Based on order, the almond ingredients market is also divided on the grounds of formation, use, development, and area. Almonds are the main ingredients used in the food and beverage segment. Global almond ingredients are used in different segments but are not limited to bakery and confectionery, dairy replacement, snacks, etc.

The almond ingredients market is rising due to consumers increasing each year for gluten-free, wholesome, and vegetable-based items.

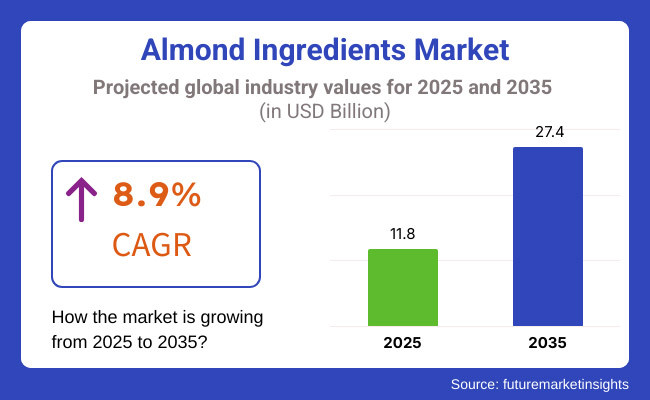

The widespread approval of health-conscious consumers towards almond ingredients provides benefits for its dense nutrient structure, among others, protein, good fat, vitamins, and minerals. The global almond ingredients market size is expected to reach USD 11.8 Billion by 2025 to USD 27.4 Billion by 2035, at a lucrative compound annual growth rate (CAGR) of 8.9% during the forecast period.

Supported by this trend of growth, product innovation and a growing trend of using almond-based components in various culinary applications is also fuelling consumer uptake.

Explore FMI!

Book a free demo

The almond ingredients market is dominated by North America, owing mainly to the high existence of the food processing industry along with high awareness of health and wellness amongst consumers in the region. Almonds have a steady market at the global level, as the United States is one of the largest producers and consumers of almonds in the world.

This news sleigh has also been driven to the completion of almond Ingredients, such as almond milk and almond flour. Moreover, the presence of key market players and consistent product innovation are also driving the market growth in this region.

The almond ingredients market in Europe accounts for a significant percentage, with Germany, France, and the United Kingdom being the key consumers. The growing healthy food culture in the region and changing preferences for plant-based/organic food products propel the almond-based ingredients market.

Almond-based foods are gaining attention from producers. Aside from the European market nurturing for clean-label and non-GMO foods, producers have also been focusing their efforts on almond-based foods such as snacks, pastries, and dairy alternatives.

The stringent food safety regulations in the region reflect a guarantee of the quality of the products, leading to improved consumer confidence, which drives the market in this region.

The almond ingredients market is estimated to grow at the fastest rate in the Asia-Pacific market due to increasing disposable incomes along with urbanization and health consumerization across the region. Increased demand for almond-based products is being seen in countries such as China, Japan, and India, as well as other potential markets, driven by Western dietary patterns and the health benefits associated with almonds.

With the expanding middle class and the availability of modern retail channels, almond ingredients are now available to a wider audience. Moreover, the demand for almond ingredients for use in both traditional and modern cuisines diverse has also favoured its market expansion in this region.

Challenge

Fluctuation in almond prices

Due to environmental reasons and supply chain issues, almonds are a high water-consuming crop and are therefore vulnerable to optimal water availability and climate variability issues. This can result in erratic supply and higher production costs, impacting pricing and availability of almond-derived products.

Moreover, the extensive mono-cropping associated with almond cultivation has implications for biodiversity and ecosystem health, which has stimulated the demand for sustainable farming methods.

Opportunity

Development of innovative and value-added products

Meeting various consumer preferences and increasing demand for plant-based and functional foods opens doors for manufacturers to launch almond protein powders, energy bars, and dairy alternatives infused with probiotics and functional ingredients. What’s more, targeting the developing world with localized marketing campaigns and low-cost solutions can access a large, untapped market.

Sustainable tourism practices, such as investing in local community development and conservation efforts, can also help businesses attract and retain customers who prioritize responsible travel, leading to long-term profitability.

The market for Almond Ingredients saw growth at a massive rate from 2020 to 2024, mainly because of enhanced consumer demand for plant-based, clean-label, and nutrient-rich food items. The rising adoption of vegan, keto, and paleo diets boosted the use of almond-based ingredients in dairy alternatives, baked foods, snacks, and protein-rich food.

Innovations related to almond processing technologies yielding organic, gluten-free, and low-sugar almond-based products have driven market growth. In spite of such high almond costs, water consumption crop growth challenges and supply chain expansion challenges were challenges to constant growth in the market.

As we look towards 2025 to 2035, the almond ingredients market will adapt with innovations around sustainability, alternative protein applications, and AI-driven food personalization. The embrace of regenerative almond farming practices, water-smart farming strategies, and carbon-neutral processing will transform the way the industry operates.

Meanwhile, functional almond ingredients that are infused with probiotics, adaptogens, and plant-based proteins will further gain presence. The incorporation of advanced AI-driven consumer insights and blockchain-based supply chain transparency will improve competitiveness, allowing for greater traceability and quality assurance.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with organic certification, non-GMO labelling, and food safety standards. |

| Consumer Preferences | Rising demand for gluten-free, high-protein, and plant-based almond ingredients. |

| Industry Adoption | Almond flour, almond milk, almond oil, and almond protein for bakery, confectionery, dairy alternatives, and health supplements. |

| Production and Sourcing | Reliance on California almond production, with increasing emphasis on organic and sustainable agriculture. |

| Market Competition | It is controlled by big global food ingredient companies & premium quality organic branded groups. |

| Market Growth Drivers | Fuelled by increasing vegan diets, dairy alternatives demand, and high protein snacking trends. |

| Sustainability and Environmental Impact | Early adoption of water-efficient irrigation, recyclable packaging, and sustainable almond sourcing. |

| Integration of AI and Supply Chain Optimization | AI has only been used in certain functions like inventory management and demand forecasting. |

| Advancements in Product Innovation | To explore the rise of flavoured almond ingredients, high protein almond flour and sugar-free almond-based items. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability regulations, carbon labelling, and allergen transparency mandates for almond-based products. |

| Consumer Preferences | Shift toward personalized nutrition, functional almond-based foods (with probiotics, fibre, and adaptogens), and bioactive ingredient innovations. |

| Industry Adoption | Expansion into precision nutrition, alternative proteins, and hybrid plant-based formulations for personalized diets. |

| Production and Sourcing | Diversification of almond sourcing from new producing regions, adoption of regenerative agriculture and climate-resilient almond cultivation. |

| Market Competition | Increased competition from start-ups focusing on functional food blends, clean-label almond innovations, and AI-powered nutrition platforms. |

| Market Growth Drivers | Expansion fuelled by AI-driven food customization, sustainability-focused ingredient sourcing, and almond-derived functional food applications. |

| Sustainability and Environmental Impact | Large-scale implementation of carbon-neutral processing, zero-waste almond utilization, and blockchain-powered traceability systems. |

| Integration of AI and Supply Chain Optimization | AI-driven precision agriculture, smart almond processing automation, and real-time supply chain monitoring. |

| Advancements in Product Innovation | Development of next-gen almond-based proteins, nutrient-dense almond superfoods, and microbiome-enhancing almond formulations. |

The USA is a leading market for almond ingredients, supported by a growing requirements for plant-based, high protein, and nutrient-rich food products. Growing awareness for dairy substitutes such as almond milk, yogurt, and cheese is significantly driving the growth of almond-based dairy substitutes in the market.

Moreover, the growing adoption of gluten-free and clean-label food trends has propelled the demand for almond flour, almond meal, and related almond-based baking ingredients. Leading almond producers and processing facilities located in the USA support the supply of high-quality almond ingredients. In addition, food producers are focusing on novel almond-based formulations to respond to changing consumer trends for functional and fortified foods.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 9.3% |

The United Kingdom's almond ingredients market is poised to grow over the next five years. The need for these nutritious almond milk protein bars, snacks, and dairy is high and gathering pace due to more attention towards health issues and the growing vegan food market. Moreover, as the clean-label movement continues to gain momentum among consumers and the demand for food and beverage applications with artificial ingredients is under higher scrutiny, we also see an increased use of natural almond derivatives in applications.

Accessibility to almond-based products continues to increase with the expansion of private-label brands and specialty health food retailers. Almond flour is increasingly being used in gluten-free and keto-friendly baked goods, which is also driving market growth in the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.6% |

Germany, France, and Italy are the major contributors to the almond ingredients market in the region, propelled by rising cognizance toward plant-based nutrition and functional food ingredient trends among consumers. Growing demand for almond-based beverages, bakery, and confectionery products in the European food industry.

Growing demand for organic and non-GMO almond ingredients The EU sustainability initiatives and focus on ethical ingredient sourcing are also encouraging the use of organic and non-GMO almond ingredients.

Moreover, the growing popularity of specialty diets, such as paleo, keto, and gluten-free, is driving the sales of almond flour, almond butter, and almond oil. Additionally, increasing investments in food processing technologies to improve almond ingredient functionality and shelf life should further fuel market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.8% |

Demand for nutritious and functional food products is driving the growth of the almond ingredients market in Japan. Strong emphasis on health and wellness among the country's inhabitants is paving the way for growth in almond protein-based dairy substitutes, protein-enriched snacks, and bakery products. Western food influences are also on the rise, along with plant-based milk substitutes, further driving demand. Moreover, almond-infused teas, confectionery, and collagen-boosted almond beverages are driving product innovations.

The cheaper availability of almond-based functional foods through e-commerce and specialty store channels improves accessibility to the market, and the government's focus on encouraging healthy food choices is further supporting growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.5% |

South Korea is fast becoming one of the most impactful players in the almond ingredient market, Driven by increasing health awareness and the rising popularity of plant-based diets, as well as sustained demand for innovative food products.

Almond flour, almond milk, and almond-based snacks are utilizing almond-based products butare driven by the development of the country’s bakery, confectionery, and dairy-alternative segments. Moreover, the growing market is driven by the café culture in South Korea and the growing trend of nut-based beverages.

The expansion of e-commerce, along with the growth of direct-to-consumer brands that focus on almond-based food products, is augmenting the growth of the market. In addition, manufacturers are creating almond products with added vitamins, probiotics, and functional ingredients to address changing consumer demand for healthier and more practical food options.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.0% |

Due to unreasonable growth in the demand for natural, versatile, and nutrient-packed food ingredients, the Whole Almonds and Almond Flour segments are anticipated to capture a larger market in the Almond Ingredients market. They functionalize food and offer taste and texture performance for food applications across multiple industries.

As dietary trends evolve and interest in plant-based nutrition rises, almond ingredients remain highly relevant in global markets, with significant potential for global growth.

Almonds is a key member of all almonds which has huge market propagation in simple snacks bakery food, and confectionery food. Unlike processed derivatives of almonds, whole almonds contain natural fibre, protein, and vitamins, making them a uniquely-suitable product for consumers focused on health.

Market adoption has been driven by the growing popularity of whole almonds in healthy snacking, especially for consumers of plant-based, keto, and gluten-free diets. In fact, whole almonds represent more than 60% of nut-based snacks sold due to their optimal nutritional profile and satiety-enhancing texture.

Market demand has been further sustained through the introduction of premium and value-added almond snack products, which includes flavoured, roasted and organic whole almonds, leading to enhanced consumer engagement and increased brand differentiation.

The adoption has also greatly increased due to the adoption of sustainable almond farming practices such as water-efficient irrigation techniques, regenerative agriculture, and the production of pesticides in sync with an ongoing focus on environmental sustainability globally.

The establishment of direct-to-consumer marketing strategies, including digital subscription models, e-commerce-based nut snack brands, and digital customer engagement platforms, has maximized market growth through improved product availability and customer loyalty.

The emergence of hybrid snack innovations and formulations with proteins, superfoods, and functional whole almonds has also qualified them for commercialization across multiple dietary preferences and lifestyle choices, thus supporting market expansion.

While being a rich source of nutrients, adaptable to various diets, and favoured among consumers, the whole almonds segment still encounters challenges from price fluctuations, supply chain constraints, and allergic reactions. Yet novel advancements in allergen-free processing, AI-powered crop optimization, and blockchain-enabled traceability promote efficiency, safety, and transparency, supporting projected global demand for whole almonds.

Almond flour has grown rapidly in popularity as a gluten-free flour, expanding the market share of gluten-free, grain-free, and low-carb baking products. Almond flour is a staple ingredient in contemporary clean-label formulations due to its high fibre, protein and heart healthy fat content versus refined flours.

The increasing popularity of almond flour in specialty baking, especially paleo, keto, and diabetic diets, has driven adoption. It’s why studies are showing that over 50% of all gluten-free baking mixes utilize almond flour to leave baked goods with superior texture, moisture retention, and nutrition profile.

The development of functional bakery product lines and high-protein, fiber-rich, and sugar-free sorts of almond flour products have bolstered the international intake marketplace, ensuring extra socioeconomic range and dietary diversity.

Adoption has been further spurred by milled using improved techniques, delivering ultra-fine grind uniformity, heat-stable processing, and enzymatic modification, resulting in enhanced baking performance and increased shelf stability.

Innovative product categories harnessing almond flour, namely low-carb bread, grain-free tortillas, and protein-fortified pancake mixes, are driving optimum growth in the market along with enhanced penetration into varying food markets.

Sustainable sourcing approaches, including organic-certified almond flour, fair-trade sourcin,g and zero-waste processing techniques, have further strengthened market growth in line with ethical consumerism and environmental responsibility.

However, despite its benefits for gluten-free formulation, improved baking performance, and nutritional advantages, manufacturers of almond flour still face issues like higher production costs, limited awareness in traditional baking, and complexities in processing.

But innovation in enzymatic flour modification, AI-ingredient customization, and precision baking technology is driving product consistency, affordability, and application versatility, all of which will facilitate the growth of almond flour in world markets.

Manufacturers are increasingly adding almond-based components to improve flavour, texture, and nutritional value, thus leading to the high share of the market in the Snacks and Bakery segments of almond ingredients. These categories of applications are key components in shaping wherein the market dynamics and ensuring the constant demand of an almond-derived ingredient in numerous formulations of food and beverages.

Due to the increasing consumer demand for nutrient-rich, minimally processed, and filling snacks, the Snacks sector continues to spearhead almond ingredient consumption. In contrast to typical snacks, formulations containing almonds deliver protein, fibre, and significant micronutrients in a way suitable for consumption on the move.

Market Adoption of Almond Ingredients The growth of the almond space can be attributed to the increased demand for both plant-based and functional snacks, especially in the fitness, wellness, and meal replacement markets. Historically, research reveals that more than 65% of new healthy snack innovations highlight almonds as the key ingredient, reinforcing their sustainability amid changing dietary trends.

With cleaner formulations for snacking, like more non-GMO, organic, and minimally processed almond products, this trend is further advancing market demand in correlation with consumer-led transparency and sustainability initiatives.

Further bolstering buy-in is the integration of advanced food technology with freeze-dried, coated, and high-protein almond snack innovations on the market, ensuring improved product shelf life and portability and convenience to consumers.

Functional snacking solutions using superfood, probiotic, and adaptogenic ingredients in almond-based snack bars have also maximized market growth, given that these benefits translate to across-the-board health advantages and a wider-reaching consumer base.

The snacks segment has some challenges due to allergen concerns, high costs of ingredients and regulatory compliance despite its benefits of clean-label transparency, health benefits and ease of dietary adaptability. Innovations in hypoallergenic processing, artificial intelligence-driven snack formulation, and sustainable ingredient sourcing are improving accessibility, safety, and growth in the market that are ensuring almond ingredients remain a powerhouse in the snack space.

Due to the growing demand for gluten-free, high-protein, and plant-based baking options, the Bakery sector has become one of the top consumers of almond components. Almond ingredients offer better moisture retention, greater texture, and enhanced health benefits over conventional wheat-based formulations, making them a sought-after option among health-oriented bakers.

The growing need for protein-rich and low-carb bakery items, especially in specialty bread, muffins, and cookies, is driving the market adoption of almond-based ingredients. More than 55% of formulations used to make gluten-free bakery products now contain almonds, according to research, because they help improve taste, structure, and nutrition.

While with its positive effects in gluten-free substitutes, performance in baking, and nutrient density, the bakery section needs supply chain dependencies, expensive ingredients, and complex product formulation.

But new exciting innovations in precise baking via AI, enzymatic modification of flour, and precise blending of almonds and their derivatives ensure continued growth opportunities for almond ingredients in the global bakery market through better formulation consistency, cost efficiency, and overall bakery innovation.

Factors such as growing demand for plant-based nutrition, increasing awareness about the health benefits associated with the use of almonds and the upsurge in the use of almond-based products in different beans and beverage applications are envisioned to drive the market for almond ingredients.

And, with innovations around almond-based formulations, expansion into dairy alternatives and growing enthusiasm for clean-label ingredients, there's a lot of growth in the category. Sustainability initiatives, functional food applications, and product diversification drive the industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Blue Diamond Growers | 12-16% |

| Olam International | 10-14% |

| Barry Callebaut | 8-12% |

| Borges Agricultural & Industrial Nuts | 6-10% |

| Kanegrade Ltd. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Blue Diamond Growers | Produces almond-based ingredients for snacks, dairy alternatives, and baking industries. |

| Olam International | Specializes in sustainably sourced almond ingredients, including almond flour and protein. |

| Barry Callebaut | Focuses on almond-based chocolate applications and functional food innovations. |

| Borges Agricultural & Industrial Nuts | Develops high-quality almond derivatives for global food and beverage markets. |

| Kanegrade Ltd. | Supplies almond ingredients for food manufacturing, including flavour enhancements and texturizers. |

Key Company Insights

Blue Diamond Growers (12-16%)

Blue Diamond Growers leads in almond ingredient production, offering a diverse range of almond-based products for global food industries.

Olam International (10-14%)

Olam is a key player in the sustainable almond supply chain, expanding its portfolio with innovative almond-based proteins and flour.

Barry Callebaut (8-12%)

Barry Callebaut integrates almond ingredients into its chocolate and confectionery offerings, driving functional food applications.

Borges Agricultural & Industrial Nuts (6-10%)

Borges focuses on premium almond ingredient processing, supplying high-quality products for international markets.

Kanegrade Ltd. (4-8%)

Kanegrade Ltd. specializes in almond-based ingredients used in food manufacturing, providing natural flavour and texture solutions.

Several specialty ingredient manufacturers, food processors, and almond suppliers contribute to the expanding almond ingredients market. These include:

The overall market size for the Almond Ingredients market was USD 11.8 Billion in 2025.

The Almond Ingredients market is expected to reach USD 27.4 Billion in 2035.

The demand for almond ingredients is expected to rise due to increasing consumer preference for plant-based and healthy food products, growing applications in the bakery and confectionery sector, and rising awareness regarding the nutritional benefits of almonds.

The top 5 countries driving the development of the Almond Ingredients market are the USA, Germany, China, India, and France.

The Almond Flour segment is expected to command a significant share over the assessment period.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.