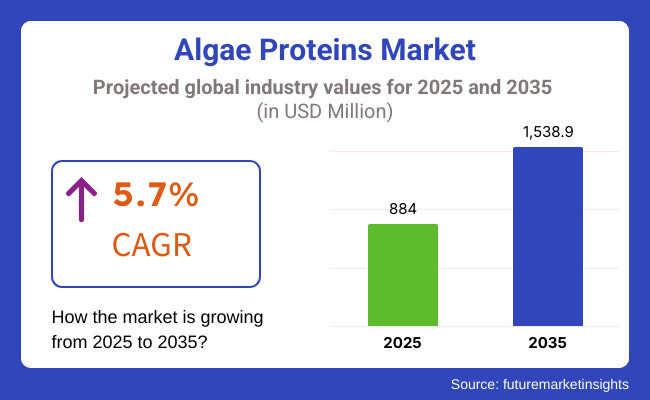

The Algae Proteins Market is expected to witness significant expansion between 2025 and 2035, driven by the growing demand for plant-based and sustainable protein alternatives across multiple industries. The market is projected to be valued at USD 884.0 million in 2025 and is anticipated to reach USD 1,538.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.7% throughout the forecast period.

A key driver of market growth is the increasing consumer preference for plant-based protein sources, especially in the food and beverage industry. With rising concerns about the environmental impact of traditional animal-based proteins, algae proteins are emerging as a nutrient-rich, eco-friendly alternative.

The high protein content, essential amino acids, and sustainability benefits of algae-based proteins make them an attractive choice for both vegan consumers and environmentally conscious brands. Additionally, algae proteins are gaining traction in functional foods, dietary supplements, and animal feed applications, further contributing to market expansion.

The market is segmented based on dosage form and application. By dosage form, algae proteins are available in capsules, liquid, powder, and others. By application, major segments include dietary supplements, food and beverage, animal feed, cosmetics, and others.

Among these segments, the food and beverage industry dominates due to the surging demand for plant-based protein alternatives in health-conscious and vegan diets. The increasing adoption of algae proteins in meat substitutes, protein bars, smoothies, and functional beverages is driving demand.

Additionally, food manufacturers are leveraging algae-derived proteins for their high digestibility, complete amino acid profile, and sustainability benefits. As global consumers shift toward clean-label, high-nutrition food products, algae proteins are becoming a preferred ingredient, positioning the food and beverage sector as the leading application segment in the market.

Explore FMI!

Book a free demo

The North American market for algae proteins is a high-end market with rising consumer demand for plant protein substitutes and sustainable food. In the USA and Canada, demand for algae-derived protein in functional foods, dietary supplements, and animal feed and nutrition has risen, leading to a boom in the algae-based protein industry.

Expansion of the flexitarian and vegan population and investments into sustainable food technologies are driving the adoption of algae proteins. Moreover, it is backed by the region with strict food safety and labeling regulations, which help to lavender algae protein food with high quality.

One such growth driver for the market is the increased growth of plant based meat alternatives for which algae proteins are used due to their high amino acid profile and functionality. Furthermore, North American based biotech firms are investing in novel extraction technologies that optimize both efficiency and scalability for algae protein production.

Europe is one of the major markets for algae proteins and is becoming one of the most sustainable food and nutrition innovations particularly in the nations such as Germany, France and the Netherlands Market growth is attributed to a favorable regulatory scenario supporting plant-based diets and an increasing number of consumers who recognize the health benefits offered by the proteins.

Algae proteins are widely used in food & beverages, sports nutrition and dietary supplements, addressing the health-oriented consumer segment in the region. The European Union’s strict sustainability standards push algae farming and protein-extraction methods with lower carbon footprints.

Similarly, the European food sector also collaborates with research institutes to explore applications for algae proteins in nutritional supplements, functional ingredients, and compostable packaging.

The Asia-Pacific region's algae proteins market will grow at the highest rate, primarily because there is increasing demand for alternative sources of protein in China, India, Japan, and South Korea. Because the region has high population density and increasing food security requirements, governments and producers of food are being compelled to seek out sustainable sources of protein, including microalgae-proteins.

This is the reason China also dominates algae protein production, aided by its large seaweed cultivation and sophisticated biotech processing. The sector of algae proteins is growing significantly in nutraceuticals and functional foods in India as well Explore plant-based proteins.

Moreover, raising aquaculture industry in Asia Pacific region propel algae protein consumption as a sustainable feed for high value nutritious component. However, issues pertaining to production scalability and cost-effectiveness continue to act as significant roadblocks to mass adoption.

Challenge

High Production Costs and Scalability Issues

Low cost of production and scalability are among the significant challenges for the algae protein industry. Algae cultivation, harvesting, and extraction involve sophisticated technology, high energy consumption, and strict environmental conditions, which imply costly large-scale production.

Furthermore, the absence of well-established commercial infrastructure for algae farming restricts the efficiency of the supply chain. Manufacturers need to identify cost-effective ways of enhancing production scalability with maximum protein yield and nutritional value.

Opportunity

Expansion in Functional Foods and Nutraceuticals

The growth of the demand for functional foods and nutraceuticals is the main opportunity in the algae proteins market. Great for overall health with their bio-active compounds, essential amino-acids, and omega-3 fatty acids. Food and beverage (FnB) brands are incorporating algae proteins to plant milk/dairy substitutes, protein bars and value-added drinks to provide nutrient-rich food/beverages-driven by consumer need.

Moreover, emerging sports nutrition market is looking towards the algae proteins as a promising alternative than from traditional protein sources. Advances in processing technologies, including fermentation-based algae protein production, are anticipated to enhance the affordability and accessibility of products.

During the period between 2020 and 2024, the market for algae proteins saw high growth due to increased demand for plant-based, sustainable protein sources and a global increase in food security concerns. The expansion of the market was fueled by the increased use of algae proteins in dietary supplements, functional foods, and animal feed.

Increased awareness among consumers of the environmental cost associated with traditional protein sources like meat and soy products led to an increase in demand for microalgae and algae-based microalgae proteins.

From 2025 to 2035, the market for algae proteins will experience a revolutionary change fueled by precision fermentation, AI-driven bioprocess optimization, and greater incorporation into mainstream food and beverage items. Utilization of personalized nutrition solutions, cellular agriculture, and bioengineered algae will reshape market dynamics.

Future algae proteins will integrate bio fortification methods in order to add value to the amino acid content, surpassing traditional plant-derived proteins. Artificial intelligence-based culture systems will manipulate growth conditions in order to grow high-yield, nutrient-packed algae biomass. The blending of algae proteins in 3D-printed food and meat analogs will fuel further uptake among food companies.

Carbon-negative algae farming technologies will be developed to facilitate large-scale, sustainable production, minimizing dependence on land-based agriculture. Block chain-based supply chain transparency will provide traceability and sustainability compliance for protein products based on algae. Hybrid protein formulations of algae with precision-fermented proteins will improve taste, texture, and consumer acceptability.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | More stringent food safety standards for new proteins, greater vigilance on algae-derived food products. |

| Technological Advancements | Enzymatic hydrolysis to facilitate better extraction, genetically enhanced algae varieties, fermentation-based bulk production. |

| Industry Applications | Dietary supplements, functional foods, animal feed, and aquaculture. |

| Adoption of Smart Equipment | AI-powered cultivation monitoring, automated harvesting methods, and improved protein extraction processes. |

| Sustainability & Cost Efficiency | Focus on reducing production costs, sustainable harvesting methods, and improved algae strain development. |

| Data Analytics & Predictive Modeling | AI-powered yield optimization, cloud-based supply chain tracking, and bioinformatics-driven algae strain selection. |

| Production & Supply Chain Dynamics | COVID-19 supply chain disruptions, rising production costs, and limited scalability. |

| Market Growth Drivers | Sustainability issues driving growth, vegan and plant-based diets on the rise, and growing application in animal feed. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Block chain-led supply chain visibility, AI-governed compliance, and strengthened safety clearances for bioengineered algae varieties. |

| Technological Advancements | AI-optimized algae growth, precision fermentation for optimized amino acid composition, and bio fortified algae protein. |

| Industry Applications | Expansion into personalized nutrition, 3D-printed foods, plant-based meat alternatives, and clinical nutrition. |

| Adoption of Smart Equipment | Fully autonomous algae farms, IoT-enabled bioreactors, and real-time nutrient optimization with AI. |

| Sustainability & Cost Efficiency | Carbon-negative algae farming, decentralized production hubs, and large-scale offshore algae cultivation. |

| Data Analytics & Predictive Modeling | Quantum-enhanced predictive modeling for strain improvements, decentralized AI-powered algae farming, and block chain-secured traceability. |

| Production & Supply Chain Dynamics | Logistics optimized using AI, decentralized algae production, and block chain-based real-time quality control. |

| Market Growth Drivers | Large-scale commercial adoption through bioengineering with AI, food and beverage integration, and high-performance nutritional applications expansion. |

The USA algae proteins market is experiencing significant growth due to the rising demand for plant-based protein alternatives, increasing awareness of sustainable food sources, and strong investments in biotechnology-driven food production. The growing vegan population and consumer shift toward nutrient-dense protein sources are also driving adoption.

Consumers are actively seeking sustainable, non-animal protein sources, increased funding for algae protein startups and production facilities, algae proteins are rich in essential amino acids, omega-3 fatty acids, and antioxidants, growing interest in algae-based protein powders for fitness and performance, policies promoting algae-based food innovations are some of the key growth factors of this market in United States.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

The UK algae proteins market is expanding due to strong consumer awareness of plant-based nutrition, government initiatives supporting sustainable food production, and growing demand for functional foods. The alternative protein sector is also gaining traction among investors and food manufacturers.

Government-backed incentives to reduce carbon footprint in food production, growing number of flexitarian and plant-based consumers, rising use of algae proteins in energy bars, fortified drinks, and bakery products, algae-derived proteins used in skincare and anti-aging products, collaboration between food-tech startups and research institutions are some of the key factors which the drive the market in United Kingdom.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.3% |

The EU market for algae proteins is expanding significantly because of stringent regulation over sustainable food sources, funding for algae-based protein research, and increasing flexitarian and vegan diets. Germany, France, and the Netherlands are leading the market with innovative biotechnology and sustainable agriculture programs.

Policies that promote algae food innovations, scaling up algae farm and processing facilities, strong EU demand for alternative protein sources, growing applications in non-dairy milk, yogurts, and cheese alternatives, popularity of algae proteins among immune-boosting and energy-boosting foods are few of the significant market growth drivers for this market in European Union.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.9% |

Japan's algae proteins market is growing as a result of strong government backing of functional foods, historical dietary tendency towards seaweed-based proteins, and research advancements in algae-based nutraceuticals. The country's aging population is fueling demand for high-nutrient, low-digestibility proteins.

Among the Market Growth Drivers in Japan are Japan's traditional consumption of spirulina, chlorella, and seaweed, algae proteins that are antioxidant-rich, omega-3s, and essential nutrients, pro-algae government policies as an emerging food ingredient of the future, expanding market for algae-infused plant-based foods, application of algae proteins in anti-aging and regenerative medicine.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

South Korea’s algae proteins market is experiencing strong growth due to rising health-conscious consumers, expansion in biotechnology and food-tech sectors, and government support for sustainable food production. The Korean food industry is also integrating algae proteins into plant-based and functional foods.

Algae proteins used in dietary supplements and functional health drinks, rising demand for sustainable protein alternatives, South Korea investing in next-gen food innovations, algae proteins incorporated in collagen-boosting and anti-aging skincare, policies promoting alternative proteins for food security are some of the major factors for growth of market in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

he algae protein market is majorly segmented as capsules and powder; as consumers continue to shift toward adopting various plant-based protein sources, such as algae, for dietary supplements, functional foods, and nutrition for health purposes, the capsules and powder segments contribute more to the overall growth of the algae protein market.

Algae protein is important to supplement manufacturers, food, and wellness brands looking to add high-protein, more sustainable options to their products as demand continues to increase for more sustainable, nutrient-dense alternatives to animal protein.

Capsules have emerged as one of the fastest-growing segments in the algae protein market, offering consumers a convenient, precisely dosed, and shelf-stable format for incorporating algae-based protein into their daily nutrition. Unlike traditional protein sources, algae protein capsules provide a plant-based alternative rich in essential amino acids, antioxidants, and omega-3 fatty acids.

The increasing consumer preference for plant-based dietary supplements has fueled the adoption of algae protein capsules, particularly among health-conscious individuals, athletes, and vegan consumers. Studies indicate that over 60% of plant-based supplement users prefer capsule formulations for their ease of consumption, ensuring continued demand for this segment.

The expansion of functional algae protein capsules, featuring targeted health benefits such as immune support, cognitive enhancement, and muscle recovery, has strengthened market demand, ensuring greater consumer engagement and sustained product innovation.

The integration of AI-powered supplement recommendation platforms, block chain-backed ingredient traceability, and personalized nutrition analytics has further boosted adoption, ensuring transparency, efficacy, and safety in algae protein capsule consumption.

The development of algae protein capsule manufacturing partnerships, featuring collaborations between nutraceutical companies, biotechnology firms, and sustainability-focused food producers, has optimized market growth, ensuring higher quality control and enhanced production efficiency.

The adoption of eco-friendly packaging solutions, featuring biodegradable capsule shells, plastic-free blister packs, and carbon-neutral supply chains, has reinforced market expansion, ensuring alignment with global sustainability goals.

Despite its advantages in convenience, precise dosing, and long shelf life, the capsule segment faces challenges such as regulatory complexities in supplement approvals, high production costs compared to bulk protein powders, and limited consumer awareness regarding algae protein benefits.

However, emerging innovations in plant-based encapsulation technologies, AI-driven dosage customization, and sustainable algae protein cultivation methods are improving efficiency, affordability, and consumer trust, ensuring continued growth for algae protein capsules worldwide.

Powder Leads Market Demand as Algae Protein Gains Adoption in Functional Foods and Beverages

Powder has gained strong market adoption, particularly among fitness enthusiasts, health-conscious consumers, and food manufacturers, as algae protein powder provides a highly versatile, easily digestible, and nutrient-dense protein source. Unlike other plant-based proteins, algae protein powder offers a complete amino acid profile with minimal environmental impact.

The increasing demand for protein-fortified functional foods and beverages, including smoothies, energy bars, and dairy alternatives, has fueled the adoption of algae protein powder, as consumers seek clean-label, high-protein nutrition solutions. Studies indicate that over 70% of consumers prefer powdered protein formats for their mix ability and application versatility, ensuring strong demand for this segment.

The expansion of customized algae protein blends, featuring flavor-enhanced, micronutrient-fortified, and gut-health-boosting formulations, has strengthened market demand, ensuring broader consumer appeal and enhanced product differentiation.

The integration of AI-driven nutrition optimization, featuring personalized protein intake recommendations, block chain-secured ingredient sourcing, and real-time dietary tracking, has further boosted adoption, ensuring precision in health-focused nutrition planning. The development of strategic partnerships between food and beverage companies, algae protein suppliers, and clean-label food brands has optimized market growth, ensuring enhanced formulation capabilities and greater consumer accessibility.

The adoption of sustainable algae farming practices, featuring closed-loop cultivation systems, regenerative ocean farming, and carbon-sequestering bioreactors, has reinforced market expansion, ensuring long-term ecological benefits and ethical protein sourcing.

Despite its advantages in versatility, digestibility, and sustainability, the powder segment faces challenges such as taste and texture limitations, competition from alternative plant proteins, and higher production costs associated with premium algae protein extraction.

However, emerging innovations in flavor-masking technologies, enzymatic protein enhancement, and cost-effective algae bioprocessing methods are improving product appeal, affordability, and mainstream market penetration, ensuring continued expansion for algae protein powder worldwide.

The dietary supplements and food & beverage segments represent two major growth drivers in the algae protein market, as health-conscious consumers, plant-based diet advocates, and functional food innovators increasingly integrate algae-derived proteins into everyday nutrition.

Dietary Supplements Expand as Algae Protein Gains Recognition for Holistic Health Benefits

Algae protein has made its way into the dietary supplements market as the most popular of them all that allows consumers to take algae protein in capsules, tablets, and powders for targeted health benefits. Unlike animal-based supplements, algae protein is derived from a more sustainable, digestible and bioavailable protein source.

The demand for algae protein supplements catering muscle and immune recovery, as well as brain health, continues to drive adoption, and consumers are willing to pay a premium on plant-based diets. According to studies, over 75% of vegan supplement consumers consider algae protein a better alternative to whey or soy protein supplements secured with sustained demand in the market.

Despite advantages in plant-based nutrition, bioavailability, and sustainability, the dietary supplements category has struggled with stringent regulatory standards, consumer skepticism over algae-derived ingredients and competition from already established protein sources.

However, new developments in clinically-backed efficacy studies, AI-aided supplement formulation and block chain-verified ingredient authenticity are bringing credibility, transparency and trust to consumers, paving the way for the continued expansion of the global algae protein dietary supplements market.

Food & Beverage Industry Expands as Algae Protein Becomes a Staple in Functional Foods

The food & beverage market has found robust market acceptance, especially with plant-based food firms, clean-label brands, and functional beverage developers, since algae protein is easily incorporated into a vast variety of protein-enriched foods. Algae protein, unlike traditional plant proteins, has greater nutrient density with fewer processing demands.

Growing demand for dairy alternative products supplemented with algae protein, protein bars, ready-to-drink smoothies, and bakery items is propelling adoption, as manufacturers of food want sustainable, quality protein sources to appeal to consumers with a health orientation.

Even with its sustainability, functional, and clean-label benefits, the food & beverage market has challenges of formulation complexity, sensory acceptance, and scalability in the supply chain. Nevertheless, new developments in microalgae strain optimization, enzymatic protein improvement, and AI-based food formulation are enhancing taste, texture, and manufacturing efficiency, which will continue to drive growth for algae protein uses in the food & beverage market globally.

The Algae Protein industry is seeing strong growth because of increasing demand for plant-based and sustainable protein sources. Protein derived from algae, with most coming from spirulina, chlorella, and other microalgae, is packed with essential amino acids, vitamins, and minerals.

Rising acceptance of vegan and vegetarian lifestyles and developments in algae culture technologies are driving the industry's growth. Besides, demand is also being driven by the food and beverages, dietary supplement, and animal feed industries. Top players are looking into scalability of production, product innovation, and alliances to firm up their market position.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Corbion | 15-20% |

| Cyanotech Corporation | 12-16% |

| Roquette Frères | 10-14% |

| Fermentalg | 8-12% |

| Allmicroalgae | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Corbion | Develops sustainable algae-based protein ingredients for food and beverage industries. |

| Cyanotech Corporation | Produces high-quality spirulina and chlorella products for dietary supplements. |

| Roquette Frères | Offers a range of plant-based ingredients, including algae proteins, for nutrition markets. |

| Fermentalg | Specializes in microalgae-based protein production using advanced fermentation techniques. |

| Allmicroalgae | Supplies organic and conventional algae proteins, focusing on sustainability. |

Key Company Insights

Corbion (15-20%)

One of the premier algae-based protein ingredient companies, Corbion is exceptionally focused on both sustainability and innovation. The organization is expanding its manufacturing capabilities in response to accelerating world demand for plant-based alternatives for protein.

Cyanotech Corporation (12-16%)

The pioneer in microalgae-based proteins, Cyanotech is a market leader in growing organic spirulina and chlorella. It has a leadership role in the nutrition supplement industry and aims to create superior culturing technology.

Roquette Frères (10-14%)

A leading company in the cultivation of plant-derived ingredients, Roquette exports refined algae proteins into international nutrition industries. The group is deeply focused on research and development in upgrading product performance as well as the sustainability of processes.

Fermentalg (8-12%)

Utilizing new fermentation methods, Fermentalg is manufacturing top-quality microalgae proteins. The firm aims to develop more applications in food, beverage, and nutraceutical sectors.

Allmicroalgae (6-10%)

A key supplier of algae-based proteins, Allmicroalgae provides both organic and conventional solutions. The company’s commitment to sustainability and clean-label products gives it a competitive advantage.

The algae protein market is also supported by regional and emerging companies, including:

The market is estimated to reach a value of USD 884.0 million by the end of 2025.

The market is projected to exhibit a CAGR of 5.7% over the assessment period.

The market is expected to clock revenue of USD 1,538.9 million by end of 2035.

Key companies in the Algae Proteins Market include Corbion, Cyanotech Corporation, Roquette Frères, Fermentalg, Allmicroalgae.

On the basis of dosage form, capsule to command significant share over the forecast period.

Take Out Coffee Market Growth - Consumer Trends & Market Expansion 2025 to 2035

Taste Modulators Market Trends - Growth & Industry Forecast 2025 to 2035

Western Europe Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Country through 2035

Western Europe Fusion Beverage Market Analysis by Product Type, Distribution Channel, and Country through 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

Korea Vanilla Bean Market Analysis byDistribution Channel, Form, Nature, Product Variety, and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.