The substantial advantage of aluminium ion battery's relatively higher charge-discharge performance, abundant raw material sources and fewer environmental pollution showing favourable characteristics of substitution to conventional lithium-ion batteries.

Due to advances in battery tech and the growing adoption of renewable power generation, aluminium ion batteries are a very exciting technology that could become one of the main forms of energy storage in the not-too-distant future.

Availability and lower cost of aluminium than lithium is the major factor supporting market growth. Aluminium is far more abundant than lithium, geopolitically diverse and much cheaper to extract and process. The costing being so less as compared to lithium ion batteries could make aluminium ion batteries an ideal solution for the grid storage and electric vehicles (EVs) which going to be huge in rollout.

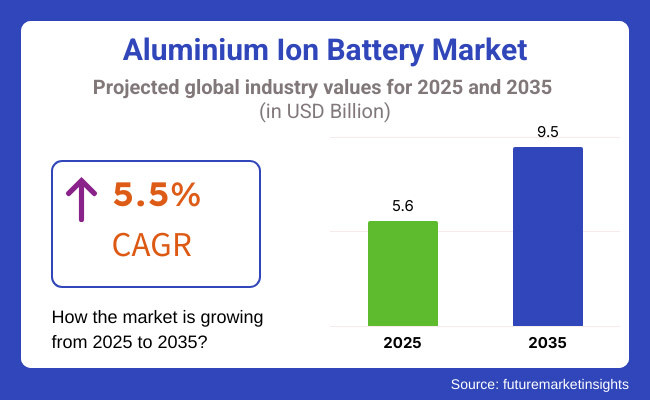

The key market for aluminium ion batteries was USD 5.6 billion in 2025, which is additionally anticipated to be USD 9.5 billion in 2035, at a CAGR of 5.5% within the anticipated region.

Additional factors contributing to the market growth are the rising emphasis on sustainability and clean energy. They do not rely on rare-earth metals such as cobalt and nickel, which have high extraction costs and environmental concerns.

So, they provide a more sustainable and ethical option for battery manufacturing. Their enhanced recyclability is also consistent with the developing global focus on circular economy principles, which will provide the foundation for sustainable long-term growth for the market.

The rapid technological advances are making aluminium ion batteries commercially viable. Scientists are continuously optimizing electrode materials, electrolytes, and battery architectures to maximize energy density, efficiency, and minimize cost, the authors write.

New developments in graphene-based cathodes and the design of formulating techniques of electrolytes have led to ground breaking performance overcoming such limitations by pushing aluminium ions batteries towards commercialisation.

Compared to over the coming years, as technological advances, cost-effectiveness, and increasing regulatory support for environmentally friendly energy alternatives, the aluminium ion battery market has also been fuelled by global demand for sustainable energy storage solutions.

Explore FMI!

Book a free demo

Increasing demand for aluminium ion batteries in the North American market, especially in the United States and Canada, can be attributed to government drive towards clean energy solutions and flourishing electric vehicle market. Battery research & development investments are driving further market expansion.

Europe is leading the way towards sustainable batteries, with Germany, France and the UK taking charge of research into aluminium ion batteries. Stringent environmental regulations and a focus on reducing lithium dependence are driving innovation and market growth in the region.

Asia-Pacific expects to lead the battery industry, China, Japan and South Korea is investing in alternative battery technologies. Aluminium ion batteries are gaining popularity with the growing renewable energy sector and the demand for next generation energy storage solutions.

Latin America, especially Brazil and Mexico, is entering a period of interest for aluminium ion batteries due to their possible applications in grid storage and electric mobility. "Initiatives to encourage the adoption of clean energy from the government would continue to drive the market penetration.

Middle East & Africa, including UAE, Saudi Arabia, and South Africa, is investigating sustainable battery alternatives to promote integration of renewable sources. Investment in aluminium ion batteries is likely to be spurred by a push to reduce reliance on fossil fuels.

Challenges

Energy Density and Commercial Scalability

The aluminium ion battery market is encountering challenges connected to energy density due to the relatively low energy storage density of aluminium-ion batteries when contrasted with lithium-ion counterparts.

While faster charging and longer cycle lifetime are expected, their low energy density limits them to applications in high-power devices such as electric vehicles (EVs). Production also remains tricky to scale due to the non-existing supply chain for battery production, high R&D costs, and specialized electrode materials.

Opportunities

Growing Demand for Safer and Sustainable Battery Technologies

As worries over environmental impact of lithium-ion batteries grow and the call for affordable, non-flammable, and environmentally friendly energy storage systems increase, aluminium-ion batteries show great promise.

Aluminium-ion batteries can charge quickly, have a relatively low environmental impact, and aluminium as a resource is abundant so they can be a good alternative in terms of grid storage, consumer electronics and low-power EV applications. Breakthroughs in graphene-based cathodes and novel electrolyte formulations continue to improve performance and scale.

Between 2020 and 2024 when the aluminium ion battery was in its research and early commercialization stage, with breakthroughs in electrode materials and electrolyte efficiency. However, the focus was still laid upon maximizing energy density at single charge-discharge cycles. But lithium-ion batteries remained the energy storage choice because of existing infrastructure and energy efficiency.

Looking forward, investments in large scale production, performance optimization, and commercial adoption in niche applications will follow until 2025-2035. We can expect rapid adoption of aluminium-ion batteries in renewable energy charging systems, portable electronic devices, and small backup electric power systems. They will also see an increased market potential due to improvements in solid state aluminium batteries, new types of cathodes and hybrid battery systems that use aluminium with other types of chemistry.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Initial safety testing and compliance for commercial use |

| Market Growth | Research-focused market with limited commercial adoption |

| Industry Adoption | Primarily in academic research and pilot projects |

| Technology Innovations | Development of graphene-based cathodes and ionic liquid electrolytes |

| Market Competition | Dominated by lithium-ion and sodium-ion battery alternatives |

| Sustainability and Efficiency | Low environmental impact but limited scalability |

| Energy Density Improvements | Lower energy storage capacity compared to lithium-ion batteries |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter energy storage regulations, sustainability incentives, and safety certifications |

| Market Growth | Expansion into consumer electronics, renewable energy storage, and niche EV applications |

| Industry Adoption | Commercial-scale adoption for grid storage, industrial power backup, and portable devices |

| Technology Innovations | Enhanced energy density, hybrid battery solutions, and solid-state aluminium-ion batteries |

| Market Competition | Growing competition with lithium-free battery chemistries and next-generation storage solutions |

| Sustainability and Efficiency | Large-scale production with improved recycling and circular economy initiatives |

| Energy Density Improvements | Enhanced cathode and electrolyte formulations to bridge the performance gap |

North America aluminium-ion battery Market covered on a USA-centric basis, is projected to grow substantially, owing to the rising adoption of next-generation energy storage devices, investments in the sustainable battery technology, and government endorsement for clean energy.

As the limitations of lithium-ion batteries become ingrained in our minds - from the scarcity of raw materials and high cost to safety issues - aluminium-ion batteries are fermented in lab as a safe, free-flowing, light-weight alternative capable of both faster charging and increased recyclability.

Research and development to explore advanced battery materials, including aluminium-ion and solid-state battery technologies, will be accelerated through funding programs under the Inflation Reduction Act (IRA) and the USA Department of Energy (DOE) Furthermore, automotive, aerospace, and renewable-energy leaders are investigating aluminium-ion batteries as candidates for electric vehicles (EVs), grid storage, and portable electronics because of their longer cycle life, lower environmental impact, and stable performance under high and low temperatures.

In addition to these developments, collaborations among large technology enterprises, universities, and start-ups are also boosting innovation and commercialization of aluminium-ion batteries. As the shift continues toward domestic battery manufacturing, the USA seems set to capture as a significant market for aluminium-ion battery development and production.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

The United Kingdom aluminium-ion battery market stands to grow in the coming years as the government pushes for initiatives in green energy, EV adoption is on the rise, and there are innovations in the development of sustainable battery materials. UK government initiatives such as the net zero strategy and the faraday battery challenge aim to encourage the development of alternative battery chemistries to facilitate clean energy storage and electric mobility.

On all counts, where energy security and avoiding reliance on critical raw materials such as lithium and cobalt are increasingly paramount, aluminium-ion batteries appear to be well-placed as an abundant and cost-effective solution. Universities like Imperial College London and the University of Cambridge are also investigating ways to improve aluminium-ion battery efficiency, charge capacity and commercial viability.

Interest in long-lasting, fast-charging energy storage solutions is being driven by the growth of the UK’s EV and renewable energy infrastructure, in particular solar and wind farms. Furthermore, startups and tech companies are also putting money into aluminium-ion battery manufacturing to take on standard lithium-based batteries.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

The EU aluminium-ion battery market is developing at a high growth rate owing to the stringent sustainability regulations, a higher focus on investment in battery research, and fast-tracked transition towards electric mobility. With the European Green Deal and Battery Regulation Act, maximizing sustainable and recyclable energy storage solutions is a growing focus area leading to increased interest in aluminium-ion batteries as an alternative to lithium-based chemistries.

Germany, France, and Italy are all leaders in the manufacture of EVs, and the development of battery technologies, led by the likes of Volkswagen, Stellantis, and Renault, has been focused on next-generation battery technologies. Moreover, implementation of circular economy principles and low-carbon manufacturing led by the EU is bolstering the adoption of recyclable aluminium-based battery solutions.

The development of commercial-scale renewable energy projects and grid-storage applications also contributed to the growth in demand for fast-charging, long-lifetime aluminium-ion batteries. In addition, partnerships between research centres, battery manufacturers and policymakers are speeding the commercialisation of aluminium-ion technology throughout Europe.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.6% |

With the country’s well-established technology industry, surging electric vehicle manufacturing, and the prospects of alternative battery chemistries, Japan aluminium-ion battery market is experiencing strong growth. Japan has been a pioneer of battery development for decades, with major companies such as Panasonic, Toyota and Toshiba pouring billions into next-gen energy storage solutions.

Scottish researchers stress on comparison of conventional lithium-ion battery technologies with energy advanced aluminium-ion battery performance, cycle life and energy density as a market solution amidst emerging lithium supply chain disruptions. Japan also has a powerful consumer electronics sector setting its sights on high-efficiency aluminium-ion batteries for use in laptops, smartphones, and IoT devices.

Japan’s vision for a carbon-neutral society and new energy strategies is accelerating research and development in recyclable and low-cost battery components such as aluminium-ion, placing them centre-stage for future energy storage applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

South Korea’s aluminium-ion battery market is expanding at a rapid pace due to leading battery manufacturers, increasing EV production, and government support for next-gen battery technologies. Businesses like LG Energy Solution and Samsung SDI are exploring aluminium-ion batteries as a possible alternative to the lithium-ion technology for energy storage and consumer electronics.

The Korean government’s Green New Deal and its drive to develop advanced battery manufacturing are urging sustainable, cheap, and rapid-charging energy storage. Aluminium-ion batteries are also in demand in the portable electronics and industrial applications segment due to the increasing popularity of 5G, IoT, and AI-powered devices which requires compact and efficient energy storage.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

Aluminium ion battery market that is expected to take off is automotive, as the need for efficient and sustainable energy storage accelerates the development of new vehicles.

The aerogel could serve as an electrode for aluminium ion batteries, which can offer benefits including higher energy density, faster charge and discharge rates and increased safety, making them an attractive substitute for the conventional lithium-ion battery system. With the rise of the electric vehicle (EV) market, car manufacturers are exploring new types of batteries that can provide cost-efficient and sustainable options over conventional fuels.

Governments and environmental agencies worldwide are quickly implementing policies in support of green transportation; low-emission and electric vehicles are seen as an important part of the future. The aluminium ion battery is noteworthy in the EV space because they are the solution to a large number of questions regarding battery life, energy efficiency, and recyclability.

Geely Group brings this technology in half and half, which allows the weight of the vehicle to be reduced, as the weight of the aluminium ion battery is less than that of a lithium battery, enhancing performance as well as energy efficiency due to the lighter vehicle weight.

Know that the automotive industry will be one of the key booming markets for aluminium ion batteries over the next few years as major automakers and battery manufacturers dump money into next-gen energy storage technologies.

In consumer electronics manufacturers need for long-lasting and safer battery type solutions aluminium ion technology has emerged as a better alternative to conventional lithium-powered batteries, like those in our smartphones, laptops, and wearables, as it is portable, deterring and fast charging.

Aluminium ion batteries have better thermal stability and a lower possibility of overheating or exploding which is one of the source's biggest advantages in consumer electronics. As a result of their long life, rapid recharge, and eco friendliness aluminum ion batteries are on the radar of the electronic makers who are slowly opting for this technology instead of lithium-ion batteries. The rising adoption smart home devices, IoT devices and next-gen computing devices also led to the demand for advanced energy storage systems.

In the industrial sector, aluminium ion batteries, as majority of industries are always dependant on uninterrupted processes, for which continuous and high-capacity energy storage systems are needed.

Reliable batteries that support backup power, machinery, and large-scale grid storage applications are needed by factories, manufacturing plants, and energy-intensive sectors. The aluminum ion batteries are an inexpensive, high efficiency replacement and help industries manage energy usage & lower carbon emissions.

In anticipation of stricter energy policies, many industrial sectors are making the transition to clean energy storage for their future energy needs, and aluminium ion batteries provide a viable path to doing so on a reasonably timescale.

Industrial, that which leverages the call for more effective energy storage in mining, heavy machinery, and automation technologies. With increasing adoption of renewable energy, aluminium ion batteries are becoming increasingly essential in industrial micro grids and solar energy storage.

Fast adoption of aluminium ion batteries in the commercial sector, especially in retail spaces, office buildings, data centers, and telecom infrastructure. To ensure non-disruptive operations, backup for power, and sustainability objectives, businesses are increasingly putting money into energy-efficient, durable solutions. As the focus on energy security and cost reduction increases, commercial establishments are now implementing advanced battery storage solutions to minimize reliance on traditional power grids.

Commercial applications would greatly benefit from the comparatively faster recharge cycles, longer shelf life, and reduced maintenance costs associated with aluminium ion batteries. The demand for high-performance energy storage systems, for example, has been pushed via the emergence of smart buildings, electric powered business fleets and AI-driven automation.

Over the coming decade, it's expected that aluminium ion batteries will make significant inroads into the commercial market, as companies look for a cheap and green alternative to power their operations.

The aluminium ion battery market emphasies energy storage as an alternative to lithium-ion technology owing to its better safety aspect, cost, and environmental impact.

As more research and development are conducted, aluminium-ion batteries are being suggested for use in electric vehicles (EVs), grid storage, and consumer electronics. Major companies in the market are working on increasing energy density, cycle life, and charge rates to make aluminium-ion solutions more competitive.

Market Share Analysis by Key Players & Aluminium Ion Battery Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Graphene Manufacturing Group (GMG) | 20-24% |

| StoreDot Ltd. | 14-18% |

| Stanford University Research Consortium | 10-14% |

| Recharge Industries | 8-12% |

| IONIC Materials Inc. | 6-10% |

| Others | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Graphene Manufacturing Group (GMG) | Leading in aluminium-graphene battery technology, offering high-performance, ultra-fast charging solutions. |

| StoreDot Ltd. | Developing next-gen aluminium-ion batteries focused on rapid charging and extended cycle life for EVs. |

| Stanford University Research Consortium | Pioneering breakthroughs in aluminium-ion battery chemistry, aiming for high efficiency and safety. |

| Recharge Industries | Specializes in aluminium-ion batteries for grid storage and industrial applications, focusing on scalability. |

| IONIC Materials Inc. | Advancing solid-state aluminium-ion batteries with improved stability and longevity. |

Key Market Insights

Graphene Manufacturing Group (GMG) (20-24%)

GMG leads in aluminium-ion battery research, integrating graphene-based components for faster charging, high conductivity, and longer battery life.

StoreDot Ltd. (14-18%)

Currently the frontrunner among the competitors, StoreDot is developing ultra-fast charging aluminium-ion cells that have the potential to bring EV charging times down to less than 10 minutes.

Stanford University Research Consortium (10-14%)

The Stanford research team is focused on high-energy-density aluminium-ion batteries with improved electrode materials for commercialization.

Recharge Industries (8-12%)

Recharge Industries is targeting large-scale battery storage with cost-effective and durable aluminium-ion solutions.

IONIC Materials Inc. (6-10%)

IONIC Materials aims to give the same advantage to consumer electronics and renewable energy storage with solid-state aluminium-ion batteries.

The overall market size for aluminium ion battery market was USD 5.6 billion in 2025.

The aluminium ion battery market is expected to reach USD 9.5 billion in 2035.

The demand for the aluminium ion battery market will rise due to increasing consumer preference for high-performance and sustainable energy storage solutions, driven by the growing emphasis on fast-charging capabilities, rising demand for eco-friendly battery alternatives, and the expanding adoption of aluminium ion technology in electric vehicles and consumer electronics. Additionally, the shift toward cost-effective and long-lasting battery solutions, the integration of advanced electrode materials for improved energy density, and the rising demand from renewable energy storage and grid applications will further propel market growth during the forecast period.

The top 5 countries which drives the development of aluminium Ion Battery Market are USA, European Union, Japan, South Korea and UK.

Consumer Electronics Sector to command significant share over the assessment period.

Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Composting Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.