Executive Summary

The global aluminum slugs industry is experiencing significant growth due to the rising demand for lightweight, high-performance materials in packaging, automotive, and industrial applications. Advances in aluminum processing, sustainability efforts, and increasing use of recycled materials are reshaping the competitive landscape.

Market growth is driven by consumer demand for eco-friendly packaging solutions, regulatory requirements promoting sustainability, and innovations in precision manufacturing. As cost-effectiveness and quality become priorities, manufacturers are investing in high-purity aluminum, automated production, and alloy innovations.

Explore FMI!

Book a free demo

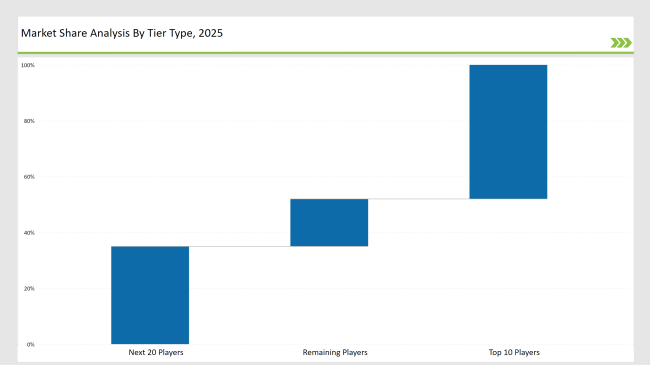

Tier 1: Alcoa, Novelis, and Hydro Aluminum hold a 48% market share, leading with advanced aluminum slug production, global supply chains, and sustainability-focused innovations.

Tier 2: Companies such as Constellium, Talum, and Impol control 35% of the market and specialize in cost-efficient, high-purity aluminum slugs for various applications.

Tier 3: Regional and niche manufacturers, comprising 17% of the market, focus on customized aluminum slug solutions, including specialty alloys, surface treatments, and lightweight compositions.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Alcoa, Novelis, Hydro Aluminum) | 19% |

| Rest of Top 5 (Constellium, Talum) | 16% |

| Next 5 of Top 10 | 13% |

Manufacturers are focusing on innovative solutions to meet evolving market needs

Industry leaders are advancing sustainability, efficiency, and material innovation.

Year-on-Year Leaders

To stay competitive in the aluminum slugs industry, suppliers should focus on

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Alcoa, Novelis, Hydro Aluminum |

| Tier 2 | Constellium, Talum, Impol |

| Tier 3 | Neuman Aluminium, Rheinfelden, SOTRALENTZ |

| Manufacturer | Latest Developments |

|---|---|

| Alcoa | Launched high-purity aluminum slugs (March 2024) |

| Novelis | Introduced recycled aluminum slug solutions (July 2023) |

| Hydro Aluminum | Expanded lightweight aluminum production (October 2023) |

| Constellium | Developed high-performance alloy-based slugs (February 2024) |

| Talum | Innovated in precision-engineered slugs (May 2024) |

The aluminum slugs industry is transitioning toward sustainability, efficiency, and material innovation. Key players are emphasizing

The industry is expected to advance in

Rising demand for lightweight, durable, and sustainable aluminum solutions.

Alcoa, Novelis, Hydro Aluminum, Constellium, and Talum.

Recycled and high-performance aluminum slugs, precision engineering, and sustainable production.

Asia-Pacific, North America, and Europe.

Companies are investing in fully recyclable, energy-efficient, and high-performance aluminum materials.

Sustainable Packaging Market Trends – Innovations & Growth 2025 to 2035

Ultra High Bond (UHB) Tape Market Analysis by Type, Thickness and End Use Through 2035

Thermoforming Machines Market Trends - Demand & Forecast 2025 to 2035

Strapping and Banding Equipment Market – Key Trends & Growth Outlook 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Specialty Pulp and Paper Chemicals Market Analysis – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.