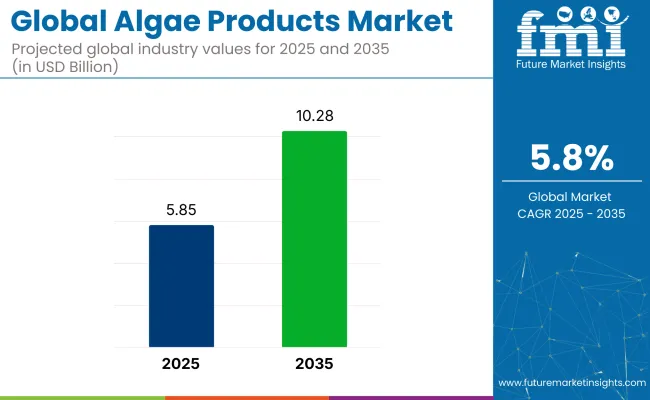

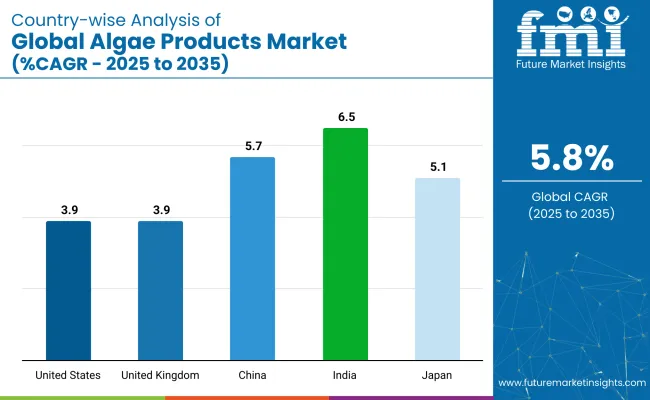

The global algae products market is projected to rise from USD 5.85 billion in 2025 to USD 10.28 billion by 2035, reflecting a CAGR of 5.8%. India, with a 6.5% CAGR, is expected to be the fastest-growing region, driven by rising demand for sustainable products and increasing investments in the algae industry.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 5.85 billion |

| Projected Industry Value (2035F) | USD 10.28 billion |

| Value-based CAGR (2025 to 2035) | 5.8% |

This growth is driven by the increasing recognition of algae products as sustainable, nutrient-dense, and environmentally friendly alternatives in various industries, including health and wellness, biofuels, and food & beverages.

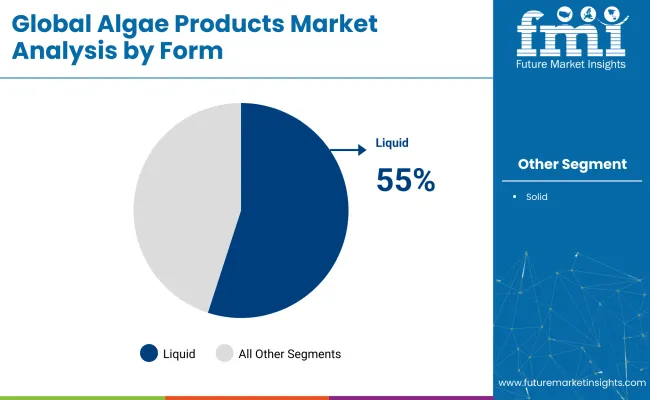

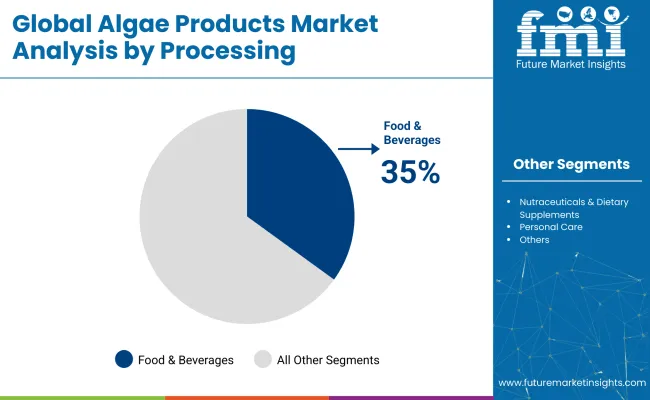

Liquid forms are expected to dominate the market, with an estimated 55.0% of the market share in 2025. Liquid products are mostly used in the health and wellness industry, particularly in dietary supplements. The food & beverages segment is expected to lead the processing category with 35.0% of the market share in 2025. Algae is increasingly incorporated into functional foods and beverages due to its high content of proteins, vitamins, and antioxidants.

Constant innovations and launches keep the industry active. DSM-Firmenich launched Life’s® DHA B54-0100, a naturally potent DHA algal oil with exceptional sensory appeal.This product delivers 545 mg of DHA and 80 mg of EPA per gram, enabling the development of smaller, more cost-effective capsules with higher DHA concentrations.

The industry accounts a specific share within its parent markets. In the food and beverage market, the algae products market contributes around 1-3%, driven by increasing consumer demand for natural and nutrient-dense ingredients. Within the nutraceutical market, the share is estimated at 5-7%, as algae-based supplements are gaining popularity for their health benefits, particularly omega-3 fatty acids.

In the cosmetic and personal care market, algae products account for approximately 2-4%, as they are used in skincare and haircare products for their moisturizing and antioxidant properties. The animal feed marketsees a share of 3-5%, with algae being utilized in animal nutrition. In the pharmaceutical market, the share is around 1-2%, as algae-derived compounds are used in certain therapeutic applications.

Algae products market analysis by top investment segments. Segmentation has been done by product type into lipids, carrageenan, alginate, algal protein, carotenoids, and others; by form into solid and liquid; by source into green algae, brown algae, blue-green algae, red algae, yellow-brown algae, and others, by processing into food and beverages, nutraceuticals and dietary supplements, personal care, feed, pharmaceuticals, and others, by region into North America, Latin America, Western Europe, Eastern Europe, Balkans and Baltic, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The lipids segment is expected to account for 25.5% of the market share in 2025. Algae-derived lipids are gaining traction due to their sustainable and eco-friendly nature, offering a renewable source of bioactive compounds.

The brown algae segment is projected to hold 24.5% of the market share in 2025. Brown algae is rich in bioactive compounds like fucoidan and alginate, which provide numerous health benefits, including anti-inflammatory and antioxidant properties.

The liquid form segment is expected to dominate with 55.0% of the market share in 2025. The liquid form offers versatility and ease of incorporation into various applications, particularly in food, beverages, and personal care products.

The food & beverages processing segment is expected to hold 35.0% of the market share in 2025. Algae’s versatility in the food industry ranging from natural flavorings and thickeners to health supplements continues to drive its adoption.

The industry is driven by increasing consumer demand for plant-based, nutrient-rich ingredients across various industries. However, challenges such as high production costs and scalability issues continue to impact the market's expansion.

Rising Demand for Plant-Based, Nutrient-Rich Ingredients

The growth in this industry is driven by the increasing consumer preference for plant-based, nutrient-rich ingredients in food, beverages, and personal care products. Algae, particularly microalgae like spirulina and chlorella, are rich in proteins, vitamins, minerals, and omega-3 fatty acids, making them attractive alternatives to traditional animal-based ingredients.

The growing awareness of the health benefits associated with algae, such as immune system support and cardiovascular health, is fueling their incorporation into various products. The shift towards vegan and vegetarian diets is propelling the demand for algae-based ingredients, as they provide sustainable and nutrient-dense options for consumers seeking plant-based alternatives.

High Production Costs and Scalability Challenges

Despite the growing demand, the industry faces challenges related to high production costs and scalability issues. The cultivation of algae requires specialized infrastructure, controlled environments, and energy inputs. Achieving large-scale production while maintaining consistent quality is challenging.

The complexity of algae cultivation, harvesting, and processing necessitates a good investment in research and development to improve efficiency and reduce costs. Competition from other plant-based ingredients and the need for specialized processing techniques complicate the scalability. Addressing these challenges is crucial for the sustainable growth and competitiveness.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| United Kingdom | 3.9% |

| China | 5.7% |

| India | 6.5% |

| Japan | 5.1% |

The United States and United Kingdom in the OECD group, are witnessing steady growth. The United States, growing at a 3.9% CAGR, is driven by rising demand for renewable energy, plant-based omega-3 supplements, and functional foods.

Innovations from companies like Heliae Development and Sapphire Energy are pushing algae-based biofertilizers and biofuels. UK, expected to grow at 3.9% CAGR, has a high production of clean-label products. UK’s strong biotechnological foundation is fostering innovation in algae cultivation and processing.

India leads with a projected 6.5% CAGRin the BRICS group, fueled by increasing demand for plant-based nutrition and sustainable agriculture. Algae products are gaining traction in aquaculture, pharmaceuticals, and plant-based nutrition. China, with a 5.7% CAGR, is heavily investing in algae-based biofuels and food ingredients, particularly for health-conscious consumers.

The country is also leveraging e-commerce for strong sales growth. In ASEAN, Japan shows solid growth at 5.1% CAGR, with its focus on longevity, cognitive health, and sustainable innovations. Japan’s advanced extraction technologies and eco-friendly solutions are driving algae product adoption across industries.

The USA is projected to grow at a CAGR of 3.9% from 2025 to 2035, driven by increasing demand for renewable energy, plant-based omega-3 supplements, and functional foods. Heliae Development is producing algae-based biofertilizers that improve soil quality and crop yields, boosting organic farming. Terravia is introducing algae-based protein snacks and powders, meeting the demand for plant-based, nutrient-dense foods.

The UK algae products market is expected to grow at a CAGR of 3.9% from 2025 to 2035, driven by the country’s focus on clean-label dietary supplements, and innovative algae applications. Companies like Algome are creating algae-based biofuels and bioplastics to reduce carbon emissions and plastic waste. The UK food sector is incorporating algae-based ingredients such as natural food colors and dietary supplements.

China’s algae products market is projected to grow at a CAGR of 5.7% from 2025 to 2035, driven by rising demand for plant-based and sustainable food ingredients, as well as government initiatives. China is investing heavily in algae-based biofuels as part of its strategy to reduce fossil fuel dependence. Algae-based omega-3 supplements and functional food ingredients are gaining popularity in China’s health food sector.

India is projected to grow at a CAGR of 6.5% from 2025 to 2035, supported by increasing awareness of health, plant-based nutrition, and sustainable agriculture.Algae-based feeds are gaining traction in India’s aquaculture industry to improve fish health and growth.India’s pharmaceutical industry is incorporating algae to produce omega-3 supplements and other functional health products. India is exploring algae fibers for biodegradable and eco-friendly fabrics in the textile industry.

Japan’s algae products market is expected to grow at a CAGR of 5.1% from 2025 to 2035, driven by the country’s interest in longevity, health, and eco-friendly innovations. Algae oil is used to support cognitive health, cardiovascular function, and anti-aging in Japan’s aging population. The demand for algae-based omega-3 supplements is increasing due to their high bioavailability and health benefits.

This sector is highly competitive, with companies fighting for market share through innovation and collaboration. Key players like Corbion and DSM are investing heavily in R&D to develop high-value, consumer-oriented products, such as algae-derived omega-3 fatty acids, providing an environmentally friendly alternative to fish oil.

Manufacturers are increasingly forming alliances and joint ventures to strengthen their market presence; for example, AlgaEnergy has partnered with Yokogawa Electric Corporation to enhance production and distribution capabilities. While large firms dominate with a large market share and resources, smaller companies like Algama and Notpla focus on niche markets and emerging technologies.

Recent Algae Products Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Market Value (2025) | USD 5.85 billion |

| Projected Market Value (2035) | USD 10.28 billion |

| CAGR (2025 to 2035) | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Product Type | Lipids, Carrageenan, Alginate, Algal Protein, Carotenoids, Others |

| Form | Solid, Liquid |

| Source | Green Algae, Brown Algae, Blue-Green Algae, Red Algae, Yellow-Brown Algae, Others |

| Processing | Food & Beverages, Nutraceuticals & Dietary Supplements, Personal Care, Feed, Pharmaceuticals, Others |

| Region | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Algae Systems LLC, Euglena Co., Cyanotech Corporation, Cargill, DSM, Kerry, Cargill, Corbion, BIOPROCESS ALGAE, LLC., BASF, Others |

| Additional Attributes | Dollar sales, CAGR trends, product type segmentation, grade-based demand, application segment growth, competitor dollar sales & market share, regional growth patterns, sales channel trends |

Lipids, Carrageenan, Alginate, Algal Protein, Carotenoids, and Others.

Solid and Liquid.

Green Algae, Brown Algae, blue-green algae, Red Algae, Yellow-Brown Algae, and Others.

Food & Beverages, Nutraceuticals & Dietary Supplements, Personal Care, Feed, Pharmaceuticals, and Others.

North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The projected market value in 2025 is USD 5.85 billion.

The forecast market value by 2035 is USD 10.28 billion.

The expected CAGR from 2025 to 2035 is 5.8%.

The liquid segment is expected to lead the algae products market in 2035, with approximately 55.0% market share.

India is expected to be the fastest-growing market in the algae products market, with a projected 6.5% CAGR.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA