Ammonium Chloride Food Grade market is likely to experience a steady growth during the forecast period, driven by growth of food & beverage industry and increasing popularity of ammonium chloride. Ammonium chloride (NH4Cl media) is a food-grade chemical which has been often used as a flavoring agent in some candies, mainly salty licorice, and yeast nourishing agent in bread-making procedures.

It is used as an additive to improve taste, stabilize food, and add a specific flavor profile. Increasing consumer demand for unique and regional flavors, along with the growing confectionery market, has driven demand. Moreover, regulatory approval of ammonium chloride for food-grade application has led to its growing adoption by manufacturers ensuring quality and safety.

From having a wider choice and increased consumption of specialty confections and baked goods in emerging markets, these trends will spur the ammonium chloride food grade market movement solutions in the coming years till 2035.

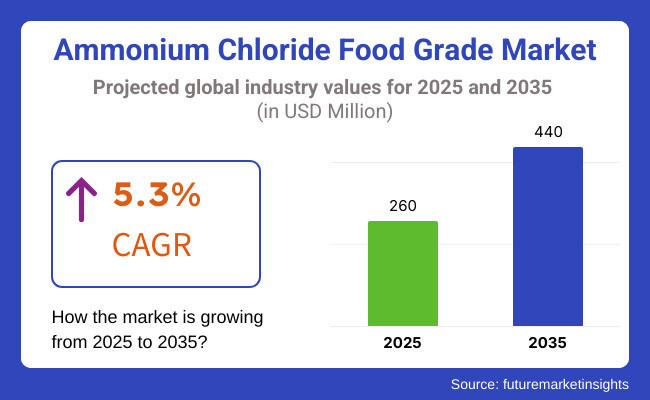

The ammonium chloride food grade industry volume is projected at around USD 260 Million in 2025. The market is anticipated to resolve approximately USD 440 Million by 2035, with a growth rate of 5.3%. The consistent growth is driven by the growing acceptance of ammonium chloride as a safe food additive as well as the diversification of its application across various confectionery products along with its importance as a functional ingredient in baking and other food processes.

The North American food-grade ammonium chloride market is driven by a strong confectionery industry and a consumer base focused on unique flavor profiles. Driven by the United States and Canada, there is increasing demand for salty licorice and other traditional confections where ammonium chloride is used as a flavor-enhancer.

Ammonium chloride is also getting used in bakery products as a yeast nutrient, alongside purposes in confectionery. This market growth would be driven by the rigorous regulatory framework of the region, its emphasis on food safety, and a constant innovation in flavoring solutions.

Europe is still one of the world's largest markets for ammonium chloride food grade, owing to a long tradition of producing and consuming salty licorice in the region, in particular in the Netherlands, Finland, and Sweden. Ammonium chloride has maintained a steady demand due to the popularity of these confections.

Ammonium chloride as a key ingredient in a variety of food products, is not going anywhere soon as European food manufacturers continue to develop new product formulations and flavors. Additionally, the finality of regulations and compliance regulations with food safety standards in the EU forms a solid basis for market enlargement.

Increasing consumption of confectionery and rising bakery production are contributing to the Asia-Pacific region being recognized as a potential market for food-grade ammonium chloride during the forecast period. The expanding applications of food-grade ammonium chloride as a food additive, beyond traditional confectioneries in regions like China, Japan, and India, is promoting an increase in the target market.

The region's large and growing population, as well as the disposable income raises and changing dietary preferences also support the increasing adoption of ammonium chloride. Moreover, the expansion of distribution networks and local manufacturers is increasing product accessibility, thereby propelling the growth of the market in Asia-Pacific.

Challenge

Regulatory Compliance, Raw Material Volatility, and Consumer Perception Issues

The Ammonium Chloride Food Grade Market faces several challenges related to stringent food safety regulations, fluctuating raw material costs, and limited consumer awareness. Regulatory agencies such as FDA (Food and Drug Administration) and EFSA (European Food Safety Authority) impose strict purity and safety standards, making compliance a key concern for manufacturers.

Additionally, fluctuations in the availability and pricing of raw materials, including ammonia and hydrochloric acid, impact production costs. Consumer perception of ammonium chloride as a chemical additive rather than a food ingredient also poses a challenge, limiting its broader adoption in certain food segments. Furthermore, competition from natural alternatives and evolving preferences for clean-label and organic food products create additional hurdles for market expansion.

Opportunity

Growth in Food Additives, Functional Food Applications, and Sustainable Ingredient Sourcing

Despite these challenges, the ammonium chloride food grade market continues to show growth potential as the demand for food additives, especially in bakery, confectionery, and processed foods segments are rising. Licorice candies, for example, has a high presence of ammonium chloride, and use in baking applications and as a yeast nutrient in bread making is expected to maintain the momentum on the market growth.

Apart from this, ammonium chloride applications are expanding in food processing, driven by increasing food production in emerging markets, rising demand for functional food ingredients, and advancements in food preservation technologies. As the food ingredient landscape continues to evolve, those companies that invest in high-purity production processes, explore sustainable sources, and broaden the product formulations available to their customers will find themselves on the cutting edge.

Between 2020 and 2024, the rising demand for ammonium chloride food grade in food processing as well as confectionery solutions with a licorice flavor and baking powder formulations. Nonetheless, growing regulatory scrutiny, changing consumer preferences towards clean-label ingredients, and price volatility of raw materials affected market dynamics. The growth of organic and non-GMO food ingredients competed with synthetic additives which affected ammonium chloride’s market share.

Looking ahead to 2025 to 2035, the market is likely to experience pivotal shift with increased demand around food safety, sustainable production, and clean-label ingredient innovations. Food processing, increased consumer demand for functional food ingredients, and emerging market applications will drive growth. Moreover, alternatives to food additives, formulation optimization, and biotechnology for production will be key ingredients for success.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strict safety regulations and labeling requirements from FDA, EFSA, and other food authorities. |

| Consumer Trends | Demand for traditional licorice-based candies, bakery applications, and processed food additives. |

| Industry Adoption | Growth in confectionery and baking industries, moderate penetration in processed food segments. |

| Supply Chain and Sourcing | Dependence on chemical manufacturers for synthetic ammonium chloride production. |

| Market Competition | Dominated by food additive manufacturers and specialty chemical producers. |

| Market Growth Drivers | Growth fueled by food industry expansion, rising processed food demand, and cost-effectiveness. |

| Sustainability and Environmental Impact | Rising concerns over synthetic additives and chemical sourcing challenges. |

| Integration of Smart Technologies | Early adoption of digital supply chain management and traceability solutions. |

| Advancements in Food Applications | Used primarily as a food additive in confectionery, baking, and processed food. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of clean-label standards, organic certification protocols, and eco-friendly manufacturing norms. |

| Consumer Trends | Shift toward natural, functional food ingredients, and plant-based food processing alternatives. |

| Industry Adoption | Expansion into functional foods, emerging health-conscious markets, and personalized nutrition solutions. |

| Supply Chain and Sourcing | Shift toward sustainable, bio-based ammonium chloride sources and localized production strategies. |

| Market Competition | Entry of biotech firms, clean-label ingredient companies, and alternative food additive innovators. |

| Market Growth Drivers | Accelerated by clean-label initiatives, AI-driven food formulation, and sustainable ingredient sourcing. |

| Sustainability and Environmental Impact | Large-scale adoption of eco-friendly manufacturing, low-waste production, and renewable raw material use. |

| Integration of Smart Technologies | Full integration of blockchain-based food safety tracking and AI-powered ingredient formulation analytics. |

| Advancements in Food Applications | Expansion into functional food, clean-label formulations, and sustainable food processing technologies. |

The ammonium chloride is mainly used in the production of baking powder and baking soda, which is why it is widely used by consumers. Market growth is driven by the increasing demand for ammonium chloride as a food additive and pH regulator. These are shaping formulation strategies toward regulatory compliance and the emerging trend of clean label ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

The United Kingdom ammonium chloride food grade market, the demand for ammonium chloride food grade is increasing due to its use in traditional confectionery products and bakery applications. Rising consumption of processed and packaged food along with stringent food safety regulations are influencing the market dynamics. To meet consumer expectations, manufacturers are focusing on sustainable sourcing and high-purity formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

In Europe, ammonium chloride food grade market is growing moderately as the product finds application in products like licorice, bakery and pH modifier agents. The quality standards established by European Food Safety Authority (EFSA) regulatory framework are expected to boost high-purity food-grade ammonium chloride demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.3% |

Japan ammonium chloride food grade market is growing at a steady rate, driven by its usage as an ingredient in specialty food products and functional beverages. With the focus on food innovation and regulatory compliance in the country driving their adoption, high-quality food additives have witnessed an increase in use, thereby sustaining the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The ammonium chloride food grade market in South Korea is developing due to the attractiveness of its applications in processed food and beverage formulations. The positive market growth for food safety standards and the growing demand for functional ingredients in packaged foods are on the rise.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

As food and beverages use it as a leavening agent, pH regulator, and flavor enhancer, the ammonium chloride food grade market grows progressively. It has applications in baked goods, confectionery, dairy, and processed foods, guaranteeing steady demand. N-acetyl cysteine belongs to the product form segmented into solid and liquid.

solid ammonium chloride is used extensively are determined to have a greater share compared to other segments in the food grade ammonium chloride market owing to high consumption in the baking, confectionery, and in dairy processing. Hydrochloride salt of Solid has a high purity rate which is perfect for food manufacturers who can store it easily as well as it has an extended shelf life, making it the most suitable substance in leavening agents, acidity regulators, and food preservatives.

Solid ammonium chloride is widely utilized in the bakery and confectionery industry as it is required for the sweets, besides being employed in cookies and bread-making, wherein it increases texture and increases the shelf stability of these products. It's also used in cheese processing and meat curing, helping fermentation and enhancing flavor.

The food industry demands high purity products, and manufacturers of solid ammonium chloride cater accordingly. Solid form is expected to continue to witness high adoption across food production sectors owing to rising demand for processed and packaged foods.

The global food-grade ammonium chloride market is witnessing growth owing to the rising demand for food additives, leavening agents as well as flavor enhancers and pH regulators within the food and beverage sector.

To improve product quality, safety, and regulatory requirements, companies are revolving around AI-based production optimization, the manufacturing process with high purity, and sustainable sourcing. The market comprises food ingredient manufacturers, chemical suppliers, and specialty food product companies that drive innovations in ammonium chloride purification, AI-based quality control, and food safety analytics.

Market Share Analysis by Key Players & Chemical Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 20-25% |

| Tata Chemicals Ltd. | 12-16% |

| Nouryon (formerly AkzoNobel Specialty Chemicals) | 10-14% |

| Jiangsu Debang Chemical Industry Group Co., Ltd. | 8-12% |

| Shandong Huanxin Chemical Co., Ltd. | 5-9% |

| Other Chemical & Food Additive Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Develops high-purity food-grade ammonium chloride, AI-driven quality control, and sustainable production solutions. |

| Tata Chemicals Ltd. | Specializes in food-grade chemical additives, pH regulators for baking applications, and AI-powered food safety compliance. |

| Nouryon (AkzoNobel Specialty Chemicals) | Provides industrial and food-grade ammonium chloride, precision formulation solutions, and high-purity chemical processing. |

| Jiangsu Debang Chemical Industry Group | Focuses on bulk ammonium chloride production for food, beverage, and pharmaceutical applications. |

| Shandong Huanxin Chemical Co., Ltd. | Offers food-grade ammonium chloride for flavoring, baking, and leavening applications, ensuring regulatory compliance. |

Key Market Insights

BASF SE (20-25%)

BASF, as a leading company in the food-grade ammonium chloride market, provides high-purity chemical formulations, AI-powered quality control, and sustainable food ingredient solutions.

Tata Chemicals Ltd. (12-16%)

Focuses on food-grade pH regulators & leavening agents, also hydroxyl ammonium chloride is a food-safe high-quality product.

Nouryon (10-14%)

Nouryon has launched a range of industrial and food-grade ammonium chloride, leveraging AI-assisted production processes to ensure quality and compliance with stringent regulations.

Jiangsu Debang Chemical Industry Group (8-12%)

Ammonium chloride production is bulk, and the food additives processing is measured by precision of the series, and follows international standards.

Shandong Huanxin Chemical Co., Ltd. (5-9%)

Their ammonium chloride solutions are used in baking, seasoning, and food processing, while AI-powered quality control and global supply chain efficiency ensure seamless delivery to customers worldwide.

Other Key Players (30-40% Combined)

Next-generation food-grade ammonium chloride is produced by several specialty chemical firms, food additive suppliers, and ingredient manufacturers, while AI-enabled accuracy in formulation, as well as sustainable food additive solutions, are offered by numerous companies. These include:

The overall market size for ammonium chloride food grade market was USD 260 Million in 2025.

The ammonium chloride food grade market is expected to reach USD 440 Million in 2035.

The demand for ammonium chloride food grade is expected to rise due to its increasing use as a food additive in bakery products, confectionery, and processed foods, along with its role as a pH regulator and yeast nutrient. Additionally, growing demand for food preservation solutions, expanding processed food consumption, and regulatory approvals for ammonium chloride in the food industry are driving market growth.

The top 5 countries which drives the development ammonium chloride food grade market are USA, UK, Europe Union, Japan and South Korea.

By form to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ammonium Humate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Dichromate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Nitrate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Metavanadate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Thiosulfate Market – Size, Share, and Forecast 2025 to 2035

Ammonium Sulphate Supply Market-Trends & Forecast 2025 to 2035

Ammonium Carbonate Market Growth 2024-2034

Ammonium Phosphate Market Trends & Analysis 2019-2029

Ammonium Phosphatides Market

Ammonium Sulfate Food Grade Market Report - Industry Insights 2025 to 2035

Diammonium Hydrogen Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Diammonium Phosphate Market

Triammonium Citrate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Ammonium Nitrate Market Growth - Trends & Forecast 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Quaternary Ammonium Compounds Market

Food Grade Ammonium Carbonate Market Growth - Product Type & Application Analysis

Food Grade Ammonium Bicarbonate Market

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Cetyl Trimethyl Ammonium Chloride Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA