The ammonium thiosulfate market is expected to experience steady growth between 2025 and 2035, owing to increased demand for fertilizers, as well as its applications in industrial sectors and wastewater treatment. Ammonium thiosulfate has a role of a source of sulphur and nitrogen in some agricultural fertilizers that can improve the availability of nutrient in soil and crop productivity.

Growing global food production and a greater emphasis on sustainable agriculture, via ammonium thiosulfate-based fertilizers, are expected to drive demand. Moreover, the growth of the market is also driven by its use as a lixiviant for leaching gold and as a reducing agent in many industries.

In Recent years several new fertilizer technologies including controlled- release formulations and improved nutrient efficiency have led to rising interest in ammonium thiosulfate by farmers and agronomists. Growing demand of sustainable fertilizers which maintain all aspects of economic, environmental, and social balances is one of the significant factors contributing to the European soil amendment market growth as it is cattle in for use that maintains the soil health and raise the crop productivity.

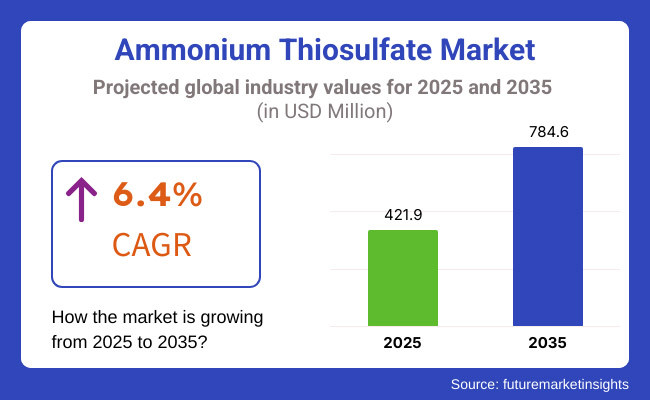

The demand for ammonium thiosulfate was valued around USD 421.9 Million in 2025 and expected to reach USD 784.6 Million by 2035, growing at a CAGR of 6.4%. The growing use of precision farming technologies, extensive investigation in alternative formulations of fertilizers, and strict environmental regulations encouraging sulphur-based fertilizers, are the major force augmenting this demand.

Industrial applications of ammonium thiosulfate, for example, in photographic processing, textile dyeing, and chemical synthesis, are driving the demand in the market. In addition, the growing awareness of the soil amendments and fertilizers based on ammonium thiosulfate, driven by innovative practices such as organic and regenerative farming methods, further drives this market. In addition, improving logistics and distribution networks are also supporting the market with more efficient supply chains and accessibility of end-users in developed and emerging economies.

Explore FMI!

Book a free demo

North America accounts for a major market for ammonium thiosulfate due to the high consumption of fertilizers for large-scale agriculture. Leading consumers include the USA and Canada, wherein nutrient management strategies are directed at enhancing crop productivity. Also, expand the market scope with industrial applications like metal recovery, water treatment, etc.

Regional market growth is also propelled by government support for sustainable farming practices and precision agriculture. Increasing use of ammonium thiosulfate in the turf management and horticulture is also a factor driving the growth of the market in the region.

Increasing investment in research and development and technological advancements in agriculture are contributing to the efficiency and performance of ammonium thiosulfate-based fertilizers. As the agriculture industry continues to move towards more digital farming solutions, precision application methods are also becoming increasingly common in order to free up resources and maximize crop yield for farmers.

There is a steady demand in Europe for ammonium thiosulfate, attributed to the growing focus on sustainable agriculture and regulatory policies that encourage the use of sulphur-based fertilizers in the region. Germany, France, and the UK among others are funding research to improve soil fertility and fertilizer efficiency. The industrial applications segment, covering chemical processing and textile treatment, is also driving market growth.

Furthermore, the region’s emphasis on reducing environmental damage with responsible fertilizer use and advanced irrigation systems is increasing the adoption of ammonium thiosulfate. Also, the increasing prevalence of eco-friendly customer behaviour is compelling manufacturers to produce eco-friendlier, much more lasting fertilizer products.

For over a decade, new precision farming technologies such as AI-enabled soil health monitoring and automated nutrient application systems have been taking European agricultural production into the next generation, and ammonium thiosulfate is an important element in the crop production methods of the future.

The sales in the Asia Pacific ammonium thiosulfate market are anticipated to show significant growth on the market owing to increasing growth of agricultural sector in China, India, and Indonesia. Cutting-edge fertilizers, which can help improve crop yield for an increasing population, is increasing demand for fertilizers. Further, market growth is also aided by government efforts for the better usage of fertilizers and the improving health of soils.

Growing demand across the region is fuelled by industrial applications such as gold extraction, wastewater treatment and chemical processing. The adoption of specialty fertilizers in precision farming is expected to have a moderate impact on the market expansion in the Asia-Pacific region.

Visit Agritech start-ups And new forms for application of nutrients Given an increasing equity in this particular sector, with the growing emphasis on food security And Sustainable Cultivation The growth of distribution channels and partnerships between agricultural cooperatives and fertilizer producers are also strengthening the penetration of the market so that farmers receive premium-quality ammonium thiosulfate more swiftly.

Challenge

Regulatory Pressures and Environmental Considerations

Ammonium thiosulfate is an eco-friendly and natural product without adverse impacts on the environment, which positively contributes to the Ammonium Thiosulfate Market, whereas the exacting guidelines such as product safety and chemical storage maintenance restrains the growth of the ammonium thiosulfate market. Ammonium thiosulfate is subjected to stringent regulations governing its manufacture, distribution, and usage, especially in the agricultural and industrial domains.

Moreover, increasing threats on groundwater pollution and environmental sustainability also push producers to use safer manufacturing processes and dispose of waste properly. Such growth certainly brings advantages for various organizations but it also brings with it threats that need to be abated by companies who have to address these challenges through regulations compliance,

sustainable sourcing, and innovations. Toggle further developing research and development bounded guidance towards building greener variants and adding up manufacturing processes are going to be the major steps to tackle these challenges with success.

Opportunity

Applications in Agriculture and Industrial Market Expansion

Market players can find immense growth potential based on the rising application in agriculture as an ammonium thiosulfate nitrogen-sulfur fertilizer. Ammonium thiosulfate is used by farmers to assist in increasing the soil health and crop productivity, especially in the case of the region being sulfur deficient. It is also increasingly used in applications including water treatment, chemical processing, and photography.

Market growth is attributed to recent developments in liquid fertilisers, precision agriculture, and better nutrient management practices. The companies that diversified their product portfolio, sustainable product formulations, and improved their distribution network will beat the competition in the growing Ammonium Thiosulfate Market. Moreover, collaborating with agricultural cooperatives and industrial manufacturers would help expand market reach and improve customer engagement.

The Ammonium Thiosulfate Market broke through in the period of 2020 to 2024 as the demand for sulphur-based fertilizer and industrial chemical applications grew. Meanwhile, farmers and stakeholders in the agricultural sector sought more efficient and sustainable approaches to fertilization, significantly fueling product adoption.

Nonetheless, market fundamentals were impacted by global headwinds including regulatory pressures, supply chain disruptions and rising raw material pricing. Companies adapted by sharpening product formulations, bolstering logistical efficiency and improving penetration in regional markets. Furthermore, a continued investment in digital solutions tailored specifically for the management of farmland and industrial processes added to the steady growth of the industry.

In the future, between 2025 to 2035, the sustainable fertilizer market will transform, as cutting-edge production methods, application methods, and industrial diversification take centre stage. This will result in a paradigm shift in the use of ammonium thiosulfate with sustainable alternatives, improved nutrient delivery systems, and agri-tech solutions coming to the fore.

Moreover, the emergence of industrial applications, wastewater treatment, and metals recovery will continue to propel the growth of the market. The next phase of the Ammonium Thiosulfate Market will be led by companies that innovate, comply with regulations and engage in sustainable practices. Additionally, energy reduction in production facilities as well as the introduction of closed-loop recycling systems will be a major force for improving environmental responsibility and cost efficiency.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adherence to regulations on agriculture and chemical safety |

| Technological Advancements | Development of liquid fertilizer formulations and efficient application techniques |

| Industry Adoption | Increased use in agriculture, industrial chemicals, and wastewater treatment |

| Supply Chain and Sourcing | Dependence on sulfur-based raw materials and conventional supply chains |

| Market Competition | Presence of established fertilizer manufacturers and specialty chemical firms |

| Market Growth Drivers | Sulfur-based fertilizers, water treatment solutions, and chemical processing agents are in huge demand |

| Sustainability and Energy Efficiency | First hammering out fertilizer runoff reduction and soil retention |

| Integration of Smart Monitoring | Limited use of digital tools in fertilizer application and industrial processes |

| Advancements in Application Techniques | Use of conventional spreading and liquid injection methods |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Increase in sustainability-oriented regulations, eco-friendly production requirements, and sophisticated compliance standards |

| Technological Advancements | Adoption of precision agriculture, smart fertilizer delivery systems, and digital monitoring technologies. |

| Industry Adoption | Expansion into advanced metal recovery, sustainable fertilization methods, and diversified chemical processing. |

| Supply Chain and Sourcing | Shift toward renewable sulfur sources, localized production hubs, and improved supply chain resilience. |

| Market Competition | Growth of sustainable fertilizer providers, niche agricultural solution developers, and innovative industrial applications. |

| Market Growth Drivers | More investment in precision agriculture and environmental sustainability and circular economy initiatives. |

| Sustainability and Energy Efficiency | Widespread use of carbon-neutral fertilizer manufacturing and resource-efficient industrial processes, as well as sustainable waste management. |

| Integration of Smart Monitoring | Expansion of AI-powered nutrient management, real-time soil health monitoring, and automated chemical process control. |

| Advancements in Application Techniques | Evolution of micro-dosing systems, controlled-release fertilizers, and environmentally optimized industrial applications. |

United States Ammonium Thiosulfate Market is projected to reach at a significant rate during the forecast period. Increasing demand from agriculture sector is one of the major factors stimulating growth in the USA ammonium thiosulfate market as it is widely used as a sulfur-containing fertilizer to improve the salts in the soil. There is are also growing focus on sustainable farming out there and improved crop yields is also contributing to the market boost.

Demand from the chemical and industrial sectors also finds its way to ammonium thiosulfate, particularly for its use in photographic solutions and metal treatment processes. Continuous research on precision agriculture and liquid fertilizer efficiency is anticipated to promote market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

The UK ammonium thiosulfate market is projected to witness growth on account of growing awareness about soil nutrient management coupled with the adoption of liquid fertilizers by large-scale farming. Ammonium thiosulfate is also gaining popularity among farmers as a sulfur fertilizer to enhance nitrogen uptake efficiency in crops like barley and wheat.

The further market growth is driven by governmental initiatives endorsing sustainable agricultural practices and eco-friendly fertilizers. Chemical Industry: Demand for industrial applications is further boosting the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

Germany, France and Italy are some of the major agricultural economies in Europe, developing the ammonium thiosulfate market steadily in the region. One of the major factors in the growth of the market is the rising use of sulfur-based fertilizers for improving soil deficiencies as well as for enhancing soil productivity.

Stringent environmental regulations are promoting the use of low-emission liquid fertilizers, driving demand for ammonium thiosulfate. Furthermore, its usage in industrial wastewater treatment and chemical synthesis is boosting the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.4% |

Ammonium thiosulfate market in Japan is witnessing steady growth, with usage in agriculture and industrial applications. Precision farming practices and soil health management in the country is leading to increased demand for liquid fertilizers, including ammonium thiosulfate.

Moreover, ammonium thiosulfate is being used in photographic processing and metal treatment processes in the chemical industry. The market is also seeing research into its alternative uses, such as environmental remediation solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

The South Korean ammonium thiosulfate market is witnessing growth due to the rising focus on increasing agricultural efficiency and crop yield. Liquid fertilizers are being used by farmers to enhance nutritional absorption and for better growth of soils; especially for high-value crops.

And outside agriculture, industrial applications like water treatment and chemical processing are adding demand. Owing to the growing emphasis on sustainable farming methods and innovative fertilizer formulations, the market is projected to remain poised for growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

The liquid ammonium thiosulfate and industrial grade segments are expected to account for high value shares in the global ammonium thiosulfate market with industries looking for viable solutions with regards to sulphur fertilization, photographic chemicals processing, and high yield industrial applications.

This makes them a vital area for fertilizer manufacturers, industrial chemical producers and specialty chemical processing industries, as these chemical formulations are used to optimize crop nutrient absorption, enhance photographic processing quality and provide improved industrial chemical synthesis.

Global demand for an effective soil sulphur replenishment source, improved photographic chemical compositions, and focused industrial-grade ammonium thiosulfate applications has encouraged companies and manufacturers to focus on high purity product formulations, large-scale distribution networks and innovative process optimizations to drive the market forward.

Liquid Form Provides Benefits for Use in Agriculture as Well as Industry

The liquid ammonium thiosulfate part is the most frequently used variety of this product employed in agriculture and industry; this portion offers a higher soluble form, fast absorption of nutrients, and enhanced character in mixtures which are typically used in precision agriculture and sulphur-containing procedures, within the manufacturing of fertilizer and photographic resolving agents.

Liquid formulations overcome the challenges of powdered ammonium thiosulfate, providing the following benefits: uniform application (ensuring that products are in the right place at the right time) minimizes the risk of handling and provides better mixing compatibility with other fertilizers and industrial chemicals.

Emerging products, such as high efficiency liquid ammonium thiosulfate, with increased sulphur bioavailability, pH stability, and controlled-release nutrients have driven adoption. According to studies, liquid ammonium thiosulfate constitutes more than 70% of ammonium thiosulfate used in agriculture, providing robust demand for its segment.

Hence, the increasing adoption of precision farming solutions based on AI-aided soil analysis, automatic feed distribution systems, and field-controlled irrigation integration has positively impacted the growth of the market owing to better crop yields and efficient nutrient utilizations.

Adoption continues to accelerate, aided by the seamless fertilizer and industrial chemical production workflows made possible by smart chemical formulation technologies enabled by AI-assisted solubility enhancement, real-time viscosity adjustments and cloud-based blending precision.

Custom solutions of liquid ammonium thiosulfate, including tailored micronutrient blends, high-purity sulphur stabilizers, and concentration levels in accordance with specific industry requirements, have facilitated market development, delivering improved performance consistency and adherence to international quality standards.

While liquid ammonium thiosulfate has proven to have several advantages over dry formulations with regard to improving yields and productivity in various sectors including agriculture and industrial chemical synthesis, the liquid segment poses challenges because of the limited shelf life, individual storage requirements of liquid ammonium thiosulfate, and higher transportation costs.

Nevertheless, new advancements in technologies such as AI-powered chemical stabilization, next-gen bulk liquid storage solutions, and block chain-enabled fertilizer supply chain tracking are enhancing product shelf life, distribution efficiency, and application accuracy, thereby allowing a continued growth for liquid ammonium thiosulfate across the globe.

Liquid ammonium thiosulfate finds its highest market uptake from fertilizer manufacture, soil health experts and industrial chemical processors that favour liquid formulations for accurate nutrient supply, chemical reaction efficacy, and industrial synthesis optimizations.

Liquid ammonium thiosulfate also offers advantages over traditional granular fertilizers or dry chemical formulations due to its uniform distribution, reduced environmental impact, and enhanced reaction kinetics, which are important in specialty chemical applications.

Mirroring releases from widespread adoption, the graph illustrates that the need for custom liquid ammonium thiosulfate blends with high precision industrial reactions offering low residue development improvements or crop-specific nutrient additives has pushed further sales. More than 60% of ammonium thiosulfate solutions are customized to meet the needs for application-specific characteristics in the finished fiber material, ensuring a consistent demand for product

Developing natural agricultural input solutions (like low-emission sulphur fertilizers, precision-sprayed ammonium thiosulfate applications (ATS), and integrated Soil Health Monitoring Systems) further enhances environmental compliance in agricultural production - all of which helps benefit segment expansion.

The rise of liquid chemical automation solutions, with AI-powered blending control, on-demand viscosity measurement, and cloud-enabled inventory management, has also spurred adoption, promising better formulation accuracy and supply management.

The evolution of ammonium thiosulfate in focus to specialized industrial applications with elevated metal leaching potential, improved pH-buffering reactions, along with a highly controlled-release sulphur chemistry with respect to ammonium thiosulfate applications, is expected to establish optimum market growth, thus leading to wider application of ammonium thiosulfate for mining, water treatment, and specialty chemical processing industries.

Although it offers advantages like process scalability, product consistency, and industrial usability, the liquid ammonium thiosulfate category has to contend with strict regulatory approvals and formulation variability based on the application sector as well as limited availability in emerging regions.

Nonetheless, innovative advances in the synthesis of bio-based ammonium thiosulfate, artificial intelligence led optimization of processes, and regulation-compliance tracking mechanisms on block chain are influencing the cost-effective, market-oriented, and eco-friendly aspects of the product, facilitating continuous expansion for liquid ammonium thiosulfate across the globe.

The industrial grade ammonium thiosulfate sector has turned out to be one of the dominant contributors to ammonium thiosulfate market, offering high-purity chemical formulations, optimized processes for metal recovery from industrial waste, and sulphur based industrial applications. This industrial-grade ammonium thiosulfate has superior chemical stability, ultra-low impurities, and controlled reaction kinetics compared with typical agricultural grade formulation, which helps enable for maximum process efficiency during industrial processing.

The evolving demand for a high-purity ammonium thiosulfate solution endowed with improved catalytic property, thermal stability, and a high-efficiency metal leaching performance has facilitated the adoption. According to studies, over 50% of the ammonium thiosulfate produced by the industry has been used in specialty chemical synthesis and metal extraction applications which is likely to guarantee a strong demand for this segment.

Market growth is attributed to expanding chemical processing applications including advanced water treatment solutions, specialty polymer formulations, and high-performance textile processing, which ensure optimal mechanisms for industrial reactions and enhanced material performance.

It characterized by AI-based process control, online purity tracking, and block chain-based supply chain verification - has also driven adoption and ensured compliance with global quality standards.

Optimization of the market, with customized industrial-grade ammonium thiosulfate blends able to provide optimal systems of catalytic activity, enhanced reaction stability, and ultra-pure sulphur processing solutions has driven market growth, ensuring greater efficiency in the production of industrial materials and environmental applications.

However, industrial-grade ammonium thiosulfate presents challenges including strict environmental regulations, complex quality assurance parameters, and cost volatility of raw materials, despite its advantages in chemical stability, industrial processing efficiency, and enhanced reaction control.

Emerging innovations house AI-based chemical formulation, cloud-based industrial process monitoring, and real-time supply chain transparency solutions that are working on making the process more efficient, cost-effective, and compliant with regulations, ensuring that industrial-grade ammonium thiosulfate remains available for expansion globally.

Ammonium thiosulfate is increasingly being used in fertilizers, industrial processes, and wastewater treatment; the growing use of these is boosting the ammonium thiosulfate market. In agriculture, it is a common sulphur and nitrogen source, especially for sulphur hungry crops.

Market growth is driven by the increasing demand for sustainable agricultural practices and effective fertilizer solutions. Also, ammonium thiosulfate is used in gold leaching, photographic developing and an industrial reagent reducing agent. Prominent manufacturers are emphasizing on production efficiency, green formulations and advanced application techniques for the product to improve its performance across various industries.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Tessenderlo Group | 18-22% |

| Koch Fertilizer LLC | 15-19% |

| TIB Chemicals AG | 12-16% |

| Martin Midstream Partners | 9-13% |

| Kugler Company | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Tessenderlo Group | Manufactures high-purity ammonium thiosulfate for agricultural and industrial applications, focusing on sustainable fertilizer solutions. |

| Koch Fertilizer LLC | Produces ammonium thiosulfate-based fertilizers with advanced nutrient efficiency technologies for large-scale farming. |

| TIB Chemicals AG | Specializes in ammonium thiosulfate for industrial use, including metal recovery, wastewater treatment, and specialty chemical formulations. |

| Martin Midstream Partners | Supplies ammonium thiosulfate as a sulphur fertilizer additive, providing customized bulk distribution services. |

| Kugler Company | Develops innovative ammonium thiosulfate-based liquid fertilizers with precision application techniques for enhanced crop yield. |

Key Company Insights

Tessenderlo Group (18-22%)

The ammonium thiosulfate market is led by the high-purity formulations manufactured by Tessenderlo Group specifically for agricultural efficiency and industrial processing. Its focus on nutrient delivery solutions and commitment to sustainability as a company also positions it well in the market.

Koch Fertilizer LLC (15-19%)

Ammonium thiosulfate providers like Koch Fertilizer LLC also serve as leading manufacturers of these fertilizers with advanced formulations designed to accelerate sulphur uptake in crops, specifically ammonium thiosulfate fillers that increase nitrogen growth in crops, which boosts productivity in every field.

TIB Chemicals AG (12-16%)

TIB Chemicals AG specializes in ammonium thiosulfate for industrial applications, including gold leaching, wastewater treatment, and specialty chemical production. Its high-quality formulations cater to a wide range of industries.

Martin Midstream Partners (9-13%)

Martin Midstream Partners commercializes ammonium thiosulfate and specializes in integration logistics and bulk supply to agricultural and industrial end-users.

Kugler Company (7-11%)

With Precision Application Solutions for Ammonium Thiosulfate-based Liquid Fertilizers, Kugler Company is helping their customers apply nutrients for maximum uptake and increased production.

Other Key Players (30-40% Combined)

The ammonium thiosulfate market also comprises of other specialized manufacturers and suppliers that offer formulations, advanced materials, and organic solutions for various agricultural and industrial applications. Notable players include:

The overall market size for Ammonium Thiosulfate Market was USD 421.9 Million in 2025.

The Ammonium Thiosulfate Market expected to reach USD 784.6 Million in 2035.

The demand for the ammonium thiosulfate market will grow due to increasing use as a nitrogen and sulphur fertilizer in agriculture, rising demand in industrial applications such as water treatment and photography, and expanding adoption in metal leaching and chemical processing industries.

The top 5 countries which drives the development of Ammonium Thiosulfate Market are USA, UK, Europe Union, Japan and South Korea.

Liquid Ammonium Thiosulfate and Industrial Grade lead market growth to command significant share over the assessment period.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.