Aluminium bottle manufacturing is expanding exponentially with companies creating light, tough, and environmentally friendly packaging materials. With heightened demands from the beverages, personal care, pharmaceuticals, and industrial segments, sustainable materials, high-barrier coating, and cutting-edge designs attract manufacturers' attention. Companies embed automation, artificial intelligence-powered quality control, and recyclable components to achieve enhanced production efficiency and environmental compliance.

Industry players advance recyclable aluminum, intelligent features of packaging, and precision mold technologies to optimize product integrity and sustainability. Trends move towards the adoption of lighter, reusable, and tamper-resistant aluminum bottles that maximize brandability and regulation adherence.

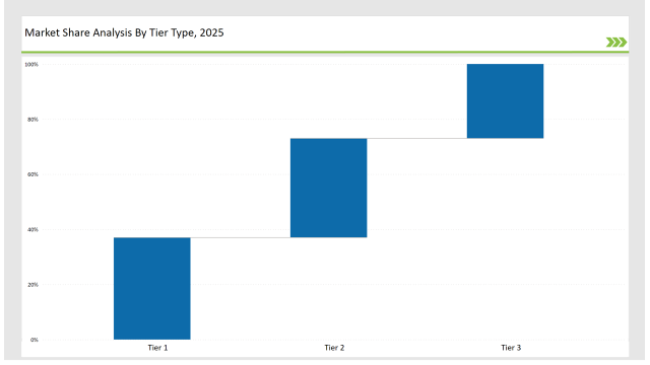

Tier 1 companies like Ball Corporation, Trivium Packaging, and Ardagh Group dominate 37% of the market through extensive production, innovative manufacturing technologies, and robust distribution channels.

Tier 2 players such as Crown Holdings, EXAL Corporation, and CCL Container control 36% market share with a focus on customization, sustainability, and innovative product design.

Tier 3 players, including regional and niche companies, hold 27% of the market share, which is focused on green coatings, intelligent packaging, and innovative bottle shaping technologies.

Explore FMI!

Book a free demo

Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Ball Corporation, Trivium Packaging, Ardagh Group) | 19% |

| Rest of Top 5 (Crown Holdings, EXAL Corporation) | 12% |

| Next 5 of Top 10 (CCL Container, Envases Group, Cosme Packaging, Mauser Packaging, Great Western Containers) | 6% |

The aluminium bottle industry serves multiple sectors where durability, sustainability, and aesthetic appeal are essential. Companies integrate advanced coating technologies and AI-driven production monitoring to enhance product quality and regulatory compliance. Manufacturers adopt high-speed forming techniques to improve production efficiency. They implement laser-based quality inspection systems to ensure defect-free products. Businesses develop refillable packaging solutions to reduce environmental impact.

Manufacturers refine aluminium bottle solutions with smart coatings, tamper-evident closures, and AI-enhanced production techniques. AI-driven defect detection improves quality assurance and minimizes waste. Companies adopt high-speed manufacturing techniques to increase efficiency. They implement precision molding to enhance design consistency and durability. Firms integrate automated inspection systems to detect and eliminate defects. Businesses utilize lightweight alloys to improve bottle strength while reducing material usage.

Companies accelerate aluminium bottle technology developments with the help of AI-driven defect detection, high-speed moulding processes, and light weight materials. Companies reduce ultra-thin aluminium walls to trim weight at no compromise of resilience. Advanced companies employ intelligent packaging solutions to optimize monitoring, validation, and end-user engagement. Companiers apply high-pressure forming processes to maximize bottle strength and minimize material loss. Companies design modular production lines to maximize scalability and flexibility. Companies optimize coatings for improved UV protection and shelf life. Companies use tamper-evident seals to enhance security and customer confidence. Industry participants use AI-driven logistics solutions to automate delivery and minimize delays. Companies employ 3D printing for rapid prototyping and cost-effective customization.

Year-on-Year Leaders

Technology vendors need to emphasize sustainability, automation, and security aspects in order to exploit market growth. Integration with beverage, personal care, and pharmaceutical companies will create demand and innovation. AI-based supply chain analytics need to be adopted by companies to make them efficient and cost-saving. Blockchain technology needs to be integrated by manufacturers to provide authentication and transparency. Firms need to invest in biodegradable materials to address changing sustainability regulations. Companies can adopt predictive maintenance systems to maximize production uptime. Refillable aluminium bottle programmes should be developed by industry players to encourage circular economy approaches.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Ball Corporation, Trivium Packaging, Ardagh Group |

| Tier 2 | Crown Holdings, EXAL Corporation, CCL Container |

| Tier 3 | Envases Group, Cosme Packaging, Mauser Packaging, Great Western Containers |

Leading manufacturers enhance AI-driven production, sustainable materials, and smart bottle technology. They integrate lightweight, high-barrier coatings to improve durability and shelf life. Companies develop cloud-based defect detection systems to optimize manufacturing efficiency. Manufacturers implement AI-driven robotics to streamline production and reduce human errors. Firms adopt high-speed filling technologies to increase efficiency and minimize waste. Businesses integrate biodegradable linings to support sustainability goals. Companies enhance customization capabilities with laser-engraved branding. Industry leaders introduce vacuum-sealed designs to extend shelf life and maintain product integrity.

| Manufacturer | Latest Developments |

|---|---|

| Ball Corporation | Expanded sustainable aluminium bottle production (March 2024) |

| Trivium Packaging | Launched tamper-resistant lightweight designs (April 2024) |

| Ardagh Group | Introduced high-barrier coatings (May 2024) |

| Crown Holdings | Released AI-driven defect detection technology (June 2024) |

| EXAL Corporation | Innovated custom ergonomic designs (July 2024) |

| CCL Container | Developed smart bottle NFC integration (August 2024) |

| Envases Group | Strengthened recyclable aluminium manufacturing (September 2024) |

The aluminium bottle market evolves as companies invest in automation, sustainable materials, and smart packaging. Firms integrate AI-driven defect detection, lightweight materials, and tamper-proof features to enhance product quality and efficiency. Companies develop advanced printing technologies to enable high-resolution branding and customization. Manufacturers adopt energy-efficient production methods to reduce environmental impact. Businesses enhance supply chain transparency with blockchain integration. Firms implement AI-driven predictive maintenance to minimize downtime. Industry leaders introduce ultra-thin aluminium walls to reduce material usage without compromising strength.

Manufacturers develop AI-driven personalization, ultra-lightweight materials, and smart packaging solutions. They refine recyclable and reusable aluminium bottles while integrating IoT-enabled tracking systems to enhance consumer experience and reduce waste. Companies enhance thermal insulation properties to improve temperature retention. They implement laser-etched branding to create durable, high-quality logos. Firms introduce bio-based polymer coatings to increase recyclability and sustainability. Manufacturers develop pressure-resistant bottles for carbonated beverages. Businesses integrate machine learning to optimize production efficiency and reduce resource consumption. Companies expand refillable bottle programs to support a circular economy. Industry leaders adopt advanced sterilization techniques to ensure product safety.

Ball Corporation, Trivium Packaging, Ardagh Group, Crown Holdings, EXAL Corporation, CCL Container, Envases Group, Cosme Packaging, Mauser Packaging, Great Western Containers.

The top 3 players collectively hold 19% of the global market.

The market shows medium concentration, with top players holding 37%.

The industry benefits from rising consumer demand for sustainable packaging, technological advancements in lightweight materials, and the expansion of refillable and recyclable bottle programs.

Cutter Box Films Market Growth – Demand & Trends Forecast 2025-2035

Disposable Tea Flask Market Trends – Growth & Forecast 2025 to 2035

Stretch Blow Molding Machines Market Segmentation based on Technology Type, Orientation Type, End Use, and Region: A Forecast for 2025 and 2035

Degassing Valves Market Analysis - Growth & Demand 2025 to 2035

Custom Binders Market Growth & Industry Forecast 2025-2035

Corner Pads Market Insights - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.