The global Alu Alu blister packaging machine market is expected to scale a significant value while the healthcare, and pharmaceutical industry is flourishing and call for strong packaging solutions. The Alu Alu blister packages are common in packaging of sensitive pharmaceutical products.

The growth of the global pharmaceuticals market is a major driver of the market growth. Due to an increasing number of patients, the aging population, and a growing capacity to produce pharmaceuticals, the demand for the pharmaceutical packaging technologies has been elevated.

Technological lead in the coronavirus market also boosts demand for packaging machines. Since then, due to increased demand, the alu Alu blister packaging machine was developed into a more machinery-aided design for high production efficiency, and at the same time, to reduce material wastage and achieve high precision.

Integrating Industry 4.0 technologies that include IoT-enabled monitoring, predictive maintenance, and real-time quality control is changing the face of packaging. As per industry analysis, the demand for environment-friendly and sustainable packaging trend is fuelling the developments of recyclable materials such as aluminum, and low-energy consumption packaging machine operations.

Despite several advantages it offers, the market is hampered by factors such as high upfront investment in the solution, requirement of skilled resources to operate the machines and competition from different packaging formats (strip and sachet packaging). However, ongoing innovations and increasing demand for tamper-free and contamination-resistant packaging will counter these challenges.

Increasing pharmaceutical and nutraceutical sectors worldwide will drive demand in the Alu Alu blister packaging machine market, as manufacturers leverage automation, efficiency, and compliance with progressive standards of regulations.

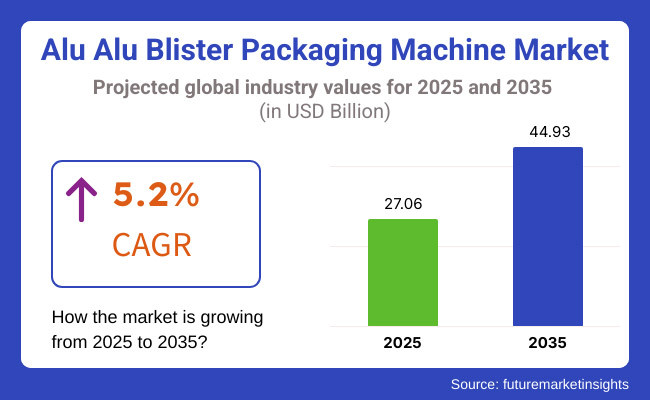

The Alu Alu blister packaging machine market accounted for USD 27.06 billion in the year 2025 and is expected to reach USD 44.93 billion by the year 2035, at a CAGR of 5.2% during the forecast period.

Explore FMI!

Book a free demo

The North America market for Alu Alu Blister Packaging Machine is the potential market in the most advanced region of the world, rather than in the few developing regions of the world, based on the North American region market (the United States, Canada and Mexico). Growth is being driven by the region’s heavily regulated pharmaceutical industry and strong investments in automation and packaging innovation.

Europe is an important market with the highest in the rank being Germany, France and the UK because of the established pharmaceutical manufacturing in these countries. Increasing adoption of Alu Alu blister packaging due to stringent EU packaging regulations and sustainability initiatives.

The Asia-Pacific region is growing quickly, with big players including China, India, and Japan. High-quality blister packaging solutions are in increasing demand, driven by strong output in the region’s pharmaceutical industry and higher generic drug production and exports.

As the pharmaceutical industries expand in Brazil, Mexico, and other Latin American states, Alu Alu blister packaging machines are being relied on increasingly. But the challenges of cost constraints and available packaging alternatives loom large.

Saudi Arabia, UAE, and South Africa are investing in pharmaceutical manufacturing capabilities, making the Middle East & Africa an emerging market for Alu Alu blister packaging. Future growth is also driven by government efforts to bolster domestic pharmaceutical production.

Challenges

High Initial Investment and Operational Complexity

The Alu Alu blister packaging machine market is challenged due to high initial investments for advanced blister packaging machines and complex machine operations.

As a result, a small to medium-sized pharmaceutical company is enclosed to grow in the market due to the lack of capital investment. And the requirement for specialized operators, routine maintenance and compliance with standards for pharmaceutical-grade packaging put a strain on manufacturers.

Opportunities

Growing Demand for Secure and Extended Shelf-Life Packaging

Increased need for tamper-proof, moisture resistance, and longer shelf-life packaging in the pharmaceutical and healthcare industries has been positively impacting the rise of the market. The global surge in regulatory standards on drug safety is anticipated to boost the demand for Alu Alu blister packaging machines.

Moreover, with growing advancements in automation, smart monitoring, and sustainable packaging materials are offering new avenues for the manufacturers to improve efficacy and compliance.

From 2020 to 2024, the Alu Alu Blister Packaging Machine Market continued to grow steadily, fueled by the rising demand for high-barrier pharmaceutical packaging and the need to comply with stringent drug safety regulations. Market growth was restricted by factors including high instrument price, slow uptake among small-scale pharma firms, and difficulties overseeing maintenance.

Some key market developments expected to shape the manufacturing landscape during the 2025 to 2035 period may entail; intelligent blister packaging machines, IoT enabled monitoring systems, and sustainability driven innovations.

The laboratory with AI will not only provide quality control but also track defects ready and at delivery and target sustainable packaging material. As a result, high flexibility and compact, fully automated and high-speed blister packaging into plastic containers or blisters will solve the strong demand for maximum efficiency and cost reduction in pharmaceutical production.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with pharmaceutical packaging safety regulations |

| Market Growth | Demand driven by pharmaceutical production and drug safety concerns |

| Industry Adoption | Adoption of automated and semi-automated blister packaging machines |

| Technology Innovations | Development of precision sealing and barrier-protected packaging |

| Market Competition | Dominance of established pharmaceutical packaging equipment manufacturers |

| Sustainability and Efficiency | Limited adoption of eco-friendly blister materials |

| Smart Packaging Integration | Basic automation and monitoring features |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global packaging standards, focus on sustainability and drug traceability |

| Market Growth | Expansion into biopharmaceutical and nutraceutical packaging segments |

| Industry Adoption | Growth in AI-driven quality control, real-time monitoring, and predictive maintenance |

| Technology Innovations | Smart blister packaging with IoT connectivity and digital tracking features |

| Market Competition | Entry of tech-driven packaging startups and sustainable material innovators |

| Sustainability and Efficiency | Large-scale use of recyclable, biodegradable, and aluminum-based sustainable packaging |

| Smart Packaging Integration | AI-powered defect detection, real-time machine diagnostics, and automated material optimization |

United States Alu-Alu blister packaging machine market is growing with the fastest CAGR with a lucrative growth rate in the forecast year. Increasing demand for tamper-evident and moisture-resistant pharmaceutical packaging in turn is prompting investments in high-tech blister packaging techniques in the pharmaceutical and nutraceutical sectors.

Moreover, growing prevalence of chronic diseases coupled with aging population has increased consumption of oral solid dosage forms (OSDs) such as tablets & capsules which would further require high speed and efficient Alu-Alu blister packaging machines.

The increased focus on automation and the rising trend of high-performance blister card packaging, which is being driven by contract manufacturing organizations (CMOs) and the generic drug industry, is expected to propel the demand for blister packaging equipment.

Because sustainability trends are informing packaging innovations, packers are incorporating smart automation, real-time monitoring, and energy-efficient technologies in Alu-Alu blister packaging machines. The rise of biologics and specialty drugs along with the increasing demand for temperature and moisture-controlled packaging solutions has been supporting Europe Alu-Alu barrier blister pack market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

The United Kingdom Alu-Alu blister packaging machine market growth is driven by stringent pharmaceutical compliance regulations, growth in generics drug manufacturing, and the rising need for sustainable and high-barrier packaging solutions.

The regulations of the UK Medicines and Healthcare products Regulatory Agency (MHRA) are strict when it comes to packaging, motivating pharmaceutical companies to procure state-of-the-art Alu-Alu blister packaging machines that uphold product integrity and shelf-life.

Trend of home healthcare and self-medication has propelled the demand for patient-friendly, unit-dose packaging solutions, which in turn is expected to propel market growth of automated blister packaging machines. The strong nutraceutical industry in the UK, especially in terms of vitamins, dietary supplements, and functional foods, is additionally propelling the demand for moisture-proof and tamper-resistant packaging.

In addition, with sustainability emerging as a challenge, packaging machine manufacturers are responding with green and energy-efficient solutions for the upcoming trends of green pharmaceutical packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.1% |

With stringent pharmaceutical compliance standards, increasing automation in packaging, and a rising need for sustainable and tamper-proof drug packaging, the European Union (EU) Alu-Alu blister packaging machine market is growing steadily.

Particularly Germany, France, and Italy are the leading authorities in terms of pharmaceutical production and packaging machinery, but that's just some of the key markets for Alu-Alu blister packaging machines.

The Good Manufacturing Practices (GMP) and Falsified Medicines Directive (FMD) regulations in the EU have mandated serialization and track-and-trace packaging solutions that have compelled higher adoption rates for smart, automated Alu-Alu blister packaging machines. Moreover, the increasing occurrence of biosimilar, biologics, and personalized medicines are driving demand for moisture resistant and high barrier blister packaging solutions.

The market is witnessing a significant drive towards sustainable packaging solutions which in turn is triggering investments in energy-efficient and recyclable Alu-Alu blister packaging materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.3% |

Japan is a fast-developing market for Alu-Alu blister packaging machines due to the growing demand from pharmaceutical manufacturing sector with the integrated approach of wariness program measuring quality of medicines, growing geriatric population coupled with the providing high standards of living leading to increase in the healthcare expenditure, and high demand from precision engineered packaging machinery.

The Pharmaceutical and Medical Device Act (PMDA) enforces quality control and traceability, thus maintaining high levels of automated and smart packaging.

As Japan’s aging population pushes demand for drugs, pharmaceutical makers are spending on high-barrier blister packaging that will guarantee longer lifespans and stronger drug stability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

The increasing demand for the blister packaging machine market in the pharmaceutical industry in South Korea can also be attributed to the need to meet the ever-increasing standards of stringency, automation in packaging facilities, and strong government regulations on drug safety, as the country’s pharmaceutical exports are growing rapidly.

The Korea Food & Drug Administration (KFDA) requires tamper-evident and high barrier packaging that is why advanced Alu-Alu blister packaging solutions are integrated.

Their biopharmaceutical industry is growing with big investments in biologics and biosimilar, resulting in an increase in the demand for Alu-Alu blister packing machines of good quality. Moreover, smart packaging solutions, such as Artificial Intelligence (AI)-assisted tracking and Internet of Things (IoT) platforms, are being swiftly embraced in the pharmaceutical packaging industry.

The manufacturers in the country are also being driven to produce energy-efficient and recyclable packaging machinery as the country is focusing on reducing plastic waste and promoting sustainable packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The segment segmentation of the blister packaging machines market is cantilever-type, which are more prevalent than rotary blister packers, due to their efficient design, easy maintenance and high flexibilities.

These machines have a modular construction, which makes changeovers fast, access easy and downtime low. These machines are preferred in industries such as pharmaceuticals, healthcare, and food processing that require high-speed packaging as well as packaging formats with minimum material wastage.

The cantilever type blister machines preferred by pharmaceutical, food, and medical device manufacturers provide precise sealing, high-speed processing and automated production lines. Because of their small layout, there’s less opportunity for microbial contamination, making them the perfect solution for industries where hygiene is everything - think pharmaceutical manufacturing.

The rise in the demand for high-output packaging lines has led to the adoption of cantilever-type machines, as they can be easily integrated with other packaging equipment. As personalized medicine and unit-dose packaging gains popularity these machines remain a go-to choice for high-precision small- batch production runs.

They further boost efficiency with an optimal user interface that enables operators to adjust settings in real-time while keeping the probability of human mistake as minimal as possible.

The increasing demand for liquid pharmaceutical routes, gels, and specialist consumer products will spur the popularity of liquid automatic filling blister machines. Not only do these machines provide accurate and volumetric filling, but they also seal the bottles in a leak-proof manner, and are compatible with liquids of various viscosities, making these screw capping machines an important tool for any liquid-centric industry.

Liquid blister packaging is gaining traction in the beverage and dairy industries as an alternative to standard bottles and sachets, fuelling a growth in demand for liquid automatic filling blister machines. They are more commonly being employed for unit-dose packaging too, improving the accuracy of dispensing and reducing risk of contamination.

Growing customer demand for pre-measured liquid products, especially in child-resistant and tamper-evident packaging, has led manufacturers to increasingly invest in advanced liquid automatic filling machines that offer efficient, sterile, and contamination-free processing פ!

Platen sealing machines have the highest market share among the sealing types, on account of the uniform distribution of heat, strong sealing integrity and suitability for different materials. Capable of forming seals that are airtight and tamper-resistant against moisture, oxygen, and contaminants, these machines use heat and pressure to protect products.

These advantages of using platen sealing in the manufacturing process have made this process a well-known technology in pharmaceuticals, healthcare, and consumer goods where a variety of packaging materials including PVC, PVDC, and aluminum foil can be processed.

This uniform sealing pressure improves seal integrity and significantly decreases the probability of leaks and seal failures, making these machines a preferred choice for manufacturers.

Platen sealing is also economical with a high output rate, making it the technology of choice for organizations looking to expand their packaging process without sacrificing quality. Growing adoption of platen sealing machines in worldwide markets can be attributed to stringent pharmaceutical regulations pertaining to tamper-proof & child-resistant packaging.

The 22mm closing size is gaining traction in certain closing sizes as it provides improved durability and protection to pharmaceutical and healthcare products. This sealing type offers optimal barrier protection, particularly for items that benefit from prolonging shelf life and resist environmental influences.

Great for moisture-sensitive and oxygen-sensitive products. The product provides better protection against child resistance and tamper evidence, making it a preferred option in the regulated industries. More suitable for advanced packaging materials, providing greater stability and integrity of your product over time. It complies with strict regulatory standards, providing global safety and packaging requirements.

As the need for more stringent controls around the packaging of pharmaceuticals and medical devices increases, many companies are opting for 22mm sealing as a universal option to improve safety, ensure compliance and prolong product shelf life.

Another form of this sealing type is also found in specialty blister packs, especially those in medical and diagnostic products in which high-value contents need to be maintained as airtight and sterile.

The Alu Alu Blister Packaging Machine Market is being reshaped by the infusion of automation, AI-based quality control, and Industry 4.0 technologies. Intelligent blister packaging assists manufacturer in development, updating, production efficiency, and monitoring the packaging environment in real time or predictive maintenance etc.

The Aluminum Curtain Wall Market is expanding significantly because of the demand for energy-efficient building materials, advanced façade systems, and sustainable construction practices. Aluminium curtain walls have sustained mass adoption in commercial and residential buildings owing to their low-waiting properties, sturdiness, durability, low maintenance, and visual appeal.

Thermal performance can be enhanced through innovations in thermally broken curtain wall systems, use of smart glass, and modular designs that target improved environmental performance in the built environment.

Market Share Analysis by Key Players & Packaging Machine Providers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| IMA Group | 17-21% |

| Uhlmann Group | 14-18% |

| Romaco Pharmatechnik GmbH | 10-14% |

| Marchesini Group S.p.A. | 9-13% |

| Hoong-A Corporation | 6-10% |

| Others | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| IMA Group | Specializes in high-speed Alu Alu blister packaging machines with automated quality control and serialization features. |

| Uhlmann Group | Develops advanced pharmaceutical blister packaging machines with integrated vision inspection and smart changeover systems. |

| Romaco Pharmatechnik GmbH | Offers flexible and modular Alu Alu blister packaging solutions for pharmaceutical and nutraceutical applications. |

| Marchesini Group S.p.A. | Provides high-efficiency blister packaging machines with robotic handling and sustainable packaging capabilities. |

| Hoong-A Corporation | Manufactures cost-effective and energy-efficient Alu Alu blister packaging machines with innovative sealing technology. |

Key Market Insights

IMA Group (17-21%)

IMA Group leads the market with its high-speed blister packaging solutions, offering AI-driven defect detection and automated blister sealing for pharmaceutical companies.

Uhlmann Group (14-18%)

Uhlmann's specialty lies in precision blister packaging machines and the integration of smart monitoring systems as a driver for operational efficiency and regulatory compliance.

Romaco Pharmatechnik GmbH (10-14%)

Romaco focuses on modular and compact blister packaging machines designed for small-batch production and rapid format changeovers.

Marchesini Group S.p.A. (9-13%)

Eco-Package, high-speed and sustainable blister packaging solutions, robotic automation.

Hoong-A Corporation (6-10%)

Hoong-A offers affordable yet high-quality Alu Alu blister packaging machines, featuring energy-efficient heating and cooling mechanisms.

The Alu Alu blister packaging machine market has innovated several products, with a focus on automation, smart packaging, and sustainability. These include:

The overall market size for Alu Alu blister packaging machine market was USD 27.06 billion in 2025.

The Alu Alu blister packaging machine market is expected to reach USD 44.93 billion in 2035.

The Alu Alu blister packaging machine market will rise due to increasing adoption of high-barrier packaging solutions, driven by the growing need for enhanced pharmaceutical product protection, rising regulatory compliance for drug packaging, and the expanding presence of automated packaging technologies. Additionally, the shift toward efficient and sustainable packaging solutions, the integration of advanced sealing and forming techniques, and the rising demand from the healthcare and nutraceutical industries for extended shelf-life packaging will further propel market growth during the forecast period.

The top 5 countries which drives the development of Alu Alu blister packaging machine market are USA, European Union, Japan, South Korea and UK.

Liquid Automatic Filling Blister Machines to command significant share over the assessment period.

Specialty Pulp and Paper Chemicals Market Analysis – Growth & Forecast 2025 to 2035

Sublimation Paper Market Analysis – Growth & Demand 2025 to 2035

Wire Cage Pallet Collar Market Growth & Insights 2025 to 2035

Kraft Paper Machine - Market Outlook 2025 to 2035

Retail Paper Bag Market Analysis by Material, Product Type, Thickness and End Use Through 2025 to 2035

Stainless Steel Water Bottles Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.