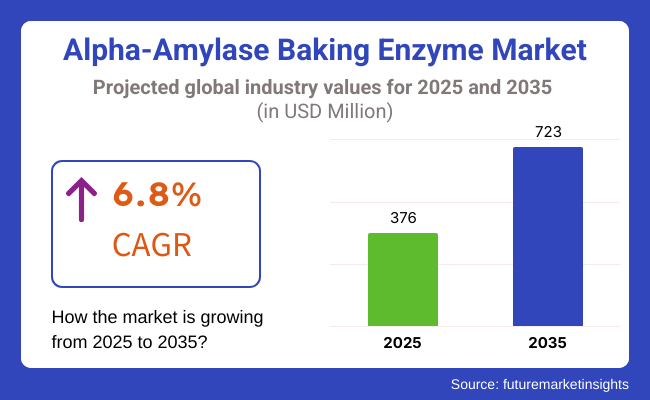

The Alpha-Amylase Baking Enzyme market is assessed to be around USD 376 Million in 2025 and is anticipated to grow to USD 723 Million by 2035, with a CAGR of 6.8% from 2025 to 2035.

Market expansion in alpha-amylase baking enzymes becomes possible because of their fundamental importance for better-quality bakery products and production efficiency. The enzyme alpha-amylase curtails starch molecules to create simple sugars while improving fermentation activity and dough management along with voluminous outcomes in breads and other bakery products.

The enzyme finds broad adoption in commercial baking operations to produce products with stable consistency and dend it longer shelf life duration and produce enhanced crust color. Food manufacturers choose enzymatic solutions over synthetic additives because of their preference for clean-label and natural ingredients thus fostering Industry growth.

The progress of enzyme biotechnology research produced specialized alpha-amylase variants with features for particular baking applications including high-temperature resistance and precise starch degradation control.

The expanding baked products drives market growth because customers demand fresh premium products. The bakery industry growth promotes alpha-amylase enzymes' usage by producers who want to enhance their processes and eliminate inconsistencies in their products.

Sector expansion occurs due to regulatory acceptance of enzyme processing in food and the growing interest in gluten-free and specialty bakery items. As competition grows stronger companies dedicate research funding to improve enzyme operational effectiveness together with reduced production expenditures and specific enzyme solutions for artisanal and industrial bakery sectors.

Explore FMI!

Book a free demo

Clean Label & Natural Enzymes

Modern consumers are demanding enzyme products that combine cleanliness with natural elements because they want healthier chemical-free food products. Organizations create novel enzymatic technologies which naturally boost baking performance and food production processes.

The DSM brand provides BakeZyme® which represents a portfolio of baking enzymes that deliver improved dough stability along with enhanced texture and extended shelf life through natural means rather than using synthetic additives.

Puratos N.V. is allocating resources to develop enzyme solutions which aid chemical-free natural baking alongside other businesses. The product line of Infinita Biotech consists of plant-based enzymes that were produced without genetically modified organisms to meet clients who seek non-GMO products.

The Sapore® brand of Puratos N.V. uses natural fermentation-based enzymes to improve both flavor and freshness in baked products. As one of its main areas of business Infinita Biotech produces plant-based enzymes that are free of GMOs to serve customers focused on health.

Sustainability & Green Manufacturing

The leading enzyme production companies now use sustainable practices to decrease their environmental impact. The enzyme manufacturer Amano Enzyme utilizes sustainable production processes with dual objectives of waste reduction and carbon emission reduction for its microbial enzymes that serve food and pharmaceutical industries.

The company successively uses energy-efficient fermentation methods alongside responsible material sourcing practices and waste reduction measures to decrease its environmental impact. To enhance the environmental stewardship of their enzyme production Amano Enzyme is advancing projects for both water resource conservation and biodegradable packing implementation.

AB Enzymes utilizes energy-efficient production methods together with sustainable raw material sourcing to deliver enzyme supply as a part of their green manufacturing practices. To fulfill global sustainability objectives Amano Enzyme puts emphasis on waste reduction and water conservation and carbon footprint minimization.

DuPont developed enzyme solutions to assist bakeries in saving energy because these solutions shorten baking times and result in reduced energy use leading to sustainable improvements in the food industry. The new innovations enable environmentally responsible manufacturing industries without compromise to product attributes.

R&D and Product Innovation

Research and development activities hold a vital position in developing enzyme formulations suitable for the baking industry. Companies make constant innovations that improve product quality and processing efficiency and shelf life duration. Factory experiments with innovative technological approaches result in specific enzyme solutions which enhance dough performance and deliver uniform end results between various bakery products.

Through its position as a worldwide biotechnology pioneer Novozymes A/S manufactures refined enzyme formulations that enhance flour function and produce uniform baking outcomes along with refined crumb properties. Their advanced technology implements solutions which enable bakeries to produce superior product quality together with better manufacturing efficiency.

DSM-Firmenich's Panamore® range enhances dough strength and elasticity, resulting in improved baking consistency. Their Delvo® enzyme solutions enable clean-label formulations, enabling bakeries to make high-quality products while satisfying consumer demand for natural and sustainable ingredients.

| Particular | Value-CAGR 2025 to 2035 |

|---|---|

| H1(2024 to 2034) | 6.9% |

| H2(2024 to 2034) | 8.3% |

| H1(2025 to 2035) | 8.4% |

| H2(2025 to 2035) | 9.7% |

The compounded annual growth rate (CAGR) for has shown a prominent progress, replicating a positive market arc. The CAGR for H1 was 6.9% for the period of 2024 to 2034, which has increased to 8.3% for the period of 2024 to 2034. Similarly, H2 saw an increase from 8.4% (2024 to 2034) to 9.7% (2024 to 2034). This rising graph indicates a significant strengthening in the position.

The global alpha-amylase baking enzyme demonstrated continuous expansion between 2020 and 2024 because consumers sought better baked products and ingredients with clear labels. The baking industry relies on Alpha-amylase enzyme because it helps improve handling during dough preparation and texture formation and allows extended product shelf storage to meet commercial bakery needs.

The Industry expanded because people favored natural food additives while new developments in enzyme technology occurred. The leadership position in the sector belongs to North America and Europe primarily because of their strong bakery industry and strict food safety legislations.

Expansion in the Asia-Pacific area occurred because of three main factors that included rising bakery consumption along with urban development and growing disposable incomes. The market performance experienced disturbances from varying raw material expenses and regulatory limitations which limited its total expansion rates.

The worldwide alpha-amylase baking enzyme market will experience stable growth during the time span of 2025 to 2035 as manufacturers emphasize developing sustainable innovative enzymatic solutions. Expenditures aimed at research and development work toward enhancing enzyme efficiency which consequently decreases both baking duration and power usage.

The increasing intake of digestive health and gluten-reduced products by consumers will boost Industry demand for enzyme-based baking solutions. Industry growth will be propelled by bakeries expanding in Asia-Pacific and Latin America because of sector growth and ongoing industrial development.

The manufacturing industry faces regulatory obstacles together with competition from chemical additives which presents challenges to operational success. The industry stands to gain advantages from changing consumer demands and advancing technologies and rising commitments to sustainable food manufacturing.

Alpha-Amylase Baking Enzyme industry eaders from Tier 1 segment maintain approximately 60% of the total share. The leader companies Novozymes A/S and DuPont (IFF Nutrition & Biosciences) together with DSM Nutritional Products and BASF SE comprise the Alpha-Amylase Baking Enzyme Industry segment.

The industry leaders in enzyme production dominate the baking sector because they maintain broad product ranges coupled with extensive global reach because of their robust research and development power. The baking industry depends on their innovative capabilities together with their skill at delivering desired industry solutions therefore allowing them to maintain their leading position in the sector.

Around 30% of the industry belongs to upper-middle-level companies which include AB Enzymes GmbH, Hansen Holding A/S, Advanced Enzyme Technologies and Amano Enzyme Inc. Special enzyme solutions and targeted baking industry segments represent the primary business areas for these regional rising companies.

The market share of Tier 1 businesses surpasses Tier 2 companies but Tier 2 enterprises are widely known for delivering distinctive solutions and solving client-specific requirements. Enzyme Development Corporation and Specialty Enzymes & Probiotics represent the final segment of 10% share in this category. The Industry space of these niche players includes operating within specific areas or regional segment by designing products targeted to unique customer needs although their global footprint remains restricted.

The following table shows the estimated growth rates of the top three territories. US, Germany and India are few attractive countries to look upon.

| Countries | CAGR |

|---|---|

| Canada | 11.9% |

| UK | 9.7% |

| India | 10.3% |

Canadian alpha-amylase baking enzyme market demonstrates a compound annual growth rate of 11.9% because baking product quality demands are rising and consumers prefer natural ingredients with clean labels and food processing technologies are improving.

The baking industry implements this enzyme frequently because it improves dough management during handling while simultaneously increasing product texture and maintaining product longevity for bread and pastries and similar baked goods. The Canadian bakery industry functions strongly while health-conscious consumer habits and major food processing company investments drive the use of enzyme-based solutions.

Sector expansion for food production enzymes is accelerated by the committed regulatory support for their application. Sector participants understand the importance of innovation in combination with sustainable enzyme manufacturing methods to fulfill marketplace demands both inside and outside industries.

The UK market for alpha-amylase shows remarkable expansion through a 9.7% CAGR rate because consumers require more processed as well as convenient food products. Sector growth for bakery applications of alpha-amylase occurs because the enzyme enhances dough functionality alongside preserving product shelf stability. Consumer demand for health-focused and natural food products has increased the use of alpha-amylase enzymes because of their alignmen with clean-label standards.

Enzymes gain increased acceptance as solutions in the UK food industry because of strong domestic food processing operations combined with increased demand for gluten-free bakery and other specialty baked goods. The industry receives benefits from enzyme formulation innovations designed to enhance production efficiency and fulfill the changing bakery industry requirements.

The Indian market for alpha-amylase shows a growth rate of 10.3% annually because the food processing sector keeps expanding together with increasing bakery product consumption throughout both cities and towns. The use of this vital enzyme to improve bakery dough characteristics and extension period plays a critical role in satisfying consumers who need ready-to-eat packaged baked products. The fast-growing Indian population combined with changing food preferences and processing food sector expansion sustain the sector expansion.

Alpha-amylase demand in India shows rapid growth because consumers prefer natural ingredients and health-oriented eating which accelerates the domestic sector expansion. The Indian bakery industry has prompted businesses to enhance their investments in enzyme production methods for commercializing innovative technology.

| Segment | Value Share (2025) |

|---|---|

| Source -Fungi | 43% |

Alpha Amylase Baking Enzyme Industry operates as a fundamental sector which improves both baking quality output and process operational efficiency. Alpha Amylase Baking Enzyme serves as a principal ingredient for the creation of bread and biscuits and cakes and pastries as well as other formed baked products because it transforms starches into digestible fermentable sugars which benefits both dough management and product texture and volume expansion.

Commercial bakeries represent the biggest utilization sector of alpha amylase through which they can achieve consistent high-quality products. Companies utilize this enzyme both for food processing needs and to enhance shelf life as well as in brewing operations when converting starches into fermentable sugars. My survey indicates North America along with Europe leads the market since they have strong bakery product industry combined with established food processing activities.

| Segment | Value Share (2025) |

|---|---|

| Application - Bread | 34% |

The Alpha Amylase Baking Enzyme Industry depends on alpha amylase because it breaks down starches to create fermentable sugars that help yeast fermentation improve bread volume and rise effectively. Alpha amylase creates a superior texture of bread with a homogeneous dough structure. Alpha amylase contributes to bread longevity by both retaining moisture within the product and stopping the staling process.

Through the Maillard reaction alpha amylase enables crusts to develop attractive colors during the baking process. The essential quality and consistency improvements in bread production depends on the usage of alpha amylase enzymes.

The commercial bakeries value Alpha amylase because it improves both production speed and product consistency. Alpha amylase provides critical functionality as an indispensable enzyme which optimizes dough handling and texture and retains freshness making it vital for present-day bread manufacturing.

competitive forces prevail within the alpha amylase baking enzyme industry since Novozymes, DuPont, and BASF dominate worldwide operations. Product innovation at these companies produces enzyme solutions which advance dough handling while building better product textures and boosting shelf duration.

Local companies have started entering the industry with competitive prices for customized enzyme solutions to satisfy regional product needs. Business organizations commonly pursue strategic partnerships and acquire industries and merge with other companies so they can advance their Industry strength while building production abilities across different locations.

The demand for sustainable clean-label products pushes the market toward natural and environmentally friendly enzyme formulations. businesses create enzymes to suit customers who seek sustainable products with minimal additives through their development strategies.

Maintaining competitiveness in the market depends on effective pricing strategies together with distribution channels while also demanding cost-effective solutions which are vital to obtain share particularly in developing industry. The industry will expand through rising adoption of processed foods alongside technological improvements in enzyme formulation development.

The global alpha-amylase baking enzyme Industry is expected to secure USD 376 Million in 2025.

The global alpha-amylase baking enzyme industry is projected to secure USD 723 Million by 2035.

The UK market 9.7% CAGR by 2035.

In India Alpha-Amylase Baking Enzyme Sector is contributing 10.3% of CAGR for the latest period.

The bread segment is projected to lead while exhibiting 34.5% by 2035.

Prominent players in the landscape include Koninklijke DSM N.V., Novozymes A/S DuPont, Puratos Group N.V., and Specialty Enzymes, Hansen Holding A/S,BASF SE, Advanced Enzyme Technologies.

Alpha-Amylase Baking Enzyme market by source, includes fungi, Bacterial and plant based.

Alpha-Amylase Baking Enzyme market by application, bread, cookies & biscuits, desserts and other applications.

Industry analysis has been carried out in key countries of North America, Latin America, Asia Pacific, Middle East & Africa and Latin America.

Yeast Extract Market Analysis by Type, Grade, Form, and End Use

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.