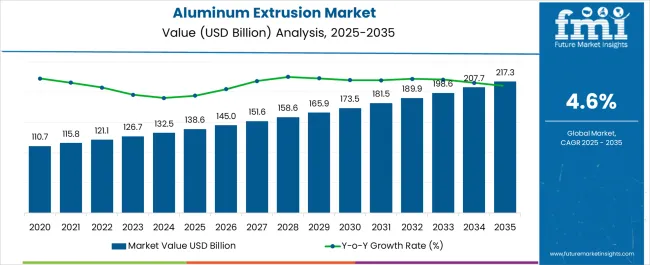

The aluminum extrusion market is estimated to be valued at USD 138.6 billion in 2025 and is projected to reach USD 217.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The market experiences sustained growth driven by expanding construction activities, automotive lightweighting initiatives, and renewable energy infrastructure development that requires custom-shaped aluminum profiles with precise dimensional tolerances and enhanced structural properties. Manufacturing facilities implement advanced extrusion technologies that accommodate complex cross-sectional geometries while maintaining surface quality standards essential for architectural applications, electronic enclosures, and transportation components. The industry's evolution toward integrated fabrication services creates demand for value-added processing including precision cutting, machining, and finishing operations that transform basic extrusions into ready-to-install components.

Construction industry applications dominate market consumption as architects specify aluminum extrusion systems for curtain wall assemblies, window frames, and structural glazing applications where thermal performance and weather resistance requirements exceed traditional material capabilities. Building contractors utilize modular extrusion systems that enable rapid assembly of commercial and residential structures while providing design flexibility for complex architectural features. Project managers emphasize supplier capabilities for custom profile development, prototype fabrication, and production scheduling that align with construction timelines and delivery requirements across geographically dispersed project sites.

Automotive manufacturers demonstrate increasing adoption of aluminum extrusions for structural components including crash management systems, battery enclosures, and heat exchanger assemblies where weight reduction directly impacts fuel efficiency and electric vehicle range performance. Production engineers specify extrusion alloys optimized for specific joining methods including welding, adhesive bonding, and mechanical fastening systems that maintain structural integrity under crash loading conditions. Quality assurance protocols require dimensional consistency and surface quality standards that enable automated assembly processes without secondary machining operations that increase manufacturing costs.

Technology integration trends emphasize computer-controlled die design and manufacturing systems that reduce profile development time while improving dimensional accuracy and surface finish consistency across production runs. Extrusion press automation enables lights-out operation with real-time monitoring of temperature, pressure, and speed parameters that optimize product quality while minimizing material waste and energy consumption. Predictive maintenance systems utilize sensor data and machine learning algorithms to anticipate equipment maintenance requirements before production disruptions occur.

Innovation development focuses on advanced alloy formulations that enhance strength-to-weight ratios while maintaining extrusion processing characteristics necessary for complex profile geometries. Surface treatment technologies advance toward integrated coating processes that apply protective and decorative finishes during extrusion operations rather than requiring secondary processing steps. Hybrid manufacturing techniques combine extrusion with additive manufacturing to create components with internal features impossible to achieve through conventional extrusion processes alone.

| Metric | Value |

|---|---|

| Aluminum Extrusion Market Estimated Value in (2025 E) | USD 138.6 billion |

| Aluminum Extrusion Market Forecast Value in (2035 F) | USD 217.3 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The aluminum extrusion market is experiencing steady growth driven by rising demand for lightweight materials, improved fuel efficiency requirements, and advancements in precision engineering. Increasing adoption of aluminum extrusions in automotive, aerospace, and construction sectors is being supported by their superior strength to weight ratio, corrosion resistance, and recyclability.

Regulatory emphasis on reducing emissions in transportation industries has further accelerated the shift toward lightweight materials such as extruded aluminum. Technological innovations in die design, automation, and alloy development are enhancing production efficiency and enabling complex profiles suitable for diverse industrial applications.

The outlook remains favorable as manufacturers prioritize sustainability, energy efficiency, and material optimization, creating strong opportunities for expansion in both mature and emerging markets.

The automotive chassis segment is projected to account for 48.60% of the total market revenue by 2025 within the product category, positioning it as the leading segment. Growth in this area is being driven by the increasing use of lightweight aluminum structures to improve vehicle performance and meet stringent emission standards.

The segment benefits from the high strength and durability of extruded aluminum, which enhances crash performance while reducing overall vehicle weight. Investments in electric vehicle manufacturing and demand for fuel efficient designs are further amplifying adoption.

As automakers continue to prioritize efficiency and sustainability, the automotive chassis segment is expected to maintain its leadership in the product category.

The aerospace segment is expected to represent 42.70% of market revenue by 2025 within the end user category, making it the most prominent segment. This dominance is attributed to the extensive use of extruded aluminum in structural components, fuselage frames, and seating systems, where high strength and reduced weight are critical.

Aerospace manufacturers rely on extruded profiles to enhance fuel efficiency and improve overall aircraft performance. Increasing global air travel and expansion of commercial fleet sizes are further stimulating demand.

Continued innovation in high strength aluminum alloys tailored for aerospace applications is reinforcing adoption, establishing this segment as the primary growth driver in the end user category.

The aluminum extrusion market accounted for worth USD 138.60 billion in 2025, growing at a 3.8% CAGR from 2020 to 2025.

Extrusion is the technique of turning aluminum or an aluminum alloy into a certain shape or profile for a range of applications. Aluminium is a versatile metal that can be formed into thin, lightweight, curved and nearly crushable sheets. The metal is permanently transformed by a thermomechanical manufacturing process. Extrusion may create any complex shape, such as tubes, profiles, rods, and other objects.

Extrusion is used in a variety of industries, including architecture, development, vehicles, electronics, aerospace, transportation, consumer durables, and others due to its exceptional features. The development of aluminum is being driven by the widespread use of green initiatives.

These applications are only conceivable because of aluminum’s beneficial properties, which include its unique combination of strength and ductility, conductivity, non-magnetic properties, and ability to be recycled repeatedly without losing integrity. Because of these qualities, aluminum extrusion is a viable and versatile solution for numerous manufacturing applications.

| Historical CAGR (2020 to 2025) | 3.8% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.6% |

As per the FMI analysts, a valuation of USD 195.48 billion by 2035 end is estimated for the market.

| Year | Market Value |

|---|---|

| 2020 | USD 92.46 billion |

| 2024 | USD 115.77 billion |

| 2025 | USD 138.60 billion |

| 2025 | USD 126.67 billion |

| 2035 | USD 195.48 billion |

The aluminum extrusion market is expanding at a steady rate due to increased demand for lightweight and robust extruded products in various industries. The excellent strength-to-weight ratio of aluminum extruded products makes it perfect for huge projects of buildings to provide strength at less weight. Together with the lightweight structure of aluminum, the corrosion resistance supplied is the second most essential attribute of extruded aluminum goods.

The strong corrosion resistance aluminum extruded goods may be used in any weather condition and any location, proving to be a market-driving factor for extruded aluminum products. Furthermore, such items or materials extruded from aluminum that exhibit great corrosion resistance minimize the overall maintenance cost for numerous industrial equipment.

Abrasion, heat, humidity, and vibrations do not affect the performance of aluminum-extruded objects. The automotive and transportation industries are seeing an increase in the amount of aluminum used in internal combustion engines and electric vehicles (EVs), which is expected to drive increasing demand for aluminum extrusion. Furthermore, rising government incentives to employ aluminum extrusions in building integrated photovoltaic (BIPV) systems, as well as rising building and construction industry development, are expected to add to market expansion.

The high initial expenses associated with aluminum extrusion for establishing the total manufacturing unit, as well as the low production efficiency, may impede market expansion. The expense of putting up the machinery and the massive infrastructure required for the extrusion press necessitates significant expenditure. Moreover, the extrusion process is inherently sluggish, that’s why aluminum extrusion cannot attain continuous output. With these two elements, the aluminum extrusion market experiences highs and lows, affecting the market's overall growth.

The industry is creating new doors for manufacturers and start-up owners to commence production and attract various clients as demand for customized and flexible designs for extruded aluminum products rises. Manufacturers may build a wide range of products, regardless of size or shape, using the aluminum extrusion method. A single piece of equipment can help in generating a variety of products without incurring any additional fees due to the machinery.

Increasing Preference for Aluminum Extrusions over Steel Owing to Superior Performance

Aluminum is a lightweight metal, with around 1/3rd of the weight of steel or copper. However, its strength-to-weight ratio is high, which makes aluminum extrusions suitable for the construction industry.

Aluminum is around 43 times strong than wood. If it is properly treated or alloyed, it can be strong than some steel grades as well. The ultimate tensile strength of aluminum material can reach up to 90,000 psi (pounds per square inch) or even more. Thus, the manufacturing sector is taking efforts to replace steel with aluminum.

The global manufacturing sector is gradually advancing towards a non-plastic world owing to the adverse effects of oil-based plastic materials on nature. Aluminum is one of the prominent sustainable materials and the most abundant metal on the earth’s crust. Although steel is the most widely used alloy across the globe, the aluminum market has significantly high potential.

Aluminum scrap can be completely recycled into new aluminum extrusions. The development of aluminum is being fuelled by the use of green activities. The use is only conceivable because of the advantageous qualities of aluminum, which range from its unique balance of strength and durability to its conductivity, non-magnetic properties, and ability to be reused again without losing integrity. Moreover, aluminum extrusion is a feasible and versatile solution for an increasing range of manufacturing needs because of these capabilities.

While the aluminum extrusion market offers various opportunities for growth and development, there are also several factors that may limit its growth. Some of the key factors are

Competition from Other Materials: Aluminum extrusions face stiff competition from other materials such as steel, composites, and plastics. These materials are often cheaper, easier to manufacture or have better properties in certain applications.

Fluctuating Raw Material Prices: The cost of aluminum, the primary raw material used in extrusion, can be volatile and unpredictable. This can impact the profitability of companies in the industry and limit their ability to invest in new technology or expand operations.

Energy-intensive Production: Aluminum extrusion is an energy-intensive process requiring significant amounts of electricity and heat. This can make production costs high, especially in regions with high energy costs.

Environmental Concerns: The production of aluminum extrusions can have a significant environmental impact, particularly in terms of energy consumption and greenhouse gas emissions. This has led to increased scrutiny from regulators and customers, who may prefer more sustainable and eco-friendly alternatives.

Trade Barriers: The aluminum extrusion market is subject to trade barriers such as tariffs and quotas, which can limit growth and increase costs for companies operating in different regions.

Overall, while the aluminum extrusion market has significant growth potential, companies operating in this industry need to be aware of these factors and be prepared to adapt to changing market conditions. This may require investing in new technologies, improving sustainability practices, or exploring new markets and applications.

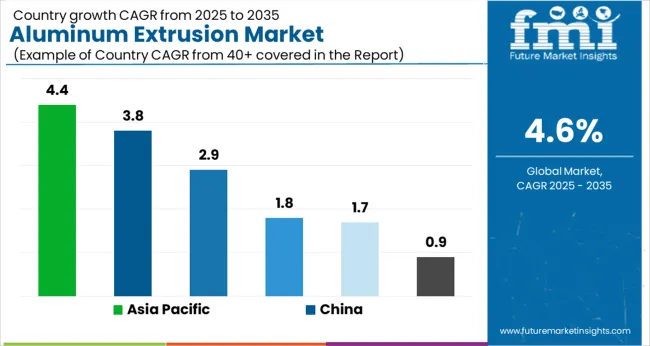

Excellent Growth Outlook Foreseen for Asia Pacific Excluding China, Europe, & North America Due to Growing Adoption of Aluminium Extruded Products

Asia Pacific excluding China holds high growth potential for the aluminum extrusions market.

Motor vehicle production in India and Thailand is growing at a significant pace along with the increasing usage of aluminum extruded products per vehicle. This has resulted in lucrative opportunities in the aluminum extrusions market of Asia Pacific excluding China.

As weight reduction of a motor vehicle is always desirable to improve its fuel efficiency without compromising the strength of the vehicle, high-performance vehicles prefer maximum use of aluminum extruded products due to their lightweight and structural strength.

Rapidly Growing Construction Industry: The construction industry in Asia Pacific is growing rapidly, driven by urbanization, population growth, and increasing demand for infrastructure. Aluminum extrusions are widely used in the construction industry for building facades, windows, doors, and other applications due to their lightweight, durability, and corrosion-resistant properties.

Growing Demand for Automotive Applications: The automotive industry in Asia Pacific is also growing rapidly, with increasing demand for lightweight and fuel-efficient vehicles. Aluminum extrusions are widely used in the automotive industry for parts such as body frames, engine components, and suspension systems.

Increasing Demand for Packaging: The demand for eco-friendly and sustainable packaging materials is growing in Asia Pacific. Aluminum extrusions are widely used in the packaging industry due to their lightweight, corrosion-resistant, and barrier properties.

Increasing Focus on Sustainability: Many countries in Asia Pacific are increasingly focused on sustainability and reducing their environmental impact. Aluminum extrusions offer a sustainable and eco-friendly alternative to other materials such as steel and plastics.

Favorable Government Policies: Many countries in Asia Pacific have favorable government policies and initiatives to support the growth of the aluminum extrusion industry. For example, India's National Aluminium Policy aims to increase domestic production of aluminum and encourage the use of aluminum in various industries.

| Countries | CAGR (2020 to 2025) |

|---|---|

| North America | 2.9% |

| Latin America | 1.8% |

| Europe | 1.7% |

| China | 3.8% |

| Asia Pacific | 4.4% |

| The Middle East & Africa | 0.9% |

Rapid Deployment of Extruded Aluminum to Upsurge Market Growth

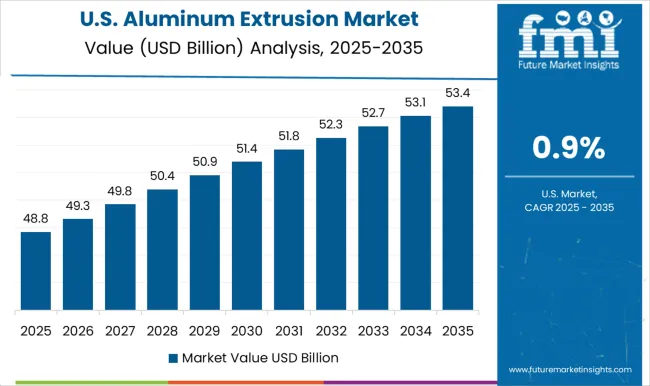

The United States is anticipated to play a significant role in the development of the aluminum extrusion market owing to the presence of a massive automotive industry and the increasing industrial use of extruded aluminum.

The expansion of the aluminum extrusions industry in the United States might be supported by a shift toward the adoption of green buildings, hence the demand for extruded aluminum is increasing.

Strong Manufacturing Capabilities of China to Fuel Demand for Aluminum Profiles

China, the leading market for aluminum extrusions, accounts for 59.5% share of the global market value.

Evolving manufacturing sector in the country and the rising per capita GDP have resulted in demand for world-class infrastructure in the country. The building & construction industry to propel the demand for aluminum profiles in China.

Rapid urbanization, rising per capita income, and an increasing population are a few important factors driving market expansion in China, resulting in increased investments in the residential and infrastructural sectors.

With the presence of key growing economies and the region's total growth ratio, the Asia Pacific region is the most prominent. The rapid industrial transformation in the mentioned region has increased demand for aluminum extrusion goods, which are now among the most widely used products in the industry.

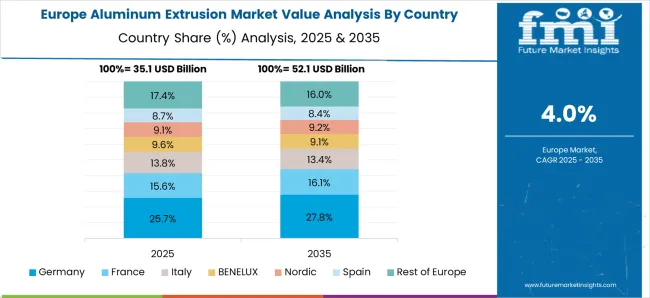

As the world's most important industrial region, Europe is home to a wide range of sectors and ranks among the leading sector in the automotive industry. Hence, it is quite evident why the aluminum extrusion market expansion has a substantial market value in Europe.

Aluminium Extrusions Playing Significant Role in Integrated Engineering Solutions for Automotive Chassis

Automotive chassis is likely to remain the highest-selling product category in the market. Aluminum is quickly becoming the most common vehicle material. Aluminum's increasing use in chassis applications, vehicle closing parts, and body-in-white parts are fuelling market expansion further. As a result, manufacturers are changing with new mobility norms to boost demand for automotive chassis.

Several manufacturers and suppliers of aluminum extrusion parts are developing new products and breakthroughs in this industry. Aluminum extrusion parts have high thermal conductivity, making them a great choice for eliminating heat from a vehicle.

Growing Use of Aluminum Extrusions for Structural Support in the Building & Construction Industry

The building & construction industry is likely to remain the top consumer industry in the aluminum extrusions market. Desirable physical properties of aluminum such as lightweight, structural strength, water resistivity, eco-friendliness, and others, have made the usage of aluminum extrusion a prominent material in building & construction.

The heat resistance of aluminum makes aluminum extrusions desirable for the construction of energy-efficient buildings in terms of maintaining internal temperature and reducing the energy requirement in heat exchangers for maintaining the temperature.

Various surface finish techniques such as anodizing, coating, chemical polishing, and others add to the aesthetics of aluminum extrusions, making them suitable for interior design.

The aluminum extrusion market is dominated by global producers and regional specialists focused on lightweighting, design flexibility, and high-strength applications across automotive, construction, and industrial sectors. Hindalco Industries Ltd. and Jindal Aluminium Ltd. lead in India with vertically integrated extrusion operations serving transportation, building, and renewable energy markets. Both companies emphasize recycled aluminum use, precision extrusion capabilities, and customized alloy development to meet growing sustainability demands.

China Zhongwang Holdings Ltd. remains a major global supplier with large-scale extrusion capacity tailored for aerospace, automotive, and rail applications. The company’s strength lies in advanced billet casting, extrusion, and fabrication technologies. Constellium N.V. and Hydro Extrusions (Norsk Hydro ASA) dominate Western markets with premium aluminum profiles featuring high mechanical strength, surface finish quality, and recyclability. Their focus on circular production and low-carbon aluminum positions them as key suppliers for EVs and architectural systems.

Kaiser Aluminum Corp. and Arconic Corp. provide specialized extrusions for aerospace, defense, and high-performance industrial applications, emphasizing precision engineering and alloy innovation. Bonnell Aluminum and Gulf Extrusions Co. LLC supply tailored extrusions for construction and consumer goods, offering strong regional distribution networks. Balexco serves the Middle East with architectural-grade extrusions, focusing on quality finishes and thermal efficiency.

| Attribute | Details |

|---|---|

| Market Size Value in 2025 | USD 126.67 billion |

| Market Size Value at End of Forecast (2035) | USD 195.48 billion |

| Market Analysis | USD billion for Value |

| Key Region Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; The Middle East & Africa |

| Key Segments | By Product, By End User, By Region |

| Key Companies Profiled | Hindalco Industries Ltd., Jindal Aluminium Ltd., China Zhongwang Holdings Ltd., Constellium N.V., Hydro Extrusions (Norsk Hydro ASA), Kaiser Aluminum Corp., Arconic Corp., Bonnell Aluminum, Gulf Extrusions Co. LLC, and Balexco |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global aluminum extrusion market is estimated to be valued at USD 138.6 billion in 2025.

The market size for the aluminum extrusion market is projected to reach USD 217.3 billion by 2035.

The aluminum extrusion market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in aluminum extrusion market are automotive chassis, profile for poles, profile for bridges, profile for rail tracks, door & window profiles, curtain walls, profile for heat exchangers, machinery components and others.

In terms of end user, aerospace segment to command 42.7% share in the aluminum extrusion market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Extrusion Lubricants Market

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Extrusion Press Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Extrusion Coatings Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA