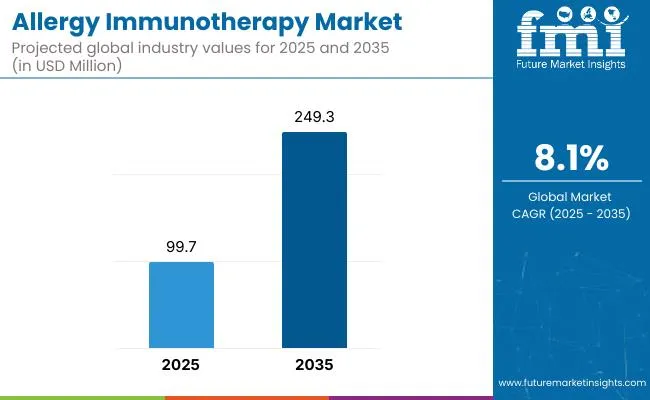

The Food Allergy Immunotherapy Market has been forecasted to attain a valuation of USD 99.7 million in 2025, rising to USD 249.3 million by 2035, resulting in an incremental gain of USD 149.6 million, which reflects a 40.0% increase over the forecast decade. A compound annual growth rate of 8.1% is expected to be recorded, indicating a rapid expansion trajectory for the food allergy immunotherapy market.

Food Allergy Immunotherapy Market Key Takeaways

| Metric | Value |

|---|---|

| Food Allergy Immunotherapy Market Estimated Value in (2025E) | USD 99.7 million |

| Food Allergy Immunotherapy Market Forecast Value in (2035F) | USD 249.3 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

The next five years from 2025 to 2030, are set to be defined by accelerated adoption of immunotherapy solutions from USD 99.7 million to approximately USD 157.7 million adding nearly USD 57.9 million, which would contribute 63.3% of the total decade growth. This period is propelled by heightened societal awareness of food allergy burden, evolving regulatory input, and real-world success stories.

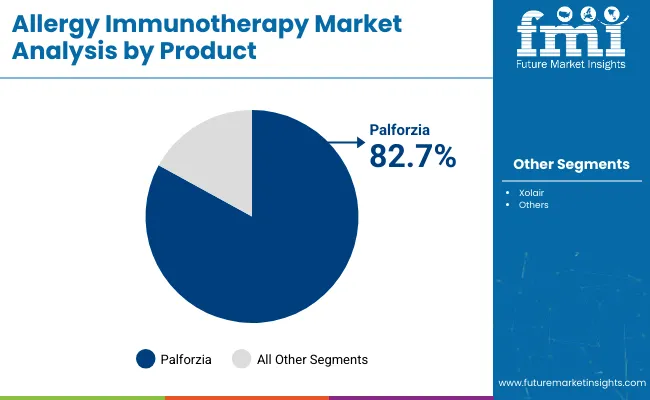

Early adopters among allergists and specialty clinics are incorporating oral immunotherapy (OIT) protocols and biologic therapies into mainstream treatment pathways. With patient demand is rising, PALFORZIA will dominate this period with over 80.0% revenue share fueled by families seeking greater dietary freedom and reduced anxiety over accidental exposures.

Between 2030 and 2035, the market adds USD 91.6 millionaccounting for over half of the total decade’s growth, as momentum builds around technological advancement, clinical integration, and rising patient empowerment. This phase capitalizes on the foundation set by the first wave of approved products, enabling new entrants and emerging solutions to gain traction.

Revenue share of XOLAIR to grow in the second half and is expected to contribute around 22.0% towards the end of the decade. Proactive food allergy management transforms into a mainstream standard, driven by innovation in diagnostics, personalized care models, and advocacy-led awareness.

From 2020 to 2024, the Food Allergy Immunotherapy Market experienced steady expansion, expanded from USD 60.1 million to USD 91.7 million, driven by growing awareness of food allergy prevalence and increased clinical adoption of immunotherapy treatments. During this period, growth was primarily fueled by the introduction and uptake of the first approved therapies Palforzia for peanut allergy and Xolair for multiple food allergiesestablishing new standards for managing food allergies beyond avoidance strategies.

The revenue composition revealed strong dominance in oral immunotherapy products and biologics, while emerging delivery methods such as epicutaneous patches and combination therapies demonstrated accelerating acceptance among patients, especially pediatric populations.

Looking ahead to 2025 and beyond, demand of food allergy immunotherapy will expand to USD 99.7 million in 2025. This market is anticipated to shift toward integrated care solutions encompassing digital adherence tools, telehealth-enabled monitoring, and personalized immunotherapy regimens. This evolving ecosystem aims to enhance treatment precision, patient engagement, and clinical outcomes across diverse demographic groups.Competitive differentiation is increasingly reliant not only on therapeutic efficacy but also on the seamless integration of immunotherapy into broader patient management frameworks incorporating real-world data analytics, automated dosing support, and coordinated care pathways.

The growth of the Food Allergy Immunotherapy Market is underpinned by a combination of clinical imperatives and technological innovations specifically tailored for long-term allergy management. Food allergies remain a growing public health challenge globally, particularly among pediatric populations, with increasing prevalence of peanut, milk, egg, and tree nut allergies.

Despite this rising burden, current treatment paradigms have largely been limited to strict avoidance and emergency interventions like epinephrine. Immunotherapy whether oral, epicutaneous, or sublingual addresses this critical gap by offering a proactive, disease-modifying approach capable of desensitizing patients to allergenic proteins and reducing the risk of severe reactions.

The widespread adoption of patient-centric care models, accelerated by the need for long-term chronic disease management, has further catalyzed interest in food allergy immunotherapies. Integration of immunotherapy protocols within allergist networks, specialty clinics, and even digitally supported home-based platforms fosters personalized desensitization programs and closer monitoring of immunologic response.

Moreover, rising awareness among parents, caregivers, and providers about the psychological and nutritional burden of food allergies alongside increasing regulatory support for breakthrough therapies has reinforced market demand. Collectively, these clinical and technological factors position the Food Allergy Immunotherapy Market for continued expansion as the convergence of precision medicine, immunology, and pediatric care unfolds.

The market is segmented by product, allergen type, age group, sales channel, and region. Product include PALFORZIA and XOLAIR. Allergen type classification covers Peanuts, Wheat, Milk, Eggs, Cashew, Walnut and Other Allergens. Based on age group, the segmentation includes Children, Teens, Young Adults, Adults and Geriatrics. Sales channel includes Institutional Sales and Retail Sales. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Product | Market Value Share, 2025 |

|---|---|

| PALFORZIA | 82.7% |

| XOLAIR | 17.3% |

The PALFORZIA segment has been projected to lead the market with a82.7% share in 2025, and it continue to do so. PALFORZIA represents a breakthrough in active desensitization therapy, offering structured, clinically monitored exposure to allergenic proteins with the goal of reducing severe allergic reactions upon accidental exposure.

Its launch has validated the clinical and regulatory pathway for OIT products, prompting increased investment and clinical trial activity across other food allergens such as egg and milk. Compared to epicutaneous and sublingual approaches, OIT offers more robust immunologic response data, though it requires rigorous dosing schedules and close clinical oversight. As the only approved product currently in commercial use, PALFORZIA has set the benchmark for product development, pricing, and patient uptake, reinforcing OIT’s leadership in the evolving food allergy treatment landscape and paving the way for pipeline candidates targeting broader allergen categories.

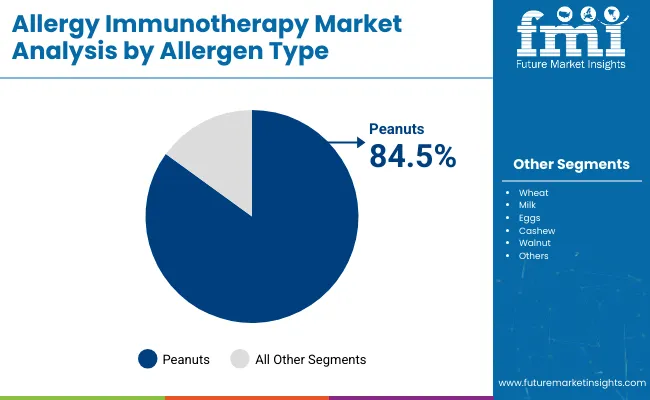

| Allergen Type | Market Value Share, 2025 |

|---|---|

| Peanuts | 84.5% |

| Wheat | 6.3% |

| Milk | 2.2% |

| Eggs | 2.0% |

| Cashew | 1.6% |

| Walnut | 3.3% |

The peanut allergy segment is expected to dominate the allergen type landscape in the Food Allergy Immunotherapy Market, accounting for approximately 84.5% of total market share in 2025. This dominance is driven primarily by the high global prevalence of peanut allergy, especially among children, and the severity of reactions associated with accidental exposure often resulting in life-threatening anaphylaxis.

The approval and commercialization of PALFORZIA by Aimmune Therapeutics (a Nestlé Health Science company) for peanut allergy has further solidified this segment's lead, serving as the first and only FDA- and EMA-approved oral immunotherapy for food allergies.

The structured development pipeline of peanut-targeted immunotherapies, including both oral and epicutaneous platforms, reflects a strong clinical and regulatory focus on this high-risk allergen. Additionally, advocacy from patient organizations and rising parental awareness have driven early diagnosis and demand for active treatment options. As a result, peanut remains the primary focus of innovation, investment, and clinical adoption within the allergen-specific immunotherapy landscape.

The adoption of food allergy immunotherapy has been steadily expanding. Continued clinical trial results and post-marketing surveillance enhance trust specifically in these therapies, elevating their utilization within specialist care settings.

Integration into Multidisciplinary and Specialist-Led Care Pathways

As clinical acceptance grows, food allergy immunotherapy protocols are being rapidly incorporated within multidisciplinary care teams and specialist-managed allergy centers. Allergists, pediatric practitioners, and immunology experts are now working closely to personalize immunotherapy regimens, providing meticulous titration and ongoing surveillance.

This coordinated, proactive approach ensures more precise dosing, effective management of adverse effects, and improved patient education, all of which contribute to optimal long-term outcomes. Strategic partnerships between therapy developers and leading clinics are facilitating the digital transformation of allergy management, enabling remote monitoring solutions, digital adherence technologies, and robust data analytics for continuous care optimization.

Specialist-Led, Protocolized Immunotherapy Delivery Models

Immunotherapy’s complex dosing schedules and reaction management require structured specialist oversight. Allergy centers proficient in oral food immunotherapy protocols are emerging as hubs of expertise, improving safety outcomes and expanding patient reach. The concentration of expertise in these centers and the establishment of standardized desensitization protocols are proprietary market drivers, differentiating early adopter regions and shaping access patterns distinctly in this market.

Up-Dosing Risk Management and Patient Eligibility Constraints

The necessity for supervised incremental dose escalationdue to the risk of systemic allergic reactions and anaphylaxis during up-dosing phasesposes a significant barrier unique to food allergy immunotherapy. This hurdle restricts treatment to carefully selected patient populations and well-equipped clinical environments, limiting broader community-level uptake. Unlike many other pharma markets, emergency preparedness during therapy sessions remains integral, thereby constraining rapid commercialization and patient convenience.

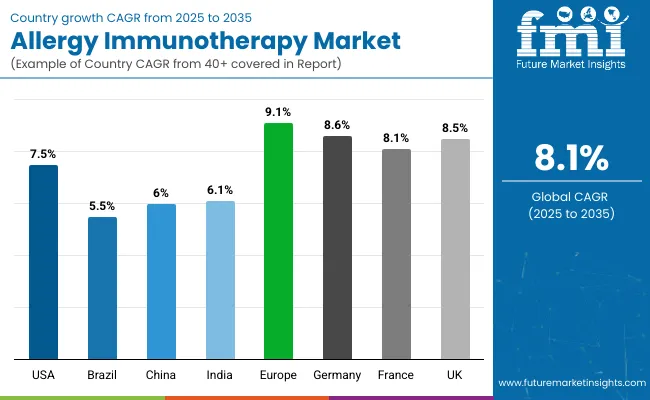

| Country | CAGR |

|---|---|

| USA | 7.5% |

| Brazil | 5.5% |

| China | 6.0% |

| India | 6.1% |

| Europe | 9.1% |

| Germany | 8.6% |

| France | 8.1% |

| UK | 8.5% |

The Food Allergy Immunotherapy Market displays significant variability in adoption and growth rates across different countries, shaped by clinical awareness, regulatory maturity, and national investment in allergy prevention and pediatric health.

In the United States, the market is projected to grow at a CAGR of 7.5%, driven by early regulatory approval of PALFORZIA, strong penetration of allergy specialty clinics, and robust parental demand for proactive allergy management.

The USA remains the only country with an FDA-approved food allergy immunotherapy, creating a commercially validated path for emerging therapies targeting egg, milk, and multi-allergen protocols. High prevalence rates particularly among school-aged children combined with strong reimbursement coverage under both public and private plans, are supporting sustained clinical adoption. Additionally, initiatives such as school-based anaphylaxis preparedness programs and allergist-led OIT expansion are reinforcing treatment uptake.

Across Europe, the market is expected to grow at a CAGR of 9.1%, with Germany (8.6%), France (8.1%) and the UK (8.5%) leading adoption. In France, widespread participation in publicly funded pediatric allergy trials and government-supported early childhood screening programs have created fertile ground for OIT pilot integration within national care pathways.

In the UK, the National Institute for Health and Care Excellence (NICE) has prioritized real-world data collection on emerging desensitization therapies, positioning the NHS as a long-term adopter once more treatments gain EMA approval. Regulatory progress, combined with clinician interest in non-pharmacologic allergy control, continues to shape Europe's cautious but steadily expanding immunotherapy landscape.

The food allergy immunotherapy market in the United States has been forecasted to expand at a CAGR of 7.5% between 2025 and 2035. This growth is fueled by the increasing clinical adoption of structured oral immunotherapy protocols, particularly for peanut allergy, which remains the most prevalent and high-risk allergen among children. The launch of PALFORZIA has validated commercial pathways and created a reference model for allergist-guided immunotherapy, catalyzing growth across specialty clinics and academic centers.

The food allergy immunotherapy market in India is expected to grow at a CAGR of 6.1% between 2028 and 2035, driven by rising pediatric allergy diagnosis, expanding urban healthcare infrastructure, and increasing awareness of food-induced anaphylaxis among Tier 1 and Tier 2 cities. Although food allergy prevalence remains underreported compared to Western nations, recent epidemiological surveys have indicated a measurable rise in milk, egg, and wheat allergies, particularly among young children in metropolitan regions such as Delhi NCR, Bengaluru, and Mumbai.

India currently lacks regulatory approval for any commercial food allergy immunotherapy product, and OIT remains largely investigator-initiated or off-label within academic and private allergy clinics. However, growing interest from pediatric gastroenterologists and immunologists is accelerating local research collaborations, with early-phase trials for OIT formulations gaining traction.

China’s food allergy immunotherapy market is projected to expand at a CAGR of 6.0% from 2028 to 2035. China remains in an early-stage developmental phase, with no commercial manufacturers currently approved by the National Medical Products Administration (NMPA). However, the market landscape is beginning to take shape through a research-driven and academically anchored ecosystem, led by tier-1 pediatric hospitals, allergy research institutes, and university-affiliated clinical centers.

Local pharmaceutical firms and biotech startups are gradually entering exploratory partnerships with academic researchers to evaluate oral and sublingual immunotherapy protocols for allergens such as milk, egg, and peanutsthough none have yet reached late-stage trials or regulatory submission.

The food allergy immunotherapy market in the United Kingdom is projected to grow at a CAGR of 8.5% between 2025 and 2035, supported by a maturing ecosystem of allergy-focused healthcare services and increasing public investment in childhood allergy management. Although no immunotherapy for food allergy has received full MHRA approval as of 2025, the United Kingdom has remained at the forefront of real-world clinical evaluation and early-access programs, particularly through NHS-supported trials and university hospital collaborations.

Growing participation in oral immunotherapy pilot programs for peanut and milk allergies, combined with the availability of specialized pediatric allergy centers across England, Scotland, and Wales, has laid a strong clinical foundation for eventual commercial rollout. Policy-level prioritization of food allergy under NHS long-term care planningparticularly in relation to school health and early intervention continues to reinforce market preparedness.

The food allergy immunotherapy market in Germany is anticipated to grow at a CAGR of 4.2% between 2025 and 2035, supported by a well-structured allergy care infrastructure, high prevalence of IgE-mediated food allergies, and a strong academic ecosystem conducting translational research in immunotherapy. Germany has one of the highest reported rates of food allergies in Europeespecially peanut, hazelnut, and milkprompting increased investment in both hospital-based desensitization programs and publicly funded clinical trials across leading university hospitals.

Unlike many countries, Germany’s allergy care is highly specialized, with certified allergy centers (AllergologischeZentren) integrated into tertiary hospitals. These centers are gradually introducing oral and epicutaneous immunotherapy protocols for select pediatric cases under controlled environments. Although commercial immunotherapy products are not yet approved by the Paul-Ehrlich-Institut, clinicians are cautiously optimistic due to ongoing EMA evaluations and cross-border collaboration with clinical hubs in Switzerland and Austria.

| Europe Country | 2025 | 2035 |

|---|---|---|

| Germany | 36.5% | 39.1% |

| UK | 26.0% | 27.7% |

| France | 4.9% | 5.1% |

| Italy | 8.6% | 9.1% |

| Spain | 8.2% | 8.1% |

| BENELUX | 8.2% | 8.1% |

| Nordic Countries | 5.6% | 3.7% |

| Rest of Western Europe | 3.4% | 2.0% |

| Product | 2028 Share (%) |

|---|---|

| PALFORZIA | 84.7% |

| XOLAIR | 15.3% |

The food allergy immunotherapy market in Japan has been projected to reach USD 3.0 million by 2028. PALFORZIAwill lead the product landscape with an84.7% share, followed by XOLAIR at 15.3%. Japan’s market growth for Food Allergy Immunotherapy is primarily driven by high pediatric food allergy prevalence, structured national guidelines on allergy management, and increasing research collaborations between academia and pharmaceutical companies. Japan has one of the most systematically documented food allergy burdens among children, particularly for egg, milk, wheat, and peanuts, supported by nationwide school-based health reporting and dietary control systems.

Unlike many Western countries, Japan has long employed in-hospital oral food challenge (OFC) protocols for allergy diagnosis and has cautiously begun integrating oral immunotherapy (OIT) within specialized pediatric allergy departments under strict clinical monitoring. While no food allergy immunotherapy has been officially approved by the Pharmaceuticals and Medical Devices Agency (PMDA), multiple investigator-initiated trials-especially for OIT in egg and wheat-are underway at national children’s hospitals and university-affiliated research centers.

| Allergen Type | Market Value Share, 2028 |

|---|---|

| Peanuts | 85.1% |

| Wheat | 7.8% |

| Milk | 0.5% |

| Eggs | 4.6% |

| Cashew | 0.2% |

| Walnut | 1.7% |

The food allergy immunotherapy market in South Korea has been projected to reach USD 2.6 million in 2028. Peanutsare expected to lead allergen type with an85.1%. South Korea’s food allergy immunotherapy market is propelled by rising incidence of pediatric food allergies, strong government-led allergy surveillance, and a digitally integrated healthcare infrastructure. South Korea has seen a steady increase in milk, egg, and peanut allergies among children over the past decade, largely attributed to dietary shifts and earlier allergen exposure in urban populations.South Korea’s healthcare system is characterized by universal coverage and a centralized medical data network, allowing real-time allergy diagnosis reporting through the National Health Insurance Service (NHIS).

| Company | Global Value Share 2025 |

|---|---|

| Stallergenes Greer | 79.0% |

| Other Players | 21.0% |

The food allergy immunotherapy market is highly consolidated, dominated by a narrow set of players with early regulatory and clinical validation. The market is currently defined by a two-tier structure, with Stallergenes Greer and Genentech (a Roche company) as the primary commercial entities actively shaping the field. Aimmune Therapeutics, acquired by Nestlé Health Science and now operating under Stallergenes Greer, leads the market with PALFORZIA, the only FDA- and EMA-approved oral immunotherapy for peanut allergy. The company’s position is reinforced by its extensive Phase 3 trial data, deep engagement with pediatric allergy networks, and expansion efforts targeting broader geographic and clinical coverage.

Genentech, in collaboration with Novartis, is developing biologic-based adjuncts (such as omalizumab) to improve the safety and efficacy of OIT protocols. These efforts reflect a strategic intent to complement desensitization therapies with immune-modulating agents, targeting patients with multiple food allergies or high anaphylaxis risk. While Genentech has not yet launched a standalone immunotherapy product, its clinical influence and biologics expertise provide significant competitive leverage.

Given the concentrated market structure, differentiation is increasingly focused on clinical validation, scalability of dosing protocols, patient adherence tools, and payer engagement strategies. Both players are investing in physician education, digital dose-tracking platforms, and long-term immunologic monitoring frameworks to strengthen clinician buy-in and reinforce their positions as first-movers in this emerging therapeutic domain.

Key Developments in Food Allergy Immunotherapy Market

| Item | Value |

|---|---|

| Quantitative Units | USD 99.7 million |

| Product | PALFORZIA and XOLAIR |

| Allergen Type | Peanuts, Wheat, Milk, Eggs, Cashew and Walnut |

| Age Group | Children, Teens, Young Adults, Adults and Geriatrics |

| Sales Channel | Institutional Sales and Retail Sales |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Europe, Germany, France and UK |

| Key Companies Profiled | Stallergenes Greer and Genentech |

The market is segmented into SLIT Tablets, Oral, Injections, and Other Product Types.

The market is categorized into Sublingual Immunotherapy (SLIT), Subcutaneous Immunotherapy (Allergy Shots), and Intralymphatic Immunotherapy (ILIT).

The market is segmented into Allergic Rhinitis, Allergic Asthma, Food Allergy, Atopic Dermatitis, and Other Indications.

The market is divided into Pollens, House Dust Mites (HDM), Mould, Animal Dander, Bee Venom, Cockroaches/Insects, and Other Allergen Types.

The market is segmented into Institutional Sales and Retail Sales.

The market is categorized into North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and Middle East and Africa.

The global Food Allergy Immunotherapy Market is estimated to be valued at USD 99.7 million in 2025.

The market size for the Food Allergy Immunotherapy Market is projected to reach approximately USD 249.3 million by 2035.

The Food Allergy Immunotherapy Market is expected to grow at a CAGR of 8.1% between 2025 and 2035.

The key product formats in the Food Allergy Immunotherapy Market include PALFORZIA and XOLAIR.

In terms of allergen type, wearable devices segment is projected to command the highest share at 84.5% in the Food Allergy Immunotherapy Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Allergy Immunotherapy Providers

Food Allergy Immunotherapy Market Analysis Size and Share Forecast Outlook 2025 to 2035

Allergy Diagnostic Market Forecast and Outlook 2025 to 2035

Allergy Tester Market Size and Share Forecast Outlook 2025 to 2035

Allergy Treatment Market Analysis - Demand & Forecast 2024 to 2034

IgE Allergy Blood Tests Market Size, Growth, and Forecast 2025 to 2035

Food Allergy Market Size and Share Forecast Outlook 2025 to 2035

Nasal Allergy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Ocular Allergy Diagnostic System Market Size and Share Forecast Outlook 2025 to 2035

Pollen Allergy Market Size and Share Forecast Outlook 2025 to 2035

Seasonal Allergy Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Needle Free Allergy Therapy Market Size and Share Forecast Outlook 2025 to 2035

Radioimmunotherapy Treatment Market

Personalized Immunotherapy Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA