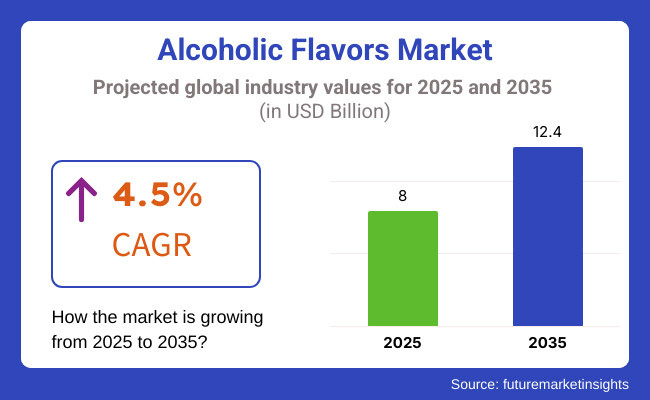

By 2035, the alcoholic flavors market is projected to see steady growth. In premium drinks, craft cocktails, and flavored alcoholic beverages, consumer demand has never been higher. This market is expected to expand from a base of USD 8 Billion in 2025 to one totaling USD 12.4 billion by 2035, recording a Compound Annual Growth Rate (CAGR) of 4.5 percent over that period.

The changing beverage landscape and the spread of drinking experiences are driving the development of alcoholic flavors in people's glasses. Consumers seek unique, cultural, and tropical tastes that inspire consumer packaged goods firms like iTi Developments to innovate with natural essences, botanical-infused textures, barrel-aging accents on texture.

Companies are investing in flavor technology, barrel aging, and consumer insights through AI to develop personalized and geography-specific alcoholic taste flavors. Cocktail culture growth, craft beverage demand growth, and low-alcohol and no-alcohol trends are dictating new product innovation.

Though with high market potential, challenges like regulatory requirements, variable raw material prices, and shifting consumer health trends remain hurdles. Nevertheless, ongoing investment in sustainable flavor extraction techniques, organic products, and AI-led flavor creation is likely to propel the market.

Explore FMI!

Book a free demo

The Epicenter of the Alcoholic Flavors Market in North America with the USA and Canada witnessing high demand for craft spirits, artisanal cocktails and flavored alcoholic drinks, North American influence in the sector has only grown. The area's rich mixology culture guides development of innovation in fruit-infused spirits, barrel-aged flavors and botanical extracts consumed as drinks.

Customers have also developed a taste for saltier, more natural spirit flavors and the frontier whisky producers - now joined by other brands - are providing low-sugar or plant-based options in response to this trend. While the market sees growth in hard seltzers, flavored whisky and elite tequilas, the using AI consumer intelligence to predict upcoming flavor directions, as well as producing specific blends tailored for varied customer segments.

Europe European nations such as France, Italy and Germany, and particularly the UK still form the heartland of the market for alcoholic flavors capable of being blended into wine or beer. The area's rich heritage of wine-making, distillation and brewing nurtures the production of complex, aged alcoholic flavors from specific regions.

The call for herbal, botanical and aged spirits only rises, with customers demanding deluxe gin or flavored vodka and cask-aged whisky. Additionally, sustainability and natural ingredient sourcing are crucial factors in the European alcoholic flavors production chain, and manufacturers employ environmentally friendly extraction processes or organic sourcing of their materials.

Asia-Pacific the Fastest Growing Alcoholic Flavor Market in Asia-Pacific It is led by China, Japan, South Korea and India where flavored whiskey, sake infusion as well as fruit-flavored spirits now enjoy a high reputation. The growth in consumption of Western-style drinks and increasing disposable incomes has created new opportunities for premium quality flavored alcoholic beverages.

As the region's cultural preference for tea, herbal teas and traditional spirits grows, there will be more fine-tuned rice wines spiced with herbs and botanicals Chinese gin with flavors of its land hibiscus and clove rum for those burning late night fires. Besides, the significant influence of Japan and South Korea on craft distillation and fermentation processes fuels the coming of sharper, older and highly crafted alcohol flavors.

Between 2020 and 2024, alcoholic flavor market increased as the consumer base longed for natural, premium, and craft-type beverages. Flavored spirits, cocktails, and infused spirits witnessed increased demand across the globe on account of evolving consumption patterns driven by millennials and Gen Z shoppers for unique and experiential flavors.

Market was marked by fruit, spice, and botanic-infused spirits with citrus, berry, elderflower, lavender, and ginger taste on the ascendant. Brands emphasized natural extracts, sustainable sources, and lower artificial ingredients, a sign of increased consumer desire for clean-label booze.

Between 2025 and 2035, the alcoholic flavor industry will experience dramatic changes in the form of AI-enabled, personalized flavor construction, functional alcohol, and sustainability. The advent of fermented flavor, artisan distillation processes, and territorial authenticity will transform the taste culture as consumer interest gravitates more toward terroir-based and heritage flavors

AI-based flavor predictive algorithms' expansion will make manufacturers able to craft hyper-personalized seasonal booze flavors to satisfy shifting desires. In addition, advancements in biotechnology and the adoption of eco-friendly fermentative technologies will decrease the production costs and the environment impact of creating flavor products so that it can become sustainable.

Premiumization will continue to spur product innovation with businesses investing in barrel-aged, distinctive botanical, and fusion-based alcohol flavoring.. The blending of molecular gastronomy and sensory-driven experience will continue to drive the craft cocktail and luxury spirits category further, delivering a multisensory drinking experience.

Government authorities and industry players will oversee the sourcing of ingredients, labeling, and ethical marketing, providing visibility and responsible manufacturing processes. Increasing demand for low-ABV and functional alcohols containing adaptogenic and botanical infusions will fuel the growth of the market, supporting consumers who drink in search of healthier alternatives.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments enforced stricter labeling and alcohol content regulations. |

| Technological Advancements | AI-assisted market insights and data-driven flavor innovation gained traction. |

| Industry Applications | Growth in premium spirits, RTD cocktails, and craft-flavored liquors. |

| Environmental Sustainability | Brands focused on natural extracts, organic sourcing, and reduced artificial additives. |

| Market Growth Drivers | Increased demand for unique and regional flavor infusions in alcoholic beverages. |

| Production & Supply Chain Dynamics | Beverage companies streamlined flavor sourcing and ingredient traceability. |

| End-User Trends | Home mixology and RTD flavored beverages surged in popularity. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter sustainability and clean-label requirements reshape product formulations. |

| Technological Advancements | AI-driven personalized flavor development, molecular gastronomy, and sustainable fermentation techniques dominate. |

| Industry Applications | Growth in functional alcoholic drinks, fermented flavors, and terroir-based spirits. |

| Environmental Sustainability | Increased investment in eco-friendly flavor production, sustainable fermentation, and responsible sourcing. |

| Market Growth Drivers | Personalized, AI-driven alcoholic flavors, low-ABV functional drinks, and adaptogenic-infused liquors gain prominence. |

| Production & Supply Chain Dynamics | Sustainable production methods, waste-reduction initiatives, and AI-driven inventory management enhance efficiency. |

| End-User Trends | Hyper-customized, experience-driven, and wellness-aligned alcoholic flavors define market demand. |

The demand for alcoholic flavored drinks, such as infused spirits, craft cocktails and pre-mixes, RTDs (ready to drink) etc., mean that the USA alcoholic flavor market is growing. With strong sales of premium products combining innovative flavors - such as barrel aged versions or botanically infused liquor - growth in consumption also lags behind rising demand for foodstuffs: another reflection of this trend.

With major beverage companies investing heavily in flavor innovation by leveraging AI and consumer preference data to make more flavors, the rise of alcohol-free and low-alcohol drinks is also boosting diversification in market products.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

US flavored spirits market is expanding with increasing demand for flavored alcoholic drinks, including infused spirits, craft cocktails, and RTD spirits beverages, among consumers. The trend may be a result of product premiumization and innovative pairing of flavors, e.g., barrel aging flavors and botanical-infused spirits, influencing the market.

