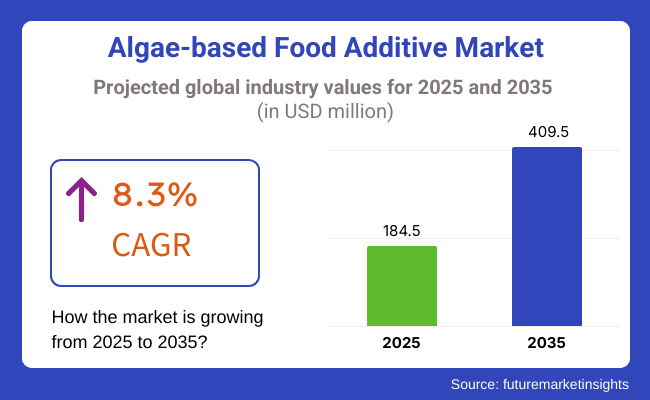

According to the analysis, Algae-based Food Additive Market in the market will see an uptick in the demand. The market for algae-based food additives is expected to attain an estimated value of USD 184.5 million in 2025 and experience a compound annual growth rate (CAGR) of 8.3% during 2025 to 2035. The total market value is projected to be USD 409.5 million by 2035.

The organic way of consuming and the preference for natural ingredients drive the introduction of algae-based food additives. Most commonly, the additives offer potential health benefits such as high protein content, essential fatty acids, and antioxidants. The market for algae-based food additives is proliferating in diverse food and travel applications owing to the consumer's growing interest in clean-label and plant-based products.

Moreover, the growing number of functional foods and dietary supplements has positively influenced the makers to use algae-based components in their new products. Algae, being a source of a natural nutrient, is one of the preferred food additives among the industry because it improves the feel of the food, extends the shelf life, and provides a good source of nutrients.

Several factors are accountable for the rapid growth of the algae-based food additive market. The transition to a vegan and vegetarian diet is becoming a powerful source behind the rising demand for plant-based food ingredients, and algae are believed to be the best alternative for synthetic and animal-based additives. Besides, the promoting of algae-based compounds' health benefits is the leading cause of their frequent application in the nutraceuticals and functional drinks.

Sustainable and organic food additives' regulatory support is another factor that is actively contributing to the growth of the market. The governments and food safety authorities throughout the world advocate the application of natural ingredients, which drives the food manufactures to use algae-based solutions. Furthermore, the latest technologies in algae culture and extraction that have been developed are efficient in bringing down production costs and improving product quality.

On the other hand, the market faces a few constraints hindering further growth. The high cost of production, intricate harvesting process, and the lack of consumer awareness in some districts are major obstacles for consumers who wish to adopt the drugs that undergo these algal additions. In addition, some manufacturers find it very hard to address the issue of flavor and texture changes due to algae-based additives used in some traditional food items.

Despite these obstacles, the market still offers numerous avenues for growth. Progress in food science and biotechnology is leading to the creation of more suitable and adaptable algae-based materials. The broadening of the e-commerce market channels and the development of the direct-to-the-consumer sales strategy are the two main drivers behind making the algae-based food additives available to health-oriented customers. Besides, the paradigm shift in enterprise to ecologically-friendly and sustainable food production is promoting the funds of the algae-based solutions.

Explore FMI!

Book a free demo

The Algae-Based Food Additive Market is picking up momentum because of its high nutritional value, sustainability, and functional properties across markets. Algae-based additives in food & beverage are natural protein sources, emulsifiers, and thickeners, thus playing a key role in plant-based and clean-label products.

Pharmaceuticals and nutraceuticals give highest priority to algae-derived omega-3s, antioxidants, and bioactive compounds for their health benefits. The cosmetics industry is increasingly adopting algae extracts due to their moisturizing and anti-aging effects. At the same time, in animal nutrition, algae-based additives enhance the nutritional quality of livestock while reducing environmental impacts.

Consumers are leading demand for non-GMO, allergen-free, and organic products, which is driving manufacturers to emphasize sustainable sourcing and production innovations. The market is set to continue growing as research unlocks new uses in functional foods, dietary supplements, and environmentally friendly formulations.

Between 2020 and 2024, the algae-based food additive market saw significant growth as the demand for natural and sustainable ingredients increased. Consumers became more health-conscious, driving interest in plant-based and functional ingredients with nutritional benefits.

Algae additives rich in proteins, vitamins, and omega-3 fatty acids took center stage as substitutes for petrochemical- and animal-derived additives. Companies started incorporating algal-derived materials into various food products, beverages, snack foods, and plant milk to contribute to nutrition and texture.

The doors opened with increasing research on the culture of algal and technology of extraction in order to scale up production and reduce costs. Modification of flavor, consistency in supply, and acceptability in regulation in some markets, nonetheless, still curbed more uses. Algae-based food additive industry will grow in the near future, 2025 to 2035, due to the fact that technology is improving extraction methods and the nutritional content of food from algae.

Greater investment in sustainable algae farming and green production technologies will drive market growth. Growing demand from consumers for natural and clean-label ingredients will accelerate adoption of algae-based additives in food and beverage markets. AI-fueled dietary analysis will create new space for tailored algae-based products on the basis of targeted nutrition.

Regulatory driving force for sustainable food manufacturing and innovation in novel product certifications will raise market confidence. Consolidation of the market and strategic alliances among food companies and algae manufacturers will be used to increase production capacity and product line to meet both consumer and supply demands.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand for plant- and natural-based additives. | Technology- and green-friendliness-induced growth. |

| Growing demand for the health benefits of algal-based additives. | Enhanced consumer respect and trust in the nutritional contribution of algae. |

| Incorporation of algae food additives into foods, drinks, and plant milk. | Aggregated uses including functional foods and personalized nutrition. |

| Development with focus on developed economies. | Penetration of emerging economies through locally placed products. |

| Meeting food safety and labeling requirements. | Regulatory shift toward sustainable and plant-based alternatives. |

| Increased exposure in stores that are health-oriented and retailing platforms based on the web. | Omnichannel efforts based on leverage of the channels of retail and direct-to-consumer. |

| Technological advancements in algae culture and extraction. | Formulation based on blockchain and AI for supply transparency. |

| Increased competition and entry from established players. | Consolidation through mergers, acquisitions, and alliances. |

| Focus on benefits to health and natural origin. | Personalized promotion and alliances with health influencers. |

| Taste modification, supply uniformity, and production cost. | Sustainability, scalability, and maintenance of product integrity. |

The food additive sector has experienced a great surge in the algae-based food additive market driven by the strong demand for natural and sustainable materials. Notwithstanding, the only significant impediments are the regulatory challenges concerning food safety, labeling, and novel ingredient approvals.

The seasonal ups and downs, the impacts of climate change, and the reliance on specific algae species, which trigger supply chain vulnerabilities, are the main problems that production stability is confronting. The raw materials' availability is further jeopardized by unexpected weather events, ocean pollution, and the deterioration of natural habitats. Utilization of controlled cultivation, sustainable harvesting as well as diversified sourcing approaches would be a viable way to address these risks.

High production and processing costs have made the product unaffordable for most of the manufacturers and as a result of this, the mass market is rejecting it. The requirement of particular extraction and refinement techniques that are not only special among others, but also the need for specialized equipment leads to a disturbing rise in the overheads. Companies should press on with efficient manufacturing innovations, exploitation of economies of scale, and formation of strategic partnerships as their priority for enhancing production efficiency, and also staying competitive.

Consumer perception and awareness are still major challenges as there are a few places where algae-based additives have been introduced. Misgiven ideas about flavor, health, and nutrition can hinder the acceptance of algae catalysts of other products. Clever marketing campaigns, scientific endorsement, and campaigns to educate people are the bases from which credibility by consumers will be built and demand will swell.

The Hydrocolloids market is majorly driven by Carrageenan and Alginate that mainly used as gelling, thickening, and stabilizing agent in most of the industries. In 2025, carrageenan is forecasted to lead the market, accounting for 50.2% of market share. Carrageenan, a plant-based ingredient derived from red seaweed, is a common ingredient in dairy, dairy alternatives, and processed meats, given its strong binding and textural properties in water.

CP Kelco, DuPont, and Cargill, among others, are driving innovations here, developing refined and semi-refined carrageenan solutions that respond to the needs of clean-label, plant-based ingredient demand. The rise in dairy substitutes, like oats and almond milk, has also contributed to the demand for carrageenan, a natural thickener.

Derived from brown seaweed, alginate is expected to witness constant growth and account for 49.8% of the market in 2025. Alginate is an extensively used polysaccharide in food, pharmaceutical, and biomedical applications, mainly known for its gelling and stabilizing features. This is now being extensively used in wound dressings, dental impressions, and encapsulation of probiotics. The companies leading the functional food and medical sectors, such as KIMICA, FMC Corporation, and Algaia, are focusing on sustainable sourcing and advanced formulations to capitalize on strong demand.

As the demand for natural and plant-derived hydrocolloids continues to rise, carrageenan and alginate will witness a steady increase in adoption across industries, in part due to clean-label trends, plant-based product innovations, and an influx of research into their health benefits.

Hydrocolloids are classified based on their possible sources , such as Red Algae or Brown Algae for making carrageenan or alginate, respectively. With its position as the primary source of carrageenan, an extensively used thickening and gelling agent in dairy substitutes, processed meats, and confectionery, Red Algae is expected to occupy 46.8% of the market share by 2025.

The demand for carrageenan extracted from red algae, which is a clean-label and vegan-friendly food ingredient, is rapidly increasing due to the strong momentum in the market for plant-based and clean-label food additives. The leading market players CP Kelco, Cargill, and DuPont are navigating their way to retain market leadership in the growing market by introducing refined and semi-refined carrageenan solutions that cater to the increasing demand in the market.

Brown Algae is expected to hold the major share of 53.2% by 2025 as, brown algae is over a good demand due to their use of alginate in the production which is a flexible hydrocolloid substrate used in food, drugs and biomedicine. Alginate is most frequently used as a thickener with universal properties, for example in sauces, dressings, and icy desserts.

Alginate is also widely used for applications such as wound care, drug delivery, and probiotic delivery. Most of the key component houses, such as FMC Corporation, KIMICA, Algaia, and others, structure pioneering developments in sustainable harvesting of brown algae and alginate-based formulations.As a result, red and brown algae are expected to continue to win market share bolstered by sustainability and natural ingredient sourcing concerns with technology and a robust pipeline across food, pharmaceuticals, and cosmetics.

The algae-based food additive market is developing owing to the increased demand for natural, plant-based, and sustainable ingredients in foods. Algae-based additives include hydrocolloids (agar, carrageenan, alginate), proteins, and pigments. Green consumers increase their preference for clean-label, vegan, and nutrient-rich formulations, which further drives the demand in the market.

Industry leaders such as Cargill, Corbion, DuPont, Koninklijke, and Kerry Group, owing to a strong product portfolio in stabilizers, emulsifiers, and natural colorants. Start-ups and niche providers get deeper into this market by coming up with novel microalgae-based protein powders, omega-3 supplements, and natural food colorants for the exploding plant-based food sector.

This competitive landscape is engineered by technological advancements in algae cultivation, extraction methods, and strain optimization that develop functional properties, bioavailability, and sustainability. Thus, companies are spending money on fermentation-based algae production and precision extraction techniques to improve machinery and commercial applications.

Strategic factors shaping competition include regulatory approvals, supply chain sustainability, and partnerships with food and beverage manufacturers. With an increasing amount of processing for algae-styled ingredients for dairy alternatives, meat alternatives, and functional foods, market players are further centering their efforts on product innovations, expansions of production capacity, and acquisitions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Inc. | 18-22% |

| Corbion N.V. | 14-18% |

| Koninklijke DSM N.V. | 10-14% |

| Kerry Group | 8-12% |

| DuPont | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Cargill, Inc. | Leading in algae-based texturizers and stabilizers, including carrageenan and alginates for dairy and plant-based products. Focused on sustainable sourcing and production expansion. |

| Corbion N.V. | Specializing in algae-based omega-3 solutions as sustainable alternatives to fish oil. Its AlgaPrime DHA is widely adopted in food and beverage applications. |

| Koninklijke DSM N.V. | Strong in algae-derived nutritional ingredients, particularly omega-3 fatty acids. Acquired assets from Martek Biosciences to enhance its algae-based innovation. |

| Kerry Group | Provides natural algae-based emulsifiers, colorants, and flavor enhancers. Expansion into clean-label and plant-based food markets through acquisitions. |

| DuPont | Offers algae-derived hydrocolloids and nutritional ingredients. Focused on functional food applications, including dairy alternatives and dietary supplements. |

Key Company Insights

Cargill Inc. (18-22%)

The market leader in algae-based stabilizers and texturizers, especially carrageenan and alginates, has expanded its sustainable production to meet the growing global demand.

Corbion N.V. (14-18%)

The algae-derived omega-3 business leader offers environmentally friendly alternatives to fish oil. Its AlgaPrime DHA is becoming more and more prominent in use in plant-based and functional foods.

Koninklijke DSM N.V. (10-14%)

The pioneer in algae-derived nutritionals, omega-3, and other essential lipids. DSM fortified its position through the acquisition of Martek Biosciences' algae technology.

Kerry Group (8-12%)

It specializes in algae-derived clean-label solutions, such as emulsifiers and natural colors. Recent acquisitions have enhanced its footprint in plant-based food applications and also functional foods.

DuPont (6-10%)

It comprises algae-based hydrocolloids for texture enhancement of food and stability. There is also an active pursuit of developing solutions concerning dairy alternatives and nutritional supplements.

The United States is set to lead the algae-based food additive market.

Carrageenan, agar, and spirulina are the three main food additives.

It's classified as Carrageenan, Alginate, Agar, Spirulina, and Others.

It's classified as Red Algae, Brown Algae, and Green Algae.

It's classified as Thickening, Gelling, Stabilizing, Emulsifying, and Enhancing Texture.

It's classified as Frozen Desserts & Dairy Products, Confectionery & Bakery, Convenience Food & Snacks, Beverages, and Others.

It's divided as North America, Latin America, Europe, East Asia, South Asia, and the Middle East & Africa.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.