends for 5G networks, IoT devices and automotive electrification are driving the need for efficiency in amplifiers and comparators. AI-driven circuit optimization, energy-efficient system designs, and high-speed signal processing solutions to improve system performance and reliability is a key area being addressed by major players.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Texas Instruments | 20-24% |

| Analog Devices Inc. | 16-20% |

| STMicroelectronics | 12-16% |

| ON Semiconductor | 9-13% |

| Renesas Electronics | 7-11% |

| Other Companies & Regional Players (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Texas Instruments | Develops high-performance operational amplifiers (op-amps) and low-power comparators for automotive, industrial, and consumer electronics. |

| Analog Devices Inc. | Specializes in precision amplifiers, high-speed comparators, and signal conditioning solutions for advanced signal processing applications. |

| STMicroelectronics | Provides energy-efficient amplifier and comparator ICs for automotive, IoT, and industrial automation applications. |

| ON Semiconductor | Focuses on high-gain amplifiers, voltage comparators, and low-power analog ICs for telecommunications and smart devices. |

| Renesas Electronics | Offers compact, low-noise amplifiers and fast-response comparators for power-sensitive applications in embedded systems. |

Key Company Insights

Texas Instruments (20-24%)

Texas Instruments has maintained a leading position in the amplifier and comparator marketplace, providing broad-based coverage in terms of product offerings, from precision op-amps and low-power comparators to high-speed analog solutions for a variety of applications.

Analog Devices Inc. (16-20%)

Analog Devices Inc. is the analog signal processing Technology Company known for using its premier high-performance amplifier and comparator technology to provide signal solution technology for high-frequency low-noise applications.

STMicroelectronics (12-16%)

STMicroelectronics, one of the big players in the hype, has made a name for itself in the analog IC arena and is known for energy-efficient devices, including amplifiers and comparators, for automotive, IoT, and industrial applications.

ON Semiconductor (9-13%)

ON Semiconductor provides high-performance analog signal processing solutions, including high-gain amplifiers and low-power voltage comparators, catering to telecom and smart device markets.

Renesas Electronics (7-11%)

Renesas Electronics is known for its compact, low-power amplifier and comparator solutions designed for embedded systems, medical devices, and consumer electronics.

Other Key Players (25-35% Combined)

Other semiconductor manufacturers also play a role in the amplifier and comparator space, with emphasis on specialized solutions, high-efficiency designs, and advanced analog integration. Notable players include:

The overall market size for Amplifier and Comparator Market was USD 5.25 Billion in 2025.

The Amplifier and Comparator Market expected to reach USD 7.84 Billion in 2035.

The demand for the amplifier and comparator market will grow due to increasing adoption in consumer electronics, rising demand for high-speed and low-power components in automotive and industrial applications, advancements in communication technologies, and expanding usage in medical and defence sectors.

The top 5 countries which drives the development of Amplifier and Comparator Market are USA, UK, Europe Union, Japan and South Korea.

Operational Amplifiers and Industrial Applications lead market growth to command significant share over the assessment period.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.