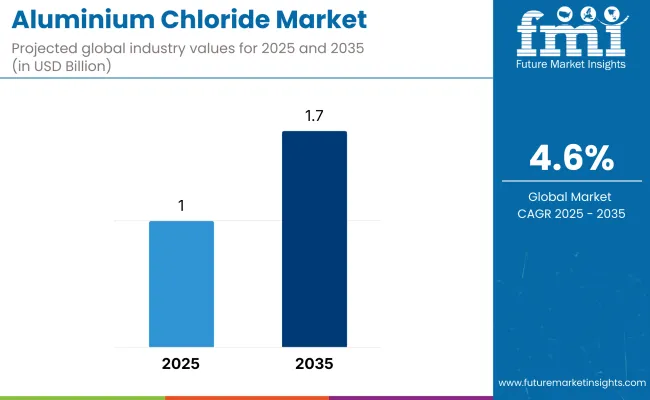

The global aluminium chloride market is worth USD 1 billion in 2025 and is poised to expand to USD 1.7 billion by 2035. This shows a CAGR of 4.6% during the forecast period. Aluminium chloride plays a crucial role as a Lewis acid catalyst in many industrial processes such as Friedel-Crafts alkylation and acylation reactions, polymerization, and isomerization.

Its catalytic efficiency makes it indispensable in petrochemical refining, where it aids in cracking hydrocarbons into higher-value products. Additionally, the rising demand for plastics, synthetic rubber, and specialty polymers further boosts the market, as aluminium chloride remains a preferred catalyst to enhance reaction yields and selectivity.

The pharmaceutical and personal care sectors are also significant growth drivers. In drug synthesis, aluminium chloride enables precise acylation and alkylation steps necessary for producing complex active pharmaceutical ingredients (APIs). In personal care products, it functions as an effective antiperspirant agent, supporting growth in both mature and emerging markets.

Environmental regulations around water quality have led to increased investments in wastewater treatment, where aluminium chloride-based coagulants are widely used to remove suspended solids, organic contaminants, and heavy metals from municipal and industrial effluents. Rapid urbanization in regions like Asia Pacific and Latin America is accelerating the adoption of these coagulants to comply with stringent discharge norms.

The market is also witnessing a strong focus on sustainability and process innovation with rising concerns about the environment. Manufacturers are adopting cleaner, energy-efficient production methods, including advanced chlorination reactors that reduce emissions and improved crystallization techniques that minimize waste.

Volatility in raw material prices such as aluminium and chlorine, along with geopolitical factors, is pushing companies to diversify supply chains and secure long-term procurement contracts. Regulatory pressure from authorities like the USA EPA and European Chemicals Agency encourages exploration of green chemistry alternatives and recycling routes to reduce carbon footprints.

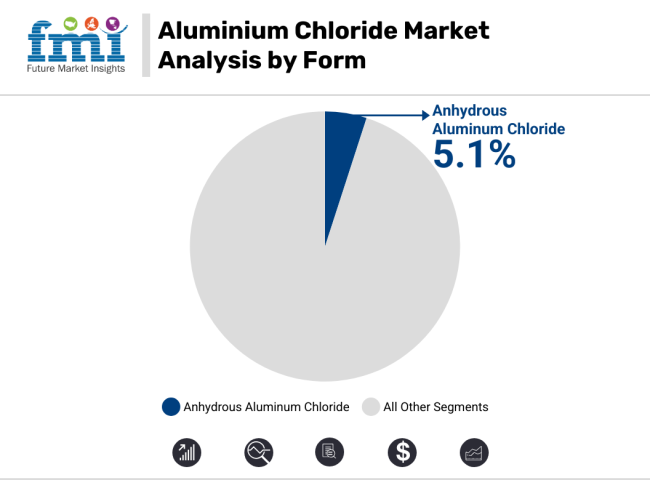

The aluminium chloride market is segmented by form into anhydrous aluminum chloride and hydrated aluminum chloride. By application, the market includes waste water treatment, synthetic rubber, lubricants, wood preservatives, and other applications (pharmaceuticals, personal care products, specialty polymers, and chemical synthesis). Regionally, the market is analyzed across North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

The anhydrous aluminum chloride segment dominates the aluminium chloride market with the highest growth, projected to achieve a CAGR of about 5.1% between 2025 and 2035. Its superior catalytic properties make it indispensable in petrochemical industries, particularly for Friedel-Crafts alkylation and acylation reactions, polymerization, and isomerization processes. These reactions are foundational to producing various chemicals, plastics, and synthetic rubbers, driving strong demand for this form.

Its ability to enhance reaction efficiency and selectivity also supports its use in pharmaceutical synthesis, where precise molecular modifications are essential. Additionally, anhydrous aluminum chloride’s role in advanced polymer manufacturing further bolsters its market growth, especially as industries push for higher-quality, high-performance materials.

In contrast, the hydrated aluminum chloride segment is growing steadily at an estimated CAGR of 3.8%. Its main application lies in wastewater treatment, where it acts as a coagulant to effectively remove suspended solids, organic matter, and heavy metals, addressing rising environmental concerns globally. This segment also serves the personal care industry as an antiperspirant agent, benefiting from increasing consumer awareness and product innovations. Moreover, it finds niche applications in lubricants and wood preservatives.

However, the hydrated form's growth is relatively moderate due to its limited catalytic applications compared to the anhydrous type. Environmental regulations and urbanization trends particularly in Asia Pacific and Latin America regions continue to support demand for hydrated aluminum chloride, ensuring steady market contributions from this segment.

In the aluminium chloride market, the waste water treatment segment is the fastest growing, expected to register a CAGR of approximately 5.0% from 2025 to 2035. This growth is driven by increasing environmental regulations and the rising need for efficient coagulation agents to remove suspended solids, heavy metals, and organic contaminants from municipal and industrial effluents globally. The demand for aluminum chloride-based coagulants is especially strong in rapidly urbanizing regions like Asia Pacific and Latin America.

The synthetic rubber segment is also witnessing steady growth, supported by the expanding automotive and manufacturing industries that rely heavily on synthetic rubbers for tires and various industrial applications. Lubricants form a smaller but consistent part of the market, where aluminum chloride acts as an additive to improve viscosity and performance under extreme conditions. The wood preservatives application is more niche but growing steadily due to increasing demand for durable and treated wood products in construction and furniture industries.

Other applications include pharmaceuticals, cosmetics, and specialty chemicals, where aluminum chloride serves diverse roles such as catalysts and active ingredients. Although these segments grow at a moderate pace compared to wastewater treatment, their contribution remains vital to the overall market expansion.

| Application | CAGR (2025 to 2035) |

|---|---|

| Waste Water Treatment | 5.0% |

Raw Material Price Fluctuations

The production of aluminium chloride requires fundamental raw materials, namely aluminium and chlorine - which is why the rates of aluminium chloride are (somewhat) sensitive to an array of human, political and energy price fluctuations. This is especially true of the aluminium industry, which is highly sensitive to global trade policies, global tariffs and resources availability - all factors that make it difficult for manufacturers to maintain stable production costs.

Regulatory constraints and environmental factors also impact on chlorine production, which may contribute to potential supply shortages. As there is a degree of volatility in the pricing of raw materials, this present challenges to the profit margins for the aluminium chloride manufacturers thus driving end users to a great extent to look for different sourcing strategies, long term agreements, and efficiency improvements during the manufacturing process to mitigate the risk associated with the financial aspect of the turmoil in raw material pricing.

Environmental and Regulatory Compliance

The aluminium chloride sector is also coming under increasing pressure to comply with stringent environmental legislation relating to chemical production, emissions control and disposal of hazardous waste. In the United States, we have the Environmental Protection Agency (EPA), and in Europe, the European Chemicals Agency (ECHA) that have similarly strict guidelines about the management, transport, and disposal of hazardous materials.

All manufacturers have to comply with stricter rules, and companies invest a lot into cleaner production technologies, environment-friendly waste management, and efficiency processes to minimize the impact on the environment. Moreover, the growing interest for green chemistry and eco-friendliness is pushing manufacturers to find alternative formulations that follow worldwide sustainability initiatives. Failure to comply may leave market participants exposed to legal sanctions, operational discontinuance, and reputational damage.

Health Hazards & Handling Issues

Hydrochloric acid, a clear and colorless aqueous solution of hydrogen chloride (HCl), is highly reactive and corrosive and presents considerable occupational hazards in its production, storage, and transportation [2]. The compound reacts violently with water, producing hydrogen chloride vapors that cause serious respiratory illness and chemical burns if anyone comes into contact with it. As a result, these risks require very stringent handling protocols, all to keep workers safe, including protective equipment and unique storage boxes.

Workers who use aluminium chloride in industry environments may need to abide by other workplace safety bodies, such as the Occupational Safety and Health Administration (OSHA) standards, to prevent accidents and illnesses caused by exposure. These handling complexities have increased operational costs, reduced adoption in smaller industries and up-skilling workers, that they handle the material safely at all levels.

Growing Demand for High-Performance Catalysts

Aluminium chloride is widely used as a catalyst in various petrochemical processes, including Friedel-Crafts reactions, polymerization, and isomerization. Increasing global demand for refined petrochemical products like plastics, synthetic rubber, and specialty chemicals is driving the demand for the high-performance catalysts that will drive up reaction rates and yields. More and more industries are developing new and advanced catalyst formulations deliberately to improve process sustainability and reduce energy and waste production.

Rising adoption of aluminium chloride as a catalyst in the manufacture of high-value chemicals due to its ability to influence yield, selectivity and minimize off-product formation would also drive its demand during the course of the forecast period notably for petrochemical and refining companies aiming to boost their top lines with better margins

Expansion of Water Treatment Infrastructure

Aluminium chloride is gaining importance as a coagulant for wastewater treatment and purification, propelled by the growing global focus on clean water and environmental sustainability. Nations across the developing world particularly in Asia, Africa and Latin America are investing billions in mega water treatment projects as concerns over water pollution and scarcity have intensified.

Higher ability to remove impurities suspended solids and heavy metals is one of the key reasons for the growing utilization of aluminium chlorides based coagulants in municipal as well as industrial wastewater treatment plants. Furthermore, the market growth is also driven by stringent government regulations to promote the disposal of water in a safe manner coupled with stringent norms for the treatment of industrial effluent. Increasing urbanization and industrial activities are leading the demand for aluminium chloride for water treatment applications, which is anticipated to grow substantially.

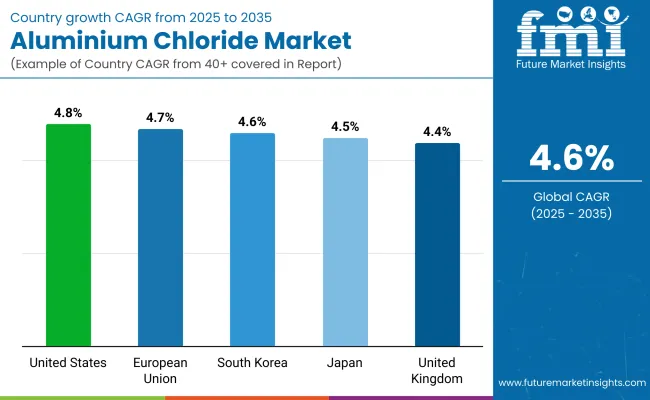

Aluminium chloride is largely used in France, Germany, Greece, Poland, the United States, the Netherlands, and Turkey, which is further contributing to the growth of US aluminium chloride market. The increased focus of countries on wastewater treatment and stringent environmental policies in the country have made several countries to adopt aluminium chloride as coagulant. In addition, growing expansion of the petrochemical industry, which requires aluminium chloride for usage as catalysts is expected to propel the market growth significantly.

The increase in demand is also being driven by modern production technologies and sustainable chemical processing. Future of the market will be determined by the research on high purity aluminium chloride as well as the development of eco-friendly alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

Industries Such as - UK Aluminium Chloride Market Trends have been on the rise for the past few years owing to its increasing application in Pharmaceutical, Chemical Processing and Wastewater Treatment sector. Strict regulations imposed by the country on water treatment and pollution control is contributing to the growth of demand for aluminium chloride-based coagulants.

In addition, the growth of the petrochemical and polymer industry and demand for advanced catalysts is boosting the market growth. Innovative recycling and environmentally friendly production practices also dictate the long-term growth of UK’s aluminium chloride market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.4% |

The iron and aluminium coagulant segment holds the utmost demand in the water treatment market, ranking in the first place in terms of its Revenue generation. This, along with the economic framework of the European Union, which is one of the strictest in the world in terms of environmental, energy and waste reduction policies for industries, is thereby driving up the demand for aluminium chloride in applications of wastewater treatment as well.

Catalysts for the petrochemical and synthetic rubber industries are also increasingly being sought to create the plastics and rubber as well as long-stranded polymer product. Proposed Eco-Sustainable Manufacturing Technologies While district heating networks are a time-tested resource for building heating, their expansive adoption is impeded by substantial levels of investment and a need for effective energy inflows from power plant outlets.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

Aluminium chloride has an extensive usage in the chemical and pharmaceutical industry in Japan, which acts as a key factor driving the growth of the aluminium chloride market. Aluminium chloride in China is seeing increasing demand given the matured manufacturing skills in the country and the high-purity chemicals manufacturing focus.

In addition, the increasing use of aluminium chloride as a catalyst in polymerization and chemical synthesis is driving the growth of the market. The study found that the new sewage treatment solutions which are compatible with eco-friendly practices will also boost market growth, fueled by Japan's investments in environmental sustainability. Emerging Chemical Process technologies for Photoresist Manufacturing & Japan transitioning into the global aluminium chloride space.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

South Korea’s aluminium chloride market is steadily growing, supported by its booming petrochemical, semiconductor and pharmaceutical sectors. The increasing investment in pioneering chemical processing and sustainable industrial solutions is a pre-condition for the evolution of aluminium chloride in catalyst applications in the country.

In addition, the increasing demand for advanced wastewater treatment solutions to comply with South Korean environmental policy is on the rise. Additionally, the demand for such products is continuously catalyzed by the emergence of high-performance materials and specialty chemicals, which bodes well for vigorous market ascension in the forecast period. Research and development investments are expected to drive technological innovation with which South Korea remains a pivotal player in the aluminium chloride market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The Aluminum Chloride market is a vital part of the chemical industry, serving high demand in pharmaceuticals, petrochemicals, wastewater treatment, and industrial catalysts. This compound is widely utilized in Friedel-Crafts reactions, polymerization and serves in the specialty chemicals.

As industry professionals talk about market participants increasingly focusing on improving produce purity, process efficiency and sustainability, they are also scaling up production capacities of the same to meet rising international demand. Key strategies include investing in the production of high-purity aluminum chloride, optimizing supply chains, and developing environmentally friendly methods.

Gulbrandsen Chemicals

Gulbrandsen Chemicals is a supplier of high-purity aluminum chloride to the pharmaceutical, petrochemical, and industrial catalyst industries. With a strong global distribution network, the company aims to increase manufacturing efficiency and sustainability. It keeps investing advanced production technologies for its market leadership.

BASF SE

BASF SE is active in the specialty chemicals sector, and manufactures aluminum chlorid for polymerization, Friedel-Crafts reactions and chlorination processes. With energy-efficient manufacture and environmental sustainability as a priority, the company has become a supplier of choice for industrial applications across the world.

Gujarat Alkalies and Chemicals Ltd.

The company is a major supplier of aluminum chloride in Asia which is used in water treatment, pharma and specialty chemicals etc., said GACL. The new facility will help the company scale up production to cater to rising demand for high-purity and industrial grades of aluminum chloride.

Kemira Oyj

Kemira Oyj develops aluminum chloride-based coagulants for usage in water treatment and wastewater treatment. The international aluminum chloride market has become increasingly dependent on the company as a result of their role in providing chemical solutions for municipal and industrial water treatment.

Aditya Birla Chemicals

Aditya Birla Chemicals produces aluminum chloride on a large scale, with economies of scale. The company can leverage its integrated supply chain and source raw materials from different locations for a competitive edge in the global market.

The market is estimated to reach a value of USD 1 billion by the end of 2025.

The market is projected to exhibit a CAGR of 4.6% over the assessment period.

The market is expected to clock revenue of USD 1.7 billion by end of 2035.

Key companies in the Aluminum Chloride Market include BASF SE, Gulbrandsen Chemicals, Gujarat Alkalies & Chemicals Ltd. (GACL)

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Kilotons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 4: Global Market Volume (Kilotons) Forecast by Production Method, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 8: Global Market Volume (Kilotons) Forecast by End-Use Industries, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 12: North America Market Volume (Kilotons) Forecast by Production Method, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 16: North America Market Volume (Kilotons) Forecast by End-Use Industries, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 20: Latin America Market Volume (Kilotons) Forecast by Production Method, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 24: Latin America Market Volume (Kilotons) Forecast by End-Use Industries, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 28: Western Europe Market Volume (Kilotons) Forecast by Production Method, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 32: Western Europe Market Volume (Kilotons) Forecast by End-Use Industries, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 36: Eastern Europe Market Volume (Kilotons) Forecast by Production Method, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 40: Eastern Europe Market Volume (Kilotons) Forecast by End-Use Industries, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Kilotons) Forecast by Production Method, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Kilotons) Forecast by End-Use Industries, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 52: East Asia Market Volume (Kilotons) Forecast by Production Method, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 56: East Asia Market Volume (Kilotons) Forecast by End-Use Industries, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Production Method, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Kilotons) Forecast by Production Method, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Kilotons) Forecast by End-Use Industries, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Kilotons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 10: Global Market Volume (Kilotons) Analysis by Production Method, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 18: Global Market Volume (Kilotons) Analysis by End-Use Industries, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 21: Global Market Attractiveness by Production Method, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 34: North America Market Volume (Kilotons) Analysis by Production Method, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 42: North America Market Volume (Kilotons) Analysis by End-Use Industries, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 45: North America Market Attractiveness by Production Method, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 58: Latin America Market Volume (Kilotons) Analysis by Production Method, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 66: Latin America Market Volume (Kilotons) Analysis by End-Use Industries, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Production Method, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 82: Western Europe Market Volume (Kilotons) Analysis by Production Method, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 90: Western Europe Market Volume (Kilotons) Analysis by End-Use Industries, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Production Method, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Kilotons) Analysis by Production Method, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Kilotons) Analysis by End-Use Industries, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Production Method, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Kilotons) Analysis by Production Method, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Kilotons) Analysis by End-Use Industries, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Production Method, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 154: East Asia Market Volume (Kilotons) Analysis by Production Method, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 162: East Asia Market Volume (Kilotons) Analysis by End-Use Industries, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Production Method, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Production Method, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Production Method, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Kilotons) Analysis by Production Method, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Production Method, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Production Method, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Kilotons) Analysis by End-Use Industries, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Production Method, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminium Profiles for Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Fishing Boat Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Foil Seal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium-Free Deodorant Market Analysis - Trends, Growth & Forecast 2025 to 2035

Competitive Breakdown of Aluminium Cup Suppliers

Competitive Landscape of Aluminium Foil Zipper Pouch Providers

Market Share Insights for Aluminium Bottle Providers

Aluminium Ion Battery Market Growth - Trends & Forecast 2025 to 2035

Aluminium Cup Market Trends - Size, Growth & Demand 2025 to 2035

Aluminium Bottle Market Growth – Size, Demand & Forecast 2025 to 2035

Aluminum Foil Zipper Pouch Market Trends - Growth & Forecast 2024 to 2034

Aluminium Foil Sachet Market

Aluminium Production Chemicals Market

Aluminium Composite Panels Market

Aluminium Nitride Market

USA Aluminium Bottle Market Insights – Demand, Size & Industry Trends 2025-2035

Japan Aluminium Bottle Market Insights – Growth, Demand & Trends 2025-2035

ASEAN Aluminium Bottle Market Insights – Growth, Demand & Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA