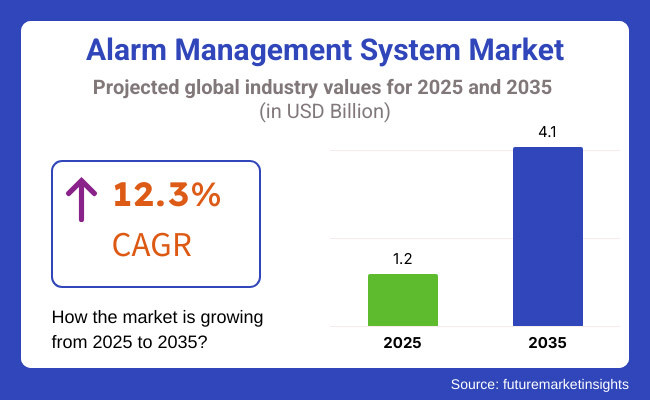

The alarm management system market is set to reach a valuation of USD 1.2 billion in 2025. The demand is projected to be USD 4.1 billion by 2035. The CAGR is expected to be 12.3% through 2035.

Industrial automation is North America's forte, while Europe is strong on regulatory compliance. Asia-Pacific has a rapid industrial expansion, all bearing the potential of global alarm management market growth. More and more products with an emphasis on alarm management show that the industrial sector needs this kind of system.

The USA Army's partnership with Evergreen Fire Alarms, LLC for ICIDS-VI demonstrates the military's commitment to the infrastructure and security sector. Notwithstanding strong growth, the market still experiences certain challenges, which include alarm overload by operators due to too many notifications, causing them to be desensitized and execute delayed actions. Furthermore, the generation of false alarms makes the whole procedure much more complicated by, again, creating non-operational inefficiencies. Companies that allocate their finances to adaptive alarm management software and predictive alert systems, which are frontiers' offers, will beat their competitors in the long run since they will become better in response precision and operational efficiency.

The AI-empowered alarm management system represents a huge opportunity, allowing companies to become both safer and more efficient. This is due to the state-of-the-art AI algorithms that can examine historical alarm data, predicting the breaking down of systems, and consequently, electronic machines are automating alarm prioritization based on the degree of seriousness.

Various industries are either establishing AI-based alarm systems for the correlation of alarms or are integrating them to identify trends, enhance performance, and reduce downtime in the medical area where; for example, AI-alarm systems are introduced by healthcare providers to solve the problem of alarm fatigue by not just prioritizing the critical ones but also filtering non-critical alerts. Besides, the energy sector applies AI in predictive maintenance to avoid expensive downtimes through the early detection of system failures.

Explore FMI!

Book a free demo

The main reason for the alarm management system market development is the request for real-time monitoring and safety compliance in various sectors, including oil & gas, healthcare, manufacturing, and power generation. Solution providers put stress primarily on system reliability along with easy integration and regulatory compliance for the meeting of industry safety standards. On the industrial side, the main issues are the introduction of advanced alarm handling procedures, which are purposed to the growing operational efficiency, risk of loss, and violation of the different legislations.

The end-users, both operators and technicians, want an ergonomic and user-friendly alarm management system that will enhance the situation and reduce disturbances in the service. Owing to the rise in automation and the use of Industry 4.0 techniques, a significant portion of market development is anticipated. The employment of artificial intelligence (AI) and machine learning (ML) in the alarm management sector is further able to augment the preceding maintenance and advanced warning systems completely, which makes these solutions needed in the case of key infrastructure.

Contract & Deals Analysis

| Company | Contract/Development Details |

|---|---|

| Evergreen Fire Alarms, LLC | The USAArmy awarded Evergreen Fire Alarms, LLC a contract for the Integrated Commercial Intrusion Detection System VI (ICIDS-VI). The contract encompasses the full range of fielding support following product verification tests to ensure system compliance with requirements. |

| Ring and Kidde Partnership | Ring partnered with Kidde to launch smart smoke and carbon monoxide alarms that integrate with the Ring app. These devices connect via Wi-Fi to send alerts directly to users' phones and offer optional 24/7 professional monitoring. |

