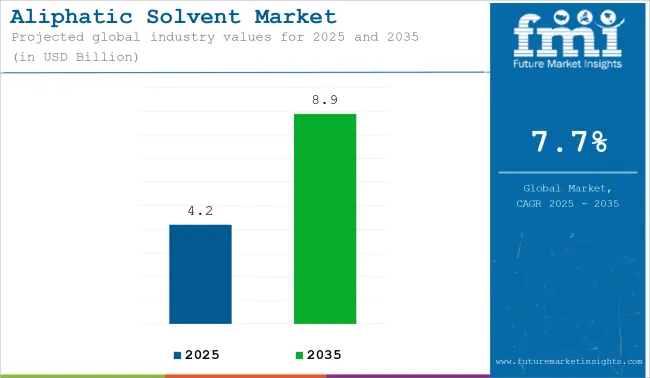

The global aliphatic solvent market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 8.9 billion by 2035, reflecting a CAGR of 7.7% during the forecast period. Growth is being supported by increasing demand across paints and coatings, adhesives, and industrial cleaning applications, particularly in construction and automotive manufacturing sectors.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.2 billion |

| Industry Value (2035F) | USD 8.9 billion |

| CAGR (2025 to 2035) | 7.7% |

In the paints and coatings industry, aliphatic solvents are being utilized for their low odor, quick-drying, and non-polar properties, which assist in forming smooth, durable coatings. According to Coatings World, demand for solvent-based paints is being sustained by developing economies, where high-performance exterior coatings are required for infrastructure and transport projects. Mineral spirits and hexane are being widely used in decorative coatings, primers, and industrial maintenance coatings.

The adhesives and rubber processing industry is incorporating aliphatic solvents to support tackiness, dispersion, and polymer solubility. The Adhesive and Sealant Council has reported increased demand for solvent-based construction adhesives across North America and Asia, attributed to improved mechanical bonding and faster curing times.

Environmental regulations are reshaping product development strategies. The USA Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) have enforced emission limits on volatile organic compounds (VOCs), resulting in increased adoption of low-aromatic and refined aliphatic solvents. These formulations are being preferred in formulations for wood finishes, metal coatings, and automotive touch-up products.

Unique selling propositions (USPs) of aliphatic solvents include high flash points, slow evaporation rates, and compatibility with a wide range of resins. These characteristics have contributed to their growing usage in cleaning agents for electrical parts and machinery degreasing, where residue-free performance is critical.

Asia-Pacific is expected to maintain market leadership due to strong manufacturing bases in China, India, and Southeast Asia. As reported by Chemweek, manufacturers in the region are expanding production capacity to meet domestic and export demand while investing in solvent recovery technologies to align with global sustainability targets.

Product differentiation through purity levels, VOC compliance, and tailored evaporation profiles is expected to drive competitive advantage across global aliphatic solvent markets through 2035.

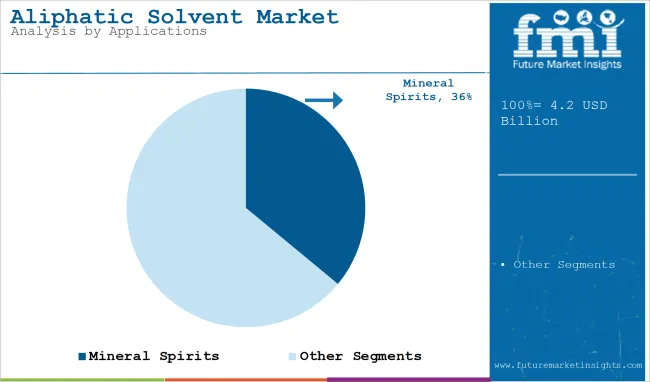

Mineral spirits are estimated to account for approximately 36% of the global aliphatic solvent market share in 2025 and are projected to grow at a CAGR of 7.9% through 2035. Known for their moderate evaporation rate and low odor, mineral spirits are widely used as diluents and cleaning agents in the paints & coatings industry, metal degreasing, and general-purpose maintenance.

Their compatibility with oil-based formulations and resins makes them suitable for varnishes, enamels, and alkyd-based coatings. Manufacturers continue to favor mineral spirits for their cost-effectiveness, flashpoint stability, and ability to reduce viscosity without compromising film formation. Regulatory shifts toward low-VOC and refined hydrocarbon grades are shaping new product development, particularly across North America and Europe.

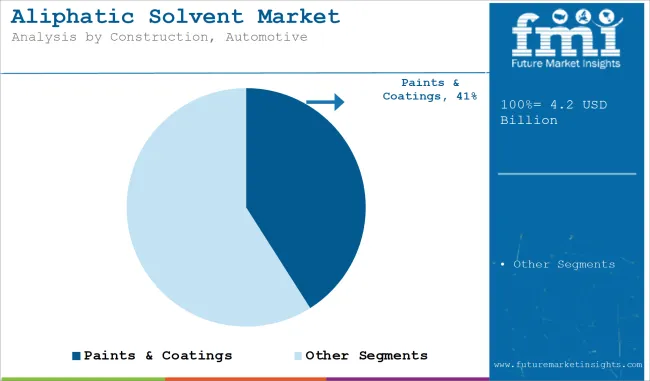

Paints & coatings are projected to hold approximately 41% of the global aliphatic solvent market share in 2025 and are expected to grow at a CAGR of 7.8% through 2035. Aliphatic solvents serve as carriers and viscosity modifiers in solvent-borne paints, offering controlled drying time and surface leveling.

Growth in residential, commercial, and industrial construction activities, particularly in Asia-Pacific and Latin America, continues to drive demand for solvent-based coatings in both architectural and protective applications. In automotive refinishing and industrial metal coatings, aliphatic solvents play a crucial role in achieving consistent finish quality and adhesion. As developing markets continue to industrialize and invest in infrastructure expansion, the paints & coatings segment remains the primary consumer of aliphatic solvent formulations.

Environmental Regulations and VOC Emissions

The major challenge facing the aliphatic solvent industry is the stringent environmental regulations governing VOC emissions and the toxicity of solvents.

For a long time now, the use of petroleum-based solvents is being restricted across the globe as it can cause air pollution and health hazards. Such-ersatz regulations push companies to invest in R&D for low-VOC, bio-degradable and non-toxic alternative solvents thereby increasing the cost of operations and limiting product choices for selective fabrications.

Growth of Bio-Based and Low-VOC Solvents

Increasing focus on sustainability is the biggest opportunity for aliphatic solvent market. To reduce environmental footprint, firms are manufacturing bio-based solvents using renewable feedstock and plan oils and agricultural residues. Low-VOC and low-odor aliphatic solvents are also on the rise, notably in the coatings, paints and adhesives industries.

Additionally, the advancements in the methods for recovering and recycling solvents are enabling cost-effective and eco-friendly alternatives to be adopted, which is enabling industries to move to greener and safer solvent alternatives.

The USA aliphatic solvent market is expanding with widespread application in the paints & coatings, adhesives, and chemical processing segments. The highly growing construction and automotive industries are driving demand for solvent-based industrial cleaning chemicals and paints. Rising demand for low-VOC and eco-friendly solvents is also influencing product development.

Aliphatic solvents are of utmost significance in architectural and industrial coatings, increased vehicle manufacturing is driving solvent-based cleaning chemicals and degreasers demand, plant expansions for chemical manufacturing that require aliphatic solvents, stringent EPA requirements driving the adoption of green formulations, expanding packaging and print industries driving solvent demand are some of the foremost growth impulses in the United States.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

The UK aliphatic solvent market is expanding as a result of heavy demand for industrial coatings, adhesives, and degreasers. Demand for sustainable, low-toxicity solvents is pushing innovation in the chemical industry.

Residential and commercial development driving paint & coating consumption, low-emission and bio-based solvents push, growth in car repair, cleaning, and coatings applications for solvents, use of aliphatic solvents in pharmaceutical formulation and chemical processing, growth in industrial maintenance and metal fabrication are some of the prominent drivers for the United Kingdom market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.5% |

The EU aliphatic solvent market is growing as a result of strict REACH regulations, growth in green solvent technologies, and increasing demand in automotive and construction industries. Germany, France, and Italy are key markets with high demand for industrial cleaning agents and coatings.

EU policies promoting the production of green solvents, strong demand for long-lasting solvent-based coatings, rising solvent usage in drug synthesis and manufacturing, expanding usage in packaging, construction, and industry, transition to water-based and low-toxicity aliphatic solvents are some of the key drivers which propel the market in European Union.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.9% |

Japan's market for aliphatic solvents is fueled by its sophisticated chemical production industry, strong demand for coatings & adhesives, and growing research into environmentally friendly solvent substitutes. The automotive and electronics industries are major users of high-purity solvents.

Aliphatic solvents find application in cleaning and degreasing operations, application in protective coatings on machinery and household items, embracement of eco-friendly solvent compositions in accordance with regulatory requirements, growing application in paint and surface treatment formulations, Japan's chemical sector seeking alternate aliphatic solvents are some of the key drivers of the market in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.2% |

South Korea's aliphatic solvent market is witnessing aggressive growth because of fast industrialization, growing exports of paints & coatings, and growth in the electronics and semiconductor sector. The government is also encouraging the production of environmentally friendly solvents.

High usage of degreasers and industrial coatings, increasing global demand for South Korean-produced paints and protective coatings, government support for green and bio-based solvent manufacturing, high-purity solvents required for cleaning and precision uses, expanded application of solvents in lubrication and maintenance are some of the key drivers of the market in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.6% |

The aliphatic solvent market is moderately consolidated, with a few dominant players controlling a significant share of production and distribution. However, regional manufacturers also contribute to market diversity, creating a competitive landscape. Entry barriers are high due to the substantial investment required in refining and manufacturing facilities, along with compliance with stringent environmental regulations.

Expertise in solvent production, including knowledge of VOCs and environmental standards, is critical for companies to maintain a competitive edge. High competition exists as firms strive to offer cost-effective, sustainable solutions, with a focus on low-VOC and bio-based alternatives.

The market is estimated to reach a value of USD 4.2 billion by the end of 2025.

The market is projected to exhibit a CAGR of 7.7% over the assessment period.

The market is expected to clock revenue of USD 8.9 billion by end of 2035.

Key companies in the Aliphatic Solvent Market include ExxonMobil Corporation, Royal Dutch Shell Plc, Total Energies, Calumet Specialty Products, SK Global Chemical Co., Ltd.

On the basis of type, hexane to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solvent Recovery Systems Market Size and Share Forecast Outlook 2025 to 2035

Solvent-Free Natural Color Dispersions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Green Solvents Market Growth – Trends & Forecast 2024-2034

Citrus Solvents Market Insights Trends & Forecast 2025 to 2035

Renewable Solvents Market

Food Grade Solvent Market Analysis - Size and Share Forecast Outlook 2025 to 2035

High Purity Solvents Market Growth - Trends & Forecast 2025 to 2035

Fluorinated Solvents Market

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Solvents Market Insights - Size, Share & Industry Growth 2025 to 2035

Vapor Degreasing Solvents Market

Industrial Cleaning Solvent Market Growth – Trends & Forecast 2024-2034

Electronics Cleaning Solvents Market - Growth & Demand 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA