The Alzheimer's drugs market is transforming very fast due to new introduction into the therapeutics of disease-modifying agents along with the use of conventional symptomatic treatments. The market is moderately concentrated by three companies capturing the share of 38.10% namely Eisai Co. Ltd., Novartis Pharmaceuticals Corp (Sandoz) & Abbvie.

These firms put a sizeable investment into R&D for medicines that will be able to bust the amyloid plaques and tau proteins. Strategic alliances are built between research institutes and regulatory authorities to accelerate the drugs at their approval and launch cycles.

Mid-majority companies are Johnson & Johnson, DR REDDYS LABS LTD, MACLEODS PHARMS LTD & Others making up a 33.3% market share. Some of them specialize in cholinesterase inhibitors (Donepezil, Rivastigmine, and Galantamine), while others are under research to develop a pipeline of their monoclonal antibodies that can be used to modulate disease progression.

Companies that are categorized in terms of size and market share percentages of 17% emergence as well as niche players include new regional biopharma companies which include Sun Pharmaceutical Industries Ltd., Unichem, Lannett co Inc. and Others New players in the field are led by precision medicine, AI-driven drug discovery, and biomarker-based patient segmentation, keeping manufacturers at par many of them continue to be early-stage interveners investing in next-generation Alzheimer's treatments with an aim to slow cognitive decline. According to an estimate, the global Alzheimer's therapeutics market would reach about USD 4,288.82 Million.

| Attribute | Details |

|---|---|

| Projected Value by 2025 | USD 4,288.82 Million |

Explore FMI!

Book a free demo

Global Market Share & Industry Share (%)

| Global Market Share | Industry Share (%) |

|---|---|

| Top 3 (Eisai Co. Ltd., Novartis Pharmaceuticals Corp (Sandoz) & Abbvie) | 38.10% |

| Top 5 (Eisai Co. Ltd., Novartis Pharmaceuticals Corp (Sandoz) & Abbvie, AUROBINDO PHARMA LTD, Viatris) | 49.70% |

| Chinese Suppliers (Shanghai Pharmaceuticals Holding Co., Ltd. etc.) | 12.50% |

| Regional & Niche Players | 37.70% |

| Market Concentration | Assessment |

|---|---|

| High (More than 60% by Top Players) | Medium |

| Medium (40 to 60% by Top 10 Players) | Medium |

| Low (Less than 30% by Top Players) | Low |

Eisai Co., Ltd.

Eisai has maximum market share in 2025, primarily based on Aricept's considerable global dominance, along with further investments toward monoclonal antibody-based AD treatments in the pipeline. Its long-term leadership is strongly supported by the partnership with Biogen in anti-amyloid therapy development.

Novartis

Novartis is collaborating with the Banner Alzheimer’s Institute and Amgen to investigate this hypothesis in cognitively healthy individuals at genetic risk of developing Alzheimer’s disease, through the Generation Program. The main molecule being tested, called CNP520, is also a BACE inhibitor.

AbbVie

AbbVie has boosted its Alzheimer's disease pipeline with a USD 1.4 billion cash deal to buy Alaida Therapeutics and its anti-amyloid antibody ALIA-1758, which is in phase 1 testing.

The Boston biotech said the platform had enabled the development of ALIA-1758 - an anti-pyroglutamate amyloid beta (Aβ3pE) antibody, which it says is a 'potential best-in-class therapy for Alzheimer's' - and could transform the treatment of neurological diseases by making it easier to deliver antibodies and other drugs like RNA interference (RNAi) candidates into the central nervous system

Aurobindo Pharma

one of leading healthcare industry of India has announced that regulatory body USA Food & Drug Administration had issued the final approval for the marketing of Memantine Hydrochloride Tablets of various concentrations like 5mg and 10 mg

Viatris

Viatris Pharma has received final approval from the USFDA for manufacturing and marketing Memantine Hydrochloride Tablets of 5mg and 10mg respectively due to their successful phase trails of the drugs.

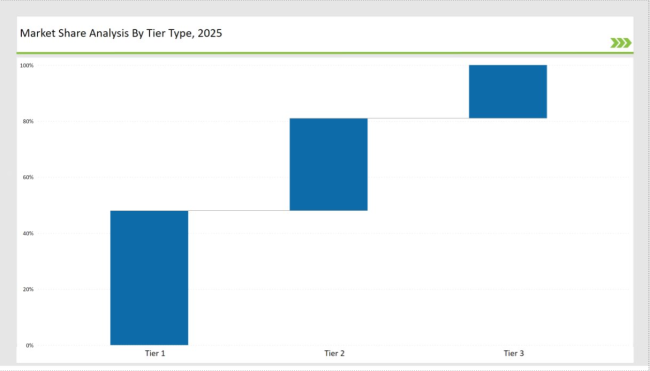

| Tier | Market Share (%) |

|---|---|

| Tier 1 - Eisai Co. Ltd., Novartis, Abbvie, AUROBINDO PHARMA LTD, Viatris | 49.7% |

| Tier 2 - Johnson & Johnson, DR REDDYS LABS LTD, MACLEODS PHARMS LTD & Others | 33.3% |

| Tier 3 - Regional & Emerging Players (Sun Pharmaceutical Industries Ltd., Unichem, Lannett co Inc. and Others) | 17.0% |

| Company Name | Unique Initiative |

|---|---|

| Eisai Co., Ltd. | Expanding anti-amyloid therapies and partnering with Biogen for next-gen Alzheimer’s DMTs. |

| Biogen Inc. | Leads monoclonal antibody-based therapies (Aduhelm, Lecanemab) with AI-enhanced clinical trials. |

| Eli Lilly & Co. | Tau protein-targeting therapies and precision medicine initiatives are driving its R&D. |

| Novartis AG | Developing combination NMDA receptor antagonist treatments for long-term AD management. |

AI-Powered Biomarker-Driven Drug Discovery for Alzheimer's Disease.

On developing big data drug development with advanced algorithms to get biomarkers regarding AD, their use with artificial intelligence in improvements is under projection. Indeed, such process architecture has been proposed to hasten the processes regarding therapeutic targets aimed at clinical trials optimization, maximizing treatment efficacies.

Increased Adoption of Combination Drug Therapies Targeting Multiple Disease Pathway

There is an ever-increasing trend toward the adoption of combination drug therapies that target multiple pathways of a disease mechanism. This increases the efficacy of treatment, especially in complicated diseases like cancer and HIV, which may involve many biological mechanisms simultaneously. Hence, it has better patient outcomes and reduces the chances of drug resistance

Global Regulatory Expansion therapies that are based on monoclonal antibodies.

Global Regulatory Expansion therapies that are based on monoclonal antibodies. The regulatory environment for therapies that are based on monoclonal antibody-based has been changing very rapidly, and greater access has been assured in the global market.

Continuous improvement on the part of the regulatory agencies assures a streamlined approach towards faster approval with a focus on innovation and with minimized risks for patients in the therapeutic applications in question.

Eisai Co. Ltd., Novartis Pharmaceuticals Corp (Sandoz) & Abbvie command about 38% share in the global market.

The global Alzheimer's therapeutics market would attain a value of nearly USD 4,288.82 Million by 2025.

Regional and domestic companies hold nearly 31% of the overall market.

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.