In many industries, automation, regulatory standards, and high safety standards became a priority during 2020 to 2024. This was a major growth factor for the global alarm management systems market. Demands started to increase for effective alarm systems in process industries, healthcare, and building management systems in order to improve safety, reduce operational risk, and increase productivity. Data and analytics ensured better prioritization of alarms while reducing nonessential alarms, whereas cloud-based solutions helped monitor from anywhere and gave centralized control. The industry will enter predictive alarm management with advanced AI algorithms, IoT, and real-time analytics during the period between 2025 and 2035. Advanced alarm systems will increasingly use machine learning features empowered to test for possible failures, correct operation issues automatically, and optimize alarm strategies. Cybersecurity and safety compliance, increasingly following the path of evolving safety rules, will remain paramount, warranting blockchain and quantum security technology implementations.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Alarm systems used AI to screen out nuisance alarms and reserve critical ones. Machine learning algorithms improved alarm performance and minimized alarm fatigue. | Predictive AI software will automatically identify anomalies, forecast equipment failures, and execute preventive measures. Self-learning systems will optimize alarm rules and workflows automatically. |

| IoT sensors help to monitor in real time and remote alarm handling to enhance operation effectiveness. | Advanced IoT integration with edge computing will enable real-time data processing, abnormality detection, and instant alerts. Digital twins will simulate scenarios to maximize alarm response plans. |

| Cloud-based alarm management systems facilitated centralized monitoring and control of several locations. | Hybrid cloud and edge computing environments will deliver scalability, security, and real-time decision-making features to facilitate Industry 4.0 environments. |

| Basic cybersecurity procedures secured alarm systems against unauthorized use and data exposure. | Quantum security and blockchain will provide alarm data integrity, withstand rigorous regulatory compliance, and reduce cyber threats. |

| Industries implemented alarm management systems to meet safety standards like ISA 18.2 and IEC 62682. | Changing safety requirements will demand predictive alarm management and autonomous safety systems, necessitating the need for round-the-clock monitoring compliance. |

| Natural interfaces, mobile app integration, and voice notifications improved usability and adoption. | Voice-based alarms, augmented reality (AR) interfaces, and context-aware notifications will improve situational awareness and decision-making. |

| Alarm systems minimized downtime and operational hazards by notifying operators of critical events. | Autonomous alarm systems will resolve operational issues in real-time, achieving maximum productivity and humans need to intervene less. |

| Alarm management coupled with SCADA, DCS, and HMI for seamless operational control. | Automation will couple alarm systems with future-proof industrial automation platforms. |

| Oil & gas, chemical, and healthcare sectors spearheaded the adoption because of safety and compliance reasons. | Smart factories, power generation, and autonomous transport will fuel growth. |

The alarm management system market is at risk primarily because of regulatory compliance. Industries like oil and gas, manufacturing, healthcare, and utilities require the best safety conditions, which are proposed by regulators like OSHA (Occupational Safety and Health Administration), IEC 62682, and the FDA. Falling short in compliance leads to the threat of legal consequences, halting the work of industries, and the bad name of the business.

Cybersecurity threats are another major risk, particularly for cloud-based and IoT-enabled alarm systems. They are more vulnerable specifically because these systems need to collect and communicate the data in real time. The cyberattacks on the systems can be the root cause for the manipulation of processes in the industries, the safety of patients, or even the disruption of critical infrastructure. Therefore, companies must shell out money for the installation of robust encryption, firewall protection, and secure access protocols to mitigate risks.

Integration challenges with existing control systems and SCADA (Supervisory Control and Data Acquisition) platforms pose another hurdle. Most industries have older generations of machines that are not all able to bear with the new cloud computing technology. To set up a new alarm management solution that is not compatible with them implies the need for investment in retrofitting the machines that will run the software without interference.

Factors like operational downtimes and false alarms can also affect system reliability and user trust. Constantly repeated alerts can lead to "alarm fatigue’’, which might cause them to ignore incoming notifications, resulting in serious safety issues. To overcome this issue, intelligent alarm prioritization and AI-driven filtering are very important to maintaining the desired level of operational efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.7% |

| China | 13.1% |

| Germany | 10.9% |

| Japan | 10.5% |

| India | 13.4% |

| Australia | 12.2% |

Wide adoption of IoT technology across all industries, along with strict safety regulations and industrialized infrastructure, pushes the USA. alarm management systems market ahead of others. The medical care industry proactively embraces alarm management systems for improved patient monitoring, reducing alarm fatigue, and regulatory compliance, such as the Joint Commission and FDA. In the manufacturing sector, IoT-based alarm systems are utilized for predictive maintenance, reducing downtime, and boosting productivity. Advanced alarm systems in energy utilize medium to high complexity detection regarding power grids and pipelines. Companies in the industry like Honeywell, GE, and Siemens have led the way in embedding AI and machine learning within alarms to enhance alarm intelligence, minimize false alarms, and optimize response times in real-time. According to FMI, the USA market is poised to grow at 11.7% CAGR during the study period.

Growth Drivers in the USA

| Primary Drivers | Details |

|---|---|

| Healthcare Safety Regulations | Smart alarm systems are used by hospitals to enhance patient safety, reduce false alarms, and comply with FDA and Joint Commission regulations. |

| Industrial Adoption of IoT | Predictive maintenance in manufacturing and real-time monitoring are maximized through IoT-based alarm systems with reduced downtime. |

| Energy Demand Segment | Power grid and distribution network operational efficiency and safety are maximized through alarm management solutions. |

With the acceleration of industrialization, the construction of smart cities, and the rising demands for energy security, the alarm management system market in China is developing at an astonishing rate. Manufacturing is also adopting automation and using IoT-based alarm systems to control advanced manufacturing machines, which ensures greater security and reduced production downtime. Government policies toward smart grid infrastructure suggest implementing real-time alarm management solutions for control over power distribution, failure detection, and blackout prevention. Smart city projects also include the application of alarm management software in traffic, environmental, and public safety surveillance. Domestic players like Huawei and Hikvision, along with international suppliers, are seriously trying to grow in AI-supported alarm solutions in terms of reliability improvement and efficiency.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Manufacturing Automation | IoT-based alarm systems enhance productivity and security in China's expanding manufacturing sector. |

| Smart City Integration | Alarm systems are a fundamental part of public safety, traffic control, and environmental monitoring. |

| Smart Grid Development | Sophisticated alarm systems enhance the reliability of power grids and prevent shutdowns. |

The alarm management system market in Germany is driven by technical accuracy, tough safety standards, and the pervasiveness of IoT practices within Industry 4.0. The automotive sector uses high-precision alarm technology for the role of quality management and line inspection, as well as maintaining international standards. Alarm management systems are extremely critical in the energy industry to monitor renewable energy plants while maintaining grid stability and operation effectiveness at a high level. Advanced alarm solutions are used in the chemical industry to push safety processes higher to prevent hazardous events. With a strong emphasis on AI incorporation, German industries such as Siemens and Bosch lead intelligent alarm management technologies in the industrial and healthcare industries. FMI is of the opinion that the German market will achieve a 10.9% CAGR during the study period.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Industry 4.0 Implementation | AI-based alarm systems are employed in smart factories for predictive maintenance and smooth functioning. |

| Automotive Quality Assurance | Alarm systems in real-time ensure quality compliance and safety in the production of motor vehicles. |

| Development of Energy Industry | Alarm systems improve safety and efficiency in power plants for electricity generation and distribution. |

Japan alarm management system market is driven on technological advancements, commercialization of manufacturing, and disaster prevention. This system is used in automotive and electronics for production quality assurance and efficiency. Being located in an area with a high risk of natural disasters, so developing high-tech alarm systems has been made a prime goal with a focus on advance warning for earthquakes, tsunamis, and intense weather. Furthermore, the elderly population is being monitored in the healthcare sector with the increasing adoption of alarm management solutions to ensure their safety and administer timely medical assistance. Omron and Fujitsu are also heavily investing in AI-based alarm solutions to facilitate faster response and predictability.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| High-Precision Automation | Alarm systems manage sophisticated manufacturing processes in the automotive and electronics industries. |

| Disaster Warning Systems | Advanced warning systems give real-time earthquake and tsunami alerts, increasing public safety. |

| Elderly Care Solutions | Alarm systems are used by hospitals to improve patient monitoring and emergency care. |

Growing urbanization, industrialization, and the need for public safety are driving positive growth for the Indian alarm management system market. The rapidly expanding manufacturing industry results in a need for automated alarm systems for process optimization, equipment monitoring, and regulatory compliance. State-supported smart city initiatives involve alarms for public security, traffic, and environmental protection. Alarm management software is referred to as the technology that helps track grid stability and ensures efficient delivery of power to an end-user in renewable energy initiatives in the power sector. Healthcare authorizations and industrial protection codes are additional persuading the installation of advanced alarm systems inside medicinal offices and plants.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Urbanization and Smart Cities | Alarm systems provide public safety and environmental monitoring in rapidly developing cities. |

| Manufacturing Expansion | Sophisticated alarm solutions provide security and efficiency in computerized manufacturing. |

| Energy Industry Expansion | Alarm management systems monitor power grids and renewable power plants for optimal performance. |

Australia's alarm management system market is developing at a steady pace in terms of mining, energy, and agriculture. Mining operators are adding advanced alarm solutions to enhance equipment performance, ensure worker safety, and meet stringent environmental and operational mandates. Advanced alarm management systems in the energy sector, and especially renewable power projects, offer improved grid stability and a smooth supply of power. Low-power, long-range solutions are also coming into play to help monitor irrigation systems, livestock, and the weather in the name of farm automation efficiency and sustainability. AI and IoT technology adoption are raising the alarm about intelligence and predictive maintenance capabilities as well. FMI believes that the Australian market will grow at 12.2% CAGR throughout the study period.

Growth Drivers in Australia

| Key Drivers | Details |

|---|---|

| Mining Safety Efficiency | Equipment condition is monitored by alarm systems and offers more safety to mines. |

| Renewable Energy Monitoring | Power transmission is optimized by advanced alarm systems and ensures grid stability. |

| Smart Agriculture Integration | Alarm systems' monitoring of weather, animals, and irrigation boosts agricultural productivity. |

The market is segmented by services and software components. The services segment consists of installation, maintenance, and consulting services, which are a must for the appropriate deployment and functioning of alarm management systems. By 2023, sectors will be deploying an increasing number of these practices in order to sharpen safety and weather operations and create value and will clearly need such differentiated services.

This segment includes installation, maintenance, and consulting services that are critical for the effective deployment and operation of alarm management systems. For example, Honeywell International Inc. offers end-to-end consulting to customize alarm management solutions in line with industrial requirements to ensure integration and fulfilling operations for alarm management solutions.

The software segment includes tools & applications that can be used to monitor, analyze, and manage alarms in real-time. Enhanced with Artificial Intelligence (AI) and Machine Learning (ML), today's technology has given rise to smart software capable of predictive analytics and even automated responses. These innovations are absolute requirements in sectors such as healthcare, manufacturing, oil and gas, energy and utility, and transport. For example, alarm management software from Siemens AG employs AI algorithms to detect potential issues before they escalate to system failures, enabling proactive measures and reduced downtime. Honeywell's corporate restructuring and emphasis on automation technologies are also expected to have an impact on its alarm management products.

The oil and gas industry has paved the path of the age of advanced alarm management systems by meeting complicated operations and critical safety standards. They use these systems to monitor critical parameters such as pressure, temperature, and flow rates in upstream, midstream, and downstream segments to ensure production takes place in a safe, efficient manner. Alarm management solutions such as those available from Honeywell can automate the validation process, increasing security and lowering human errors.

The other obstacles include enabling elements like alarm flooding and nuisance alarms, which can lead to operator fatigue and heightened human error. Industry leaders are issuing advanced alarm management capabilities to address dynamic alarming capabilities and potentially prioritize alarms with machine learning. For instance, Emerson's DeltaV system features integrated alarm operations that enhance visibility and protection against alarm floods that contribute to situational awareness and "making the call."

Ensuring that the safety strategy is coherent across all systems is where an alarm management system should interact alongside a DCS and SIS. One of the examples given by Yokogawa omits seamless communication and coordination as a key to proactive and effective responses, continuous monitoring, and documentation to keep alarm systems healthy.

The chemical industry has also adopted advanced alarm management with goals of safety and operational efficiency. Emerson provides systems and software solutions for process control to the chemical industry to help improve efficiency and increase production flexibility.

It is expected that this demand in both industries will lead to alarm management solutions becoming more robust in order to ensure safety and operational performance through continuous improvement in a mature manner as the regulatory landscape continues to tighten.

The alarm management system market finds itself in stiff competition across industries such as manufacturing, healthcare, energy, and utilities due to its operational efficiency, safety, and regulatory compliance features. These systems assist in the real-time monitoring and response to various incidents, leading to operational streamlining and risk mitigation.

In the AI universe, alarm analytics, predictive maintenance capabilities, and cloud-based management platforms create a fortress for industry leaders, i.e., Schneider Electric, Honeywell, ABB, Siemens, and Rockwell Automation. Advanced IIoT-based alarm solutions have been made available by Honeywell, while Schneider Electric is developing adaptive alarm rationalization tools that will help reduce alert fatigue.

By injecting a steady stream of serious competition through cheaper, scalable, and customizable solutions in alarm management, regional and emerging players are claiming their stake. Companies waging this war on automated event response, data-driven alarm prioritization, and cyber-secure architectures will eventually emerge as the most competitive players in the ever-evolving market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Honeywell International Inc. | 15-20% |

| ABB Ltd. | 12-17% |

| Siemens AG | 10-15% |

| Emerson Electric Co. | 8-12% |

| Rockwell Automation Inc. | 7-11% |

| Other Companies (combined) | 35-48% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Honeywell International Inc. | Provides advanced alarm management solutions with integrated analytics and real-time monitoring for industrial automation. Focuses on safety and compliance. |

| ABB Ltd. | Specializes in cloud-based alarm management integrated with control systems for predictive maintenance and incident response. Expands into energy and utility sectors. |

| Siemens AG | Delivers AI-driven alarm management for smart manufacturing and process optimization. Integrates with IoT for enhanced operational efficiency. |

| Emerson Electric Co. | Offers scalable alarm management systems with event analysis and root cause identification. Targets process industries and healthcare. |

| Rockwell Automation Inc. | Develops advanced alarm management with real-time analytics and workflow automation. Focuses on industrial safety and productivity. |

Honeywell International Inc. (15-20%)

Honeywell is the market leader in alarm management systems, leveraging its expertise in industrial automation and safety solutions. The company focuses on integrated analytics, real-time monitoring, and compliance management. Honeywell’s strategic direction includes expanding its cloud-based solutions and enhancing predictive maintenance capabilities. It continues to innovate with AI-driven alarm rationalization to reduce operator fatigue and improve incident response times.

ABB Ltd. (12-17%)

ABB is known for its cloud-enabled alarm management systems that seamlessly integrate with its automation control systems. The company emphasizes predictive maintenance, energy efficiency, and remote monitoring. ABB is expanding its presence in the energy and utility sectors, enhancing operational safety and productivity. Its strategic focus includes leveraging AI for alarm prioritization and incident management.

Siemens AG (10-15%)

Siemens is at the forefront of smart manufacturing with its AI-powered alarm management systems. It focuses on process optimization and operational efficiency by integrating IoT and machine learning. Siemens is investing in digital transformation, emphasizing cybersecurity and scalable cloud solutions. The company aims to enhance proactive maintenance with predictive analytics and real-time data integration.

Emerson Electric Co. (8-12%)

Emerson offers scalable alarm management solutions designed for process industries, including oil and gas, pharmaceuticals, and healthcare. The company emphasizes event analysis, root cause identification, and regulatory compliance. Emerson is expanding its digital ecosystem by integrating alarm management with its Plantweb™ digital ecosystem. Its strategic focus includes enhancing remote monitoring and predictive analytics.

Rockwell Automation Inc. (7-11%)

Rockwell Automation specializes in advanced alarm management with a focus on industrial safety and productivity. The company integrates real-time analytics and workflow automation to optimize alarm responses. Rockwell is investing in cybersecurity and cloud-based alarm management solutions to enhance scalability and remote access. Its strategic direction includes expanding partnerships for integrated digital transformation solutions.

Other Key Players (35-48% Combined)

The global alarm management system industry is projected to witness a CAGR of 12.3% between 2025 and 2035.

The global alarm management system industry is estimated to grow USD 1.2 billion in 2025.

The Global Alarm Management System industry is anticipated to reach USD 4.1 billion by 2035 end.

North America is expected to record the highest CAGR, driven by increasing industrial automation and safety regulations in critical infrastructure.

The key players operating in the global alarm management system industry include Vocera Communications, Masimo Corporation, PAS Global LLC, exida.com LLC, Honeywell International Inc., Ascom Holdings, Yokogawa India Ltd., GE Healthcare, Spok Inc. & Koninklijke Philips.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.