From protein levels to heart health, almond butter has it all; and with these kinds of attributes, the humble nut butter finds applications in some pretty diverse projects within food and drink processing segments and has increased massively in popularity in recent years.

Packed full of core vitamins, minerals, and nutritional fats, the healthy eater, not to mention vegans on a plant diet, is among almond butter's fan base. Almond butter is widely found in homes and food service establishments as demand for natural and high-proteins substitutes increases.

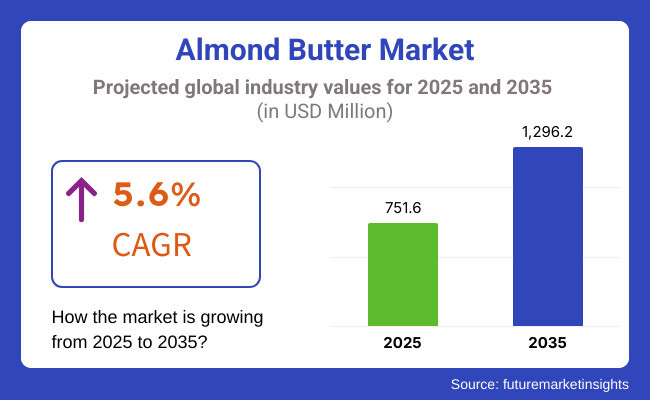

The market for almond butter is projected to grow at a very fast pace over the next 10 years as consumers increasingly appreciate its health benefits and usability for preparing an increasing array of culinary offerings. USD 751.6 Million in 2025, and is projecting a CAGR of 5.6% for the period between 2023-2035 to reach USD 1296.2 Million by 2035.

One more driving force behind this growth is the rising incidence of individuals with soy allergy, encouraging people to seek substitute products such as almond butter instead of peanut butter and other nuts butters.

With protein-rich features, in addition to an abundance of vitamins and minerals, almond butter is a top seller among health and well-being-oriented consumers. And with the above-listed versatility, it can be added to everything from breakfast foods and smoothies to baked foods and savoury foods.

With ongoing innovation by producers with new flavours and formulation, almond butter is set to see broader acceptance across various consumer groups.

Explore FMI!

Book a free demo

The almond butter market in North America would be led by a huge consumer base with health benefits, along with accessibility through both retail and online stores. In addition, the relatively high disposable income levels in the region along with rising inclination towards using plant-based and organic foods has resulted in high demand for premium almond butter products.

This has not only led to increased sales through traditional retail outlets but the rise of e-commerce has made almond butter even more accessible, contributing to the increase in sales.

The manufacturers in North America have also been leading in innovation in flavours and sustainability in packaging. Data segmentation in Asia Pacific can also be seen where increasing demand for quality with convenience like fast food has given an edge to pizza category leading to healthy growth of the category in a geography.

The region also boasts a robust foodservice sector including cafes, bakeries, and quick-service restaurants that has embraced almond butter as a versatile and increasingly sought-after ingredient in many dishes.

Natural food trends contribute to a large percent in the almond butter market in Europe, as the demand for organic products grows throughout the region. In addition, the demand for almond butter is further rising owing to an inclination towards plant-based diets among Germany, France, and the United Kingdom-based population.

The emphasis of the region on clean-label products and the sustainable sourcing of such attributes is well-aligned with consumer expectations, urging manufacturers to innovate and comply with stringent quality standards.

Meanwhile, a rise in specialty and artisanal almond butter products has also been noted in the European market, catering to a niche segment of gourmet food enthusiasts. Combined with unique flavours and eye-catching packaging, these high-quality offerings have helped products stand out in an increasingly competitive market.

Great European consumers have also chosen almond better than less sustainable alternatives, in influence of growing awareness of food production and environmental impact. This has allowed the almond butter market to maintain their steady growth over the years.

The almond butter market in the Asia-Pacific region is predicted to register the most significant progress due to increasing disposable incomes, the acceleration of urbanization, and the growing consciousness about health and wellness. Almond butter consumption is growing in countries including China, Japan and India, not just as a healthier spread but as a component of established and new recipes.

But having an almond butter available, that found is also being driven by this burgeoning e-commerce sector in the region, and then obviously the deepening of international brands, leading and making almond butter available at a mass level increasing consumption is definitely something that we will continue to see as well.

In the Asia-Pacific consumers are increasingly experimenting with almond butter across sweet and savoury applications. This versatility, along with its perceived health benefits, makes it appealing to a broad demographic. Also, increasing middle class in the region and rising focus on preventive healthcare, are also aiding the continued demand of almond butter throughout the forecast period.

Challenge

volatility in almond supply and pricing

Since almonds require very particular growing conditions, any weather change or water scarcity will have a big effect on yield. Lately, almond prices have become volatile due to rising productions costs along with increasing demand in other segments.

But this eventually has an impact on the price of almond butter premium priced products, not everyone on the consumer end can afford it. In addition, nut butters from competitors, like peanut and cashew, continue to provide price compression and options for consumers to select other products in crowded marketplaces.

Opportunity

Expanding applications and reaching new customer segments

Manufacturers have room to experiment with unique flavour profiles with the growing popularity of things like almond butter combined with superfoods such as chia seeds or matcha to attract millennials and Gen Z consumers prioritizing health.

Moreover, growing awareness of almond butter’s health benefits in developing markets can tap new channels for growth. Targeted marketing campaigns, consumer education initiatives, and sustainable farming practices will further build a strong presence in this context, making manufacturers be positioned to make almond butter a versatile product that contributes to a healthy global diet.

The Almond Butter Market experienced strong growth from 2020 to 2024 as consumers increasingly seek plant-based, protein-rich, and nutrient-dense food products. Healthier diets, vegan lifestyles and clean-label food trends supported almond butter demand through retail, foodservice and industrial applications.

The market has evolved with innovations like flavoured almond butter varieties, and organic and non-GMO almond butter variants, as well as sugar-free alternatives. But manufacturers faced challenges from high production costs, volatility in raw material prices, and supply chain disruptions.

Almond Butter Market Outlook the 2025 to 2035 Horizon: More than ever, almond butter is expected to evolve towards sustainability driven sourcing, functional ingredient fortifications, and AI driven food personalization. The integration of agro-processing technologies and alternative proteins, coupled with regenerative farming practices, will build the sustainability of domestic markets.

High demand for almond butter in protein-enriched foods, functional foods, and dairy alternatives will in turn bolster demand. Moreover, Ai-enabled consumer insights and block chain-driven transparency in the supply chain will transform markets to provide better-informed consumers with traceability and quality assurance.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with organic labelling, non-GMO certification, and food safety regulations. |

| Consumer Preferences | Rising demand for organic, sugar-free, and high-protein almond butter. |

| Industry Adoption | Expansion in retail, foodservice, and snack industries, with increased use in smoothies, spreads, and bakery products. |

| Production and Sourcing | Dependence on California almonds, with limited diversification of raw material sourcing. |

| Market Competition | Dominated by leading nut butter brands and premium organic food companies. |

| Market Growth Drivers | Demand driven by vegan, keto, and paleo diet trends, alongside increasing protein-rich snack consumption. |

| Sustainability and Environmental Impact | Initial efforts toward recyclable packaging and sustainable almond sourcing. |

| Integration of AI and Supply Chain Optimization | Limited use of AI in consumer insights and production efficiency. |

| Advancements in Product Innovation | Development of flavoured, high-protein, and sugar-free almond butter variants. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter carbon footprint labelling, sustainability standards, and allergen transparency regulations. |

| Consumer Preferences | Growth in personalized nutrition, functional almond butter (with probiotics, adaptogens, or added proteins), and bioactive ingredient formulations. |

| Industry Adoption | Adoption in sports nutrition, meal replacements, and plant-based dairy alternatives. Growth in subscription-based almond butter brands. |

| Production and Sourcing | Expansion of sustainable almond farming practices, regenerative agriculture, and global sourcing from new almond-producing regions. |

| Market Competition | Increased competition from start-up brands focusing on innovative flavours, eco-friendly packaging, and functional blends. |

| Market Growth Drivers | Expansion fuelled by personalized nutrition, AI-driven consumer recommendations, and sustainable ingredient sourcing. |

| Sustainability and Environmental Impact | Large-scale adoption of carbon-neutral processing, water-efficient almond cultivation, and biodegradable packaging. |

| Integration of AI and Supply Chain Optimization | AI-driven demand forecasting, real-time quality control, and block chain-powered supply chain transparency. |

| Advancements in Product Innovation | Evolution of enhanced almond butter with superfoods, plant-based protein fortifications, and probiotic-infused formulations. |

North America dominated the almond butter market in 2020 where United States is a major contributor in almond butter market owing to rising consumer demand for plant based and natural food product. However, rising demand for healthy spreads, along with increasing knowledge on health and nutrition benefits related with almond butter, is expected to support market growth.

Vegan and ketogenic diet trends are also driving up consumption. Furthermore, key food manufacturers are focusing on developing novel products of almond butter such as organic, sugar free, and fortified almond butter. The availability of established retailers and e-commerce platforms is fostering greater product availability.

Market expansion is also being aided by government campaigns promoting nut-based products as healthy substitutes for traditional spreads.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.9% |

The UK almond butter market is witnessing steady growth as health-conscious consumers look for alternative nutritious, high-protein options to regular spread. With clean-label trends and increasing awareness of a wider cycle of edible functional foods, the demand for organic, non-GMO, and additive-free almond butter is on the rise.

Government efforts that drive people to eat healthier along with the adoption of plant based diet is also driving the growth of market. Moreover, the expansion of private-label brands and niche health food outlets is increasing accessibility. The growth in segment adoption in the food service sector such as smoothies, baked goods, among other applications will continue to accelerate the market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.4% |

Almond butter consumption is mainly focused in Western Europe, led by Germany, then France and Italy, due to shifting consumer trends and the increased demand for plant-based and functional foods. Conversely, the high focus on sustainability and clean label food by the European Union is encouraging almond butter companies to invest in organic and sustainably sourced products.

In addition, the increasing lactose-intolerant and vegan base in the region is driving demand. Almond butter is going to become even more loved with the development of online grocery platforms and specialty food stores enhancing distribution channels. Innovative breakfast options like chocolate, cinnamon and protein-rich almond butter are boosting market appeal.

And the region's rigorous food safety regulations are compelling manufacturers to be open about what they place on labels and where they obtain their ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.5% |

Almond butter market in Japan is growing, driven by the growing demand for functional and nutrient-rich food products among consumers. The country’s old population is fuelling demand for health-conscious diets, such as nut-based spreads that are rich in protein and antioxidant content.

The increase in almond butter sales in Japan is also driven by the trend of Western food consumption and rising premium health foods consumption in the country. And on-the-rise innovations in product formulation include almond butter with matcha, collagen or added probiotics. Speciality food stores, supermarkets and online platforms is increasing product availability.

This is complemented by government initiatives advocating plant-based options that constitute a balanced diet, thereby bolstering market development.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

Driven by increasing health awareness and a growing consumption of plant-based diets, South Korea is set to emerge as the one of the leading market for almond batter. Almond butter, an increasingly consumed high-energy food option among health-conscious consumers, is another factor that is driving demand.

Moreover, the country’s burgeoning café culture and bakery industry are adding almond butter into assorted food applications, such as smoothies, desserts, and pastries. The evolution of e-commerce and home delivery services is also aiding in the expansion of markets. Additionally, South Korean manufacturers are focusing on new flavours and packaging solutions to adapt to evolving consumer preferences and improve market competitiveness.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

Premium food ingredients are in high demand among consumers, as are inexpensive food ingredients. Though they account for a relatively small percentage of the beverage industry, these segments are important in driving overall growth, as well as providing options for health-conscious consumers and casual drinkers.

Almond butter manufacturers are expanding their portfolios to meet the evolving consumer tastes by emphasizing clean-label ingredients, non-GMO certification and eco-friendly production methods.

Health-conscious consumers looking for natural and less processed food products have turned to organic almond butter as one of their options! Whereas organic almond butter is grown without synthetic pesticides or herbicides, contains no high-fructose corn syrup and is GMO-free (genetically modified organisms), so it presents a much cleaner choice with a more transparent supply chain.

Market adoption has been driven largely by consumers following plant-based, vegan, and clean-eating lifestyles with increased demand for organic almond butter. Research shows that 65.0% of people buying organic food choose this Almond Butter because of its dietary value, heart-healthy fat content, and natural protein content.

The growing trend of certified organic farming, that include regenerative agriculture, water-efficient almond cultivation and biodiversity conservation, has increased demand in the market, ensuring that almond butter production will be sustainable long-lasting way.

Further, the introduction of digital traceability solutions on block chain-enabled verification of ingredients for comprehensive traceability, AI-enabled verification of production and distribution quality, and consumer-friendly transparency has boosted the adoption with higher trust and brand loyalty segments.

The introduction and continued development of organic-driven product innovations, such as unsweetened, flavoured and fortified almond butter variants, have further stream-lined growth in the market, catering to health-conscious and specialty-diet consumers with an enhanced level of accessibility.

Sustainable practices, such as green packaging efforts using biodegradable, recyclable, and plastic-free materials, have also driven market growth, since these efforts aim towards fulfilment of global sustainability and zero-waste goals.

Although organic almond butters enjoy their obvious strengths in terms of health benefits, environmental sustainability, and clean-label appeal, the segment also confronts challenges such as its premium price, limited distribution in some markets, and supply chain volatility from climate uncertainty.

But with precision agriculture, artificial intelligence (AI)-enabled crop forecasting, and cooperative farming movement, innovations are likely to improve efficiency, cost-effectiveness, and supply chain resilience, sustainably promoting the organic almond butter market globally.

Traditional almond butter accounts for the largest market share because of the abundant availability, versatility, and low cost of its use in food applications. Organic almond butter tends to come with a higher price tag or may not be as accessible to mainstream consumers, as it is still made from almonds grown without synthetic inputs and processed without chemical additives.

Market adoption has been driven by increasing demand for affordable, nutrient-dense spreads, especially among wheeled households and foodservice operators. Conventional almond butters account for more than 70% of commercial almond butter sales according to studies, thanks to their scalability and competitive price.

The growth of fortified and value-added formulations, such as protein-enriched, vitamin-fortified, and flavoured almond butter products, has helped drive market demand, making sure they cater to as many consumer segments as possible.

Advancements in industrial-scale processing, including AI-driven roasting optimization, precision grinding techniques and automated quality assurance, have also accelerated adoption, guaranteeing consistency in texture, taste and shelf stability.

Strategic private-label partnerships initiated for co-branding opportunities, direct-to-consumer subscription, and large-scale retail partnerships have enhanced the market and ensured higher accessibility and market penetration.

As physical venues began to reopen, hybrid marketing strategies with an increased focus on influencers, performance-driven sales and sampling have continued to facilitate market growth, whilst driving brand awareness and consumer retention.

The conventional almond butter segment is yet affected because of the pesticide residue, sustainability issues, and consumers shifting preference to organic alternatives despite its cost advantages and mass production capabilities with a much larger consumer base as compared to the premium almond butter segment. Innovations in residue-free farming, sustainable sourcing certifications, and AI-powered quality testing are increasing product safety, credibility, and consumer trust and thus, the world marketability for conventional almond butter will still stay intact.

Driven by increasing application of almond butter for various culinary uses, the Almond Butter market is dominated by Spreads and Liquid segments. These categories are key to driving industry trends and maintaining broad adoption of traditional and new food formulations, including breakfast spreads and functional beverages.

Almond butter spreads have become more widely adopted in the market because they are easy to use, have a rich consistency, and can be used in meal preparation. And almond butter is a step up from traditional peanut butter, with many health benefits such as its high monounsaturated fat content, plant-based protein, and naturally occurring vitamin E.

Rising sales of healthy and functional spreads, particularly in households practicing low carb, keto, and paleo diet practices have uplifted market adoption. With its versatility to be utilized across sandwiches, smoothies and paired with snacks, spreadable formulations are preferred by more than 60% of almond butter consumers as per studies.

The growth of almond butter spreads underpinned with superfoods, sugar-free, protein-rich, and added with collagen, probiotics, and adaptogenic herbs has created a stronger demand from the market, to keep up with the trends of holistic nutrition.

Allergen-free processing, which includes peanut-free production lines, cross-contamination safeguards, and strict quality control measures, has boosted adoption even further, ensuring consumer safety and regulatory compliance.

This is ensuring wider consumer preference segment diversity, thus propelling the market growth with the advent of novel flavour profiles, ranging from honey sweetened to vanilla flavoured and cinnamon added almond butter spreads.

Offering benefits like convenience, nutrient density, and multi-use applications, the almond butter spreads segment is nonetheless challenged by price sensitivity, spoilage risks, and competition from emerging nut-based alternatives.

But recent technologies that better maximize cold-pressed extraction, prevent oxidation with artificial intelligence, and fortify with functional ingredients, are helping products maintain vending stability, integrity and a differentiated public image eons more, inspiring global growth almond butter spreads.

Liquid almond butter has found a solid footing in the market as food and beverage manufacturers look to innovative plant-based substitutes for dairy and traditional nut-based ingredients. Liquid almond butter provides better solubility, easier blending, and improved functionality in RTDs, protein shakes and desserts compared to spreadable formulations.

Fuelling adoption is growing demand for plant-based and dairy-free offerings, especially in functional beverages, sports nutrition, and premium dessert formulations. More than half of plant-based beverage brands recently added liquid almond butter to their portfolios to improve creaminess, texture and nutritional value, according to studies.

Despite its advantages in terms of solubility, functional nutrition, and formulation versatility, the liquid almond butter segment is challenged by oxidative susceptibility, emulsification stability, and temperature sensitivity issues.

But new innovations such as microencapsulation, artificial intelligence-powered emulsifier optimization, and cold-pressed liquid extraction can provide stability, consistency, and market penetration to the products, thus ensuring further growth of the liquid almond butter applications across the world.

Increasing consumer shift towards plant-based and healthy diet options along with Rising awareness regarding the health benefits offered by almond butter High demand for organic and natural spreads. The market has been growing at a considerable rate with the expansion of retail outlet channels and product diversification.

Defining trends currently influencing the industry include clean-label formulations, environmentally sustainable sourcing and greater push through emerging markets.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Justin’s, LLC | 12-16% |

| Barney Butter | 10-14% |

| Blue Diamond Growers | 8-12% |

| MaraNatha | 6-10% |

| Once Again Nut Butter | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Justin’s, LLC | Produces premium almond butter with organic and non-GMO ingredients, focusing on sustainability. |

| Barney Butter | Specializes in no-stir almond butter with a smooth texture and allergen-free production. |

| Blue Diamond Growers | Offers a range of almond-based spreads with high-protein and low-sugar formulations. |

| MaraNatha | Develops organic and classic almond butter varieties, emphasizing clean-label ingredients. |

| Once Again Nut Butter | Focuses on fair-trade, sustainably sourced almond butter with a strong presence in natural food markets. |

Key Company Insights

Justin’s, LLC (12-16%)

Justin’s leads the almond butter market with a strong emphasis on organic and sustainable sourcing, expanding its presence in premium retail stores.

Barney Butter (10-14%)

Barney Butter differentiates itself with allergen-free almond butter, catering to consumers with dietary restrictions and a preference for clean-label products.

Blue Diamond Growers (8-12%)

Blue Diamond focuses on high-protein, low-sugar almond butter variants, leveraging its strong brand presence in the almond-based food sector.

MaraNatha (6-10%)

MaraNatha specializes in organic and classic almond butter, appealing to health-conscious consumers and clean-label advocates.

Once Again Nut Butter (4-8%)

Once Again Nut Butter stands out with its fair-trade and sustainably sourced almond butter, targeting the growing ethical consumer base.

Several specialty food companies, organic product manufacturers, and private label brands contribute to the growing almond butter market. These include:

The overall market size for Almond Butter Market was USD 751.6 Million in 2025.

The Almond Butter Market expected to reach USD 1296.2 Million in 2035.

The demand for almond butter will be driven by the growing consumer preference for plant-based protein, increasing awareness of healthy fats, rising vegan and ketogenic diet trends, and expanding applications in the food industry.

The top 5 countries which drives the development of Almond Butter Market are USA, UK, Europe Union, Japan and South Korea.

organic almond butter segment drives to command significant share over the assessment period.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.