Between 2025 and 2035, the algae fats market is set to experience significant growth points: Plant-based nutrition is on the rise in both popularity and demand; biofuel applications are also increasingly sought after and currently there's an entire industry of functional foods being produced by specialist companies in all corners the world.

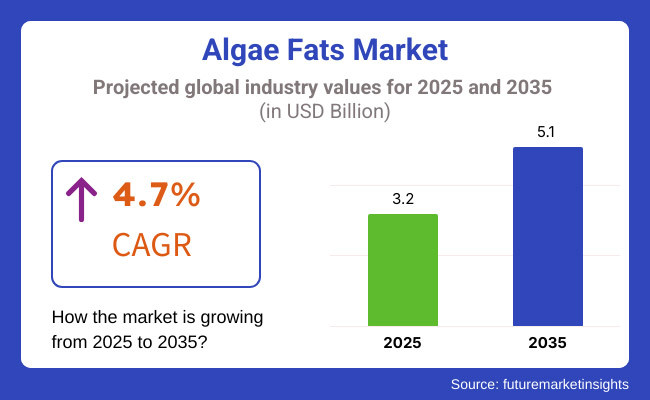

According to Market status reports of the forecasting period ending 2035 forecast i.e., this estimate is expected to burgeon from USD 3.2 billion in 2025 up by nine times straight to USD 5.1 billion. Compared with traditional fats and oils, the nutrient-rich Algal Fats offer another tasty alternative. They provide not only high levels of Omega-3 fatty acids but also are bioavailable and come with environmental benefits.

Algae-derived oils which are now being used in functional foods, dairy ingredient alternatives and plant-based products from the food & beverage industry show promise for the future. Furthermore a significant role to play is located in biofuels, animal feed formulations, and certain pharmaceutical fields for foods.

The growing incidence of vegan, plant-based diets is pushing the market to adopt, with nutrition supplement manufacturers and food tech companies involved in algae-based innovation. Scaling up production, government policies and consumer awareness are seen as the main obstacles in future development of a market with such great potential.

However, the recent advance in reinforced bioreactors (imposing more than just a nod towards Japanese origami) also promises much hope; there has been substantial progress on these as well as Algal AI Cultivation technology.

Explore FMI!

Book a free demo

North America is the main market for algae fats. In North America, the USA and Canada are two countries where demand for plant-based nutrition, sustainable biofuels and functional food additives are developing fast. An increasingly wide range of dietary supplements and dairy alternatives uses omega-3 rich algae oil, and this is also pushing the area to expand further.

Algae-derived fats that are classified as Generally Recognized as Safe (GRAS) by regulators such as the United States Food and Drug Administration and Health Canada, are allowing manufacturers to move their functional food applications to a bigger scale. In addition, lots of biotechnology companies here are involved in algae farming and they are placing a portion of their efforts into the large-scale production of sustainable algae-based food products.

Europe is one of the hot spots for algae-sourced fats. In Europe, with Germany, France, and the UK at the center of it all, plant-based food formulations, nutraceuticals, and sustainable biofuels are what dominates. The European Food Safety Authority (EFSA) is pushing the food industry to expand usage of algae fats, political popularity being based on how much less carbon is emitted as opposed to animals on which we rely.

Algae fats are increasingly consumed as cheese that is called vegan, margarine, and omega-3-oil supplements. These products are very much in demand among ever more discerning European consumers who are always looking for new sources of health.

Asia-Pacific is the fastest-expanding market for algae fats. In the Asian-Pacific region, China, Japan, South Korea and India are all markets where demand for foods with special functions as well as sustainable oils and bio-based fuels is taking off. What pushes the adoption of algae fats ever forward is the growing population, the increasing standard of living, and government efforts to support alternative protein sources.

China's plant-based and clean-label food movement is making the public more and more accustomed to the idea that lipids fabricated from algae can be used in most dairy-and meat-type product areas. Japanese and South Korean markets are already working on an array of projects including marine biotechnology as well as algae-based omega-3 nutritional supplements to help meet the health needs of their aging populations.

More than this, government-financed efforts to develop algae farming, biofuels and feed for sustainable aquaculture have lent strength to the capacity of Asia-Pacific to produce algae fats as well.

With the development of plant-based products and concerns about environmental friendliness, people are ever more awaking to a world in which traditional animal fats are gradually being replaced by new kinds of lipids extracted from algae. As a result, algae fats, with high levels of omega-3 fatty acids and essential lipids, bring health benefits to those eating them.

They are good for cardiovascular wellness; are conducive to normal functioning of the brain considering their high content in DHA; and provide for metabolism regulation and anti-inflammatory protection too.

Growing investments in Co-innovation, Algae Advanced Lipids and new range of products based on new technology Plants and microorganisms for enzyme production; R & D center for biotechnology Renovation of fats and oils A sort of market advantage for algae fats in the food industry In addition is the fact that the texture and flavor of plant-based meats, dairy alternatives, and processed foods can be improved with them.

Algae production not only requires fewer resources -it emits less CO₂ and does not require deforestation. As such, it is the perfect choice as fat.

Among algae fats market obtained general recognition become sustainably lipid alternatives for most food and cosmetic industries and nutraceutical endeavours actively sought solutions future development working in this vein.

In addition to the environmental impact and health issues caused by cardiovascular diseases, more ethical factor highlighted in 2008 conference papers started recognizing microalgae-based oil refinement and technologies were rapidly applied to diabetes, hyperlipidemia treatments by 2011.

The food industry began to incorporate increasingly algae fats derived from dairy alternatives and bakery products as well as meat analogs, providing a sustainable source of cholesterol-free oils in place for conventional livestock or plant products. In addition, due to their high omega-3 content, algae fats are now a crucial ingredient for infant food and health nutrition products.

Looking forward, from 2025 to 2035 the algae general fats market will undergo tremendous changes. Growth will be driven by bioengineering; artificial intelligence (AI) driven production models must gain international approvals. As companies moves towards large scale production, the most important issues become how to reduce costs; at the same time what new uses of personal care products and pharmaceuticals with algae fats.

As lab-grown fats and precision fermentation rise on the scene in the future, algae fats will replace palm oil, fish oil and hydrogenated fats for use in multiple industries. Governments will provide food production a green light by encouraging sustainable practices through legislation; the result, is that algae-based fats become mainstream.

Also, fuelled by biotechnology advances in recent years which will result in improvements to strains and higher lipid yields from algae fats, the costs of algae fats are pushed down. Further demand for algae-derived lipids will come from expanding alternative protein markets, developing sustainable pet food formulations and marketing eco-friendly cosmetics.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Initial approvals for food-grade algae fats in select markets. |

| Technological Advancements | Research focused on extraction and processing innovations. |

| Industry Applications | Adoption in nutraceuticals, dairy alternatives, and functional foods. |

| Environmental Sustainability | Awareness of algae as a low-resource alternative to palm and animal fats. |

| Market Growth Drivers | Increased demand for vegan and cholesterol-free fat sources. |

| Production & Supply Chain Dynamics | Limited production capacity hindered mass adoption. |

| End-User Trends | Consumers explored plant-based dairy, functional health products, and omega-rich supplements. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Widespread global regulatory acceptance and labeling standardization. |

| Technological Advancements | AI-driven cultivation, bioengineering advancements, and cost-efficient fermentation techniques. |

| Industry Applications | Expansion into cosmetics, pharmaceuticals, alternative proteins, and sustainable fuels. |

| Environmental Sustainability | Industry-wide adoption of algae-based lipids to replace deforestation-driven fat sources. |

| Market Growth Drivers | AI-driven precision fermentation, personalized nutrition, and government-backed sustainability initiatives. |

| Production & Supply Chain Dynamics | Expansion of global algae farming, strategic partnerships, and efficient supply chain networks. |

| End-User Trends | Personalized nutrition, 3D-printed foods, and bioengineered fats shape future consumption patterns. |

USA algae fats market expanding on account of consumers want sustainable, plant-based alternatives to food, nutraceuticals and the biofuels thresh. As awareness of the heart health benefits grows, companies are developing more products with omega-3 fatty acids made from algae.

Advances made in biotechnology and government support mechanisms for renewable energy are driving more users of algae fats to turn them into biofuels or industrial lubricants, thus boosting production levels as a whole. The presence of major enterprises and research institutions is speeding up innovation in algae-derived lipid production further.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

The UK fats from algae market is growing because of the increasing adoption of plant-based ingredients by mainstream food and beverage sectors. In particular, there is a demand for sustainable omega-3 sources amongst those following vegan or vegetarian diets.

The skin-nourishing properties of algae fats furthermore make them increasingly popular as cosmetic agents, being incorporated into the formulations of functional foods and cosmetics. Government policies supporting alternative protein and lipid sources are also helping to drive research and commercial exploitation in this space.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

Germany, France and the Netherlands lead in terms of European markets for algae fats, driven by their large demand from food, nutraceutical and biofuels sectors. The European Union's at large regulatory framework supports sustainable plant ingredients already fact underpinning strong growth in lipids developed from sources such as algae.

The market is also getting a boost from research into algae-based alternatives for aquaculture and livestock feed. Additionally, algae fats are increasingly being used as ingredients in pharmaceuticals and cosmetics - an ever-broader base of commercial applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.2% |

Japan is at the forefront of the global market for algae fats, blessed with advanced biotechnology capabilities and a populace hungry for functional foods. In order to compete today 1s Japanese companies PA or Omega-3 DHA as well birthday use widely in such health foods as baby of supplements the and dietary a products.

Japanese companies aiming to innovate are investing heavily in fermentation-produced algae fats, in order to improve their purity and yield. Meanwhile, growing interest in biofuels made from the fat or oil contained in algae means some companies have been able to start making a profit, thanks to help they are receive from government-funded initiatives in pursuit of sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

Sterling contributions to the algae fats market come from South Korea, where demand for plant-based omega-3 supplements and functional foods is on the rise. The country's top-ranking cosmetics industry has" algae fats also incorporated into its skincare and personal care products.

Still further, South Korean companies in the food and beverage sector are using algae fats to provide lipid sources for non-dairy plant based foods. Such initiatives are supported by government moves to back alternative energy strategies, and will further boost research into algae-based fats.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

As increasing numbers of consumers and industries switch to sustainable ingredients that are plant-based and rich in nutrients, the food-grade and feed-grade segments still dominate the algae fats market. These algae-derived fats are responsible for creating new nutritional platforms, improving animal feeds and making fuel. They are indispensable to things like nutraceuticals, livestock feed bacheloires biofuels and functional foodstuffs alike.

Food-Grade Algae Fats Lead Market Demand as Sustainable and Nutritionally Dense Inclusions Emerge in Consumer's Lives

Looking for high-value sources of omega-3 fatty acids, natural healthy unsaturated fats and rich anti-oxidative profiles, food-grade algae fats have quickly become popular alternatives to fish oil or artificial fat sources. Unlike those animal-related fats derived from natural occurrences, food-grade algae fats become a plant-based, allergen-free, and highly bioavailable source of essential fatty acids which fits all three types of people; vegan yet realistic non-vegetarians.

At present food-grade algae fats are as popular in functional foods and dietary supplements as Omega-3 fortified beverages, plant-based dairy alternatives or functional snacks - all of which are ready to go mainstream. Food manufacturers are looking for replacements that come from sustainable and ethical sources with more nutritionally beneficial effects.

Algae-fortified protein bars in the plant-based nutritional subculture such as vegan omega 3 capsules, DHA and EPA derived from algae solutions to the wellness needs of men as well women Everywhere from head to foot and therefore everywhere in demand thereby I increased demand for algae fats in mainstream food and supplement industries is assured.

By developing AI-driven food innovation containing machine-learning-based algae lipid extraction technologies, precision fermentation methods that produce a distinct high level of fatty acids and ingredient traceability using blockchain techniques, it has enhanced broad use so that it does not just cater to obscure niches of the market but acts as a safety guarantee for consumers.

The development of microencapsulated algae fats, including stable, shelf-stable, and odorless powders of DHA (docosahexaenoic acid) and EPA (eicosapentaenoic acid) for food and beverage applications as well as lysine or tryptophan fortified yeast, has stimulated market growth. It is more adaptable to the many kinds of new foodstuffs that are nowadays being developed at large than ever before.

The small-scale, decentralized and widely dispersed non-exploitative seaweed farming practices, using treated waste as a nutrient for the cultivation process, combined with carbon-negative technology in this field have helped enlarge the market for seaweed products and bring them into line with consumer-led environmentalism.

Although the food-grade algae fats segment offers advantages in nutritional value, sustainability and clean label appeal, it must also overcome issues such as high production costs, scalability limitations and the need to educate consumers about algae-derived lipids.

Meanwhile, AI-driven lipid optimization in emerging food-grade algae products, cost-effective precision fermentation for algae fat synthesis, and mainstream food categories that benefit from the fortification of their fats with seaweed all serve to make things easier on the cost-effectiveness front. Furthermore, such approaches are key to growing consumer acceptance of food-grade algae fats and for now ensuring continued market growth.

Sustainable Omega-3 and Essential Fat Source, As the Livestock and Aquaculture Industries Move Toward Environmentally Friendly Alternatives, Feed-Grade Algae Fats Take Root

In particular, feed-grade algae fats are finding strong market acceptance among feed producers for livestock, pet food manufacturers, and aquaculturalists. This is making for demand of ever-increasing proportions in the market-organic, long fatty acids that bring no side effects to fish; food input with little or no antibiotics; aquatic animal diets in accordance with human health.

While petrochemical-based ruminant feed is unequally disbursed for livestock, his feed-diverging rapidly-growing method now faces elimination tomorrow because a better solution is found today. Algae fat-fed livestock and fish provide a nonpolluting fuel rich variety of options with little ethical compromise, starting from the mid-range but well into bun at least.

Edible algae oil is in ever-rising demand in animal feed, with animal husbandry technicians showing a clear preference for cheap, high-quality and long shelf-life feed-grade algae - derived lipids. T

his beneficiary of their search for high-performance and high-disease-resistance feed formulations that contain omega-3 is seeing across-the-board sales soaring More than 50% of the leading aquaculture feed civilizations have begun to utilize omega-3 based algae for their fish meal components, This market has sure demands me.

The addition of algae fats into upscale pet foods has formularized this kind of product virtually across-the-board, ranging from omega-3 enriched dog and cat food to algae supplements for dogs,cats, mice, birds and fishes made particularly from real marine lipid blends.

AI-powered feed formulations in widespread use, high-precision algorithms for real-time nutrient analysis, optimized algae strains with improved fatty acid ratios, machine learning-driven dietary impact assessment results posted have increased productivity induced more carefully fed animals both biased politic toward. This also ensures greater precision in raising their food and healthier animals.

Among the livestock that were fed on fat-enriched algae and DHA in Jiangxi, an entirely different consumer health experience from fat-reduced poultry. So commodity livestock and illustrations like them serve the manmade nutrition industry well: it is certainly special!

There are many other cycles on the part of algae production system. For example, from waste to feed which is also a closed-loop systemqual where you never have to input anything outside of the process in order to make anything, and zero waste food systems in aquaculture. Through this market expansion mode, it'll be easier to get in tune with livestock nutrition sustainability purposes.

Not only is feed-grade algae fats an important source of omega-3, but it also cuts down on our ecosystem's pollution. Livestock can be healthier as a result. However, it is not without its challenges, such as expensive feed formulation costs, small-scale production capacity, and the slow progress of regulatory approvals for newer algae-based feed ingredients.

The company sounds upbeat and promise-filled, as it talks of using AI to simulate feed cost; blockchain-based tracking in livestock nutrition; and new generation algae lipid bioprocessing technologies that would greatly reduce regulatory costs while bringing greater effects at scale-all vital for the global animal nutrition market.

Two main market drivers have emerged in the algae lipid business: those of biofuels and health-care products.

The biofuels sector is now one of the major industrial applications of algae fats, capable (it claims) for producing a carbon-neutral fuel that is renewably sourced and has high energy density. Algal-based feedstock provides higher returns than traditional biodiesel precursors like soy or palm oil per acre, without the drawbacks of being at loggerheads with crops for food. It is this which makes it sustainable in a variety of different ways.

The growing demand for algal biofuels in aviation, the shipping sector, and also for the automotive industry has led to all algal-derived biodiesel and biojet fuels enjoying a good market welcome in recent years.

In spite of its advantages in sustainability, low soil usage and high oil production, the biofuel sector is facing problems. These include expensive plants, a lack of large-scale refinery facilities, and an overhang offissues with oil extraction efficiency.

However, newly emerging in these areas are breakthroughs in next-generation bioreactor systems and blockchain-based carbon offset tracking for biofuels derived from algae - the development of AI-powered solutions to optimize lipid yield, all of which are increasing scalability, efficiency, and environmental safety as well as easing regulatory constraints.

This paved the way for upgrading algae fats onto the ladder of energy production and environmental conservation as profits now begin rolling up mountains like Sisyphus at last down from all directions!

As more and more health-minded consumers, sports nutrition brands and vegan supplement producers adopt sustainable, vegetable-based sources of omega-3s instead of eating fish water sean turn to algae derived omega-3, the dietary supplement segment market is experiencing strong growth. Algae-derived omega-3 can be had without mercury pollution and give a rich diet - according to the EPA and DHA requirements for humans - even though it has already proved itself bio-friendly.

Strong consumer interest in algae fats has led to more and sales of a burgeoning range of allied functional products. These include algae-based omega-3 enriched softgels and algae oil capsules for health supplements and functional food additives derived from algae fat. Additionally, hamburgers are being made out of algae fat, with the result that it is now found in more places than ever before and easily accessible for large numbers of consumers.

Although the dietary supplement market has sustainability perks, bioavailability advantages, and is easier to get a clean label for, it is also troubled by higher than average pricing, a lack of consumer awareness and fierce competition from fish-oil alternatives. That said, newer systems are now in the works to change this situation.

Through algorithm-based consultation aids for dietary supplements, mixed data on ingredients from blockchain-enabled traceability and cheaper omega-3 fatty acid syntheses using precision fermentation technology, the result promised is both affordability and transparency within reach of any budget conscious consumer. The future of algae-derived dietary supplements looks bright and far-reaching.

The fats market for algae is expected to have further growth. Key factors driving this trend include rising demand for plant-based omega-rich fats that are both sustainable and eco-friendly; increasing vegan and functional food sectors; whilst, as noted in the illustration, use of algae fats continues to puzzle out ways of migrating into pharmaceuticals, nutraceuticals and bio- fuels.

Unlike fish oil and chemically synthesized sources, Algae fats are friendly to the environment, high in bit nutrition value and with great sustainability they perform better when taken into the bloodstream.

Leading companies devote R&D resources towards cutting edge extraction technology, high-throughput microalgae cultivation, and clean label approaches to their product range expansion-novel applications in biomedicine and industry. Increasingly, algae-derived DHA and EPA can be found in dietary supplements, infant formulae and products from the dairy alternatives line. This is further fueling the expansion of the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| DSM-Firmenich | 14-18% |

| Corbion N.V. | 10-14% |

| BASF SE | 8-12% |

| Polaris | 6-10% |

| Cargill Inc. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| DSM-Firmenich | Produces high-purity algae-based omega-3 fats, catering to functional foods, dietary supplements, and pharmaceutical applications. |

| Corbion N.V. | Specializes in fermentation-based algae fat production, focusing on sustainable DHA and EPA sources for food and feed applications. |

| BASF SE | Develops algae-derived omega-3 and omega-6 fatty acids, integrating biotechnology advancements for enhanced lipid extraction. |

| Polaris | Offers microalgae-based fat ingredients for fortified dairy alternatives, plant-based meats, and infant nutrition. |

| Cargill Inc. | Invests in large-scale algae fat production, expanding its portfolio for biofuel applications and functional food products. |

Key Company Insights & Competitive Strengths

DSM-Firmenich (14-18%)

Corbion N.V. (10-14%)

BASF SE (8-12%)

Polaris (6-10%)

Cargill Inc. (5-9%)

Other Key Players (40-50% Combined)

Several biotechnology firms and food ingredient manufacturers contribute to the advancement and commercialization of algae fats, focusing on high-yield production and new application development:

The overall market size for the Algae Fats Market was USD 3.2 billion in 2025.

The market is expected to reach USD 5.1 billion in 2035.

The demand will be fueled by rising consumer preference for plant-based and sustainable fat sources, increasing applications in functional foods and dietary supplements, growing awareness of the health benefits of algae-derived omega-3 fatty acids, and expanding use in the pharmaceutical and cosmetic industries.

The top five contributors are USA, European Union, Japan, South Korea and UK.

Food & Beverage applications, particularly in nutritional supplements and dairy alternatives, are anticipated to command a significant market share over the assessment period.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.