The Americas COVID-19 Testing Market has experienced a significant evolution since the emergence of the pandemic, shaped by increased testing efforts, technological innovations, and the relentless pursuit of early detection and containment of the virus. The diagnostic solutions market includes many platforms, ranging from molecular tests (RT-PCR), antigen tests to serological tests, which also meet different diagnosis needs.

Testing has been a foundation of public health strategies that have helped governments, health care providers and private enterprises monitor infection rates, direct public health interventions and get economies back open safely. While the region grapples with new variants, rising and falling case numbers, and changing public health rules, the need for COVID-19 testing solutions remains high.

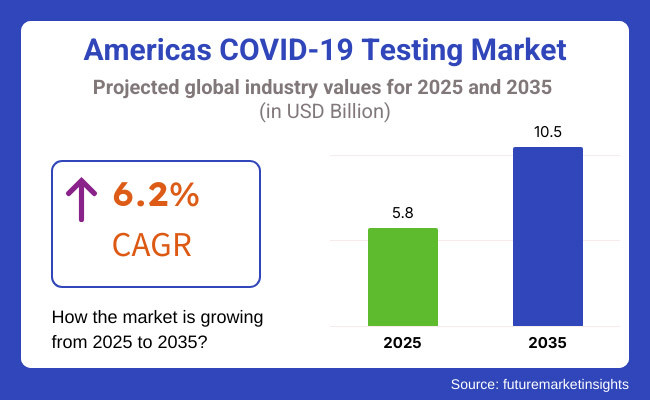

Additionally, the market is advancing as novel, rapid, and precise testing tools. The Americas COVID-19 testing market was valued at around USD 5.8 Billion in 2025, backed by the continued need for diagnostic products and services amid persistent monitoring and surveillance initiatives. The global market is estimated to be over USD 10.5 Billion by 2035 at a CAGR of 6.2%. This increases the importance of testing infrastructure as components of long-term pandemic management efforts and continued public health readiness.

Explore FMI!

Book a free demo

The Americas market for COVID-19 testing is dominated by North America, which offers a wide healthcare infrastructure, extensive access to testing facilities, and early adoption of advanced diagnostic technologies. The USA has played a central role through significant government funding, a system of public-private partnerships, and an extensive testing infrastructure.

Additionally, the market has gained from the expansion of testing programs, the introduction of supply chain systems, and the adoption of rapid testing technologies in Mexico and Canada. North America is likely to remain the dominant regional COVID-19 testing market as booster campaigns and initiatives to contain emerging variants continue.

COVID-19 testing solutions have been on the rise in South America, with governments focusing on disease surveillance and containment. Other countries such as Brazil and Argentina, which also extended widely, have established testing campaigns to track-infection rates and guide vaccination efforts and also to inform public health decisions. In the face of challenges like limited resources and supply chain bottlenecks, the region has improved both accessibility and efficiency of testing.

Along with investments in laboratory infrastructure, international collaborations and low-priced rapid tests have all also led to market growth. With the rise of vaccination coverage coupled with the established importance of testing in combatting possible outbreaks, the South America COVID-19 testing industry is set to see continued growth.

Challenge

Declining Testing Demand, Regulatory Changes, and Market Saturation

Emerging challenges for the Americas covid-19 testing market the challenges for the Americas COVID-19 Testing Market are primarily focused on decreasing testing demand due to regulatory changes and market saturation, especially after the peak of the pandemic. As vaccination rates climbed and global restrictions lifted, the need for large-scale tests took a nosedive, resulting in diminished investment in diagnostics and laboratory infrastructure.

Manufacturers have also faced profitability challenges due to oversupply of test kits, regulatory changes surrounding emergency use authorizations (EUAs), and pricing pressure. Testing fatigue by consumers, narrow reimbursement policies for routine testing, and competition from alternative diagnostic modalities also limits the market.

Opportunity

Multiplex Panel Diagnostics, AI-Powered Testing, and Pandemic Preparedness Innovations

Given the reduction in COVID-19 testing, diagnostics still offer opportunities in innovation, multiplexing, and epidemiologic monitoring. The industry is being reshaped by the emergence of respiratory panel diagnostics (which include testing today COVID-19, influenza, and RSV), AI-assisted testing technologies, and home-based molecular diagnostics.

Continued needs of variant detection, long COVID studies and pandemic preparedness keep diagnostic companies a critical component of resilience in health care. Also, advances in rapid antigen and PCR technologies and automated, high-through level lab testing solutions will allow rapid, more affordable and accurate diagnostics, which more broadly can be adapted to detect other infectious diseases.

Between 2020 and 2024, the Americas COVID-19 testing market led by mass testing mandates, travel screening and workplace safety requirements. Governments, healthcare institutions, and private labs undertook massive, rapid expansions of diagnostic capacity, with PCR-, antigen-, and serology-based testing predominant. But all that changed as cases dropped, vaccines became widely available and testing volume plummeted, with the result that labs closed, manufacturers scaled back production and government priorities shifted.

Looking ahead to 2025 to 2035, built-in infectious disease diagnostics based on NGS, AI-based predictive fashions, and multiplexed testing panels to be used in public wellbeing. Novel home-based, decentralized diagnostic solutions will also flourish to complement and support the remote monitoring, digital health, and real-time epidemiological tracking of the population. Market of pandemic preparedness solutions, genomic surveillance of viral mutations, integrated disease monitoring platforms will continue to be relevant because the demand.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emergency Use Authorizations (EUAs) allowed rapid commercialization of tests, with frequent policy changes. |

| Testing Demand | Mass testing for COVID-19, with high volume in travel, workplace screening, and healthcare facilities. |

| Industry Adoption | Expansion of lab-based PCR, rapid antigen, and serology testing across public and private healthcare settings. |

| Supply Chain and Sourcing | Heavy reliance on government procurement and bulk manufacturing of test kits. |

| Market Competition | Dominated by major diagnostic companies and biotech firms producing large-scale testing kits. |

| Market Growth Drivers | Growth fueled by government mandates, pandemic response strategies, and global testing collaboration efforts. |

| Sustainability and Environmental Impact | High biomedical waste generation from disposable test kits and PPE. |

| Integration of Smart Technologies | Limited automation in lab-based PCR testing, basic digital health integrations. |

| Advancements in Diagnostic Models | Focus on PCR, antigen, and serology-based testing for active infections and antibodies. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulatory pathways, focus on permanent approvals, data security, and diagnostic accuracy mandates. |

| Testing Demand | Decline in single-virus testing, shift toward multiplex panels (COVID-19, flu, RSV, and other pathogens). |

| Industry Adoption | Widespread adoption of at-home molecular tests, AI-driven lab diagnostics, and cloud-based test result tracking. |

| Supply Chain and Sourcing | Shift toward on-demand manufacturing, sustainable supply chains, and smart inventory management. |

| Market Competition | Diversification of players, entry of AI-driven diagnostic firms and decentralized healthcare startups. |

| Market Growth Drivers | Accelerated by pandemic preparedness initiatives, AI-powered diagnostics, and epidemiological disease tracking. |

| Sustainability and Environmental Impact | Adoption of biodegradable test kits, digital result reporting, and sustainable diagnostic materials. |

| Integration of Smart Technologies | Expansion of AI-driven testing platforms, telehealth-enabled diagnostics, and blockchain-secured patient data. |

| Advancements in Diagnostic Models | Evolution toward AI-assisted pathogen detection, CRISPR-based diagnostics, and next-gen multi-pathogen panels. |

Major factors driving the market studied are increasing COVID-19 tests demand, increasing products portfolio of companies to overcome strains, surveys, and future studies. General availability of PCR and antigen tests, together with government-funded programs for pandemic preparedness will keep the market sustainable. Market expansion is also being stoked by the incorporation of AI-based diagnostic tools and at-home testing kits.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

as the healthcare system in Canada continues to take precautionary measures for virus containment, the COVID-19 testing market in Canada retains its significance. Consumer demand is shaped by the increase of telemedicine services and at-home diagnostic testing, while government spending towards public health infrastructure continues to drive need for testing solutions to gauge disease prevalence.

| Country | CAGR (2025 to 2035) |

|---|---|

| Canada | 6.1% |

The growth in Mexico's COVID-19 testing market is steady as it is supported by improved healthcare infrastructure and growing acceptance of rapid new testing kits. The increasing awareness regarding early diagnosis, and collaborations between government bodies and private testing service providers, is fueling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Mexico | 6.2% |

The COVID-19 testing market in Brazil is dynamic, reflecting advances in laboratory testing capabilities and increasing attention to pandemic preparedness. Increased focus on public health surveillance and access to testing availability in urban and rural areas are paving the way for the Market. Continued development and investment in biotech innovations also is expected to drive long-term growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 6.3% |

the Argentine health cabinet highlights the steady growth of the COVID-19 testing market, mirroring the constant vigilance for new strains of the virus and the need to strengthen diagnostic infrastructure. The emergence of affordable testing solutions and the deployment of mobile testing units in underserved areas are fueling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Argentina | 6.1% |

The Americas COVID-19 testing market is dynamic and progressive with the emergence of rapid, fast, point-of-care and laboratory-based testing solutions each capable of diagnosing and monitoring SARS-CoV-2 infections. The study has identified and highlighted the key segments and factors that are driving the growth of the market.

SARS-CoV-2 antigen rapid test kits have become one of the pillars of COVID-19 diagnostics, particularly in point-of-care settings, factories, airports, and home-based testing. These tests identify current infections based on the presence of viral proteins, yielding results in minutes and not needing to be processed in a lab.

Given their affordability and rapid turnaround times, antigen rapid testing remains the dominant modality for mass screening, clearing for travel and self-testing programs of tests used by governments and healthcare agencies. The efficiency and precision of antigen rapid tests is further propelling growth for the antigen rapid tests market because of the increasing adoption of AI-integrated test interpretation and digital health platforms.

Although RT-PCR tests are still the gold standard, antigen rapid test kits are widely used in at home and community-based testing programmers that ensure they are accessible and permit immediate infection control measures.

In COVID-19 diagnostic testing and also in the context of antigen rapid tests and RT-PCR assays, nasopharyngeal swabs remain the preferred method of sample collection. These swabs allow for extremely sensitive detection of viruses, and are thus critical for clinical testing, hospital diagnostics, and public health screening.

Since they are proven to be reliable tests for typing SARS-CoV-2 virus, the providers prefer nasopharyngeal swab based tests because they guarantee accuracy of results that can be used in monitoring infections in this pandemic disease as well as for the purpose of epidemiological studies. Although more recent innovations include improved swab design and self-administered testing options that do not require nasopharyngeal sample collection, the latter remains commonplace across a variety of testing environments.

In Americas, the COVID-19 testing market has been propelled by increasing requirements for rapid diagnostics, widespread screening, and ongoing surveillance of new variants. To make testing more accessible, faster and more reliable, companies and healthcare providers are advancing AI-driven diagnostic tools, at-home test kits, and accurate, high-speed molecular testing.

Biotech companies, diagnostic test manufacturers, government health agencies, and research institutions continue to innovate in PCR testing, rapid antigen detection, and AI-powered analysis of diagnostic data.

Market Share Analysis by Key Players & Diagnostic Test Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Abbott Laboratories | 20-25% |

| F. Hoffmann-La Roche Ltd. | 12-16% |

| Thermo Fisher Scientific Inc. | 10-14% |

| Becton, Dickinson and Company (BD) | 8-12% |

| Quidel Corporation | 5-9% |

| Other Diagnostic Test Manufacturers & Laboratories (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Abbott Laboratories | Develops rapid antigen and PCR test kits, AI-integrated diagnostics, and scalable at-home and point-of-care COVID-19 testing. |

| F. Hoffmann-La Roche Ltd. | Specializes in high-accuracy RT-PCR testing, AI-powered diagnostic software, and COVID-19 variant detection tools. |

| Thermo Fisher Scientific Inc. | Provides high-throughput COVID-19 testing, automated sample processing, and AI-assisted viral genome sequencing. |

| Becton, Dickinson and Company (BD) | Focuses on rapid antigen testing, portable diagnostic devices, and AI-based pandemic surveillance analytics. |

| Quidel Corporation | Offers at-home COVID-19 testing, AI-powered diagnostic result interpretation, and scalable immunoassay-based detection systems. |

Key Market Insights

Abbott Laboratories (20-25%)

Abbott is the leader in COVID-19 testing, providing rapid diagnostic tests, AI-powered disease surveillance, and scalable point-of-care testing capabilities.

F. Hoffmann-La Roche Ltd. (12-16%)

Roche is a leader in highly-sensitive and specific PCR testing that tracks receiving variants, AI-based molecular diagnostics, and advanced viral RNA detection.

Thermo Fisher Scientific Inc. (10-14%)

Thermo Fisher's solutions enable mass-scale COVID-19 testing, optimize automated lab workflows, AI-assisted genomic tracking, and pandemic response analytics.

Becton, Dickinson and Company (BD) (8-12%)

BD approach is portable antigen testing built on innovative integrations of rapid result interpretation, AI-driven test validation and rapid scalable deployment of diagnostics.

Quidel Corporation (5-9%)

The company provides at-home COVID-19 test kits with digital result reporting and AI-enabled risk assessment integrated with public health tracking.

Other Key Players (30-40% Combined)

Next-generation COVID-19 testing innovations for rapid and decentralized diagnostics, along with AI-driven pandemic analytics for outbreak management, as well as large-scale population health management, emerge from contributions to this area from several biotech firms, government agencies, and diagnostic test providers. These include:

The overall market size for Americas covid-19 testing market was USD 5.8 Billion in 2025.

The Americas covid-19 testing market is expected to reach USD 10.5 Billion in 2035.

The demand for Americas COVID-19 Testing is expected to rise due to the emergence of new variants, ongoing surveillance programs, and the need for early detection and containment measures. Additionally, increasing government initiatives, advancements in rapid and at-home testing technologies, and the integration of AI-driven diagnostic tools are driving market growth.

The top 5 countries which drives the development of Americas covid-19 testing market are USA, UK, Europe Union, Japan and South Korea.

By Test Type to command significant share over the assessment period.

Specialty Medical Chairs Market Trends - Size, Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

Portal Hypertension Management Market Trends - Size, Growth & Forecast 2025 to 2035

Precocious Puberty Treatment Market Overview – Growth, Trends & Demand Forecast 2025 to 2035

Pleural Diseases Therapeutics Market – Drug Trends & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.