Aluminium foil zipper pouch business is growing fast with industries creating high-barrier, sustainable, and resealable packaging materials. With demand on the rise in food, pharma, and personal care sectors, the market looks to lighten pouch weight while ensuring toughness and customization. Organizations implement automation, AI-assisted quality check, and environmental friendly material use for improved manufacturing with compliance with government regulations.

Industry players emphasize biodegradable films, advanced sealing systems, and precision production to enhance product functionality and sustainability. The market is shifting towards light-weight, tamper-evident, and recyclable aluminium foil zipper pouches that offer enhanced product protection and environmental stewardship.

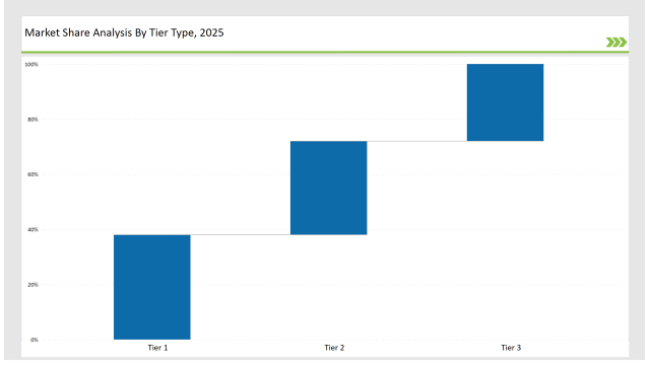

Tier 1 players such as Amcor, Mondi Group, and Sealed Air control 38% of the market with mass production, advanced production technology, and international distribution networks.

Tier 2 players such as Sonoco, Huhtamaki, and ProAmpac own 34% market share, focusing on high-efficiency production, sustainability, and customization.

Tier 3 players, comprising regional and niche companies, hold 28% of the market with specialization in special resealing technologies, intelligent packaging, and green materials.

Explore FMI!

Book a free demo

Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Mondi Group, Sealed Air) | 18% |

| Rest of Top 5 (Huhtamaki, ProAmpac) | 13% |

| Next 5 of Top 10 (Sonoco, Glenroy, Coveris, Berry Global, Winpak) | 7% |

The aluminium foil zipper pouch industry offers different industries packaging integrity, sustainability, and convenience. Companies promote intelligent manufacturing techniques and artificial intelligence-based production monitoring to improve product quality and regulatory compliance. Companies produce high-barrier films to extend shelf life and maintain freshness. Manufacturers add light materials to reduce transportation costs and environmental impact. Companies utilize automated inspection systems to detect defects and improve consistency.

Manufacturers refine aluminium foil zipper pouch solutions with biodegradable films, tamper-evident designs, and AI-enhanced production techniques. AI-driven defect detection improves quality assurance and reduces waste. Companies integrate smart sensors to monitor sealing integrity in real time. Firms adopt high-speed filling systems to increase production efficiency. Manufacturers enhance pouch flexibility to improve user convenience and storage. Businesses implement UV-resistant coatings to protect contents from light exposure.

Companies lead aluminium foil zipper pouch innovation through the adoption of high-precision sealing, AI-based defect inspection, and recyclable packaging. They refine light but durable designs for higher sustainability and product integrity. Industry leaders adopt smart packaging technology for more consumer engagement and tracking of product use. Manufacturers invest in automation packaging systems for increased efficiency and lower labor costs.

Companies maximize barrier properties for product protection from moisture, oxygen, and light exposure. Companies incorporate biodegradable laminates to achieve global sustainability goals. Industry leaders develop resealable zippers with improved functionality to enhance consumer convenience. Businesses adopt AI-driven analytics to monitor packaging performance and optimize supply chain logistics. Companies explore edible packaging alternatives to reduce plastic waste.

Year-on-Year Leaders

Technology suppliers should prioritize sustainability, automation, and security features to drive market growth. Collaborating with food, pharmaceuticals, and personal care industries will foster innovation and adoption. Companies should integrate AI-powered predictive analytics to optimize supply chain efficiency. Manufacturers must explore bio-based materials to meet sustainability regulations. Firms should enhance digital printing technologies to enable cost-effective customization.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Mondi Group, Sealed Air |

| Tier 2 | Huhtamaki, ProAmpac, Sonoco |

| Tier 3 | Glenroy, Coveris, Berry Global, Winpak |

Leading manufacturers enhance AI-driven production, sustainable materials, and smart packaging technology. They integrate lightweight, tamper-proof features to improve safety and durability. Companies develop cloud-based defect detection systems to optimize manufacturing efficiency.

Manufacturers implement energy-efficient production processes to reduce environmental impact. Firms adopt machine learning algorithms to predict defects and enhance quality control. Companies leverage nanotechnology to improve material strength and barrier properties. Industry leaders invest in recyclable multi-layer film structures to enhance sustainability.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Expanded high-barrier recyclable pouch production (March 2024) |

| Mondi Group | Developed biodegradable tamper-resistant pouches (April 2024) |

| Sealed Air | Introduced custom ergonomic designs (May 2024) |

| Huhtamaki | Released AI-powered defect detection (June 2024) |

| ProAmpac | Innovated smart resealable packaging (July 2024) |

| Sonoco | Strengthened recyclable pouch manufacturing (August 2024) |

| Glenroy | Enhanced pharmaceutical-grade packaging solutions (September 2024) |

The aluminium foil zipper pouch industry changes as businesses invest in automation, intelligent materials, and eco-friendly packaging. Businesses implement AI-based defect detection, lightweight materials, and tamper-evident functions to enhance product safety and effectiveness. Businesses upgrade high-speed manufacturing methods to raise production without reducing quality.

Manufacturers implement predictive maintenance systems to lower downtime and maximize machinery efficiency. Businesses create bio-based coatings to further enhance sustainability and minimize environmental footprint. Companies invest in the latest sealing technologies to make products more durable and longer lasting.

Manufacturers design AI-powered customization, ultra-lightweight materials, and tamper-proof packaging. They enhance recyclable and biodegradable pouches and infuse IoT-powered smart packaging solutions to make products more functional and waste-reduced. They make high-speed manufacturing lines more efficient and scalable. They add antimicrobial coatings to prolong product shelf life and safety. Companies deploy 3D printing technology to speed up prototyping and cut development expenses.

Companies use blockchain traceability technology to increase supply chain transparency. Industry players leverage predictive analytics to reduce material wastage and optimize manufacturing planning. Businesses concentrate on using heat-resistant materials to extend pouch durability in hot applications. Manufacturers develop resealing innovations to enhance convenience and freshness retention.

Amcor, Mondi Group, Sealed Air, Huhtamaki, ProAmpac, Sonoco, Glenroy, Coveris, Berry Global, Winpak.

The top 3 players collectively hold 18% of the global market.

The market shows medium concentration, with top players holding 38%.

Market concentration is influenced by technological advancements, economies of scale, regulatory policies, and the growing demand for sustainable packaging solutions.

Improve freshness and shelf life with high-barrier, resealable pouches.

Ensure moisture-proof and tamper-evident packaging.

Develop flexible, easy-to-use, and visually appealing pouches.

Strengthen chemical resistance with high-performance material.

Reduce environmental impact and comply with regulations.

Enhance safety and prevent contamination.

Improve branding and user experience.

Cutter Box Films Market Growth – Demand & Trends Forecast 2025-2035

Disposable Tea Flask Market Trends – Growth & Forecast 2025 to 2035

Stretch Blow Molding Machines Market Segmentation based on Technology Type, Orientation Type, End Use, and Region: A Forecast for 2025 and 2035

Degassing Valves Market Analysis - Growth & Demand 2025 to 2035

Custom Binders Market Growth & Industry Forecast 2025-2035

Corner Pads Market Insights - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.