The global ammonium sulfate food grade market is poised to witness moderate growth over the coming years, owing to its functions as a food additive, acidity regulator, and a nutrient source. Ammonium sulfate is commonly used as a dough conditioner and a yeast nutrient in bread and bakery products in food production. Due to its consistent performance, texture improvement and increased product stability, they have become an effective ingredient for food manufacturers.

Furthermore, as the demand for processed and packaged foods increases further due to consumer demand, food-grade ammonium sulfate provides an inexpensive and effective means to preserve product quality and longevity. As it is widely accepted by regulatory authorities to be safe for food use and the food production is on the rise in emerging markets, steady demand growth for ammonium sulfate food grade market can be expected through 2035.

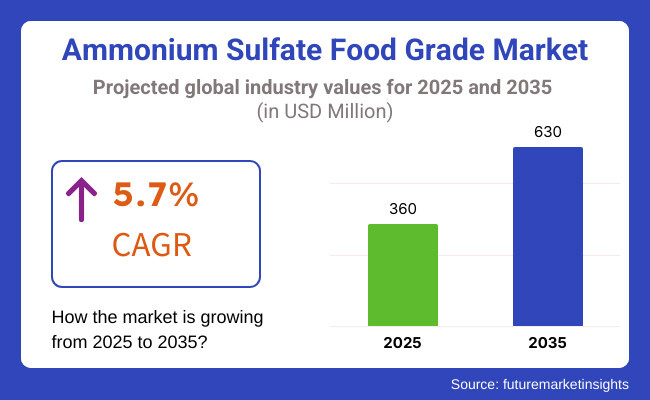

In 2025 the market was valued at an estimated USD 360 Million, and by 2035 the market is expected to reach USD 630 Million with a compound annual growth rate (CAGR) of 5.7%. Such steady growth is fueled by the versatility of this ingredient, regulatory compliance and its contribution toward food quality.

Explore FMI!

Book a free demo

North America remains a key consumer of food grade ammonium sulfate owing to its thriving bakery and food processing sector. The ingredient is commonly used in North America as a dough conditioner and yeast nutrient during the making of bread, rolls and many other baked items.

Applying Ammonium sulfate to Food Production: The region’s food safety focus, combined with established manufacturing standards, has enhanced confidence in food-grade uses for ammonium sulfate. Furthermore, increasing preference for high quality bakery products among North American consumers and consistent performance of food-grade ammonium sulfate in industrial scale food production are also further fueling the demand for food-grade ammonium sulfate.

This burgeoning market is set to benefit from a strong European market with its food additive regulations and a strong bakery culture. Germany, France, and Italy is among the countries with a well-to-do bakery industry dependent on ammonium sulphate for dough consistency and texture.

The strict standards of the European Union for food safety and additive use make ammonium sulfate a safe ingredient for manufacturers. With a rising demand for convenience foods and packaged bakery products, the functional additive role of ammonium sulfate is likely to remain stable and support the market share of the region.

High urbanization growth rate, high growth disposable incomes, and growing food manufacturing capabilities are predicted to make Asia-Pacific one of the emerging areas for ammonium sulfate food grade manufacturing.

In rise in processed snack and bakery consumption in the Asian countries such as Japan, India, and Section provides opportunities for food additives market. Moreover, the wide availability of ammonium sulfate in this region due to distribution channels & investment in food production infrastructure is expected to create opportunities for growth in the market.

Challenge

Stringent Food Safety Regulations, Price Volatility, and Alternative Additive Competition

The ammonium sulfate food grade market is facing several challenges, especially regulatory compliance, changing raw material prices, and limited consumer awareness. High cost of compliance is anticipated as regulatory authorities viz. FDA (Food and Drug Administration), EFSA (European Food Safety Authority), and Codex Alimentarius establish stringent purity and safety standards for ammonium sulfate for food application.

Moreover, production costs and market pricing are affected by price volatility of its upstream key raw materials, sulfur and ammonia. Consumer perception of ammonium sulfate as a synthetic additive, rather than a food ingredient that has functional benefits, limits adoption in clean-label and organic food segments. Increasing competition from alternatives food additives like organic acids and natural yeast nutrients is also a major market constraint.

Opportunities

Expansion in Functional Foods, Biotechnology-Driven Production, and Sustainable Food Processing

Ammonium sulfate is commonly used as a yeast nutrient in bread-making, a pH regulator in food products, and as a processing aid in food manufacture. The growth of the bakery and confectionery industry, increasing food production across the globe, and technological advancements in food processing are projected to fuel demand. Companies with sustainability efforts in sustainable sourcing, biodegradable formulations and production processes, will differentiate themselves. Moreover, the use of ammonium sulfate in processing plant-based proteins and functional food applications create new opportunities for growth.

Between 2020 and 2024, the demand for ammonium sulfate food grade market remained stable, primarily due to its applications in commercial baking, dairy processing, and food fortification. But market dynamics were affected by growing regulatory scrutiny, the rise of clean-label products, and competition from natural alternatives.

The gain in plant-based food processing and functional ingredient innovations opened up new avenues of applications, but adoption had been muted as customers still preferred to shy away from synthetic ingredients with prolonged shelf life properties.

Looking ahead to 2025 to 2035, the market directed more towards sustainability, biotechnological production, and clean label ingredients, etc. Improvements in AI-managed food formulation, blockchain-fueled ingredient tracing, and bio based ammonium sulfate manufacturing will transform industry benchmarks. Growing applications in such sectors, as plant-based protein processing, nutraceuticals, and functional beverages, will further support future market growth.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strict FDA, EFSA, and Codex Alimentarius compliance for food-grade ammonium sulfate. |

| Consumer Trends | Used in commercial baking, dairy processing, and yeast fermentation. |

| Industry Adoption | Moderate usage in confectionery, processed foods, and bakery formulations. |

| Supply Chain and Sourcing | Dependence on industrial ammonium sulfate suppliers with limited sustainable sourcing options. |

| Market Competition | Dominated by chemical manufacturers and specialty food ingredient suppliers. |

| Market Growth Drivers | Growth fueled by demand in baking, dairy, and yeast fermentation applications. |

| Sustainability and Environmental Impact | Limited focus on sustainability, with traditional chemical manufacturing methods. |

| Integration of Smart Technologies | Early adoption of supply chain digitization and basic food safety monitoring. |

| Advancements in Food Applications | Used primarily as a processing aid in bakery, dairy, and food preservation. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of clean-label certification, eco-friendly production regulations, and sustainability reporting. |

| Consumer Trends | Growing adoption in plant-based protein, functional foods, and alternative dairy formulations. |

| Industry Adoption | Widespread adoption in functional food, sustainable food processing, and plant-based nutrition. |

| Supply Chain and Sourcing | Shift toward biotech-driven ammonium sulfate production and localized ingredient manufacturing. |

| Market Competition | Entry of biotech startups, sustainable ingredient innovators, and AI-powered food formulation firms. |

| Market Growth Drivers | Accelerated by sustainable food production, AI-driven food formulation, and advanced fermentation processes. |

| Sustainability and Environmental Impact | Large-scale adoption of bio-based ammonium sulfate, carbon-neutral production, and circular economy models. |

| Integration of Smart Technologies | Full integration of blockchain traceability, AI-driven ingredient optimization, and automated quality control. |

| Advancements in Food Applications | Expansion into nutraceuticals, sports nutrition, functional beverages, and precision fermentation processes. |

The USA ammonium sulfate food grade market is on rise due to increasing application in food additive, dough conditioner, and acidity regulator in bakery and confectionery in United States. Growing demand for value-added, processed foods and high-quality food-grade additives is driving market growth. Moreover, the imposition of regulatory compliance according to FDA food safety standards bolsters the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

In the United Kingdom, the ammonium sulfate (food grade) market is growing as there is an increasing trend of adopting functional additives in food and beverage industry to improve the product quality. Rising demand for baked goods and packaged food products, along with strict food safety compliance, is fueling the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

The ammonium sulfate food grade market is gaining traction across the European Union as it acts as a food processing aid and a food acidity regulator that is used in several food applications. The growth in demand is attributed to the food safety, quality assurance and sustainable sourcing of food-grade chemicals in the region. A crucial role of the European Food Safety Authority (EFSA) is the regulation of such additives and their compliance with strict safety standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.7% |

Japan ammonium sulfate food grade market is witnessing moderate growth, spurred by its application in bakery and food processing. Due to the strong emphasis in food innovation, product safety, and functional additives in the country, the usage as a pH regulator and dough improver also remains stable.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

The ammonium sulfate food grade market in South Korea is witnessing growth, as the food manufacturers are now more focused on enhancing the consistency and shelf life of food products. Market growth is driven by the demand for high-quality additives in the bakery and processed food industries, as well as food safety and regulatory compliance in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

The market for ammonium sulfate food grade market is growing due to its essential role in food processing, pH regulation, and protein purification. Ammonium sulfate is commonly used as a food additive and dough conditioner for improved texture, shelf life, and functionality. It is classified on the basis of Form (Solid, Powder, Granular, Liquid) and Application (Food, Feed).

Ammonium sulfate exists in a powdered form, and therefore, the food-grade segment is ruled by this form, widely used during baking process, dairy processing and in beverage production. The powdered ammonium sulfate is favored by manufacturers owing to its finer consistency, good solubility, and accurate dosing in food formulations.

As for baking industry, powdered ammonium sulfate is one type of leavening agent that is used to enhance the texture, volume, and stability of bread and pastries. Also, as a processing aid in dairy products and brewing - where it speeds up yeast fermentation as well as in food processing to improve protein purification.

Based on the application, the food application segment dominates the ammonium sulfate food grade market since food manufacturers significantly utilize ammonium sulfate for dough conditioning, acidity control, and protein stabilization. The safety use of color in baking, dairy and processed products is backed by food safety agencies' regulatory approvals like that of the FDA and EFSA, which is expected to gain momentum in its adoption.

With the rising demands of the consumer for high-quality baked goods, processed dairy, and functional foods, the demand for ammonium sulfate as a safe, effective food additive continues to grow. Stability, and affordability, it became a ubiquitous ingredient in contemporary food manufacturing.

In food and beverage industries, the rising requirements for food additives, dough conditioners, acidity regulators, and protein purification agents are driving the growth of the food-grade ammonium sulfate market. To improve food safety, product consistency, and compliance with regulations, many companies are emphasizing AI-driven quality control, high-purity production processes, and sustainable sourcing practices.

Chemical manufacturers focus on nitrogen and ammoniated products, while food ingredient suppliers emphasize ammonium sulfate optimization for food applications, and specialty food processing companies develop innovative purification methods, AI-enhanced formulation methods, and sustainable production practices.

Market Share Analysis by Key Players & Chemical Suppliers

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 18-22% |

| Tata Chemicals Ltd. | 12-16% |

| Evonik Industries AG | 10-14% |

| Honeywell International Inc. | 8-12% |

| Nutrien Ltd. | 5-9% |

| Other Chemical & Food Additive Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Produces high-purity ammonium sulfate, AI-driven quality assurance, and eco-friendly food additive formulations. |

| Tata Chemicals Ltd. | Specializes in food-grade ammonium sulfate, pH regulators for baking, and AI-powered production process optimization. |

| Evonik Industries AG | Develops ammonium sulfate for food processing applications, including leavening agents and dough conditioners. |

| Honeywell International Inc. | Focuses on high-efficiency ammonium sulfate production, ensuring regulatory compliance and AI-assisted product safety. |

| Nutrien Ltd. | Provides agro-food-grade ammonium sulfate, customized formulations for food and fermentation processes, and AI-driven product standardization. |

Key Market Insights

BASF SE (18-22%)

Extensive product portfolio comprising additives to key-formulate mineral-based nutrients, BASF is known to lead in the food-grade ammonium sulfate market for its sustainable food additive solutions featuring AI-integrated quality control of its motifs and high-purity formulations.

Tata Chemicals Ltd. (12-16%)

Tata produces food-grade ammonium sulfate for baking solutions that help in regulating acidity and conditioning dough in a way that complies with regulatory requirements, Tata focuses on food-grade ammonium sulfate for baking applications.

Evonik Industries AG (10-14%)

Ammonium sulfate formulations, food grade, optimize applications of leavening agent and fermentation-enhancing additives.

Honeywell International Inc. (8-12%)

Implementing AI-powered quality assurance systems and food safety monitoring, Honeywell is committed to making ammonium sulfate safer and more sustainable.

Nutrien Ltd. (5-9%)

Nutrien creates food-safe solutions with our ammonium sulfate specialists. Our team of ammonium sulfate experts provide high-quality ingredients for baking, fermentation and protein processing.

Other Key Players (30-40% Combined)

Next-gen food-grade ammonium sulfate producers, AI-based food safety assurance companies, as well as sustainable ingredient innovators include several specialty chemical producers and food ingredient manufacturers as well as specialty processing industries. These include:

The overall market size for ammonium sulfate food grade market was USD 360 Million in 2025.

The ammonium sulfate food grade market is expected to reach USD 630 Million in 2035.

The demand for ammonium sulfate food grade is expected to rise due to its increasing use as a food additive, dough conditioner, and acidity regulator in bakery and confectionery products. Additionally, the growing processed food industry, rising consumer preference for high-quality food ingredients, and regulatory approvals for ammonium sulfate in food applications are driving market growth.

The top 5 countries which drives the development ammonium sulfate food grade market are USA, UK, Europe Union, Japan and South Korea.

By form to command significant share over the assessment period.

Western Europe Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Country through 2035

Western Europe Fusion Beverage Market Analysis by Product Type, Distribution Channel, and Country through 2035

Western Europe Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Country Through 2035

Korea Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Region Through 2035

Western Europe Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Country Through 2035

Western Europe Dehydrated Vegetables Market Analysis by Product Type, Form, Nature, End Use, Technology, Distribution Channel, and Country Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.