The Alu Alu blister packaging machine market has shown tremendous growth due to the demands from pharmaceutical, health and nutraceutical industries for high barrier, tamper-proof, and extended shelf life packaging. In order to achieve efficiency and compliance with regulations, companies are creating an environment where they could incorporate business automation, artificial intelligence-based quality inspection and energy-efficient production.

Industry innovators focus on all aspects of high speed manufacturing, green materials and accuracy engineering that guarantee the highest machine efficiency and integrity of packaging. The industry is heading towards full automation and high volume clean, green solutions for blister packaging attributable to product safety and regulatory compliance.

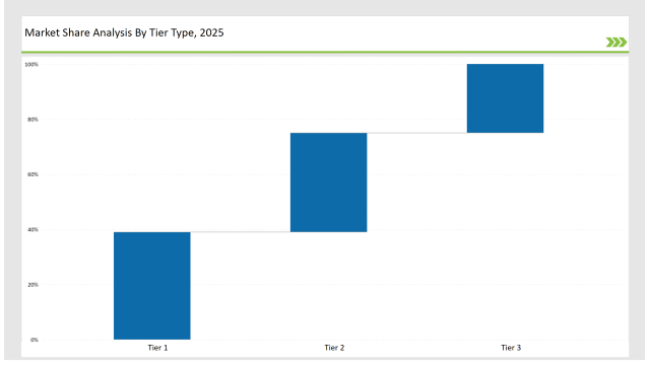

Tier 1 companies dominate close to 39% of this market with highly advanced robotics, global distribution networks, and high-precision engineering. These include Uhlmann, Romaco and Marchesini Group.

Tier 2 companies like IMA Group, Bosch Packaging and Hoonga have approximately covered 36 % of the market in which they target cost-efficient, modular, and flexible machine solutions.

Tier 3 players include regional and niche companies which target 25% of the market because they manufacture customized machines, small size, and eco-friendly blister packaging innovations..

Explore FMI!

Book a free demo

| Category | Market Share (%) |

|---|---|

| Top 3 (Uhlmann, Romaco, Marchesini Group) | 18% |

| Rest of Top 5 (IMA Group, Bosch Packaging) | 13% |

| Next 5 of Top 10 (Hoonga, Mediseal, Sepha, Jornen, CAM) | 8% |

The Alu Alu blister packaging machine industry serves multiple sectors that require moisture protection, barrier properties, and tamper resistance. Companies enhance intelligent control systems and AI-driven defect detection to improve precision and efficiency. Manufacturers implement real-time monitoring to ensure consistent packaging quality. They adopt high-speed automation to increase production rates. Firms optimize material usage to reduce waste and enhance sustainability.

Manufacturers refine Alu Alu blister packaging machines with automated material handling, predictive maintenance, and sustainable packaging compatibility. AI-driven defect detection ensures consistent seal integrity and minimal wastage. Companies integrate real-time monitoring systems to track production efficiency. They develop faster tooling changeover mechanisms to enhance operational speed. Firms implement data-driven decision-making to optimize material usage and reduce costs.

Companies accelerate blister packaging innovation by adopting high-speed sealing, automated tooling changeovers, and IoT-enabled performance monitoring. They refine sustainable material usage and AI-powered process optimization to meet regulatory and environmental standards. Industry leaders implement smart diagnostics and remote maintenance to improve uptime and reduce operational costs. Manufacturers integrate AI-driven predictive analytics to optimize production planning. They develop advanced material coatings to enhance packaging durability. Companies invest in high-efficiency energy solutions to reduce production costs. Firms incorporate augmented reality (AR) for enhanced operational training and machine maintenance. Businesses implement blockchain-based tracking systems to improve supply chain transparency.

Technology suppliers should prioritize automation, sustainability, and high-speed production efficiency to maintain competitiveness. Collaborating with pharmaceutical, nutraceutical, and medical device industries will drive innovation and market expansion. Companies should integrate AI-driven monitoring systems to enhance real-time data analysis. They must adopt cloud-based platforms to optimize supply chain transparency. Firms should focus on developing energy-efficient machines to meet regulatory sustainability requirements.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Uhlmann, Romaco, Marchesini Group |

| Tier 2 | IMA Group, Bosch Packaging, Hoonga |

| Tier 3 | Mediseal, Sepha, Jornen, CAM |

Leading manufacturers enhance AI-driven packaging efficiency, remote diagnostics, and high-speed tooling changeovers. They integrate energy-efficient sealing systems and cloud-based performance tracking to optimize production workflows. Companies develop AI-powered calibration systems to improve packaging accuracy. They incorporate smart sensors to monitor real-time machine performance. Firms optimize material handling processes to reduce downtime and increase efficiency.

| Manufacturer | Latest Developments |

|---|---|

| Uhlmann | Expanded fully automated blister packaging (March 2024) |

| Romaco | Developed high-precision sealing solutions (April 2024) |

| Marchesini Group | Introduced sustainable blister materials (May 2024) |

| IMA Group | Released AI-powered defect detection (June 2024) |

| Bosch Packaging | Innovated high-speed modular solutions (July 2024) |

| Hoonga | Strengthened cost-effective compact machines (August 2024) |

| Mediseal | Enhanced vision inspection AI technology (September 2024) |

The Alu Alu blister packaging machine market evolves as companies invest in automation, smart materials, and sustainable packaging solutions. Firms integrate IoT-enabled diagnostics, high-speed changeovers, and AI-enhanced quality control to optimize efficiency and reliability. Manufacturers implement predictive maintenance systems to reduce downtime and enhance equipment longevity. They incorporate high-speed filling mechanisms to improve production output. Companies develop tamper-evident packaging features to ensure product integrity.

Manufacturers develop AI-powered customization, next-gen eco-friendly materials, and high-speed automation. They optimize modular designs for versatile manufacturing with real-time monitoring and predictive maintenance to optimize operational efficiency. Firms streamline heat-sealing processes for increased packaging ruggedness. Firms use robotic assembly lines to increase accuracy and minimize human mistakes. Firms implement AI-based analytics to forecast maintenance requirements and minimize downtime. Firms improve energy efficiency by utilizing renewable energy sources for manufacturing processes. Producers create intelligent packaging solutions to allow products to be tracked in real time. Businesses utilize blockchain technology to provide transparency to the supply chain.

Uhlmann, Romaco, Marchesini Group, IMA Group, Bosch Packaging, Hoonga, Mediseal, Sepha, Jornen, CAM.

The top 3 players collectively hold 18% of the global market.

The market shows medium concentration, with top players holding 39%.

Companies are adopting AI-driven predictive maintenance, enhancing automation for increased efficiency, and integrating eco-friendly materials to meet sustainability goals.

Metallized PET Cartons Market Analysis – Trends & Demand 2025 to 2035

Kraft Paper Pouch Market Growth – Demand & Forecast 2025 to 2035

Mobile Cases and Covers Market Growth – Demand & Forecast 2025 to 2035

Heavy Duty Paper Tags Market Insights – Growth & Demand 2025 to 2035

Glass Growlers Market Demand & Packaging Innovations 2025 to 2035

HDPE Containers Market Insights & Growth Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.