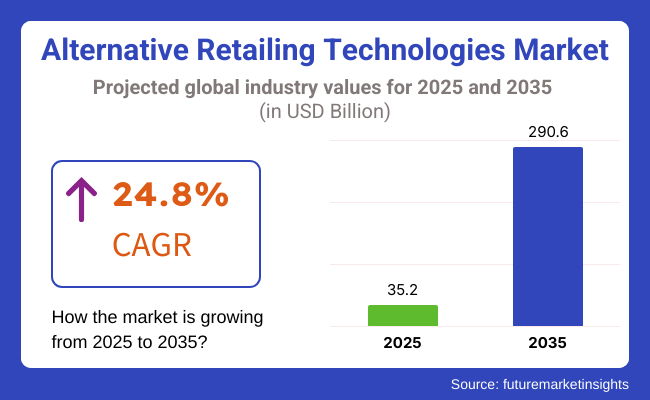

The global alternative retailing technologies market is projected to grow from approximately USD 35.2 billion in 2025 to around USD 290.6 billion by 2035, reflecting a CAGR of 24.8% during the forecast period.

This growth is being spurred by the high adoption of emerging technologies by retailers to gain enhanced customer experiences, streamline operations, and enhance inventory management. AI-powered automation, cashier-less stores, and block chain-based transactions are also fueling industry growth.

Emerging retailing technologies also have a pivotal role in streamlining supply chain operations, enabling mass personalization, and ensuring seamless shopping. They are likely to enhance efficiency and drive industry growth by combining AI-powered analytics, IoT-enabled smart shelves, and mobile payments.

In addition to this, expansion in immersive solutions like AR/VR-driven virtual stores and interactive kiosks is transforming consumer engagement with customized and intuitive shopping experiences. Store owners are employing real-time data analysis and cloud-based infrastructure to enhance decision-making, while the increasing adoption of contactless payment systems and biometric authentication is further enhancing transaction.

Explore FMI!

Book a free demo

The industry is evolving rapidly, primarily driven by automation, AI, and immersive shopping. Retailers are increasing in the deployment of intelligent checkout systems, RFID tracking, and IoT-enabled inventory management solutions, prioritizing operational efficiency.

E-commerce sites are focusing on AI-powered personalization, cloud analytics, and block chain for secure transactions. Consumers are looking for an uninterrupted shopping experience that includes contactless payments, virtual try-ons, and AI-powered recommendations.

Security and compliance are common and significant issues in every segment, in other words, ensuring data privacy and deterring fraud. Cost-effectiveness and technological advancements influence the decision to buy, with companies seeking both high ROI and customer-focused solutions. Retailing in the future will need more of predictive analytics, automation, and AR/VR shopping facade due, to mostly, an extra interactive and efficient ecosystem.

| Company | Contract Value (USD Million) |

|---|---|

| iR | Approximately USD 2,900 - USD 3,100 |

| AO World | Approximately USD 10 - USD 15 |

| InPost | Approximately USD 950 - USD 1,050 |

During the period 2020 to 2024, the industry witnessed rapid growth as a result of digital transformation, automation, and changing consumer attitudes. Smart checkout solutions, AI-based inventory management, and frictionless payment became common among retailers to improve efficiency.

Contactless shopping became popular, and this led to setting up of cashier-less shops, self-checkout kiosks, and recommendation engines that the AI operated. Retail operations became streamlined through IoT sensors and real-time analytics, while data security technologies like biometric authentication and block chain-protected transactions improved protection against data risks.

Despite advancing, there are other issues such as deployment being costly, this makes retailers to develop more innovative digital solutions with AI-powered platforms and decentralized data management.

Between 2025 and 2035, retailing technologies will continue to evolve, and AI-powered hyper-personalization will transform customer interactions. Data analysis in real-time will enable personalized recommendations, dynamic pricing, and predicted demand forecasting. 6G connectivity will enable AI-powered smart stores.

There will be AR shopping assistants and people can do shopping seamlessly. Block chain-based supply chain visibility will become the focal point, ensuring ethical sourcing and streamlined inventory management. As companies put emphasis on sustainability, personalization, and automation, the future of retail will be marked by smart, predictive, and immersive retail solutions.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Tighter regulations (GDPR, CCPA, PCI-DSS) demanded secure digital transactions and protection of customer data. | AI-powered, block chain-protected retail platforms provide real-time compliance automation, decentralized data storage, and privacy-preserving transactions. |

| AI-powered analytics enhanced demand forecasting, personalized recommendations, and customer engagement. | Retail platforms that use AI, automatically analyze purchasing behavior, optimize pricing models, and forecast industry trends. |

| Retailers embraced self-checkout kiosks, mobile payment systems, and Omni channel integration. | AI-driven, frictionless shopping experiences include cashier-less stores, intelligent shelf tracking, and instant order fulfillment. |

| IoT sensors and cloud analytics maximized inventory monitoring and customer traffic tracking. | AI-enhanced smart retail ecosystems use real-time predictive analytics, automated stock replenishment, and interactive AR shopping assistants. |

| Businesses implemented robotic warehouses, AI-powered Chabot, and automated inventory management systems. | AI-driven, intent-based automation platforms provide predictive restocking, self-configuring inventory systems, and robotic fulfillment solutions. |

| The rise of edge computing improved localized data processing and reduced latency in retail operations. | Retail solutions enable real-time personalization, low-latency order processing, and seamless in-store AI assistants. |

| Increased cyber threats led to transactions that are encrypted, checking authentication using biometric, and AI-driven fraud detection. | Artificial intelligence-driven, block chain-protected payment systems self-detect fraud, block cybercrime, and facilitate real-time transaction protection. |

| Speedier 5G connectivity amplified real-time monitoring, artificial intelligence-based analysis, and autonomous in-store journeys. | Artificial intelligence-enabled, 6G-fueled retail platforms harness ultra-low latency engagements, dynamic pricing strategies, and real-time consumer behavior data. |

| Retailers streamlined energy use, minimized packaging, and executed environmentally friendly supply chain practices. | AI-powered, carbon-conscious retail platforms dynamically optimize energy consumption, optimize green logistics, and facilitate sustainable e-commerce operations. |

| Companies investigated block chain-based supply chain tracking for transparency and responsible sourcing. | AI-powered, decentralized retail environments facilitate tamper-evident product origin, real-time supply chain authentication, and unalterable trade records. |

The industry also has its share of risks like acceptance of technology, cyber-attacks, regulatory compliance, supply chain affiliations, and customers' acceptance.One of the technological adoption difficulties is that some retailers are skeptical about investing in AI-powered checkout systems, cashier-less stores, and IoT-powered inventory tracking devices which require substantial upfront expenses. The low adoption rate which can hinder the industry is the reason for the need for more scalable and cost-effective solutions.

Cybersecurity threats are major issues, particularly kiosks, mobile self-checkout apps, and biometric payment systems. Data breaches, unauthorized access, and payment fraud are some of the problems that undermine consumer trust. The factors such as end-to-end encryption, biometric authentication, and fraud detection algorithms are able to mitigate risks.

Regulatory compliance is crucial, especially in data privacy laws (GDPR, CCPA), AI ethics, and labor laws concerned with automation taking the place of human workers. The companies should ensure that the data they process is compliant with regional data protection laws and the ethical AI usage guidelines to avoid incurring penalties.

The dependencies on the supply chain can impair the tech firms adopting new practices. The retailers who are implementing RFID tracking, IoT sensors, and automated fulfilment centers are dependent on the regular provision of hardware and software elements. The delay in scheduling hardware and software components due to the loss of supply chain connectivity, the shortage of semiconductors, or geopolitical strife can, in fact, make the products costlier.

| Countries/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 11.2% |

| UK | 10.8% |

| European Union | 11.0% |

| Japan | 10.9% |

| South Korea | 11.3% |

The USA industry expansion for AI-powered checkout systems, autonomous retail stores, and intelligent inventory control companies are building sophisticated retail technology to add value for the customer, as well as decrease operational spend and streamline supply chain functions.

Industry opportunities expand with the increasing demand for cashier less stores, contactless payments, and real-time analytics. Retailers leverage innovative solutions ranging from AI-powered Chabot to augmented reality shopping experiences to data-driven customer personalization to entice and retain consumers.

Blockchain technology in retail improves the transparency and security of supply chain management. Alternative retailing technologies have found their way into the USA retail and e-commerce, and consumer goods industries to develop optimized sales strategies and improve operational efficiency.

Furthermore, regulatory policies promote organizations to focus on secure and scalable retail automation solutions. These advanced retail technologies address the growing need for an Omni channel shopping experience and voice-assisted purchasing. According to FMI, the USA market is expected to witness a growth rate of 11.2% CAGR through the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| AI-Driven Checkout Systems | Retailers move towards cashier less stores and smart payment modernisation to enhance the process. |

| Smart Inventory Management | Automation is used by businesses to lower operational costs and maximize supply chains (among other things). |

| Block chain Adoption | Block chain Solutions Companies leverage block chain solutions for inventory management, enhancing supply chain transparency and security. |

The UK industry is growing as retailers adopt AI-powered self-checkout kiosks, digital payment alternatives, and intelligent vending machines. Alternative retailing tech informs customers about shopping, wait times, and security. Dynamic pricing models and interactive product displays powered by AI are helping retailers improve customer engagement and sales.

Increasing integration of digital kiosks, RFID-enabled retail and mobile checkout solutions boosts the industry growth. Regulatory frameworks that support data security and facilitate digital commerce also foster the adoption of alternative retailing technologies.

Sustainable practices are also becoming mainstream as businesses seek ways to reduce waste and manage resources efficiently through initiatives such as digital receipts and AI-powered inventory management. FMI believes that the UK industry will be the next growing industry with 10.8% CAGR growth during the forecast period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| AI-Powered Self-Checkout | Businesses implement smart kiosks and digital payment solutions to minimize wait time. |

| Dynamic Pricing Models | AI-Driven Demand Forecasting to Optimize Pricing Strategies. |

| Sustainability Initiatives | Companies are using digital receipts and AI-controlled inventory systems to reduce waste. |

AI-powered point-of-sale systems, robotic store assistants, and autonomous checkout solutions are employed by businesses across all classes in the European Union, contributing to the growth of the European Union industry. Industry leader nations like Germany, France, and Italy are incorporating smart retail technologies in supermarkets, fashion stores, and convenience stores.

By analyzing consumer behavior in real time and using AI-powered recommendation engines, businesses can optimize their offerings for improved customer satisfaction. Strict data security and consumer protection regulations imposed by the EU, particularly the GDPR, have forced retailers to look for alternative retailing solutions that are GDPR-compliant in nature.

Furthermore, improvement of IoT-based retail analytics and machine learning augment the implementation of automated retail systems among industries. Cashless transactions, drone delivery, and even virtual fitting rooms enter the European retail landscape.

Factors of Growth in European Union

| Key Drivers | Details |

|---|---|

| AI-Powered Beacon Technology in Retail | Many retailers are turning to automated checkout solutions to help them become more efficient. |

| GDPR Compliance | Retail businesses spend on these secure and regulation-compliant retails technologies. |

| Virtual Fitting Rooms | Companies add to customer engagement with interactive experiences through their digital shopping environment. |

Newly launched retail automation systems processes provide retailers with modern technical solutions that allow customer service to be enhanced, labor expenses to be minimized, and improve the accuracy of company records. Customer service robots powered by artificial intelligence and automated restocking solutions both serve to optimize efficiency.

The adoption of alternative retailing technologists increases by Japan focusing on smart cities and digital retail transformation. Cashless payment solutions and AI-driven store management platforms are invested in by convenience stores, department stores, and e-commerce platforms.

Augmented reality AR and virtual reality VR are also playing role in shopping experiences, as they allow consumers to explore products with a realistic image, thus making them more confident in their purchases. It said that FMI believes that the Japan industry is likely to grow at 10.9% CAGR through the forecast period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI-Powered Customer Assistance | Companies send in machines and smart kiosks to streamline operations |

| New Trends in Shopping Integration | Retailers use immersive technology to help consumers. |

| Cashless Payment Solutions | AI Startups work with companies to provide seamless transaction using AI-based payment GateWay |

The industry in South Korea is flourishing while retailers facilitate the usage of these AI-powered shopping assistants along with automated fulfilment centers and unmanned convenience stores. Governments are also supporting such digital transformation initiatives that are consequently accelerating the adoption of such smart retail solutions across various industries. Machine learning product recommendations, AI fraud detection, and interactive digital signage are all integrated into major retailers to improve customer engagement and security.

To maximize consumer interactions, companies introduce giving facial recognition payment systems, implementing store robotic clerk services, providing individualized AI locksmith shopping and many other experience. In addition, the expansion of the industry is further augmented by the new advancements in 5G connectivity and cloud-based retail solutions.

Such developments make alternative retailing technologies in South Korea be reinforced through the increasing use of block chain for supply chain transparency, automated logistics solutions and other. The South Korean industry will expand at a 11.3% CAGR during the study period, according to FMI.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| AI-Powered Virtual Shopping Assistants | Machine-learning based recommendations improve business customer service. |

| 5G and Cloud-Based Solutions | Advanced connectivity enables automation in retail. |

| Blockchain for Supply Chain | Retailers enhance transparency and security with blockchain technology. |

As retailers strive to bring their in-store experience to the virtual world, the adoption of online 3D virtual stores is gaining momentum. Virtual stores can take customers into a 3D space, view products in real time, and make purchases in a way that is indistinguishable from physical retail stores. This segment saw further acceleration with the advent of Metaverse shopping, augmented reality (AR), and virtual reality (VR) experiences.

Companies such as Amazon, Alibaba, and eBay are creating 3D shopping environments that allow shoppers to explore product offerings in a virtual space prior to purchasing. Meta (formerly Facebook) and Microsoft are spending on Metaverse-based retail spaces, allowing brands to create immersive, personalized shopping environments.

Gucci, Louis Vuitton, and Balenciaga are putting 3D virtual stores on their websites where customers can browse exclusive collections and talk to digital versions of sales associates. The IKEA Place AR technology used in IKEA's virtual showroom allows customers to see how it would look if they had the furniture in their homes.

Online shopping destinations constitute the biggest share of alternative retailing technologies, with a range of retailers improving the effectiveness of their e-commerce sites using artificial intelligence-powered suggestions, Chabot-driven customer service, real-time inventory tracking systems, and so on.

Companies such as Amazon, Walmart, and Target are employing AI-powered personalization in order to provide customized product recommendations and smooth shopping experiences. Broadly speaking, cloud-based e-commerce solutions like Shopify and BigCommerce allow small and medium-sized retailers to compete with the likes of large marketplaces.

For instance, leading brands like Nike and Adidas introduced direct-to-consumer (DTC) online shops, utilized AI and data analytics to offer personalized shopping experiences, and provided exclusive product launches. Brands can leverage search engines and social media to reach more customers through Google Shopping and Instagram Shopping.

More and more retailers are leveraging the power of tablet technology to elevate one of a customer's most important experiences: in-store shopping with self-service checkout, product recommendations, and digital catalogues. Tablets enable sales associates to offer tailored assistance, view customer purchase history, and complete transactions instantly.

Apple Stores utilize iPads for checkout and product demos, improving the customer experience. A tablet-powered Beauty Hub at Sephora allows customers to browse makeup products, see virtual try-ons, and get beauty recommendations powered by AI. Tablets and smartphones also allow customers to check for available products, compare specifications, and even schedule consultations with experts (as do major retailers like Best Buy and Home Depot).

Wireless voice communication technologies are changing the retail workforce management landscape by giving store employees instant voice communication to maximize productivity (especially in terms of customer service) and operational efficiency.

Retail companies such as Walmart, Target, and Kroger use wireless headsets for store associates, allowing departments to compare notes in real time. Motorola Solutions and Honeywell offer advanced "walkie-talkie" voice communication systems that are well-suited for large retail environments where teams must manage inventory, answer customer inquiries, and improve security.

