The aluminium curtain wall market is set to grow substantially, this is mainly due to the rise in demand for energy-efficient building solution, advancements made in the facet technology and growing urbanization globally. Aluminum curtain walls are used in almost all commercial and some residential and industrial buildings.

Because they are lightweight and durable, aluminium curtain walls are ideal for creating aesthetic values for a building. As sustainable construction practices and enhanced energy-efficiency standards are becoming paramount, aluminium curtain walls are increasingly preferred by modern architectural designs.

The increasing trend of high-rise buildings and skyscrapers in urban areas is one of the major growth factor for the market. Aluminium curtain walls streamline superior structural functionality with maximum influx of natural light, mitigating the requirement of artificial lighting and thereby enhancing energy efficiency.

These systems are also extremely resistant to harsh weather conditions such as heavy rain, wind, and UV rays, making them suitable for large commercial buildings, airports, and luxury residential projects.

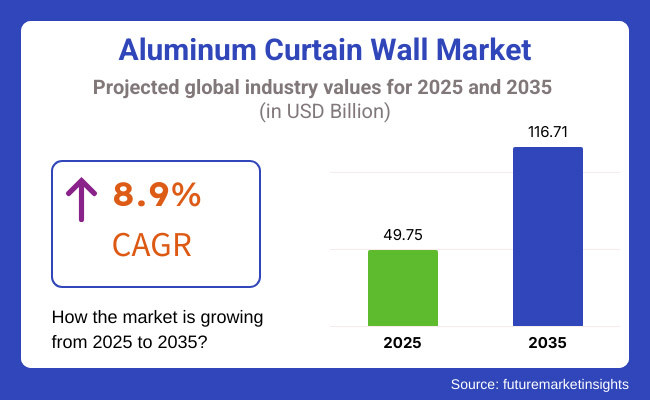

In 2025, the aluminium curtain wall market will be worth USD 49.75 billion, growing at a CAGR of 8.9% over the following 10 years to reach USD 116.71 billion by 2035.

One of the leading manners situated in aluminium curtain walls market is energy efficiency. A new generation of building materials which save energy and adhere to the principles of sustainability is now being favored by the authorities in many parts of the world, amid rising concerns regarding carbon emissions.

Aluminum curtain walls with thermal breaks, coupled with double glazed glass panels, improve insulation and thermal efficiency, allowing buildings to save on heating and cooling costs. That matches up with green building efforts like LEED (Leadership in Energy and Environmental Design) certifications, which is only creating more market demand.

Technological developments are also driving market growth. New and improved materials, coatings and installation methods have contributed to the performance of aluminium curtain walls. Smart glass technology, which enables conditional control of light, heat and transparency, is also becoming more commonplace as it offers further opportunities for energy efficiency and occupant comfort.

In addition, with the development of prefabricated curtain wall systems, installation time and costs are being reduced significantly, which has led to widespread use of curtain wall systems in large-scale projects.

While the market outlook is robust, high installation costs and maintenance requirements might stifle growth. Continued research and development attempting to make aluminium curtain walls cheaper and more effective should help to reduce these restrictions.

With global construction activities on the rise and emerging economies grasping the full extent of the growth, the aluminium curtain wall market is set to witness a booming decade ahead.

Explore FMI!

Book a free demo

Growing construction activity and energy efficiency standards are boosting demand for the aluminium curtain wall in North America, particularly in the United States and Canada. Government incentives are accelerating the adoption of green buildings.

Europe remains a key market, led by Germany, the UK and France, where stringent environmental regulations and a rise in renovation projects in heritage buildings is underpinning demand. The local demand for energy-efficient facade solutions is driven by the region's focus on shrinking carbon footprints.

Asia-Pacific, with China and India and Japan topping the charts, is witnessing rapid urbanisation, surging high-rise constructions and other infrastructure investments. Rising demand for modern architectural designs and smart cities are driving the regional aluminium curtain wall market.

Commercial and residential projects with aluminium curtain walls are also on the rise in Brazil and Mexico, in particular, Latin America. This is aiding in the growth of the market as government-led initiatives in sustainable construction are playing an important role.

With UAE, Saudi Arabia, and South Africa spearheading this growth, the construction of futuristic architecture and large-scale infrastructure projects in Middle East & Africa region is one of the key factors driving the demand for aluminium curtain walls in the overall modern building designs.

Challenges

High Initial Costs and Complex Installation

The aluminium curtain wall market is subject to high initial investment costs and complex installation processes. The design and manufacture of these units is a specialist field, and so adoption on a smaller construction project is costly.

Moreover, volatility in raw material prices, including aluminium and glass, affect project budgets and return on investments. But maintaining structural integrity and thermal efficiency is another challenge, as curtain walls have to comply with strict energy code and environmental requirements.

Opportunities

Rising Demand for Energy-Efficient and Sustainable Building Facades

Due to the growing demand for green buildings and LEED-certified structures, aluminium curtain walls with better thermal insulation, solar shading, and double-glazing technology are becoming increasingly popular. Moreover, the development of lightweight & high strength aluminium alloys and smart glass integration are opening new avenues for growth.

Urban Growth and High-Rise Construction Projects: Expansion of urbanization with ongoing high-rise construction projects further drives the growth of the market.

The aluminium curtain wall market grew steadily from 2020 to 2024 due to urban development, expansion of commercial infrastructure and investing in energy efficient building solutions. With an emphasis on green buildings, governments and industry stakeholders advocated the adoption of high-performance curtain walls for greater thermal efficiency and aesthetic value. However, supply chain disruptions and changes in aluminium prices presented challenges.

For the 5-10 years period ahead, the market will be influenced by new technologies such as smart facades, self-cleaning coatings, or high-performance glazing systems, etc. Photovoltaic (PV) panels integrated into curtain walls for energy generation will be more widely implemented, in step with international net-zero emission goals. In addition, the development of modular and prefabricated aluminium curtain wall system will optimize construction efficiency and minimize project timelines.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency codes and fire safety regulations |

| Market Growth | Expansion in commercial buildings and high-rise residential projects |

| Industry Adoption | Adoption in office towers, shopping malls, and mixed-use buildings |

| Technology Innovations | Development of thermally broken aluminium curtain walls and high-strength alloys |

| Market Competition | Presence of key players offering customizable and lightweight systems |

| Sustainability and Efficiency | Focus on reducing carbon footprint with recyclable materials |

| Material and Design Trends | Shift towards frameless and semi-unitized systems |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates, carbon-neutral construction goals, and advanced insulation standards |

| Market Growth | Growth in smart facades, green buildings, and net-zero energy construction |

| Industry Adoption | Widespread use in modular construction, smart city projects, and high-performance building envelopes |

| Technology Innovations | Integration of PV curtain walls, dynamic glazing, and AI-driven smart facades |

| Market Competition | Increased competition with prefabricated and advanced composite materials |

| Sustainability and Efficiency | Large-scale adoption of energy-generating facades, self-cleaning surfaces, and smart energy management |

| Material and Design Trends | Growth in modular and pre-engineered curtain wall solutions for faster construction |

The United States aluminium curtain wall market is expected to grow significantly during the forecast period, owing to rapid urbanization, increasing investments in commercial infrastructure and the rising adoption of energy-efficient green building solutions.

For example, the increasing popularity of high-performance façade systems in a skyscraper, office complex, and luxury residential buildings is spurring demand for lightweight, durable, and aesthetic better-looking aluminium curtain walls.

The adoption of thermally efficient curtain wall systems that maintain building insulation and lower energy costs is being accelerated by stricter building energy codes and sustainability mandates from organizations including the USA Green Building Council (USGBC) and Leadership in Energy and Environmental Design (LEED). The growing demand for green building construction is also propelling demand for the use of aluminium curtain walls integrated with solar panels and advanced glazing technologies.

Moreover, the renovation and retrofitting of older commercial buildings in urban areas such as New York, Chicago, and Los Angeles is unlocking growth opportunities for contemporary, high-strength aluminium façade systems. The increasing demand for modular construction architecture has introduced prefabricated and unitized aluminium curtain walls that offer quicker installation, reduced cost and improved performance, by the manufacturers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.3% |

The UK aluminium curtain wall market is witnessing steady growth owing to government regulations toward energy efficiency, rising prevalence for green buildings and rapid urban renewal projects. Demand for high-performance aluminium curtain wall systems, which improve thermal efficiency and cut carbon footprints, is accelerating as a result of net-zero carbon targets and tighter building insulation rules in the UK.

As urban centers such as London, Manchester and Birmingham enter the next stage of large commercial redevelopment, owners are looking at more modern, sleek and energy-efficient façade solutions. Double-skin and ventilated curtain walls continue to gain popularity as systems that allow for natural ventilation, providing optimum daylighting while also maximizing energy savings.

However, the ongoing technological evolution of smart façade systems through building automation for operations such as shading, automated photovoltaic (PV) panels, and climate-responsive glass is transforming the hallmark of the aluminium curtain wall segment. Moreover, lightweight aluminium curtain walls are also being utilized for renovations of heritage buildings to strike a balance between visual presentations and building performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.7% |

EU upholds its stringent energy efficiency regulations, like the EPBD (EU’s Energy Performance of Buildings Directive), Germany, France and Italy lead the adoption of advanced aluminium façade systems.

As demand for high-rise, energy-efficient buildings continues to rise, architects and developers are looking to double-glazed and ventilated curtain wall systems to provide enhanced thermal insulation and indoor air quality. A further driving force of demand for innovative aluminium façade solutions such as kinetic and solar-integrated curtain walls is the global trend towards smart cities and green urban planning strategies.

But with strong focus on circular economy principles in Europe, this is promoting curtain wall manufacturers to use recycled aluminium reducing overall environmental impact. The market is also driven by increasing investments in commercial real estate and luxury residential towers, both of which prefer aluminium curtain walls for their contemporary appearance and high durability.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 8.9% |

The growth in the Japanese aluminium curtain wall segment can be attributed to the increasing development of earthquake-resistant buildings, rising need for energy-efficient structures, and redevelopment of urban areas through construction activities in the Japan region. Japan being a high seismicity zone, use of light weight and flexible aluminium thin faced curtain walls for High Rise buildings are on frequent increase for stability and safety of structures.

The Tokyo 2040 Urban Renewal Plan and the increased push for smart city initiatives are creating increased demand for modern, aesthetically appealing, and technologically advanced aluminium façades. Japan’s stringent energy conservation requirements are also driving the adoption of double-skin systems and ventilated curtain-wall systems with thermal and daylighting performances.

Increasing automation of façades and climate-responsive features of building materials has led to the increasing use of aluminium curtain walls with dynamic shades, energy-harvesting panels and self-cleaning glass integrated into the wall.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.0% |

The South Korean aluminium curtain wall market is witnessing robust growth, driven by rapid urbanization, increase of smart buildings, and the rising demand for high-performance architectural facades. Government-initiated green building programs and energy efficiency regulations in South Korea are driving the adoption of advanced curtain wall systems.

As most of Korea's major cities like Seoul and Busan go on a skyscraper building spree with (super) tall commercial and mixed buildings, the demand for lightweight, modular aluminium curtain wall systems with high durability, weather resistance and modern aesthetics is becoming more prevalent. As a result of the advent of smart construction technologies, an increasing number of IoT-integrated curtain walls that include automated shading and climate-related features are being adopted.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.8% |

Curtain walls are rapidly being adopted by the construction industry, thanks to their high efficiency, quick installation, and optimally improved structural stability. They are factory-prefabricated and delivered to construction sites fully assembled as panels that drastically reduce labor costs and installation time.

Even with all of these benefits, there are certainly some considerations that engineers should keep in mind and consider these benefits all factor into a final product that minimizes errors, has a high degree of precision, and overall improves the performance of the building, which is exactly why unitized systems are becoming more popular in modern architectural projects.

Energy efficiency and aesthetics are top priorities for developers, while unitized systems provide a unified, high-grade finish complete with integrated thermal and sound insulation capabilities. The curtain wall refrains from blocking natural light, thus strengthening the sustainability journey of the building using abundant natural light available.

The unitized segment is expected to dominate the aluminium curtain wall market over the next decade, thanks to ongoing advancements in glass coatings, aluminium framing technology, and structural engineering.

Stick-built curtain walls still account for a large portion of the market and are used primarily for projects where the façades rely on custom or complex configurations.

In contrast to unitized systems, which are pre-assembled at a factory and shipped in large, heavy, expensive pieces to the job site, stick-built curtain walls can be universally assembled on-site, allowing a higher level of customization and flexibility for architects and developers when making late-breaking design modifications through the construction process. Their flexibility leads to their frequent use in tailored commercial buildings, cultural institutions, and bespoke architectural projects.

While the installation of a stick-built system may take longer and have higher labor costs, it is still an economical solution for mid-rise buildings and other projects that require a vastly different type of façade. Provide structural strength, versatility in design, and weather resistance, which are ideal for extreme weather.

Moreover, with improvements such as lightweight aluminium framing and energy-efficient glazing systems, stick-built curtain walls remain a proven, long-lasting solution for 21st century building solutions.

Commercial sectors hold a major share of the aluminium curtain wall market, as energy-efficient and aesthetic building exteriors are in demand. Aluminium curtain walls systems are used extensively in high-rise office buildings, hotels, shopping malls, as well as in corporates campuses. These structures need facades that are not only durable and lightweight but also resistant to the elements while adding to the aesthetic appeal and functional performance.

Advanced Glass & Aluminum curtain wall solutions are a strong focus for commercial developers to increase thermal insulation, decrease energy consumption, and improve occupant comfort.

In addition, modern commercial buildings with smart glass technology and sustainable materials will accelerate the new curtain wall design. This segment is likely to continue to grow with rapid expansion of urban business districts, mixed-use developments and commercial skyscrapers.

An increasing trend towards the adoption of aluminium curtain walls is seen in the residential sector for select luxury apartments, premium condominiums and eco-friendly homes. Aluminium curtain walls are the trend, as homeowners and developers are gravitating towards natural lighting, energy efficiency and contemporary architectural aesthetics, so to construct modern residences, the choice naturally leans towards aluminium.

They also protect better against weather elements, generate less noise, and have better durability, making them a good overall investment for residential buildings. High-rise residential projects in urban areas are designed with curtain wall systems that provide sleek, modern facades that maximize energy savings and natural light.

The increasing demand for enhanced residential structures that are both sustainable and attractive will undoubtedly see aluminium curtain walls become an integral part of future urban housing designs.

The aluminium curtain wall market is expanding rapidly, supported by the growing need for energy-efficient building materials, cutting-edge façade systems, and green construction methods. We utilize curtain walls commonly made out of aluminium in most commercial and residential projects for their light-weighting, durability, and aesthetics.

Innovations in thermally broken curtain walls, integration with smart glass, and modular curtain wall designs that are technologically-advanced.

Market Share Analysis by Key Players & Aluminum Curtain Wall Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Kawneer (Arconic Inc.) | 18-22% |

| Yuanda China Holdings Limited | 14-18% |

| Schüco International KG | 12-16% |

| Reynaers Aluminium | 8-12% |

| Alumil Aluminium Industry S.A. | 6-10% |

| Others | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Kawneer (Arconic Inc.) | Offers high-performance aluminium curtain walls with advanced thermal insulation and energy-efficient glazing solutions. |

| Yuanda China Holdings Limited | Specializes in large-scale commercial and high-rise building curtain wall systems, emphasizing customization and durability. |

| Schüco International KG | Develops innovative façade solutions with smart glass integration, automated ventilation, and advanced aluminium profile technologies. |

| Reynaers Aluminium | Focuses on premium architectural aluminium systems with high sustainability ratings and superior weather resistance. |

| Alumil Aluminium Industry S.A. | Manufactures versatile curtain wall solutions tailored for modern buildings with an emphasis on thermal performance. |

Key Market Insights

Kawneer (Arconic Inc.) (18-22%)

Kawneer leads the aluminium curtain wall market with a strong presence in North America and Europe, offering thermally efficient and high-strength aluminium façade solutions.

Yuanda China Holdings Limited (14-18%)

Yuanda is a major player in the global market, supplying large-scale projects with custom-engineered aluminium curtain wall systems for skyscrapers and commercial complexes.

Schüco International KG (12-16%)

Schüco is renowned for its smart and energy-efficient aluminium curtain wall solutions, integrating dynamic glass technologies for optimized indoor environments.

Reynaers Aluminium (8-12%)

Manufacturer of premium aluminium façade systems, Reynaers, engineers advanced insulation that drives green building certifications such as LEED and BREEAM.

Alumil Aluminium Industry S.A. (6-10%)

Alumil focuses on modular and adaptive aluminium curtain walls that enhance both aesthetic and functional aspects of modern architecture.

The aluminium curtain wall market is expanding with several global and regional manufacturers focusing on sustainability, automation, and modular designs.

The overall market size for aluminium curtain wall market was USD 49.75billion in 2025.

The aluminium curtain wall market is expected to reach USD 116.71 billion in 2035.

The growth of the aluminium curtain wall market will be driven by increasing adoption of energy-efficient building solutions, fueled by the rising emphasis on sustainable construction, expanding use of lightweight and durable façade systems, and the continuous innovation in architectural design. Additionally, the shift toward high-performance glazing technologies, advancements in thermal insulation materials, and the growing preference for modern aesthetics in commercial and residential structures will further support market expansion during the forecast period.

The top 5 countries which drives the development of aluminum curtain wall market are USA, European Union, Japan, South Korea and UK.

Residential Sector and commercial sector command significant share over the assessment period.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.