Big soft drink players are spending on flavor innovation, using AI-based taste profiling and consumer analysis. In addition, the rising shift towards low-alcohol and non-alcoholic flavored drinks is also driving product diversification further in the market

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

Germany, Italy, and France are the leaders in alcoholic flavor business in Europe due to large-scale production of wine, beer, and spirits. The specialty fruit-flavored, botanical, and barrel-aged alcoholic flavors market is growing, especially in the premium and craft alcohol sectors.

The European market is also witnessing an increase in demand for natural and organic flavor extracts because consumers require clean-label ingredients. Green production and sourcing of alcoholic flavors are also compelling regulatory frameworks for the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

The alcohol flavors market of Japan is increasing as flavored spirit consumption, variant sake, and high-end craft cocktails gain traction. Distinctive flavor types like yuzu, matcha, and sakura-flavored liquors are being increasingly implemented in domestic markets as well as for exportation.

Japanese beverage companies are placing bets on fermentation-based flavoring and AI-enabled sensory analysis to drive taste experiences. The demand for no-alcohol and low-alcohol beverages with high-end flavor profiles is also fueling the growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The South Korean alcoholic flavor market is growing due to shifting customer demand for soju-flavored drinks, fruit-flavored beer, and new RTD cocktail drinks. K-culture and K-drinks around the globe are influencing unique alcoholic flavors like ginseng, honey, and tropical fruit-flavored alcohol.

The growing popularity of Western alcoholic drinks with Korean flavor infusions is also influencing market trends. Also, social media influence and digital marketing campaigns are driving the demand for new and seasonal flavors at a faster rate.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

Passion fruit and pineapple tastes are at the pinnacle of alcoholic flavour, because consumers worldwide continue to crave tropical, fruity, and refreshing flavours of alcoholic drinks. The flavours come first in the sensory perception of spirits, cocktails, and ready-to-drink (RTD) products, and hence the need for liquor companies, mixologists, beverage companies, and foodservice operations.

The drinkable markets have been conquered by pineapple with its sweet but sour, tropical flavor and peoples' taste for fruity cocktails. Pineapples, unlike traditional liquor flavors, provide a refreshing drink which amplifies the taster's pleasure; this is best experienced in highly-crafted rum stitches, margaritas that resemble daisies and fruit-based rum.

With the release of Pina Colada-style cocktails, rum and fizzy drinks with a splash of pineapple juice, and even tropical stylings on spritzers whose umbrella tops add color to this update, as well as such flavorings as orange or other exotic fruits alike in each case too.

Statistics demonstrate that over two-thirds of imbibers opt for libations bearing traces of citrus or berries, ensuring robust demand for libations containing pineapple. The pre-mixed cocktail industry's spread, with canned pineapple coladas and pre-bottled piña colada sodas within arm's reach, has stimulated desires in a manner benefitting both drinkers and producers, offering hassle-free gratification.

Addition of natural and organic pineapple extracts and cold-pressed fruit oils, along with non-gmo flavor combinations and organic pineapple distillates, has encouraged further acceptance and more well-being in alignment with the general trend of healthy food and drinks.

The development of low-alcohol and non-alcoholic pineapple beverages, including zero-proof pineapple margaritas, artificial pineapple-flavor hard seltzers and fancy malt drinks, has guaranteed maximum market growth and brought in wider appeal to the alcohol-free sober curious group as well as users who want to be healthy through what they drink.

The practice of creating environmentally friendly products, offering fair-trade pineapples for farmers, carbon-neutral pineapple processing, use of pineapple waste product and so on, has served to drive market growth and ensure that the demands of environmentally conscious consumers are met more broadly.

While its flair for tropical flavor appeal, cocktail application, and clean-label ingenuity, pineapple flavor category faces the weakness in seasonality in availability of natural fruit, natural extraction uniformity, and excessive synthetic pineapple flavor competition.

Yet, the newer AI-driven flavor augmentation trends, blockchain-enabled responsible pineapple sourcing trends, and precision fermentation-based copy replication of tropical fruit essence trends are improving efficiency, quality, and long-term marketplace opportunities and, thus, growth prospects of pineapple-flavored spirits to be maintained.

Passion Fruit Taste Expands as Exotic, Aromatic Alcohol Beverages Have Global Demand

Passion fruit has seen cross-market adoption with top premium liquor brands, small-batch cocktail bars, and health-conscious drinkers as international demand for exotic, aromatic, and sour alcohol beverages continues to soar.

In contrast to the citrus type flavors we are accustomed to; passion fruit brings a strong sourness tempered with mellow sweetness this kind of soft and rich taste" is characteristic of many fruit-flavored alcoholic beverages.

The surge in demand for passion fruit flavored spirits and cocktails, including such drinks as passion fruit martinis, passion fruit vodka, tropical tree of passion fruits sours has further boosted the uptake of passion fruit flavors. As studies show, more than 55% of mixologists take passion fruit as their main exotic cocktail-making ingredient, which is why this flavour is still in great demand.

The growth of the craft and premium spirits sector, most recently including passion fruit-infused liqueurs flavored with artificial garden fruit essences and sorely missed wild fruits such as passion fruit sours, has pulled the market in this direction - increasing attractiveness for consumers to whom taste is most important of all.

The use of passion fruit in health-conscious alcoholic beverages, such as vitality-boosting passion fruit hard seltzers, vitamin-enriched flavored vodka, and probiotic-rich passion fruit beer will also accelerate take-up This helps to bring its whole relevance home within a very short time frame, for all types of drinkers up and down the spectrum from mass-market pabulum to blissful artisan creativity.

The development of passiflora flavorings - passiflora being a family of plants which produces passion fruit - through sustainable and ethically sourced wild collected passionfruit extracts, sustainable passionfruit farming projects certified by Fairtrade International and zero waste passionfruit puree applications has pushed market growth still further into line with both media-driven lifestyle trends and the conservation ethos propounded as best practice through government legislative efforts over the last six years.

The use of AI-based flavor profiling like customized passion fruit cocktail recommendations, real-time monitoring for mixing bars busy concocting the latest templates and also VR taste tests for brands where "reality" quite literally equals taste has been a propellant force behind market expansion; By being more interactive with its customers and creating new products for alcoholic mixed drinks with a passionfruit Pair of footprints.

Though it has a lead in foreignness appeal, innovation in mixology, and health drink positioning, the passion fruit flavor category is threatened by high procurement cost, seasonality of fruits, and the need for advanced preservation techniques to maintain natural integrity of flavors.

Nevertheless, emerging technologies in AI precision fermentation for reproducing passion fruit aroma, blockchain-traceability of tropical fruits sourced, and AI-powered virtual taste sessions for passion fruit-based cocktails are promoting efficiency, authenticity, and reach into the marketplace, with implications of long-term growth for alcoholic beverages flavored with passion fruit.

The vodka and rum segments represent two major sources of market demand; as alcohol companies increasingly integrate their portfolios with flavored spirits and tropical cocktail bases.

Vodka Leads the Market Demand in Segments such as Flavored and Infused Spirits

Vodka dominates the segment of flavored spirits, which migrate globally. And unlike regular vodka, which is priced in the much-loved fruit vodka category offers young people something complete new to explore: For younger consumers who eager to try fruit-forward spirits.

With demand continuing to grow for fruit-infused vodka like pineapple vodka, passion fruit vodka, and mixed berry-infused vodka, people are also starting to use fruit-based spirits. Many drinkers simply prefer a more mellow and easier drink that they can make quickly but has rich flavor. Surveys show that 75% of vodka drinkers like a flavored compilation either way you look at it, so this is a popular market segment.

Flavored vodka is thus presented with opportunities today. As maturity improves, however, experts worry about academic slavery, temporary project, the new role of capital and vast amounts of development space being inefficiently used or not fully exploited to expand itself further habitually.

Nonetheless certain new things cannot but mean change children eventually go through growing pains. Take AI-supported low-calorie vodka formulations, for one thing, peer-reviewed blockchain-originated organic vodka making, or even AI-empowered virtual vodka tastings; all these changes are bringing the efficiency of production, consumer trust and marketing into real life, and guarantee that flavored vodka must surely get better too.

Rum Segment Expands as Tropical and Fruity Infusions Dominate Cocktail Culture

Rum enjoys widespread popularity both with tourists from the tropics although driven by premium rum distilleries and mixology professionals. As a far cry from vodka, however, rum itself is flavored in tropical fruits like pineapple and passion fruit which make the ideal combination of cocktail bases.

With the increasing demand for flavored and spiced rum, including pineapple rum, passion fruit rum and the very popular blend of Caribbean tropical fruit rums, fruit-based rum formulations are catching on. As consumers increasingly request taste information in real-time online or want to know where their drink is sourced all the time, the market needs to cover summer-friendly drinking experiences that are both exotic and novel.

However, even though the tropical flavor-crafted rum segment enjoys both mixability and luxuriousness which other spirit types do not possess, and also boasts a proud tradition as regards spirits culture, it faces challenges such as foreign trade barriers to premium priced goods; classification of flavored rum for regulations; and low-level brand diversification in mainstream markets.

Yet with exciting developments like AI-generated rum aging optimization, blockchain-activated rum value verification, or rendering rum brands into compelling digital stories ongoing research is also increasing production efficiency, brand trust and consumer engagement, ensuring that the expansion of flavored rums in the alcoholic flavorings market will continue.

With consumers increasingly requesting high-quality alcohol-the demand for premium cocktails, flavor-infused spirits and related products continues to grow rapidly. As the market has been changing, beverage producers are trying out new methods like natural extracts, herbal infusions or special blends of striking flavors in its product lines.

Concern for sustainability and clean label has high-profile players all using the latest flavor extraction techniques, to get more flavor and yet still save on energy. At the same time, much that like pre-mixed cocktails rtd (ready to drink), flavoured beers or even light spirits Gregory Hargreaves is a writer living in Berlin. In the future the market will probably develop even more rapidly than it has already been doing.

Alcoholic flavors market becomes generally much more fragmented over time-the CAGR stands at 6.5% globally and over the years has shown remarkable variability in percentage points from one region to another. This depends largely on how various markets' regulatory frameworks are set up or are moving forward, with certain factors such as consumer tastes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Givaudan SA | 14-18% |

| Firmenich SA | 10-14% |

| Symrise AG | 8-12% |

| International Flavors & Fragrances (IFF) | 7-11% |

| Kerry Group plc | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Givaudan SA | Develops premium alcoholic flavor profiles, specializing in natural fruit, botanical, and oak-aged flavors for spirits and cocktails. |

| Firmenich SA | Focuses on whiskey, rum, and gin flavor enhancement, integrating sustainable extraction technologies. |

| Symrise AG | Produces flavor infusions for beer, cider, and flavored liqueurs, emphasizing clean-label and organic ingredients. |

| International Flavors & Fragrances (IFF) | Innovates ready-to-drink (RTD) cocktail flavors, utilizing AI-driven sensory profiling for enhanced taste experiences. |

| Kerry Group plc | Specializes in dairy and fruit-based alcoholic flavor compounds, catering to the expanding low-alcohol and functional beverage segment. |

Key Company Insights & Competitive Strengths

Givaudan SA (14-18%)

Firmenich SA (10-14%)

Symrise AG (8-12%)

International Flavors & Fragrances (IFF) (7-11%)

Kerry Group plc (5-9%)

Other Key Players (40-50% Combined)

Several regional and specialty flavor companies contribute to the alcoholic flavors market by focusing on unique, craft-oriented formulations and specialty infusions:

The overall market size for the Alcoholic Flavors Market was USD 8 Billion in 2025.

The market is expected to reach USD 12.4 Billion in 2035.

The demand will be fueled by the rising popularity of flavored alcoholic beverages, increasing consumer preference for craft and premium spirits, growing applications of alcoholic flavors in food and confectionery, and innovations in natural and botanical flavor infusions.

The top five contributors are the USA, European Union, Japan, South Korea and UK.

Whiskey and Rum-based flavors are anticipated to command a significant market share over the assessment period.

Lecithin and Phospholipids Market Analysis by Product Type, Form, Nature, Function and Application Through 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.