The bioplastics market from algae is growing as firms innovate sustainable, biodegradable, and high-performance products. Driven by demand from packaging, automotive, and consumer goods industries, manufacturers are keen on carbon-reducing bio-based polymers. Firms incorporate automation, AI-enabled quality control, and green manufacturing practices to ensure efficiency and regulatory compliance.

Industry experts focus on scalability, biopolymer tailoring, and advanced manufacturing techniques for better performance and sustainability. The industry is moving towards algae-based bioplastics that are biodegradable, have high strength, and are economically viable for circular economies and environmental compliance.

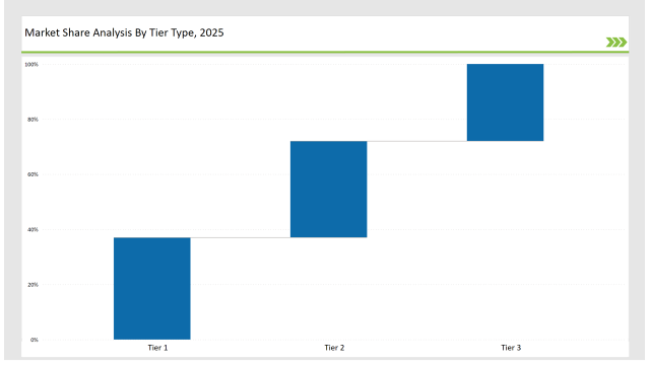

Tier 1 companies like Algix, Bloom Bioplastics, and Corbion dominate 37% of the market based on massive algae farming, polymer extraction processes, and international supply chains.

Tier 2 players such as Checkerspot, Solaplast, and Algifol control 35% market share with emphasis on high-performance biocomposites, tailor-made biopolymer formulations, and sustainable material development.

Tier 3 companies, which include regional and niche players, account for 28% of the market, with expertise in biodegradable films, algae-based resin innovation, and localized production solutions.

Explore FMI!

Book a free demo

| Category | Market Share (%) |

|---|---|

| Top 3 (Algix, Bloom Bioplastics, Corbion) | 18% |

| Rest of Top 5 (Checkerspot, Solaplast) | 11% |

| Next 5 of Top 10 (Algifol, Evonik, Algatech, Green Science Alliance, Algotek) | 8% |

The algae-based bioplastics industry serves multiple sectors where sustainability, durability, and cost-efficiency drive innovation. Companies integrate AI-driven production monitoring and bioengineering techniques to improve material properties and scalability. Firms enhance algae cultivation techniques to maximize biopolymer yield. Manufacturers develop rapid biodegradability solutions to accelerate plastic decomposition. Businesses invest in energy-efficient processing methods to minimize environmental impact.

Manufacturers enhance algae-based bioplastic solutions with customized bio-polymer formulations, high-strength composites, and AI-driven material development. Smart monitoring systems improve production efficiency and material consistency. Companies refine extrusion techniques to enhance material properties and consistency. Researchers explore algae strain modifications to increase biopolymer yield. Firms implement precision blending to optimize bioplastic performance.

Companies accelerate algae-based bioplastic innovations by scaling up production facilities, improving polymer processing methods, and investing in AI-powered defect detection. They refine cost-effective extraction techniques to increase biopolymer yield while maintaining sustainability. Industry leaders implement blockchain-enabled traceability to ensure responsible sourcing and reduce greenwashing concerns. Manufacturers enhance enzymatic processing to improve polymer extraction efficiency. Companies adopt high-speed bio-reactor systems to increase algae cultivation rates. Firms develop algae-derived nanomaterials to improve mechanical properties of bioplastics. Researchers explore genetic modifications to enhance algae strains for higher biopolymer output. Industry leaders invest in automation to streamline algae harvesting and reduce operational costs.

Technology suppliers need to concentrate on sustainable sourcing, process automation, and next-generation polymer engineering to stay ahead of the competition. Partnership with packaging, automotive, and agro-industries will drive adoption and innovation. Organizations need to invest in AI-driven quality control to maximize production efficiency. Firms should develop algae-derived polymers with improved thermal stability. Manufacturers should integrate biodegradable additives to enhance material functionality.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Algix, Bloom Bioplastics, Corbion |

| Tier 2 | Checkerspot, Solaplast, Algifol |

| Tier 3 | Algotek, Evonik, Algatech, Green Science Alliance |

Leading manufacturers enhance AI-powered quality control, scalable algae cultivation, and bio-polymer customization. They develop lightweight, high-strength formulations to improve functionality and durability. Companies integrate cloud-based monitoring to optimize production processes and reduce material waste. Firms implement AI-driven analytics to predict and resolve production inefficiencies. Researchers develop algae-based composites with enhanced heat resistance. Manufacturers adopt automated precision molding to ensure consistency and reduce defects.

| Manufacturer | Latest Developments |

|---|---|

| Algix | Expanded algae-based polymer production (March 2024) |

| Bloom Bioplastics | Developed high-performance bio-resins (April 2024) |

| Corbion | Introduced biodegradable high-barrier films (May 2024) |

| Checkerspot | Released bio-based thermoplastic elastomers (June 2024) |

| Solaplast | Innovated biodegradable food packaging (July 2024) |

| Algifol | Strengthened high-strength bioplastic composites (August 2024) |

| Algotek | Enhanced industrial applications of bio-resins (September 2024) |

The algae-based bioplastics market evolves as companies invest in automated production, AI-driven material innovation, and carbon-neutral processing. Firms develop high-barrier biodegradable materials and algae-derived resins to improve performance and environmental impact. Manufacturers enhance production speed by integrating AI-powered process optimization. Companies adopt circular economy principles to ensure the full lifecycle sustainability of bioplastic products.

Manufacturers develop AI-driven biopolymer engineering, scalable algae cultivation, and advanced material blending. They refine cost-effective production methods while expanding biodegradable, durable, and carbon-negative solutions to meet global sustainability goals. Companies optimize algae strain selection to enhance biopolymer yield and quality. They integrate renewable energy sources into production facilities to minimize carbon footprints. Firms adopt machine learning algorithms to predict and control polymerization processes. Researchers explore hybrid bioplastic formulations to combine algae-based materials with other bio-polymers. Manufacturers strengthen supply chain transparency with blockchain technology. Businesses develop water-resistant algae-based bioplastics for packaging and agricultural applications.

Algix, Bloom Bioplastics, Corbion, Checkerspot, Solaplast, Algifol, Algotek, Evonik, Algatech, Green Science Alliance.

Algae-based bioplastics offer biodegradability, lower carbon footprint, and reduced dependence on fossil fuels.

The top 3 players collectively hold 18% of the global market.

The market shows medium concentration, with top players holding 37%.

Metallized PET Cartons Market Analysis – Trends & Demand 2025 to 2035

Metal Banding Machine Market Trends – Growth & Forecast 2025 to 2035

Kraft Paper Pouch Market Growth – Demand & Forecast 2025 to 2035

Mobile Cases and Covers Market Growth – Demand & Forecast 2025 to 2035

Heavy Duty Paper Tags Market Insights – Growth & Demand 2025 to 2035

Glass Growlers Market Demand & Packaging Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.