Amazon's Just Walk Out tech combines connected voice with cashier less stores powered by AI, which theses sensors and RFID-based tracking purchase automatically. Both Lowe's and Macy's have implemented voice-activated assistant technologies to help employees quickly find product information and locate items on shelves.

The industry is quickly gaining momentum with the advancement of retailers and the idea of digital transformation as a prime means of improving customer experiences, streamlining operations, and maximizing sales efficiency.

A further reason for driving the industry growth towards maximizing operational cost reductions and optimizing retail automation is widely adopted AI-powered checkout systems, contactless payment solutions, and IoT-enabled smart shelves.

Leading players like Amazon (Just Walk Out), Alibaba Group, NCR Corporation, and Toshiba Global Commerce sell innovative automated retail solutions that combine cashier-less store technology with AI-based customer analytics. Emerging startups and niche providers are concentrated on augmented reality (AR) shopping, RFID-based inventory tracking, and personalized AI shopping assistants, contributing to heightened competition.

Industry maturity is defined by the deployment of block chain for secure transactions, multi-biometric or advanced biometric authentication, and real-time data-based personalization. As retailers focus on an experience with the minimum friction for shopping, computer vision, machine learning, and smart checkouts are used to make these differentiators possible.

Strategic partnerships, acquisitions, and investments in both cloud-based retail platforms and Omni channel solutions define the competition landscape. The demand for self-service retail, AI-optimized demand forecasting, and sustainable retail technologies profusely augment innovations in the space.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amazon (Just Walk Out) | 20-25% |

| Alibaba Group | 15-20% |

| NCR Corporation | 12-17% |

| Toshiba Global Commerce | 8-12% |

| Standard AI | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amazon (Just Walk Out) | Develops AI-powered cashier-less store technology, real-time inventory tracking, and seamless checkout solutions. |

| Alibaba Group | Provides smart retail solutions, facial recognition payment systems, and AI-driven e-commerce personalization. |

| NCR Corporation | Specializes in self-checkout kiosks, cloud-based retail automation, and digital payment processing. |

| Toshiba Global Commerce | Focuses on point-of-sale (POS) solutions, retail automation software, and AI-driven inventory management. |

| Standard AI | Offers autonomous checkout technology, AI-powered retail insights, and real-time shopper behavior tracking. |

Key Company Insights

Amazon (Just Walk Out) (20-25%)

AI-driven cashier-less shop technology, real-time inventory tracking, and frictionless checkout are what make Amazon lead the alternative retailing technologies sector.

Alibaba Group (15-20%)

Alibaba extends the edge in intelligent retail system integration by ensuring AI-empowered personalization, contactless payment systems, and automated store management.

NCR Corporation (12-17%)

NCR Corporation deals in self-checkout solutions, cloud-based retail automation, and next-gen digital payment processing.

Toshiba Global Commerce (8-12%)

AI-powered POS Systems, Smart Checkouts, and Automated Inventory Management have been integrated into the retail platform for optimization.

Standard AI (5-9%)

Standard AI, which also offers autonomous checkout technology, real-time analytics of customer behavior, and AI-derived retail insights.

Other Key Players (20-30% Combined)

The industry will continue to grow as retailers integrate AI, automation, and real-time data analytics to enhance customer experiences, optimize inventory, and reduce operational costs.

The industry is projected to reach USD 35.2 billion in 2025.

The industry is expected to grow significantly, reaching USD 290.6 billion by 2035.

South Korea is poised for the fastest growth, with a CAGR of 11.3% from 2025 to 2035.

Vend Limited, RIBA Retail, Tulip Retail, Seamless Receipts, and IBM are the key players in the industry.

The AI-driven segment are being widely used.

By online technologies, the industry is segmented into online 3-D virtual stores, online shopping sites, online store information sites, and interactive printing.

By in-store technologies, the industry is segmented into tablet technology, wireless voice communication, guest internet access, in-store kiosks, hand-held shopping assistants, and body scanning.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Japan & Middle East and Africa.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.