The alcohol packaging industry is booming due to the different companies developing premium, green, and tamper-evident packaging solutions. Manufacturers now seek lighter, sturdier, and customizable packages under severe pressure from brewing, distilling, and wine producing houses. They are now beginning to use automation for production and for artificial intelligence-driven quality checking of packaging materials and to minimize the complexity of production and meet regulatory requirements with sustainable materials.

Industry participants are interested in biodegradable packaging materials, tamper-evident caps, and high-end designs to drive product presentation and sustainability. The industry is shifting towards light, smart, and recyclable packaging of alcohol to improve brand appeal and regulatory conformity.

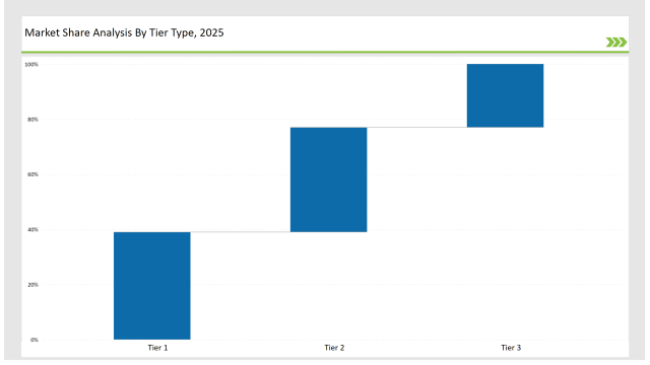

Tier 1 players such as Amcor, Owens-Illinois, and Ball Corporation hold 39% of the market with advanced manufacturing, mass production, and global distribution networks.

Tier 2 players like Ardagh Group, Crown Holdings, and Berlin Packaging hold 38% market share, focusing on customization, eco-friendly solutions, and high-efficient manufacturing.

Tier 3 players, which comprise regional and niche players, have a market share of 23% and emphasize green materials, smart labels, and unique bottle shapes.

Explore FMI!

Book a free demo

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Owens-Illinois, Ball Corporation) | 19% |

| Rest of Top 5 (Ardagh Group, Crown Holdings) | 13% |

| Next 5 of Top 10 (Berlin Packaging, Vidrala, Vetropack, Gerresheimer, Stoelzle Glass) | 7% |

The packaging of alcohol products caters to various industries that need packaging integrity, sustainability, and branding. Businesses improve smart labeling, AI-based production monitoring, and high-end packaging materials to enhance product attractiveness and compliance with regulations. Manufacturers use high-barrier coatings to prolong shelf life and maintain product quality. They use lightweight glass substitutes to minimize shipping costs and environmental footprint.

Manufacturers refine alcohol packaging solutions with biodegradable materials, smart labeling, and AI-enhanced production techniques. AI-driven defect detection improves quality assurance and reduces waste. Companies develop tamper-evident packaging to enhance consumer safety. They adopt automated inspection systems to identify defects in real time. Manufacturers implement energy-efficient production methods to reduce carbon emissions.

Companies accelerate alcohol packaging innovations by adopting smart labeling, AI-powered defect detection, and eco-friendly materials. They refine lightweight yet durable designs to improve sustainability and brand recognition. Industry leaders implement IoT-enabled tracking solutions to enhance supply chain efficiency and prevent counterfeiting. Manufacturers develop temperature-sensitive labels to maintain beverage quality. Companies integrate augmented reality (AR) features into packaging for interactive consumer experiences. Firms explore biodegradable glass alternatives to reduce environmental impact. Businesses enhance UV-resistant coatings to improve product shelf life. Companies invest in high-pressure processing-compatible packaging to preserve freshness.

Technology vendors must focus on sustainability, automation, and brand protection to stimulate market growth. Cooperation with breweries, distilleries, and wineries will boost innovation and adoption. Companies must create AI-driven logistics to make supply chain efficiency better. They must invest in biodegradable coatings to enhance packaging sustainability.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Owens-Illinois, Ball Corporation |

| Tier 2 | Ardagh Group, Crown Holdings, Berlin Packaging |

| Tier 3 | Vidrala, Vetropack, Gerresheimer, Stoelzle Glass |

Industry leaders advance AI-based manufacturing, eco-friendly materials, and high-end packaging solutions. They incorporate intelligent security features and tamper-evident closures to avoid counterfeiting and reinforce brand protection. Businesses adopt high-speed automation to optimize packaging processes. They adopt advanced printing technologies to improve label durability and brand aesthetics.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Expanded biodegradable packaging solutions (March 2024) |

| Owens-Illinois | Developed lightweight glass bottle technology (April 2024) |

| Ball Corporation | Introduced smart NFC-enabled aluminum cans (May 2024) |

| Ardagh Group | Released AI-powered defect detection systems (June 2024) |

| Crown Holdings | Strengthened tamper-proof aluminum closures (July 2024) |

| Berlin Packaging | Innovated luxury spirit bottle designs (August 2024) |

| Gerresheimer | Enhanced pharmaceutical alcohol packaging (September 2024) |

The packaging of alcohol changes as businesses invest in automation, premiumization, and eco-friendly materials. Businesses incorporate intelligent labels, AI-based defect detection, and tamper-evident capabilities to enhance security and product attractiveness. Businesses create AI-based packaging solutions to maximize production efficiency. Businesses implement blockchain technology to increase supply chain transparency and authenticity.

Manufacturers create AI-powered personalization, extremely light materials, and intelligent security systems. They enhance recyclable and biodegradable packs as well as IoT-integrated product tracking solutions to improve transparency and sustainability. Businesses streamline high-speed production lines to maximize efficiency and minimize costs. They deploy predictive analytics for optimizing supply chain logistics. Manufacturers upgrade packaging attractiveness with premium finishes and creative design aspects. Companies invest in intelligent QR code-based packs to enhance customer interaction. Companies incorporate sophisticated anti-counterfeiting functionalities to safeguard brand reputation. Firms implement automated recycling and sorting technologies to enable circular economy efforts.

Amcor, Owens-Illinois, Ball Corporation, Ardagh Group, Crown Holdings, Berlin Packaging, Vidrala, Vetropack, Gerresheimer, Stoelzle Glass.

The top 3 players collectively hold 19% of the global market.

The market shows medium concentration, with top players holding 39%.

Companies focus on sustainability, smart labeling, and AI-driven production to improve efficiency, enhance brand appeal, and meet regulatory standards.

Europe Sharps Container Market Analysis by Usage, Capacity, End Use, and Region Forecast Through 2035

Europe Flexible Plastic Packaging Market Analysis by Material, Product Type, End Use, Packaging Type, and Region Forecast Through 2035

Bottle Capping Machine Market Analysis by Automation, Operating Speed, Machine Type, End-use Industry, and Region Forecast Through 2035

Market Share Breakdown of Alu Alu Blister Packaging Machine Industry

Market Share Breakdown of Tablet Packing Machine Industry

Market Share Breakdown of Algae-Based Bioplastics Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.