Aluminium cups provides a unique durable, light-weight and recyclable option to plastic and paper based cups and is increasingly becoming a popular option for consumers and businesses wanting to reduce their carbon footprint. With worldwide fears around plastic waste and single-use plastics increasing, aluminium cups are beginning to be adopted in a range of sectors, from manning food service offerings to hospitality and sports events.

Aluminium is amongst the most recyclable materials on the planet and its recycling rate dwarfs that of plastic and glass. Aluminium can be recycled countless times and retain quality, making it the material of choice for environmentally-sensitive companies and individuals alike. Aluminium-based packaging solutions are also increasingly favoured by governments around the world that are tightening regulations regarding the use of plastic.

Absorbing their sustainability, aluminium cups are gaining in popularity also because of its durability and thermal properties. Aluminium cups instead do not break and preserve the beverages' temperature for a longer time, so they can definitely be used for both hot as well as cold beverages unlike plastic and paper cups. Their break-resistant and stylish, high-end look have also spurred innovative high-end adoption into restaurants, bars and event spaces. The market is being fueled as major sporting events, music festivals and entertainment venues increasingly adopt aluminium cups as part of their sustainability efforts.

Technological innovations in the production of aluminium cups are further revolutionizing the manufacturing process, allowing for more efficient and economical production. Light weighting (cutting the amount of material used while retaining performance characteristics), the development of intricate geometric shapes, and precision printing have all made it possible to manufacture premium, bespoke aluminium cups to suit the needs of even the most demanding customers. The growing availability of branded aluminium cups, especially in the beverage industry, also fuels segment growth.

However, there are challenges in the aluminium cup market, including high initial production costs and competition from alternative materials, including biodegradable plastics and paper cups. But persistent improvements in sourcing materials and manufacturing processes coupled with increased consumer awareness of sustainable options will result in continuing, though modest, market growth.

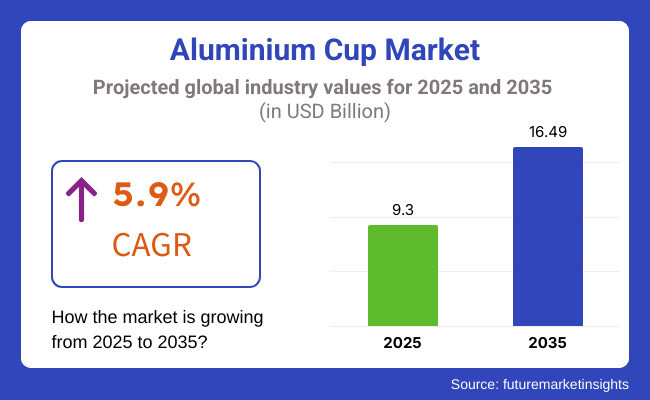

The aluminium cup market accounted for USD 9.3 billion in the year 2025 and is expected to reach USD 16.49 billion by the year 2035, at a CAGR of 5.9% during the forecast period.

Due to regulations on sustainability and besides that rising adoption in different events and food service chains make North America, especially United States and Canada, a promising market for aluminium cups. In addition, key beverage companies and recycling infrastructure are present in these countries, thus supporting the growth of the market.

The demand for aluminum cups in Europe has skyrocketed with Germany, France and the UK leading the charge. The European Union’s stringent regulations on single-use plastics, and increased consumer preference for sustainable alternatives, are also driving the market's expansion.

The Asia-Pacific region, especially China, India, and Japan, is emerging as a rapidly growing market. The move toward sustainable packaging by fast-food chains and beverage companies - aided by governments that has taken steps against plastic waste - has boosted demand.

Brazil and Mexico are witnessing steady growth in the aluminium cup market in Latin America. The increasing focus on sustainability in the region, along with rising urbanization and disposable income, is driving growing adoption levels.

The country section of Middle East & Africa market report also provides individual market influencing factors and changes in regulation in the market domestically that impacts the current and future trends of the market.

Challenges

High Production Costs and Recycling Challenges

The Aluminium Cup Market is largely confronted by factors like high manufacturing costs, which includes the cost of raw material, energy-intensive manufacturing process, etc. While aluminum is very recyclable, a lot of the world has never had a proper recycling infrastructure and that can increase production costs and bottlenecks in the supply chain.

Moreover, competition from plastic and biodegradable alternatives is threatening large-scale adoption, particularly in cost-sensitive markets.

Opportunities

Rising Demand for Sustainable and Eco-Friendly Drinkware

Plastic cups can be replaced with sustainable, reusable, and recyclable alternatives, and so, it created a lot of opportunities for the Aluminium Cup Market. There has been an increased push for eco-friendly beverage packaging solutions as governments and regulatory authorities across the globe are inflicting stricter bans on the single-use plastic usage.

Additionally, the introduction of innovative lightweight designs of cup aluminum and the growth of the circular economy are accelerating the market recovery. The acceleration of sports events, music festivals, and environmentally responsible hospitality companies is increasing the demand for alternatives to single-use and disposable plastics, allowing aluminum cups to shine.

Environmental consciousness and restrictions on single-use plastics led to increased demand for Aluminium cup market between 2020 and 2024. Brands and beverage companies began to offer aluminum cups as sustainable alternatives for events, fast-food chains and upscale beverage packaging. However, limitations including lack of recycling capability, expensive production process, and consumer price sensitivity hindered mass adoption.

In the 2025 to 2035 period, the market will be approached with advancements in lightweight low-cost cup manufacturing based on aluminum. Growth will be driven by increased investment in closed-loop recycling systems, improved and more durable coating technologies, and wider adoption of aluminum cups in commercial and residential settings. Moreover, branding innovations, including personalization and printing of aluminum cups for marketing and promotional purposes would fuel the growth of market opportunities.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Ban on single-use plastics driving initial adoption |

| Market Growth | Growth fueled by eco-conscious consumers and sustainability initiatives |

| Industry Adoption | Limited to premium beverage brands, sports venues, and eco-friendly businesses |

| Technology Innovations | Development of reusable and lightweight aluminum cups |

| Market Competition | Competition from biodegradable plastics and reusable cups |

| Sustainability and Efficiency | Recycling initiatives gaining traction |

| Consumer Awareness | Early-stage awareness among eco-conscious buyers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Strengthened regulations promoting aluminum recycling and sustainability mandates |

| Market Growth | Expansion into mass consumer markets, hospitality, and beverage packaging industries |

| Industry Adoption | Widespread adoption in fast-food chains, supermarkets, and daily consumer use |

| Technology Innovations | Advanced coatings for enhanced durability, thermal insulation, and recyclability |

| Market Competition | Aluminum cups becoming a mainstream alternative to both plastic and paper cups |

| Sustainability and Efficiency | Large-scale closed-loop recycling systems, carbon-neutral production, and enhanced reusability |

| Consumer Awareness | Widespread consumer adoption with incentives for aluminum cup returns and reuse |

Rising consumer demand for sustainable and recyclable alternatives to plastic cups, increasing environmental regulations, and expanding applications in the food & beverage industry are driving the growth of the United States aluminium cup market Single-use plastics are receiving greater restrictions across the USA, with bans in states like California, New York, and Washington, so aluminium cups make a favourite eco-friendly choice as they can be 100% recycled as well as reused multiple times.

Growing health consciousness among consumers is driving the transition from plastic-based to BPA free and non-toxic aluminium cups owing to the superior qualities of BPA free and non-toxic resources, particularly in premium drinkware and reusable beverage containers. The demand in the hospitality, airline, and corporate sectors is also catalysed by technological advancements in lightweight aluminum cup production and customized branding options.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

In the United Kingdom, the aluminium cup market continues to develop solidly, driven by both government-led plastic decrease activities and strong interest from the hospitality division, while consumers progressively opt for practical alternatives. Imposes a fine of £200 on plastic cups and containers that do not comply with the tax, also applicable to the 4.53 billion plastic containers we throw away in Germany alone.

An increasing trend toward sustainable drinking solutions in pubs, coffee houses, and fast-food outlets are also aiding the growth of the market. The cups are also increasingly being adopted by larger UK festivals, football stadiums and major music events as part of carbon-neutral goals.

Reusable drinkware is a sector that is expanding, and new forms of ever lightweight aluminium cup designs are attracting new market segments, such as corporate offices, airlines and home users who want alternatives to plastic cups that don't come with toxicity or toxicity issues and are recyclable.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The European Union (EU) aluminium cup market is moving ahead with an intense shipping rate due to impenetrable sustainability policies, various circular economy principles, and consumers’ pushes for recyclable beverage packaging. Countries such as Germany, France, and the Netherlands are amongst the leading economies pushing plastic reduction programmes, encouraging aluminium alternatives for foodservice and consumer packaging.

The EU’s Single-Use Plastics Directive (SUPD) has prohibited some plastic beverage cups and lids, leading to an increase in demand for sustainable, reusable aluminium cups in restaurants, hotels and stadiums. In addition, its being completely recyclable is gaining traction among the consumers due to global rise in awareness regarding waste reduction and carbon footprint shift as well which is fueling the overall movement towards using aluminum cups rather than plastic and paper.

Additionally, market growth is being accelerated by the beverage industry's transition to sustainable packaging solutions, as well as companies, including Heineken, Carlsberg, and Nestlé investing in aluminium-based drinkware. Improved lightweight aluminium cup technology is also increasing consumer convenience and driving down manufacturing costs.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.9% |

The aluminium cup market in Japan is booming due to strong environmental awareness, strict plastic waste regulation by government, and a nationwide sophisticated aluminium recycling infrastructure. The ministry of the environment's plastic reduction strategy has led to grocery stores and large foodservice distributors switching from plastic cups to aluminium ones.

The focus of Japanese consumers is primarily on product quality, reusability, and sustainability, resulting in a significant rise in the adoption of premium aluminium cups in cafes, corporate offices, and high-end restaurants. Additionally, the robust existence of beverage packaging in Japan contributes to improving aluminium cup design, including lightweight and customizable solutions.

And increasing demand for fashionable, reusable drinkware from the hospitality industry is broadening market possibilities. As the food vending machine and takeaway culture proliferate, companies are rolling out recyclable aluminium beverage cups for coffee, tea and soft drinks.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The aluminium cup market in South Korea is rapidly accelerating driven by government initiatives to curb plastics, increasing awareness of biodegradable and eco-friendly drinkware and expanding demand in foodservice and hospitality industry. The Korean Ministry of Environment’s ambition for zero waste has initiated a nationwide change to aluminium packaging in coffee shops, restaurants and convenience stores.

South Korea’s tech-savvy consumers generally prefer sleek, modern and reusable aluminium cups, especially on the go. Branded aluminium cups have become especially popular with the emergence of premium cafés and bubble tea outlets.

Moreover, South Korea's vibrant K-pop and entertainment industry has added to the increasing demand for aluminium cup souvenirs at concerts, sports events, and fan merchandise sales.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

The market is largely driven by rising global demand for eco-friendly and recyclable beverage and drinkware, with beverage cups dominating the market. This reduces environmental damage as consumers and companies adjust to aluminium cups as an environmentally friendly choice over disposable plastic cups. These cups boast durability, reusability and better insulation for hot and cold drinks.

Aluminium cups are widely used in the beverage industry, especially soft drinks, alcoholic drinks and energy drinks. Due to their lightweight property, break-resistant features and temperature retention for a longer period they are preferred by the event organizers, restaurants and sports arenas.

Customisable aluminium cups, providing new branding opportunities, are also being adopted by beverage brands, driving consumer participation. This segment can also expect to benefit from the increasing popularity of premium, reusable aluminium drinkware in cafes, hotels and sustainable packaging wear.

While government Hations for discouraging plastic usage, another major factor bolstering from growth of aluminium beverage cups is consumer’s preference towards eco-conscious packaging.

The global market for baking cups is growing due to increased home baking and burgeoning commercial bakery industries. These cups are heat-resistant, non-stick and able to withstand high temperatures, making them perfect for muffins, cupcakes, and pastries. Aluminium cups are sturdier and grease-resistant than paper cups which ensures presentation perfection and less wastage.

Aluminum baking cups market is witnessing growth due to rising trend of ready-to-bake and pre-packaged desserts. In the food industry, this technology helps manufacturers keep their products fresh, transport them conveniently, and have long shelf lives.

Their moisture resistance and heat durability keep their shape even under superhot conditions, and they’re a favourite of professional and home bakers alike. With more and more health-conscious consumers looking for chemical-free baking solutions, aluminium cups are proving to be a safer and more convincing alternative to silicone or plastic products.

The aluminium cup market for cups of around 200ml-300ml capacity is expected to dominate the market as these cups are widely used across various industries. This size range is ideal for soft drinks, cocktails and coffee, which is the preferred choice for restaurants, fast-food chains and entertainment venue. These cups are also used for yogurt, desserts and small portion meal servings and serve the foodservice and ready-to-eat markets.

Aluminium cups in this category have portability balanced with convenience, there is enough volume in each cup for a single-serving drink, yet lightweight and easy-to-carry. Increased emphasis on premium drinkware for sustainability conscious consumers further enhances the adoption of 200ml-300ml aluminium cups, especially among event organizers, and outdoor catering services.

Lightweight aluminium cups with 300ml-400ml capacity are surging in popularity in premium beverage categories such as craft beers, cocktails and specialty coffees. Enough volume to hold full-volume servings of drinks while still effectively insulating and keeping the drink fresh. Bars, breweries, and high-end cafes have turned to custom-designed aluminium cups to satisfy consumers that are demanding high-quality drinkware to improve the drinking experience.

Increasingly, the medium-capacity aluminium cups that combine durability, reusability, and a modern aesthetic conform to a wave of eco-obsessed consumers demanding sustainable hospitality trends. This segment is likely to see steady growth as an increasing number of brands will replace the conventional plastic cups with these aluminium alternatives to achieve sustainability targets and changing consumer preferences.

The Aluminium Cup industry has been scanning every POV with strong growth in the market with the increasing major demand for the sustainable and recyclable drinkware solutions.

Market growth is driven by the rising shift from single-use plastics, increasing environmental awareness, and widespread adoption of aluminum cups in events, hospitality, and retail sectors. Major players are working on the design of lightweight aluminum cups, development of coating technologies to improve use cases, and strategic collaborations with beverage brands to improve their market penetration.

Market Share Analysis by Key Players & Aluminium Cup Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Ball Corporation | 19-23% |

| Trivium Packaging | 13-17% |

| Crown Holdings, Inc. | 10-14% |

| Enviro-Cup USA | 7-11% |

| Novelis Inc. | 5-9% |

| Others | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Ball Corporation | Industry leader in recyclable aluminum cups, focusing on lightweight and durable drinkware solutions for events and hospitality. |

| Trivium Packaging | Specializes in premium aluminum cups with advanced barrier coatings to enhance beverage taste and shelf life. |

| Crown Holdings, Inc. | Develops innovative aluminum cup designs with custom branding solutions for beverage companies and large-scale events. |

| Enviro-Cup USA | Focuses on sustainable and compostable aluminum cup alternatives, catering to eco-conscious consumers. |

| Novelis Inc. | Provides high-recycled-content aluminum cups with advanced forming techniques for enhanced durability and heat resistance. |

Key Market Insights

Ball Corporation (19-23%)

Ball Corporation, which specializes in sustainable activity within the aluminum cup industry, holds a leading position, creating fully recyclable aluminum cups used for sporting events, music festivals, and other hospitality areas.

Trivium Packaging (13-17%)

Trivium provides high-end aluminum packaging with sophisticated coating technologies that help maintain freshness levels in beverage products while also eliminating corrosion.

Crown Holdings, Inc. (10-14%)

Crown Holdings is a supplier of customizable aluminum cups for large beverage brands, incorporating branding and design innovations to these cups for promo opportunities.

Enviro-Cup USA (7-11%)

Enviro-Cup targets the growing eco-conscious market segment, offering biodegradable aluminum cups and promoting closed-loop recycling programs.

Novelis Inc. (5-9%)

Novelis will be centred on high-recycled-content aluminum cups integrating sustainable material sourcing and advanced manufacturing processes that minimize environmental impact.

Several manufacturers and specialty drinkware providers contribute to the aluminum cup market by focusing on innovative designs, branding capabilities, and sustainability initiatives. These include:

The overall market size for aluminium cup market was USD 9.3 billion in 2025.

The aluminium cup market is expected to reach USD 16.49 billion in 2035.

The aluminium cup market will rise due to increasing consumer preference for sustainable and recyclable beverage packaging, driven by the growing emphasis on environmental sustainability, rising restrictions on single-use plastics, and the expanding adoption of aluminium cups in the food service and hospitality industries. Additionally, the shift toward durable and lightweight packaging solutions, the integration of advanced manufacturing techniques for improved cup design, and the rising demand from sports arenas, entertainment venues, and quick-service restaurants for eco-friendly alternatives will further propel market growth during the forecast period.

The top 5 countries which drives the development of aluminium cup market are USA, European Union, Japan, South Korea and UK

Beverage Cups to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Aluminium Cup Suppliers

Aluminium Profiles for Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Fishing Boat Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Foil Seal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Chloride Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium-Free Deodorant Market Analysis - Trends, Growth & Forecast 2025 to 2035

Competitive Landscape of Aluminium Foil Zipper Pouch Providers

Market Share Insights for Aluminium Bottle Providers

Aluminium Ion Battery Market Growth - Trends & Forecast 2025 to 2035

Aluminium Bottle Market Growth – Size, Demand & Forecast 2025 to 2035

Aluminum Foil Zipper Pouch Market Trends - Growth & Forecast 2024 to 2034

Aluminium Foil Sachet Market

Aluminium Production Chemicals Market

Aluminium Composite Panels Market

Aluminium Nitride Market

USA Aluminium Bottle Market Insights – Demand, Size & Industry Trends 2025-2035

Japan Aluminium Bottle Market Insights – Growth, Demand & Trends 2025-2035

ASEAN Aluminium Bottle Market Insights – Growth, Demand & Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA