The global allergy immunotherapy market consists of multinational pharmaceutical companies, regional healthcare providers, biotechnology firms, and specialty immunotherapy developers.

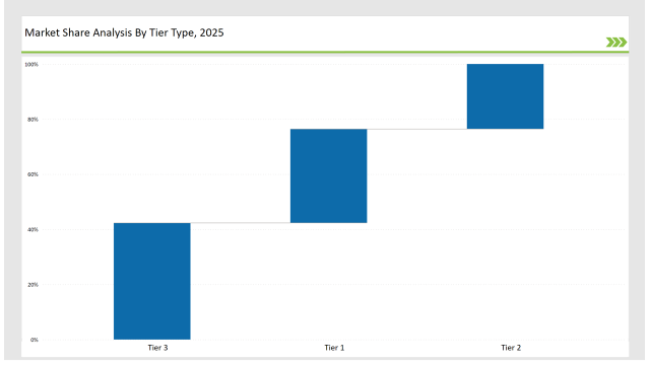

The market is primarily dominated by leading pharmaceutical companies such as ALK Abello, Stallergenes Greer and Allergy Therapeutics, which collectively hold approximately 34.1% of the market. These companies focus on advanced immunotherapy formulations, precision-targeted allergens, and innovative drug delivery mechanisms.

Regional companies like Anergis, DBV Technologies, Dermapharm Holdings, and others contribute to a regional market share of about 42.3%, offering cost-effective solutions along with some niche allergy treatments.

With new and established pure pharmaceutical companies or biotechnology businesses involved, allergy immunotherapy exhibits a highly competitive market that accelerates innovation, consequently driving this market.

Market participants are working to enhance standards for allergenic extracts, focus on technological enhancement, and adopt novel formulations that help in further therapies, like subcutaneous immunotherapy or SLIT. The rigid regulatory compliances laid by the FDA, EMA, and the Paul Ehrlich Institute invite a great degree of investments into clinical trials for product safety and efficacy standardizations.

Therefore, the competitive strategies involved in this market broadly include product differentiation, innovation related to research, and geographical expansion. Thus, Tier 1 companies hold an uptight lead in the global market owing to their well-established portfolios of FDA and EMA-approved SLIT tablets and SCIT formulations.

Tier 2 and regional players are now eyeing cost-effective solutions for the emerging markets, where affordability and accessibility are reckoned as the prime growth drivers.

Explore FMI!

Book a free demo

Global Market Share & Industry Share (%)

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top 3 (ALK Abello, Stallergenes Greer and Allergy Therapeutics) | 34.1% |

| Rest of Top 5 (ALK Abello, Stallergenes Greer and Allergy Therapeutics, HAL Allergy Group and Biomay AG) | 56.3% |

| Emerging & Regional Players | 14.5% |

The market is highly concentrated with Top Players collectively holds around 60.8%.

The allergy immunotherapy market can be segmented based on sublingual immunotherapy tablets, including Odactra, Grastek, Ragwitek, Oralair, and Actair, apart from oral and injections.

Since these are easily administered, non-invasive in nature, and have a good patient compliance record, SLIT tablets are thus an emerging segment. These sublingual formulations are effective and long-lasting to treat respiratory allergies and are securing regulatory approvals all over the world.

Injectable immunotherapy comprises subcutaneous allergy shots that dominate the market share at 66.3%. While requiring frequent administration, these injections remain a highly effective treatment for severe allergies, offering long-term desensitization and symptom reduction.

Continuous advancements in formulation and delivery methods are improving patient compliance and treatment outcomes, further solidifying injectable immunotherapy as a key segment in allergy management.

The market is further classified based on immunotherapy type:

Allergy immunotherapy treatments cater to multiple allergic conditions:

2024 has been a year of transformation in the allergy immunotherapy market, wherein leading companies furthered precision immunotherapy and newer modes of treatment:

Rise of SLIT Therapies

The growing patient preference for sublingual immunotherapy (SLIT) tablets is driven by their ease of administration, reduced side effects, and ability to be taken at home.

These tablets eliminate the need for frequent clinic visits, making them a convenient alternative to allergy shots. SLIT is particularly appealing to pediatric and needle-averse patients, as it offers a non-invasive way to build tolerance to allergens over time. Additionally, SLIT has demonstrated a strong safety profile, with fewer severe reactions compared to subcutaneous immunotherapy.

Expansion of Oral Immunotherapy for Food Allergies

Oral immunotherapies for life-threatening food allergies see a rapid rise in use due to their potential induction of long-term tolerance against such allergens.

These function by exposing patients in a controlled manner to doses of allergens, which are strengthening immune resistance and thereby reducing adverse reactions. Clinical trials have realized tremendous success in desensitizing patients, reducing the risk of anaphylaxis, and improving safety profiles.

As more regulatory approvals are gained and access to innovative oral treatments like Palforzia increases, more sufferers from food allergy can be treated effectively with long-term training of the immune system. With their growing use, these therapies are transforming food allergy management and improving the quality of life in patients.

| By Tier Type | Example of Key Players |

|---|---|

| Tier 1 | ALK Abello, Stallergenes Greer, Allergy Therapeutics |

| Tier 2 | HAL Allergy Group, Biomay AG, HollisterStier Allery and Desentum OY |

| Tier 3 | Emerging biotech firms and specialty providers |

| Brand | Key Focus |

|---|---|

| ALK-Abelló | Expanding SLIT therapy portfolio and enhancing regulatory approvals. |

| Stallergenes Greer | Advancing personalized allergy immunotherapy solutions. |

| LETI Pharma | Improving biologic standardization of allergen extracts. |

| Allergy Therapeutics | Developing next-generation injectable immunotherapy. |

| HollisterStier | Investing in biologic allergy treatment innovations. |

ALK Abello, Stallergenes Greer, and Allergy Therapeutics command about 34.1% share in the global market.

The global Allergy Immunotherapy market represents a sale of USD 1,942.1 million in 2025.

Regional and domestic companies hold nearly 14.5% of the overall market.

SLIT tablets offering significant growth prospects to market players.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.