Alu Alu cold blister films, also referred to as cold-formed aluminum foil (CFF) packaging, provide excellent protection against external factors like moisture, oxygen, and light, and hence are preferred for the packaging of pharmaceuticals products, which are sensitive to temperature and moisture, such as tablets and capsules. These films are extensively utilized in the pharmaceutical and healthcare vertical, where the efficacy of the drugs and longer shelf life are of utmost importance.

Increasing global pharmaceutical production, especially in emerging economies like India, China, and Brazil, is one of the major market growth drivers. In view of strict regulatory norms from FDA, EMA, WHO, among other agencies, pharmaceutical manufacturers are keen on advanced product packaging materials, which also elongate the integrity of the product.

Alu Alu cold blister films satisfy these needs by offering better protection and minimizing contamination risks. The growing incidence of chronic diseases and rising consumption of prescription drugs have also increased the requirement for secure, tamper-resistant package solutions.

Also, the market is driven by technological advancements in manufacturing Alu Alu cold blister film. The adoption of innovative co-extruded multilayer high-barrier structures, advanced cold-forming capabilities and use of sustainable alternatives are on the rise.

Further, sustainable packaging trends are prompting manufacturers to design recyclable and biodegradable aluminum-based blister films in accordance with global environmental regulations. We also expect the market to witness market adoption driven by the integration of smart packaging technologies, such as track-and-trace features and anti-counterfeiting, into the traditional packaging system.

But high production costs, limited recyclability, and competition with alternative packaging materials (thermoformed PVC and PVdC films) remain challenges for the market. Despite these challenges, the burgeoning demand for high-barrier solutions in the pharmaceutical industry coupled with the steady uptick in material tech innovations will propel the market in the long term.

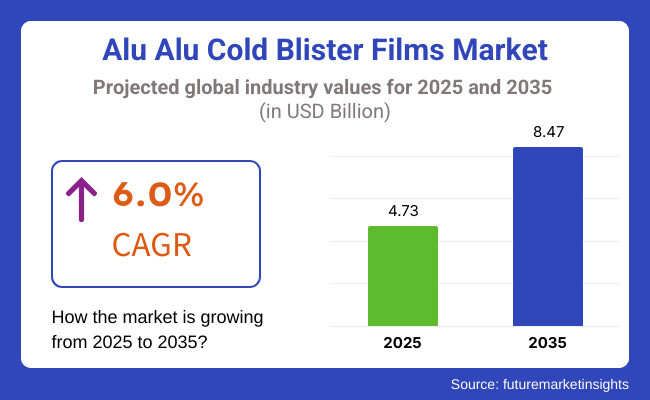

The Alu Alu cold blister films market accounted for USD 4.73 billion in the year 2025 and is expected to reach USD 8.47 billion by the year 2035, at a CAGR of 6.0% during the forecast period.

The United States and Canada, with their strict and robust pharmaceutical packaging regulations coupled with the presence of key drug manufacturers is a significant market for Alu Alu cold blister films in North America. The escalating emphasis on patient safety and tamper-proof packaging in the region is contributing to the growth of the market.

Europe remains strong market with Germany, France and the UK lead the field of high-barrier pharmaceutical packaging. Sustainable drug packaging pushes innovation and investment in Alu Alu cold blister films with European Union stringent drug safety regulations.

Owing to China, India, and Japan, Asia-Pacific is projected to be the fastest growing market. The rapidly expanding regional pharma space is focused on generic drug export and manufacture, and consequently increasing the demand for high barrier, affordable packaging products.

And in these countries, especially Brazil and Mexico, the pharmaceutical industry is backing the incremental growth. But its uptake could be slower considering the relatively steep price of the material and other more affordable options also on the market.

Middle East & Africa is expected to be growing at slower pace essentially with countries like Saudi Arabia, UAE and South Africa proving the lead with their burgeoning pharmaceutical manufacturing capabilities. Growing demand for domestic manufacturing of the drug due to government measures will in turn boost the need for the use of Alu Alu cold blister film in future.

Challenges

High Manufacturing Costs and Material Sourcing Issues

The Alu Alu Cold Blister Films Market is confronted by one of the most challenging circumstances, the elevated expense of production due to the high prices of raw materials that are essential to the manufacturing process. The layered construction of these films - containing aluminum, polyvinyl chloride (PVC) and other barrier materials - increases manufacturing costs.

Additionally, there is the strict pharmaceutical packaging compliance requirements associated with closed-door inspections, which can be difficult to meet for small- and mid-sized manufacturers. These operational challenges are exacerbated by the need for a specialist machinery and knowledge.

Opportunities

Rising Demand for High-Barrier Pharmaceutical Packaging

High Barrier Pharmaceutical Packaging Market Outlook High-barrier pharmaceutical packaging business recognizes that the growing demand for pharmaceutical products worldwide provides significant growth opportunities. These advanced Alu Alu cold blister films are the best protecting it against moisture, oxygen and light which is the perfect condition for drugs to have longer shelf life.

The rise of pharmaceutical industry in developing countries is one of the primary factors driving the use of these films. A new green and recyclable packaging material is emerging, it may lead to the next generation sustainable cold-form blister films.

Between 2020 and 2024, the Alu Alu cold blister films market experienced steady growth due to heightened pharmaceutical production and stricter drug safety regulations. The COVID-19 pandemic reinforced the need for secure and tamper-proof drug packaging, accelerating the adoption of cold-form blister films. However, high material costs, supply chain disruptions, and regulatory compliance issues remained key challenges.

Looking ahead to 2025 to 2035, the market will witness advancements in sustainable packaging solutions, digital traceability, and AI-driven quality control. Biodegradable and recyclable Alu Alu films will gain traction as sustainability becomes a priority in pharmaceutical packaging.

Additionally, the integration of smart packaging technologies, such as embedded QR codes for authentication and patient compliance tracking, will redefine the industry.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with pharmaceutical packaging safety regulations |

| Market Growth | Growth driven by pharmaceutical production and drug protection needs |

| Industry Adoption | Use of conventional Alu Alu films for standard drug packaging |

| Technology Innovations | Advances in multi-layer barrier films for improved drug stability |

| Market Competition | Dominance of established pharmaceutical packaging material manufacturers |

| Sustainability and Efficiency | Limited use of recyclable cold-form blister films |

| Smart Packaging Integration | Basic tamper-proof and high-barrier packaging solutions |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global packaging standards, focus on sustainability and traceability |

| Market Growth | Expansion into biopharmaceutical and specialty drug packaging |

| Industry Adoption | Increased adoption of eco-friendly, biodegradable, and recyclable blister films |

| Technology Innovations | Smart packaging with embedded digital tracking and real-time authentication |

| Market Competition | Entry of sustainable packaging startups and advanced film technology providers |

| Sustainability and Efficiency | Large-scale adoption of biodegradable and aluminum-based sustainable packaging |

| Smart Packaging Integration | AI-driven defect detection, QR code-enabled patient tracking, and digital serialization |

With an increasing demand for drug stability, long shelf life, and the overall stability of drug products, pharmaceutical manufacturers are turning to high-barrier Alu-Alu cold-formed blister films as the ideal solution to keep sensitive drug formulations protected from moisture, oxygen, and light.

This trend has been especially fueled by the rising prevalence of chronic diseases & aging of the population which is driving the demand for oral solid dosage (OSD) forms such as tablets & capsules to further propel high-profile blister packaging market.

Most notably, contract manufacturing organizations (CMOs) and generic drug manufacturers are ramping up production as well, thus creating the demand for frugal and tamper-proof packaging alternatives.

United States is likely to witness increasing focus on sustainable and eco-friendly pharmaceutical packaging, which shall further urge manufacturers in country look to develop recyclable, lighter, and energy-efficient Alu-Alu cold blister films.

In addition, as the biologics, nutraceuticals, and specialty drugs market continues to expand, the increasing need for higher protection and pharmaceutical regulatory compliances is expected to propel the demand for advanced cold-forming films.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

The Alu-Alu cold blister films market in United Kingdom is mainly driven by growing pharmaceutical exports, wider adoption of tamper-resistant packaging and compliance with stringent MHRA (Medicines and Healthcare products Regulatory Agency) standards.

This growing self-medication and homecare trend, which relies on easily accessible, safe, and simple packaging and handled solutions, will only increase investment in high-barrier Alu-Alu cold-formed blister films.

Cold-forming films in the UK are also getting popular as a country, the UK is creating high demands for maintaining longer shelf life and protection against external conditions for its nutraceutical and food supplements and are one of the fastest-growing industries.

The latest trend in packaging is to achieve a sustainable future; therefore, manufacturers are working diligently to prepare sustainable packaging solutions which are lighter and environment-friendly whilst that Alu-Alu films offer benefits of protection as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.8% |

The Alu Alu cold blister films market in the European Union mode the growth at a steady pace, owing to stringent comformity standards set up by the EU pharmaceutical industry, increasing pharmaceutical export rates along with growing demand and availability for high-barrier sustainable packaging solutions.

As we head into the future, countries such as Germany, France and Italy are emerging as a front-runner pharmaceutical hub, while R&D spending on advanced drug packaging technologies continues to expand to foster drug stability and compliance with the EU.

Serialization-ready, tamper-evident, and high-barrier Alu-Alu cold blister films are now being mandated for pharmaceutical companies due to the EU’s Falsified Medicines Directive (FMD) and Good Manufacturing Practices (GMP) regulations. Also, the prevalence of eco-friendly pharmaceutical packaging solutions is creating opportunities for innovations in planet-friendly cold-formed aluminum laminates, which offer enhanced product protection with least environmental footprint.

The use of biologics and personalized medicine is growing, and with it comes demand for moisture-resistant packing and oxygen-barrier packaging solutions – fuel the need for high-performance Alu-Alu cold-forming films and investment.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.0% |

Japan's Alu-Alu cold blister film market is expected to be growing steadily, owing to a strong pharmaceutical manufacturing capacity, aging population, and healthy demand for high-barrier pharmaceutical packaging.

Due to strict measures for quality control (under the Pharmaceutical and Medical Device Act (PMDA), the use of high-performance, tamper-proof Alu-Alu blister films in drug packaging becomes very particular.

Faced with the aging population, Japan has a long-term need for medication, which further promotes the demand for moisture-proof, lightweight & elderly-oriented pharmaceutical packaging products. In addition, cold forming blister film is being given a boost through precision engineering and automated mechanization in Japan.

As sustainability becomes a greater focus, Japanese pharmaceutical makers are migrating to eco-conscious, recyclable cold-formed aluminum laminates that deliver robust barrier protection but with a smaller carbon footprint.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

Alu-Alu cold blister films are plastic pharmaceutical films widely used for the manufacturing of pharmaceutical products such as tablets, capsules, and others. It is due to such barriers of entry in pharmaceutical and biotech industries is drawing large amount of investment and creating huge market demand for high-barrier Alu-Alu cold-forming blister films, which assure stability and shelf life of drugs.

A South Korean ongoing development of its advanced technology sector, along with the increasing adoption of smart technologies, is fuelling automation in the packaging industry, including in pharmaceutical packaging, where more and more AI-driven and IoT-enabled packaging solutions are being embraced.

South Korea's strong sustainability push is also motivating manufacturers to produce eco-safe cold formed aluminum films in order to reduce waste and enhance recyclability.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

Face seal blister films represent the most preferred sub-type of Alu Alu cold blister films, mainly because they offer secure, tamper-evident, and cost-effective packaging. These films can be manufactured with a thin layer of plastic that is sealed to a coated paperboard backing for product visibility and protection from outside agents.

Face seal blister films are a popular choice for manufacturers, and as they use less plastic than conventional clamshell options, provide a cost-effective solution. This clear plastic film boosts consumer assurance as it allows the customers to see the product without opening the pack.

This type of packaging adds an extra layer of security that can help protect against unauthorized access and damage to the product. Face seal blister films are suited for low-volume packaging in sensitive industries such as pharmaceuticals, personal care, and consumer electronics and also streamline the manufacturing process for complex structures, and they adapt well to automated packaging lines.

The rise of eco-friendly blister packaging has also contributed to the growth of face seal films, as organizations increasingly move toward weight-efficient, recyclable, and biodegradable materials to minimize their environmental footprint.

The growth of trapped blister films is driven by their added security, aesthetic appeal, and sustainability advantages. These films are sandwiched between two layers of paperboard rather than sealed to only one layer on the ends, which means plastic is reduced and the extra layers mean better rigidity to protect the fragile contents.

Trapped blister films with paperboard layers are now preferred because they cut down on plastic usage by replacing significant amounts of plastic in these films, making them a more sustainable choice. This type of packaging creates a luxurious look and feel, making it suitable for upscale cosmetics, electronics and medical devices.

The new paperboard layer also provides an additional level of structural support and can help minimize both product breakage and deformation during shipping and handling. That's a full sized printable area, enabling colorful graphics and branding elements that help differentiate the product on retail shelves.

Trapped blister packaging is gaining popularity as an alternative to conventional blister in recent years because the regulatory pressures to create sustainable solutions for plastic waste collection are increasing. With the implementation of regulations greater in various areas of protected substances, demand for trapped bubble movies is predicted to boost across various industries.

Alu Alu cold blister films are preferred for tablets, as tablets account for 60% or more of the global application segment. These films have better moisture, oxygen, and light barrier properties, which. Enables them extended shelf life and drug stability.

Alu Alu cold blister films have become an indispensable material for the pharmaceutical industry as they provide much better protection (100% moisture, oxygen, and UV light barrier, preventing the tablets from degrading) using a combination of polyamide and aluminium.

The cold-formed blister films meet the global standards fully compliant with the global pharmaceutical packaging guidelines which ensures medication safety and integrity. The sealed structure ensures a minimum security level where opening and thus contamination is not possible. The use of blister packaging allows for single dose dispensing which can improve patient adherence to prescribed clinical regimens.

Pharmaceutical companies are handling Alu Alu cold blister films as their lifeline for maintaining tablet efficacy and shelf life due to the increase in generic drug production and personalized medicine.

Alu Alu cold blister films are also widely used in the medical device industry as they offer sterile, contamination-free, and tamper-resistant packaging.

These films preserve essential healthcare products like surgical instruments, syringes, and diagnostic tools from moisture, oxygen, and external contamination. In conclusion, the excellent barrier properties and durability of Alu Alu blister films help maintain medical devices in perfect condition in their original trammel until their use, which is why they are used by numerous health manufacturers.

The Alu Alu cold blister films such as moisture resistance, as well as the superior chemical barrier they create, unlike polymer film or other types of tablet strips. Commonly used for temperature-sensitive drugs Alu Alu cold blister films offer a longer shelf life and compliance with various regulations.

Makers in the market are emphasizing on material innovation, sustainable aluminum sourcing, and advanced barrier technologies integration to enhance quality and efficacy of product.

Market Share Analysis by Key Players & Cold Blister Film Providers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Amcor Plc | 18-22% |

| Constantia Flexibles Group | 14-18% |

| Huhtamaki PPL Ltd. | 10-14% |

| Uflex Ltd. | 8-12% |

| Winpak Ltd. | 6-10% |

| Others | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Amcor Plc | Specializes in high-barrier Alu Alu cold blister films with advanced moisture and oxygen resistance for pharmaceutical packaging. |

| Constantia Flexibles Group | Develops sustainable and lightweight Alu Alu films with high-performance cold forming properties. |

| Huhtamaki PPL Ltd. | Provides cost-effective Alu Alu cold blister films with superior lidding and sealing capabilities. |

| Uflex Ltd. | Offers innovative, eco-friendly Alu Alu cold blister films with enhanced recyclability and minimal material waste. |

| Winpak Ltd. | Manufactures ultra-thin, high-strength cold-formed aluminum blister films for pharmaceutical applications. |

Key Market Insights

Amcor Plc (18-22%)

Amcor leads the market with its premium-quality Alu Alu cold blister films, integrating nanocoating technology for improved barrier properties and extended drug shelf life.

Constantia Flexibles Group (14-18%)

Constantia is an innovator in lightweight and sustainable Alu Alu cold blister films, and also applies advanced polymer coatings to maximize the flexibility and strength of the material.

Huhtamaki PPL Ltd. (10-14%)

Huhtamaki focuses on cost-effective and highly customizable Alu Alu films with advanced lamination techniques to improve pharmaceutical protection.

Uflex Ltd. (8-12%)

Uflex is investing in eco-friendly cold blister packaging, developing recyclable aluminum structures with superior cold-forming capabilities.

Winpak Ltd. (6-10%)

Winpak is known for its ultra-thin, high-strength Alu Alu cold blister films that reduce material usage while maintaining excellent protective properties.

Several manufacturers contribute to market growth by developing innovative Alu Alu cold blister films with a focus on sustainability and enhanced performance. These include:

The overall market size for Alu Alu cold blister films market was USD 4.73 billion in 2025.

The Alu Alu cold blister films market is expected to reach USD 8.47 billion in 2035.

The demand for the Alu Alu cold blister films market will rise due to increasing adoption of high-barrier packaging solutions, driven by the growing need for pharmaceutical product protection, rising regulatory compliance for drug packaging, and the expanding use of moisture-resistant and tamper-proof materials. Additionally, the shift toward sustainable and advanced packaging technologies, the integration of improved multilayer film structures, and the rising demand from the healthcare and nutraceutical industries for extended shelf-life solutions will further propel market growth during the forecast period.

The top 5 countries which drives the development of Alu Alu cold blister films market are USA, European Union, Japan, South Korea and UK.

Trapped Blister Films to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share & Competitive Positioning in Alu Alu Cold Blister Films

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Foil Zipper Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Alu-Alu Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Profiles for Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Alunite Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA