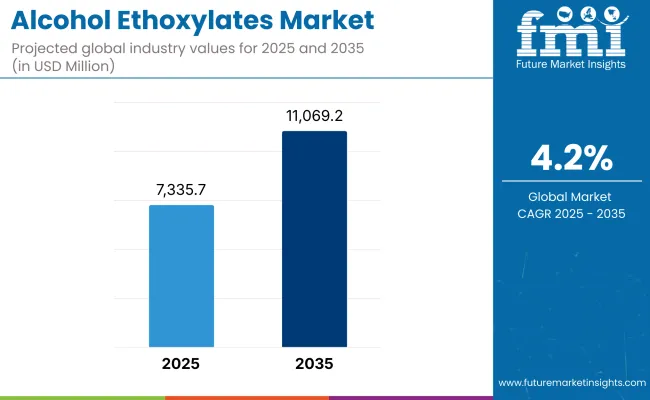

Global sales of alcohol ethoxylates were reported at USD 6,206.8 million in 2020. The market is anticipated to register a year on year growth of 3.9% in the year 2024, thus, leading to a market size of USD 7,335.7 million by end of 2025. During the assessment period (2025 to 2035), the market is projected to record a CAGR of 4.2% and reach USD 11,069.2 million by 2035.

Alcohol ethoxylates represent a class of non-ionic surfactants obtained through the ethoxylation of alcohols, usually fatty alcohols. The general reaction concerning this is that ethylene oxide is added to alcohol, yielding a water-soluble product. Surfactant properties of alcohol ethoxylates are very good, mainly wetting, emulsifying, and dispersing.

The major and expanding uses of alcohol ethoxylates are those in households, personal care applications, specifically for shampoos, body washes, and then in detergents, which deal with the merits of being rather mild and fairly effective. A heavy use takes place in agrochemicals and paint/coating industry, with oil and gas for cleaning and emulsification purposes.

There is growing demand for natural-based Alcohol ethoxylates, which are considered eco-friendly and biodegradable. As the trend for sustainability continues, these surfactants will likely see significant growth in demand, especially in cleaning products and personal care formulations.

| Attributes | Key Insights |

|---|---|

| Market Value, 2025 | USD 7,335.7 million |

| Market Value, 2035 | USD 11,069.2 million |

| Value CAGR (2025 to 2035) | 4.2% |

The East Asia region is anticipated to show significant growth in the alcohol ethoxylates market due to the rise in demand for the product from various industries such as home and personal care, agrochemicals, and paints and coatings. This growth can be attributed to the strong manufacturing base of the region, especially in countries such as China, Japan, and South Korea, which are among the global hubs for the production of chemicals and consumer goods. The consumption of personal care products and detergents in East Asia, with an ever-growing population, urbanization, and higher-income middle class, keeps increasing to boost the demand for alcohol ethoxylates.

The agrochemical industry in East Asia is gaining momentum, mainly because of increasing demand for efficient farming methods; this drives demand for surfactants used in pesticides and herbicides. In addition, there is a higher preference for natural-based alcohol ethoxylates, which are biodegradable and safer for the environment, owing to the growing interest in sustainability and eco-friendly formulations across the region.

The table below presents the annual growth rates of the global alcohol ethoxylates industry from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth trajectory evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half year, between the years 2024 and 2025. The industry is expected to grow at a CAGR of 4.0% in H1-2024. In H2, the growth rate increases.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 4.0% (2024 to 2034) |

| H2 2024 | 4.3% (2024 to 2034) |

| H1 2025 | 4.2% (2025 to 2035) |

| H2 2025 | 4.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly increase to 4.2% in the first half and relatively increase to 4.4% in the second half. In the first half (H1), the sector saw an increase of 20 BPS while in the second half (H2), there was a slight increase of 10 BPS.

Growing Demand for Alcohol Ethoxylates in Home and Personal Care Products across Emerging Markets

Emerging markets, especially in Asia, Latin America, and parts of Africa, are recording increased consumer awareness in personal hygiene and grooming. This, therefore, presents an impending demand for personal care products such as shampoo, body wash, detergents, and face cleansers.

Because of the excellent surfactant properties, alcohol ethoxylates find wide applications in such formulations to offer efficiency in cleaning and improving product texture. This trend is now shifting towards premium and value-added products with improving disposable incomes, further accelerating demand for Alcohol Ethoxylates.

Alcohol ethoxylates are favoured in personal care products due to their comparative mildness and efficiency over a broad pH range. The increasing awareness among the end-consumer in emerging markets about the ingredients their skin and scalp is exposed to will further drive the demand for milder, non-aggressive surfactants such as alcohol ethoxylates.

These countries are developing their e-commerce and retail channels, which enhance the accessibility of personal care products, hence driving the growth in the alcohol ethoxylates market.

Rising Agrochemical Industry Demand for Alcohol Ethoxylates to Improve Effectiveness of Pesticides and Herbicides

Ethoxylates are surfactants commonly used in agrochemical formulations, including pesticides and herbicides. This helps the wetting, spreading, and penetration of active ingredients on plant surfaces for better coverage and distribution, hence leading to enhanced performance and effectiveness of treatments applied in agricultural applications. For farmers who now seek more efficient and sustainable methods of increasing yield while preventing the onslaught of pests and diseases, demand for advanced formulations like such is increasing.

With the increasing environmental concerns, there is a growing trend towards using more biodegradable and eco-friendly surfactants in agrochemical formulations. Alcohol ethoxylates, especially those derived from renewable sources, are considered more environmentally friendly compared to conventional surfactants. This trend aligns with the agrochemical industry's focus on adopting sustainable practices, further driving the demand for Alcohol Ethoxylates in agriculture.

Increasing Usage of Alcohol Ethoxylates in Oil and Gas Industry for Emulsifiers, Drilling Fluids, and Cleaning Age

The alcohol ethoxylates find wide applications in drilling fluids and as emulsifiers in the oil and gas industry because of their excellent surfactant property. They contribute toward better stability and efficiency in drilling operations by causing proper dispersion of water and oil-based fluids, hence enhancing the performance of the drilling and extraction process.

The continuous search for better technologies for extraction, complemented by the rising demand for oil and gas, increases demand for such value-added chemicals.

Alcohol ethoxylates find application in cleaning agents for oil rigs, pipelines, and other equipment owing to their potential to degrade oil and grease for equipment maintenance and smooth flow of operations. As the oil and gas sector expands across the world, the demand for reliable and efficient cleaning solutions keeps increasing, further contributing to the growing demand.

Environmental Concerns over Non-biodegradable Alcohol Ethoxylates Limiting Adoption in Eco-conscious Markets and Regulations

Non-biodegradable alcohol ethoxylates have the ability to persist in the environment, especially in water sources. They do not break down but instead accumulate with time and thus might affect ecosystems and harm aquatic life. This impact calls for a decision by consumers and industries for greener and friendlier products, thus putting a cap on non-biodegradable alcohol ethoxylates.

With increased ecological consciousness, the demand for products that are biodegradable and harmless to the environment increases. Growing trends to use sustainable products force manufacturers to look for alternatives to non-biodegradable alcohol ethoxylates. This shift towards natural and biodegradable surfactants hampers the growth of non-biodegradable variants in the market, since they cannot meet the growing demand for environmentally responsible solutions.

Volatile Raw Material Prices Impacting Cost Stability and Profitability of Alcohol Ethoxylates in the Market

Fluctuating Costs of Raw Materials: The production of alcohol ethoxylates relies heavily on raw materials such as ethylene oxide and fatty alcohols, both of which are subject to price fluctuations due to market conditions and supply chain disruptions. Volatile raw material prices can increase production costs, making it difficult for manufacturers to maintain price stability and profitability. This unpredictability may deter investment and expansion in the alcohol ethoxylates market.

Impact on Product Pricing and Profit Margins: As raw material costs rise, manufacturers are often forced to either absorb the costs or pass them onto consumers, potentially leading to higher product prices. This can reduce demand, especially in price-sensitive markets. In turn, profit margins shrink, limiting the growth opportunities for alcohol ethoxylates manufacturers and hindering the overall market expansion.

Between 2020 and 2024, the Alcohol ethoxylates Market enjoyed a stable increase as firms were busy minimizing their carbon footprints. With the acceleration in consumer ecological awareness contributing to this, the chemical market is in a velvety affair with ecological-friendly manufacturing. In support of this production transition, the prevailing environmental regulations in Europe and North America provided a blanket cover.

On the other hand, from 2025 to 2035, the expected sales growth will be even more pronounced as the sectors will further widen their horizons by adopting the environmental friendly practices. Breakthroughs in green chemistry and the industrial production of mechanization will enacting the main role in speeds up the embrace of new products and processes. The two regions of the crescent moon, namely the Asia-Pacific and Latin America, will both witness a rapid recovery, although it will be more so in the industry of textiles due to mass production and increased consumer concerns on the state of the environment.

The alcohol ethoxylates market is concentrated with key participants accounting for 50-55% of market share. Some technologies are really capital intensive, demanding high expertise and practical usages in order to attain wide acceptance among end customers. Such firms are leveraging this capability for customized solutions to reinforce their positions within regional high-demand markets of North America, the Middle East, and Asia-Pacific. These companies are referred as Tier-I players in the assessment. Examples of such players include Evonik, SABIC, Venus Ethoxyethers Pvt., Ltd., P and G Chemicals, and Oxiteno.

The second level of players account for 15-30% of the market in total. These companies are regional players and their product offerings are either technology-specific or specification-specific. These players have been termed as Tier-II players in the report. Companies such as Akzo Nobel N.V., Enaspol A.S, HELM AG, are a few examples of this category.

The remaining chunk of the market share is enjoyed by small and niche players, which target particular technologies or localized markets, generally smaller industrial set-ups or captive power generation. They often try to compete with bigger firms on the basis of flexibility and competitive pricing. Such firms are termed as Tier-III players in this market assessment. Examples include Royal Dutch Shell, Sasol.

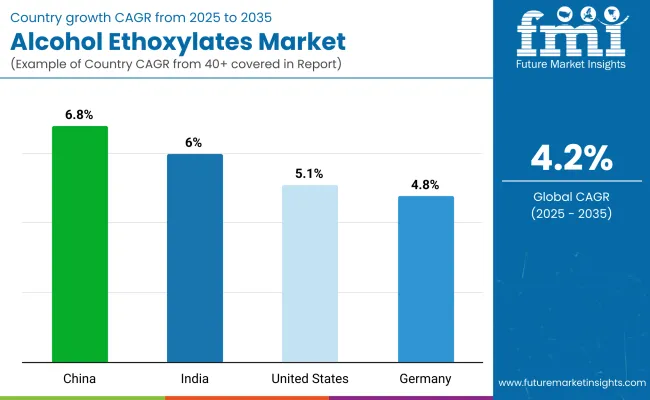

The countries that lead in adopting alcohol ethoxylates include United States, China, India and Germany, due to robust industrial growth, increasing personal care demand, and expanding agrochemical applications.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

| China | 6.8% |

| India | 6.0% |

| Germany | 4.8% |

The United States forms one of the leading markets for alcohol ethoxylates, mainly owing to strict environmental regulations and increasingly green-conscious customers. Agencies like the Environmental Protection Agency are promoting manufacturing companies to engage in green activities and shift their products towards becoming biodegradable and sustainable ones.

This practice goes in tune with the fact that consumers today are becoming environmentally conscious and wanting more eco-friendly products, most importantly in segments of household care and personal hygiene.

Because of these issues, alcohol ethoxylates, for example, have become key ingredients in such applications due to their effectiveness, efficiency, and biodegradability. In this regard, American companies create value from this trend by developing products using plant-based feedstock instead of synthetic materials, hence minimizing environmental degradation.

This move not only supports regulatory compliance but also improves brand reputation among environmentally conscious consumers. Regulatory pressures pushing simultaneously with the demand pull placed alcohol ethoxylates within the remarkable growth phase within the USA market.

In the Asia-Pacific region, China leads the demand for alcohol ethoxylates with huge growth in the industrial sectors and demand in various sectors like textiles and agricultural sectors. Alcohol ethoxylates have their use in the textile industry for cleaning and processing and hence help produce high-quality fabrics that meet both domestic and export demands. In agriculture, it is used as an emulsifier and wetting agent to enhance the activity of agrochemicals, such as pesticides and herbicides.

This demand has been further enhanced by the growing demand for biodegradable and sustainable products in these industries. The manufacturing of alcohol ethoxylates involves scaling up production to meet the increasing market demand, keeping in mind the global quality standards. With large-scale application across these growing industries, China becomes a key player in the global market, and its significant production capacity drives regional and international growth.

The Indian alcohol ethoxylates market is growing at a healthy CAGR of 6.0%. These constitute some of the key factors shaping consumer preferences for safe and eco-friendly products regarding personal care and household cleaning. With increasing consumer focus on sustainability, brands are being forced to reformulate their products with renewable and biodegradable ingredients like alcohol ethoxylates. This is tied with the rise in environmental sensitivity while making buying decisions.

Apart from the personal care and cleaning industries, alcohol ethoxylates are in demand by the agricultural industry in India. Active molecules act as very good emulsifiers and surfactants in crop protection products, hence improving the efficacy of pesticides and herbicides.

Alcohol ethoxylates definitely play a supporting role in sustainable agricultural development by reducing the impact on the environment while improving water and air quality. The Indian alcohol ethoxylates market is expected to witness growth during the next few years due to an increased awareness and growing usage in various sectors.

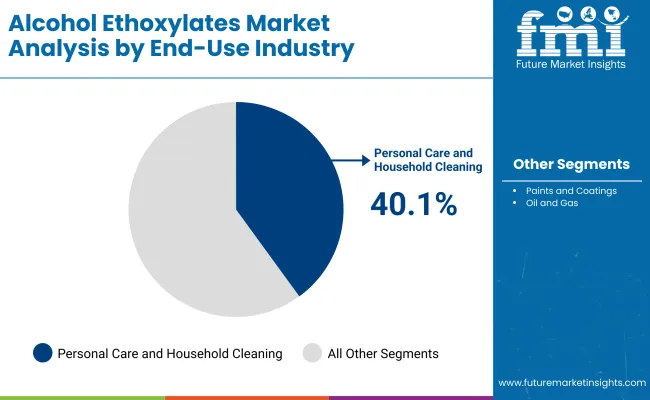

The section explains the market value of the leading segments in the industry. In terms of end-use industry, the personal care and household cleaning category will likely dominate and generate a share of around 40.1% in 2025.

The Industrial Cleaning and Agrochemicals segment is projected to hold a share of 25.9% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Type | Value Share, 2024 |

|---|---|

| Personal Care and Household Cleaning | 40.1% |

The segments of personal care and household cleaning are considered the key markets for alcohol ethoxylates. The increasing emphasis is on biodegradable surfactants. With growing consumer consciousness, more eco-friendly products are in demand, and therefore, sustainability is gaining prime importance during product formulation.

Alcohol ethoxylates possess excellent emulsifying and cleaning properties, and thus, they form very important constituents in detergents, shampoos, and liquid soaps. Properties giving better product efficiency, good cleaning performance, and a superior product texture help them improve effectiveness. Since consumers increasingly ask for sustainable and effective products, alcohol ethoxylates remain important for the personal care sector and within the cleaning industries.

| Capacity | Value Share, 2024 |

|---|---|

| Industrial Cleaning and Agrochemicals | 25.9% |

Alcohol ethoxylates are used in industrial cleaning and agrochemicals, which have been driving growth in these areas. In industrial cleaning, alcohol ethoxylates are used for degreasing and surface preparation, thus providing a more cost-effective and environmentally friendly alternative to traditional solvents.

The effectiveness of alcohol ethoxylates in removing oils and grease while being biodegradable makes them suitable for sustainable industrial practices. In agrochemicals, the effect of alcohol ethoxylates is said to be the improvement of emulsification, wetting, and spreading properties, making them very useful in agriculture industry, which supports more efficient crop protection methods based on the increasing demand for sustainable farming solutions.

The Alcohol Ethoxylates Market is highly competitive, with the initiatives that players focus on along with product sustainability and strategic partnerships being the two mainstays of expansion. Think of key companies such as BASF SE, Huntsman Corporation, Clariant AG, Evonik Industries, and Stepan Company as your primary innovators in the sector.

The suppliers are channeling funds into research and development to create new lines of renewable and biodegradable alcohol ethoxylates as they seek to address the demand existing in organic products. BAYFS also started the alcohol ethoxylates product line from bio-based sources which can be used in personal care, while Evonik has added capacity to cope with the high supply global demand. Collaborations with to clients in sectors such as textiles, personal care, and agriculture help the businesses not just solidify their presence but also promote sustainable solutions

Industry Updates

On the basis of product type, the market is categorized into Lauryl Alcohol (C12-C14) Ethoxylatesm Ceto Stearyl Alcohol (C16-C18) Ethoxylates, Behenyl Alcohol (C22) Ethoxylates, Oleyl Cetyl, and Others

On the basis of source, the market is categorized into Natural, and Synthetic

On the basis of function, the market is categorized into Wetting Agents, Coagulants, Emulsifiers, Dispersing Agent, and Others

On the basis of end-use industry, the market is categorized into Paints and Coatings, Oil and Gas, Agrochemicals, Home and Personal Care, Polymer, Pharmaceutical and Others

Key regions considered for the study include North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and Middle East and Africa

The overall market size for Alcohol Ethoxylates was USD 7,040.0 million in 2024.

The Alcohol Ethoxylates Market is expected to reach USD 7,335.7 million in 2025.

The demand for alcohol ethoxylates will be driven by growing consumer preference for eco-friendly personal care products, sustainable agrochemicals, and increasing industrial use in paints, coatings, oil and gas, and cleaning applications.

The Alcohol Ethoxylates Market is projected to reach USD 11,069.2 million in 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Kilotons) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Carbon Chain Length, 2017 to 2032

Table 4: Global Market Volume (Kilotons) Forecast by Carbon Chain Length, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 6: Global Market Volume (Kilotons) Forecast by Application, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by End-Use Industry, 2017 to 2032

Table 8: Global Market Volume (Kilotons) Forecast by End-Use Industry, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: North America Market Volume (Kilotons) Forecast by Country, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Carbon Chain Length, 2017 to 2032

Table 12: North America Market Volume (Kilotons) Forecast by Carbon Chain Length, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 14: North America Market Volume (Kilotons) Forecast by Application, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by End-Use Industry, 2017 to 2032

Table 16: North America Market Volume (Kilotons) Forecast by End-Use Industry, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Latin America Market Volume (Kilotons) Forecast by Country, 2017 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Carbon Chain Length, 2017 to 2032

Table 20: Latin America Market Volume (Kilotons) Forecast by Carbon Chain Length, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 22: Latin America Market Volume (Kilotons) Forecast by Application, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by End-Use Industry, 2017 to 2032

Table 24: Latin America Market Volume (Kilotons) Forecast by End-Use Industry, 2017 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Europe Market Volume (Kilotons) Forecast by Country, 2017 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Carbon Chain Length, 2017 to 2032

Table 28: Europe Market Volume (Kilotons) Forecast by Carbon Chain Length, 2017 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 30: Europe Market Volume (Kilotons) Forecast by Application, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by End-Use Industry, 2017 to 2032

Table 32: Europe Market Volume (Kilotons) Forecast by End-Use Industry, 2017 to 2032

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 34: East Asia Market Volume (Kilotons) Forecast by Country, 2017 to 2032

Table 35: East Asia Market Value (US$ Million) Forecast by Carbon Chain Length, 2017 to 2032

Table 36: East Asia Market Volume (Kilotons) Forecast by Carbon Chain Length, 2017 to 2032

Table 37: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 38: East Asia Market Volume (Kilotons) Forecast by Application, 2017 to 2032

Table 39: East Asia Market Value (US$ Million) Forecast by End-Use Industry, 2017 to 2032

Table 40: East Asia Market Volume (Kilotons) Forecast by End-Use Industry, 2017 to 2032

Table 41: South Asia & Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: South Asia & Pacific Market Volume (Kilotons) Forecast by Country, 2017 to 2032

Table 43: South Asia & Pacific Market Value (US$ Million) Forecast by Carbon Chain Length, 2017 to 2032

Table 44: South Asia & Pacific Market Volume (Kilotons) Forecast by Carbon Chain Length, 2017 to 2032

Table 45: South Asia & Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 46: South Asia & Pacific Market Volume (Kilotons) Forecast by Application, 2017 to 2032

Table 47: South Asia & Pacific Market Value (US$ Million) Forecast by End-Use Industry, 2017 to 2032

Table 48: South Asia & Pacific Market Volume (Kilotons) Forecast by End-Use Industry, 2017 to 2032

Table 49: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 50: Middle East and Africa Market Volume (Kilotons) Forecast by Country, 2017 to 2032

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Carbon Chain Length, 2017 to 2032

Table 52: Middle East and Africa Market Volume (Kilotons) Forecast by Carbon Chain Length, 2017 to 2032

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 54: Middle East and Africa Market Volume (Kilotons) Forecast by Application, 2017 to 2032

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Industry, 2017 to 2032

Table 56: Middle East and Africa Market Volume (Kilotons) Forecast by End-Use Industry, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Carbon Chain Length, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by End-Use Industry, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Volume (Kilotons) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Carbon Chain Length, 2017 to 2032

Figure 10: Global Market Volume (Kilotons) Analysis by Carbon Chain Length, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Carbon Chain Length, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Carbon Chain Length, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 14: Global Market Volume (Kilotons) Analysis by Application, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by End-Use Industry, 2017 to 2032

Figure 18: Global Market Volume (Kilotons) Analysis by End-Use Industry, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by End-Use Industry, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-Use Industry, 2022 to 2032

Figure 21: Global Market Attractiveness by Carbon Chain Length, 2022 to 2032

Figure 22: Global Market Attractiveness by Application, 2022 to 2032

Figure 23: Global Market Attractiveness by End-Use Industry, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Carbon Chain Length, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by End-Use Industry, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 30: North America Market Volume (Kilotons) Analysis by Country, 2017 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Carbon Chain Length, 2017 to 2032

Figure 34: North America Market Volume (Kilotons) Analysis by Carbon Chain Length, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Carbon Chain Length, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Carbon Chain Length, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 38: North America Market Volume (Kilotons) Analysis by Application, 2017 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by End-Use Industry, 2017 to 2032

Figure 42: North America Market Volume (Kilotons) Analysis by End-Use Industry, 2017 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by End-Use Industry, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2022 to 2032

Figure 45: North America Market Attractiveness by Carbon Chain Length, 2022 to 2032

Figure 46: North America Market Attractiveness by Application, 2022 to 2032

Figure 47: North America Market Attractiveness by End-Use Industry, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Carbon Chain Length, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by End-Use Industry, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 54: Latin America Market Volume (Kilotons) Analysis by Country, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Carbon Chain Length, 2017 to 2032

Figure 58: Latin America Market Volume (Kilotons) Analysis by Carbon Chain Length, 2017 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Carbon Chain Length, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Carbon Chain Length, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 62: Latin America Market Volume (Kilotons) Analysis by Application, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by End-Use Industry, 2017 to 2032

Figure 66: Latin America Market Volume (Kilotons) Analysis by End-Use Industry, 2017 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-Use Industry, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Carbon Chain Length, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 71: Latin America Market Attractiveness by End-Use Industry, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Carbon Chain Length, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by End-Use Industry, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 78: Europe Market Volume (Kilotons) Analysis by Country, 2017 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Carbon Chain Length, 2017 to 2032

Figure 82: Europe Market Volume (Kilotons) Analysis by Carbon Chain Length, 2017 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Carbon Chain Length, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Carbon Chain Length, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 86: Europe Market Volume (Kilotons) Analysis by Application, 2017 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by End-Use Industry, 2017 to 2032

Figure 90: Europe Market Volume (Kilotons) Analysis by End-Use Industry, 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2022 to 2032

Figure 93: Europe Market Attractiveness by Carbon Chain Length, 2022 to 2032

Figure 94: Europe Market Attractiveness by Application, 2022 to 2032

Figure 95: Europe Market Attractiveness by End-Use Industry, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: East Asia Market Value (US$ Million) by Carbon Chain Length, 2022 to 2032

Figure 98: East Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 99: East Asia Market Value (US$ Million) by End-Use Industry, 2022 to 2032

Figure 100: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 102: East Asia Market Volume (Kilotons) Analysis by Country, 2017 to 2032

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: East Asia Market Value (US$ Million) Analysis by Carbon Chain Length, 2017 to 2032

Figure 106: East Asia Market Volume (Kilotons) Analysis by Carbon Chain Length, 2017 to 2032

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Carbon Chain Length, 2022 to 2032

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Carbon Chain Length, 2022 to 2032

Figure 109: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 110: East Asia Market Volume (Kilotons) Analysis by Application, 2017 to 2032

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 113: East Asia Market Value (US$ Million) Analysis by End-Use Industry, 2017 to 2032

Figure 114: East Asia Market Volume (Kilotons) Analysis by End-Use Industry, 2017 to 2032

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End-Use Industry, 2022 to 2032

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End-Use Industry, 2022 to 2032

Figure 117: East Asia Market Attractiveness by Carbon Chain Length, 2022 to 2032

Figure 118: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 119: East Asia Market Attractiveness by End-Use Industry, 2022 to 2032

Figure 120: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 121: South Asia & Pacific Market Value (US$ Million) by Carbon Chain Length, 2022 to 2032

Figure 122: South Asia & Pacific Market Value (US$ Million) by Application, 2022 to 2032

Figure 123: South Asia & Pacific Market Value (US$ Million) by End-Use Industry, 2022 to 2032

Figure 124: South Asia & Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: South Asia & Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 126: South Asia & Pacific Market Volume (Kilotons) Analysis by Country, 2017 to 2032

Figure 127: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: South Asia & Pacific Market Value (US$ Million) Analysis by Carbon Chain Length, 2017 to 2032

Figure 130: South Asia & Pacific Market Volume (Kilotons) Analysis by Carbon Chain Length, 2017 to 2032

Figure 131: South Asia & Pacific Market Value Share (%) and BPS Analysis by Carbon Chain Length, 2022 to 2032

Figure 132: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Carbon Chain Length, 2022 to 2032

Figure 133: South Asia & Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 134: South Asia & Pacific Market Volume (Kilotons) Analysis by Application, 2017 to 2032

Figure 135: South Asia & Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 136: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 137: South Asia & Pacific Market Value (US$ Million) Analysis by End-Use Industry, 2017 to 2032

Figure 138: South Asia & Pacific Market Volume (Kilotons) Analysis by End-Use Industry, 2017 to 2032

Figure 139: South Asia & Pacific Market Value Share (%) and BPS Analysis by End-Use Industry, 2022 to 2032

Figure 140: South Asia & Pacific Market Y-o-Y Growth (%) Projections by End-Use Industry, 2022 to 2032

Figure 141: South Asia & Pacific Market Attractiveness by Carbon Chain Length, 2022 to 2032

Figure 142: South Asia & Pacific Market Attractiveness by Application, 2022 to 2032

Figure 143: South Asia & Pacific Market Attractiveness by End-Use Industry, 2022 to 2032

Figure 144: South Asia & Pacific Market Attractiveness by Country, 2022 to 2032

Figure 145: Middle East and Africa Market Value (US$ Million) by Carbon Chain Length, 2022 to 2032

Figure 146: Middle East and Africa Market Value (US$ Million) by Application, 2022 to 2032

Figure 147: Middle East and Africa Market Value (US$ Million) by End-Use Industry, 2022 to 2032

Figure 148: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 149: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 150: Middle East and Africa Market Volume (Kilotons) Analysis by Country, 2017 to 2032

Figure 151: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 152: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 153: Middle East and Africa Market Value (US$ Million) Analysis by Carbon Chain Length, 2017 to 2032

Figure 154: Middle East and Africa Market Volume (Kilotons) Analysis by Carbon Chain Length, 2017 to 2032

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Carbon Chain Length, 2022 to 2032

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Carbon Chain Length, 2022 to 2032

Figure 157: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 158: Middle East and Africa Market Volume (Kilotons) Analysis by Application, 2017 to 2032

Figure 159: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 160: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 161: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Industry, 2017 to 2032

Figure 162: Middle East and Africa Market Volume (Kilotons) Analysis by End-Use Industry, 2017 to 2032

Figure 163: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Industry, 2022 to 2032

Figure 164: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Industry, 2022 to 2032

Figure 165: Middle East and Africa Market Attractiveness by Carbon Chain Length, 2022 to 2032

Figure 166: Middle East and Africa Market Attractiveness by Application, 2022 to 2032

Figure 167: Middle East and Africa Market Attractiveness by End-Use Industry, 2022 to 2032

Figure 168: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Dehydrogenase Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Based Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alcoholic Flavors Market Size, Growth, and Forecast for 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Alcohol Use Disorder Treatment Market Growth - Demand & Innovations 2025 to 2035

Assessing Alcohol Packaging Market Share & Industry Trends

Alcohol Packaging Market from 2024 to 2034

Alcoholic Ice Cream Market

Bioalcohols Market Size and Share Forecast Outlook 2025 to 2035

TCD Alcohol DM Market Size and Share Forecast Outlook 2025 to 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Beer Market Insights - Trends, Demand & Growth 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Low-alcohol Beverages Market Analysis by Type, Distribution Channel, Packaging Format and Region through 2035

Industry Share & Competitive Positioning in Non-Alcoholic Malt Beverages

Oxo Alcohols Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA