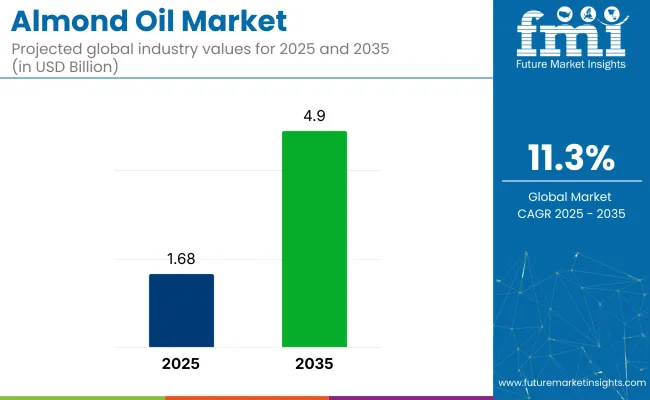

The global almond oil market is expected to be valued at USD 1.68 billion in 2025, with projections reaching USD 4.9 billion by 2035, reflecting a solid CAGR of 11.3% throughout the forecast period. The industry growth is driven by the increasing demand for natural, plant-based products, which offer health benefits without harmful additives.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 1.68 billion |

| Projected Industry Value (2035F) | USD 4.9 billion |

| Value-based CAGR (2025 to 2035) | 11.3% |

Almond oil, with its wide range of uses and therapeutic properties, continues to gain popularity in food, cosmetics, pharmaceuticals, and aromatherapy sectors.

The almond oil industry holds a relatively small share within its parent markets. Within the vegetable oil market, almond oil accounts for approximately 1-2% as it competes with other oils like sunflower, olive, and palm. In the essential oils market, almond oil holds around 2-3% due to its presence as a preferred oil in therapeutic and cosmetic applications.

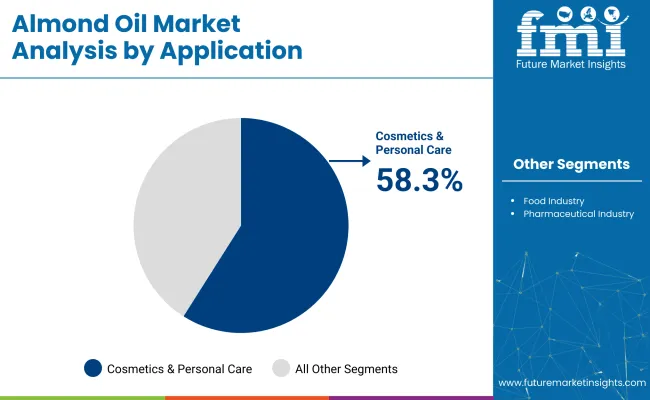

In the cosmetics and personal care market, almond oil contributes 3-5%, driven by its widespread use in skincare and haircare products. Within the nutraceuticals market, almond oil occupies about 0.5-1%, as it is valued for its health benefits, including antioxidants and vitamin content. Lastly, in the food and beverages market, almond oil accounts for 0.5-1%, commonly used as a cooking and salad oil in premium food products.

Clarice Turner, President & CEO of the Almond Board of California, emphasized that innovation and industry expansion are key to the almond industry's growth. She stated, "Innovation and exports to guide almond rebound," stressing the importance of diversifying product offerings and exploring new export markets to sustain demand and bolster the almond sector.

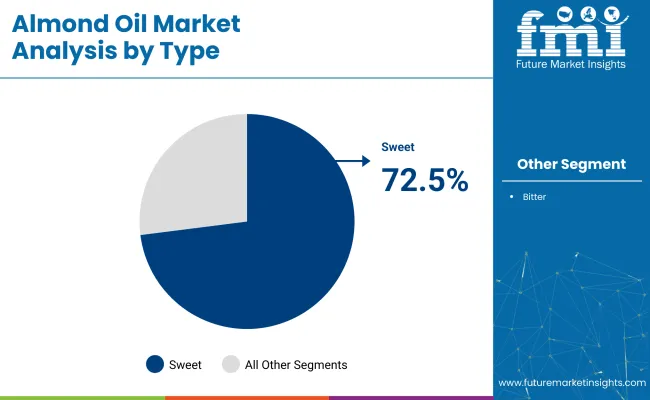

Almond oil market analysis by top investment segments. The segmentation has been conducted by type into sweet almond oil and bitter almond oil. Application has been categorized into cosmetics and personal care products, food industry, and pharmaceutical industry. End use has been divided into commercial use and household use.

Distribution channel has been segmented into hypermarkets and supermarkets, wholesalers and distributors, departmental stores, and online retail stores. Region has been classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East and Africa.

Sweet almond extract is projected to account for nearly 72.5% industry share by 2025, driven by its versatility, nutrient-rich profile, and multiple applications across sectors.

Cosmetics and personal care applications are expected to hold 58.3% of the industry share in 2025, making them the largest end-user segment.

The commercial use segment is projected to dominate in 2025, with widespread adoption in the food, cosmetics, and pharmaceutical industries.

Retail distribution channels, including hypermarkets/supermarkets and online retail, are expected to hold a significant share, with supermarkets accounting for 35% of the industry share by 2025.

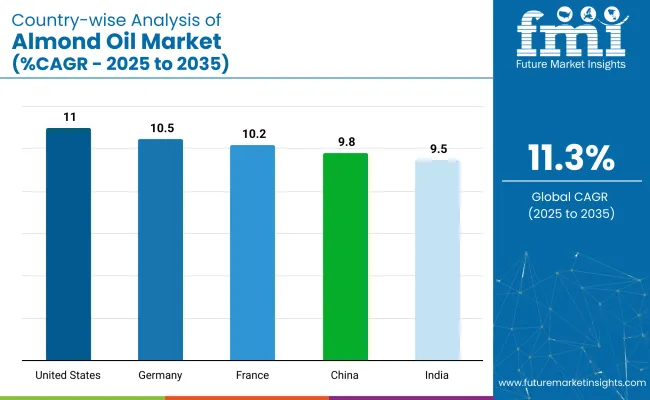

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 11% |

| Germany | 10.5% |

| France | 10.2% |

| China | 9.8% |

| India | 9.5% |

India’s momentum is driven by increasing demand in its rapidly expanding poultry and dairy sectors, alongside growing awareness of the health benefits of oil for both culinary and beauty applications. China follows closely, with a projected 9.8% CAGR, supported by its growing middle class and increasing preference for premium, natural skincare products. In contrast, developed economies such as France (10.2%), Germany (10.5%), and the United States (11.0%) are expanding at a steady 0.95-1.03x rate.

The United States leads the demand for oil, fueled by its almond production and the increasing consumer interest in natural, health-conscious ingredients for food and personal care. Germany and France benefit from rising trends in organic and natural products, particularly in skincare and food. As the industry grows and adds over USD 3 billion by 2035, both high-growth regions like India and China, and steady demand from OECD countries will shape its trajectory.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The United States is set to experience significant growth in the almond oil sector, projected to grow at a CAGR of 11% from 2025 to 2035. The strong demand for natural oils in personal care and food applications is a key driver of this growth. USA consumers are increasingly adopting organic, sustainable products, particularly in wellness and beauty. Furthermore, manufacturers are innovating to meet consumer preferences for eco-friendly, high-quality formulations.

The UK almond oil sector is growing steadily, with a projected CAGR of 10.0% through 2035. A shift towards natural ingredients in food and personal care is driving demand. Consumers in the UK are increasingly favoring products that offer both health and sustainability benefits. Almond based oil’s versatility in skin care, hair care, and culinary uses makes it a preferred choice for health-conscious individuals. The industry is expected to maintain steady growth due to the demand for eco-friendly, high-quality products and the increasing popularity of clean-label beauty formulations.

The almond oil industry in Germany is projected to grow at a CAGR of 10.5% through 2035. The demand for organic, sustainable products in both the food and cosmetics sectors is driving this expansion. German consumers are highly inclined towards natural, high-quality ingredients for skincare and health-conscious cooking. Regulatory support for eco-friendly production practices and an increasing focus on wellness will continue to fuel industry growth.

The industry in France is expected to grow at a CAGR of 10.2% from 2025 to 2035. Driven by the country’s rich culinary traditions and rising wellness trends, almond oil is gaining popularity in both food and personal care. French consumers appreciate natural and sustainable products, making almond oil a preferred ingredient in gourmet dishes and luxury skincare. The growing preference for clean-label, organic products aligns with France’s focus on health and sustainability, positioning it as a key industry in Europe.

The Almond oil based sector is poised for rapid growth, projected to increase at a CAGR of 9.5% through 2035. The rising health-consciousness among Indian consumers, coupled with the growing popularity of natural beauty and wellness products, is driving demand. Almond oil is increasingly used for its beneficial properties in skin and hair care. With a young population and expanding middle class, India is seeing an uptick in the use of high-quality, organic products.

China is experiencing steady growth in its almond oil sector, with a projected CAGR of 9.8% through 2035. This growth is largely driven by increased health awareness, particularly among urban populations. The oil’s versatile applications in both personal care and culinary products are appealing to Chinese consumers. As the middle class continues to expand, demand for premium natural oils is on the rise.

The sector is growing rapidly due to rising consumer demand for natural and organic products across various industries, including cosmetics, food, and pharmaceuticals. Key players such as Blue Diamond Growers, Caloy Company LP, Bajaj Consumer Care Ltd., Dabur India Ltd., AAK Natural Oils, and others have been crucial in driving this expansion. For example, Blue Diamond Growers has focused on increasing global exports, the Bajaj Consumer Care Ltd. has leveraged its strong brand presence to expand its Almond Drops range into personal care products.

The industry is both fragmented and consolidated. Entry barriers include substantial investments in processing infrastructure, meeting stringent quality standards, and building strong distribution networks.

Recent Almond Oil Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.68 billion |

| Projected Market Size (2035) | USD 4.9 billion |

| CAGR (2025 to 2035) | 11.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Types Analyzed | Sweet Almond Oil, Bitter Almond Oil |

| Applications Analyzed | Cosmetics and Personal Care Products, Food Industry, Pharmaceutical Industry |

| End Uses Analyzed | Commercial Use, Household Use |

| Distribution Channels Analyzed | Hypermarkets/Supermarkets, Wholesalers/Distributors, Departmental Stores, Online Retail Stores |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan & Baltic Countries, Russia and Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, United Arab Emirates (UAE), South Africa |

| Key Players | Blue Diamond Growers, Caloy Company LP, Bajaj Consumer Care Ltd., Dabur India Ltd., AAK Natural Oils, Frontier Co-op, Eden Botanicals, Flora Manufacturing & Distributing Ltd., Liberty Vegetable Oil Company, Mountain Ocean Ltd. |

| Additional Attributes | Dollar sales growth by product type, regional demand trends, competitive landscape, pricing strategies, distribution channel insights, consumer preferences, organic almond oil demand, and application-specific growth drivers. |

The industry is segmented into sweet almond oil and bitter almond oil.

Segmentation includes for cosmetics and personal care products, food industry, and pharmaceutical industry.

The industry is divided into commercial use and household use.

Channels comprise hypermarkets/supermarkets, wholesalers/distributors, departmental stores, and online retail stores.

The industry is analysed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The market is expected to reach USD 4.9 billion by 2035.

The market size is projected to be USD 1.68 billion in 2025.

The market is expected to grow at a CAGR of 11.3% from 2025 to 2035.

Cosmetics and Personal Care is projected to dominate the application segment with a 58.3% market share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Almond Oil-Based Serums Market Size and Share Forecast Outlook 2025 to 2035

Almond Milk Market Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Almond Flour Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Extract Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Drink Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Butter Market Growth - Healthy Spreads & Industry Demand 2025 to 2035

Demand for Almond Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA