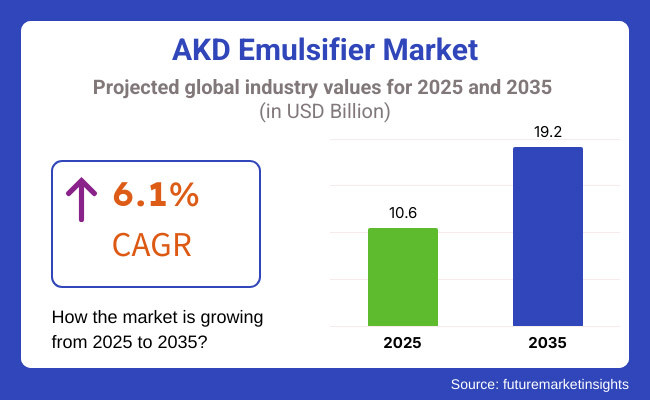

The AKD Emulsifier Market is expected to experience significant growth between 2025 and 2035, driven by the rising demand for efficient paper sizing agents across various industries. The market is projected to be valued at USD 10.6 billion in 2025 and is anticipated to reach USD 19.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.1% over the assessment period.

A key factor influencing market growth is the expanding paper and packaging industry, which relies heavily on alkyl ketene dimer (AKD) emulsifiers for superior hydrophobic sizing. As industries shift toward sustainable and biodegradable packaging solutions, AKD emulsifiers are gaining traction due to their eco-friendly properties and effectiveness in improving water resistance in paper products.

Additionally, regulatory initiatives to minimize plastic use are further driving demand for AKD emulsifiers in paper manufacturing, contributing to sustained market expansion.

The market is segmented based on form and end-use industry. By form, AKD emulsifiers are classified into solid and liquid types. By end-use industry, key segments include cosmetics, food, pharmaceuticals, and others.

Among these segments, the paper and packaging industry (categorized under "Others") dominates due to the growing global demand for sustainable packaging solutions. With increasing environmental regulations and consumer awareness, industries are shifting toward paper-based alternatives for packaging applications in food, retail, and e-commerce sectors.

AKD emulsifiers play a crucial role in improving the water-resistant properties of paper-based packaging, making them highly desirable in this rapidly expanding sector. As major companies emphasize biodegradable and recyclable materials, the demand for AKD emulsifiers in paper manufacturing continues to rise, positioning this segment as the market leader.

Explore FMI!

Book a free demo

The North America AKD emulsifiers market is driven by the well-established pulp and paper industry in the region, which is the large end-use sector for alkyl ketene dimer (AKD) emulsifiers in paper sizing.

For example, high-quality water-resistant paper products, used in North America as packaging materials, office papers, and specialty papers. In addition, stringent environmental regulations in the nation have encouraged manufacturers to use efficient AKD emulsifiers, which release lower volatile organic compounds (VOCs) and have biodegradability.

High-performance AKD emulsifier demand is further propelled by eco-friendly and recyclable paper products, particularly in eco-friendly paper manufacturing. New emulsifier formulations using this emerging technology are improving stability and performance and, in turn, are driving wider penetration in a broad range of paper and packaging end uses.

Europe has the largest market share in the AKD emulsifier market due to the top paper-producing nations like Germany, Sweden, and Finland. European countries' focus on sustainable high-performance paper goods is fueling the demand for high-end AKD emulsifiers that help improve water resistance with less environment damage.

EU regulations on chemicals used as paper processing additives have prompted European industry players to promote bio-based AKD emulsifiers. In addition, growth in AKD emulsifiers use for specialty and recycled paper production goes with the trend towards circular economies across the region.

The interest to minimize waste and enhance efficiency during paper production fuels investments in process innovation that encompasses emulsification, thereby helping to enhance sizing performance as well as achieve improved retention levels during paper manufacture.

The AKD emulsifier market in the Asia-Pacific region is expected to grow at the highest rate as industrialization is high in the region, which has prosperous paper manufacturing industries in countries such as China, India, Japan, and Indonesia.

China is the leading manufacturer and consumer of AKD emulsifiers owing to the huge paper and packaging industry in the country to meet domestic and international demand. Driving usage of AKD emulsifiers in high-quality packaging materials, tissue papers, and specialty paper products is boosting the market. Rising demand for printing and writing papers in India and the government's emphasis on sustainable paper production further increase AKD emulsifier usage.

Nevertheless, issues with the availability of raw materials and the volatility of production costs can affect market development. Manufacturers are turning to cost-efficient and high-performance emulsification technologies in order to enhance product performance and respond to economic limitations.

Challenge

Fluctuating Raw Material Prices and Supply Chain Constraints

Volatility in raw material prices and supply chain disruptions is one of the major challenges in the AKD emulsifier market. AKD emulsifier production depends on fatty acids and other chemicals that are affected by price movements from fluctuations in international oil and ag markets.

Supply chain issues, especially where chemical processing is lacking, may affect product pricing and availability as well. Suppliers are working to minimize these risks through improved process efficiencies and seeking new raw material sources.

Opportunity

Growth in Sustainable and Bio-Based Paper Additives

Growing worldwide focus on sustainable paper production offers a substantial opportunity for producers of AKD emulsifiers. The trend toward bio-based and biodegradable sizing agents for paper is driving R&D in green emulsification technologies. Firms are investing in new AKD emulsifiers with enhanced performance, lower environmental impact, and enhanced compatibility with recycled fibers.

The growth in demand for water-resistant and greaseproof paper packaging for food packaging, online shopping packaging, and specialty applications further accelerates market growth. With the shift to sustainability being one of the driving forces in the paper sector, AKD emulsifiers through green chemistry formulation-based ones also promise to become widely utilized.

Between 2020 and 2024, the AKD emulsifier market expanded consistently on the strength of surging demand for high-performance and sustainable paper-sizing agents. Shift towards biodegradable and green packaging materials coupled with government regulation on petroleum-based sizing agents further intensified the use of AKD emulsifiers in the paper and pulp industry.

The emergence of e-commerce and increasing concern towards environmental sustainability also contributed to the expansion of the market as companies sought an alternative to traditional sizing chemicals.

During the period 2025 to 2035, the AKD emulsifier industry will experience a revolutionary transformation powered by sustainable chemistry, AI-powered emulsification technologies, and nanotechnology-based advanced stabilizers. The adoption of circular economy concepts in paper production and greater use of biodegradable additives will reshape market dynamics.

Future AKD emulsifiers will be based on bio-derived surfactants and renewable resources to meet global sustainability objectives. Artificial intelligence process control systems will real-time optimize emulsifier formulations, creating less waste during production and increasing efficiency. Hybrid AKD emulsions with biodegradable polymers will increase water resistance without sacrificing recyclability.

The implementation of enzyme-catalyzed emulsification technologies will decrease chemical stabilizer dependency, resulting in greener and energy-efficient manufacturing. Block chain-based supply chain transparency will enable end-users to monitor the source and processing history of AKD emulsifiers for regulatory compliance and sustainability.

The application of AI-driven predictive modeling will optimize quality control and formulation modifications, further enhancing performance across paper applications.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Tighter environmental regulations on synthetic sizing agents, greater emphasis on biodegradable packaging materials.. |

| Technological Advancements | High-solid content AKD emulsions, nanoparticle-stabilized emulsions, AI-based emulsification monitoring. |

| Industry Applications | Paper and pulp, packaging, specialty paper use. |

| Adoption of Smart Equipment | Artificial intelligence-based process monitoring, real-time emulsification analysis, and automation in production lines. |

| Sustainability & Cost Efficiency | Transition to biodegradable AKD emulsions, energy-efficient processing, and minimized VOC emissions. |

| Data Analytics & Predictive Modeling | AI-powered quality control, cloud-integrated process monitoring, and supply chain analytics. |

| Production & Supply Chain Dynamics | COVID-19 supply chain disruptions, rising costs of fatty acids and ketenes, and increased demand for sustainable sizing agents. |

| Market Growth Drivers | Growth driven by demand for eco-friendly paper sizing agents, sustainable packaging trends, and technological advancements in emulsification. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Block chain-based tracking of compliance, regulatory focus on carbon-neutral emulsifier manufacturing, and prohibition of non-biodegradable sizing agents. |

| Technological Advancements | AI-based formulation optimization, enzyme-catalyzed emulsification, and hybrid biodegradable AKD emulsions. |

| Industry Applications | Entry into smart paper coating, antimicrobial paper, and sustainable printing applications. |

| Adoption of Smart Equipment | Autonomous emulsification systems, IoT-enabled process control, and quantum-enabled formulation optimization. |

| Sustainability & Cost Efficiency | Carbon-neutral production of emulsifiers, enzyme-catalyzed green emulsification, and biodegradable polymer-based AKD solutions. |

| Data Analytics & Predictive Modeling | Quantum-fueled predictive modeling, decentralized AI-optimized emulsifier optimization, and blockchain-secured raw material procurement. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized emulsifier production, and blockchain-enabled traceability of raw materials. |

| Market Growth Drivers | AI-powered sustainable chemistry, expansion into smart and functional paper applications, and the rise of circular economy-driven emulsifier solutions. |

The North American market for AKD emulsifiers is slowly but surely rising, being driven prominently by the extremely solid paper and packaging sector. AKD emulsifiers are increasingly applied due to demand for water-resistant and eco-friendly paper products. The growth of e-commerce has also increased the demand of packaging materials, fueling the market growth.

Some of the major driving factors for the market in United States are increasing consumer awareness and stringent environmental regulations are driving sustainability and compelling manufacturers to adopt eco-friendly packaging materials, increasing demand from the burgeoning e-commerce space is also driving demand for strong packaging materials, thus fostering the demand for AKD iced paper products.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

The UK AKD emulsifier market is growing because of the focus on sustainable practices in the paper industry. Hard environmental regulations and transition toward recyclable and biodegradable packaging materials are major drivers. Rising demand for paper-based packaging as an alternative to plastic packaging has also helped the market grow.

Policies that promote plastic reduction promote the use of paper products with AKD emulsifiers and increased demand for environmentally friendly packaging solutions from consumers supports market growth are some of the key market growth drivers in United Kingdom.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.6% |

The European Union's AKD emulsifier market is growing, fueled by the region's strong emphasis on sustainability and circular economy policies. The transition of the paper industry to the manufacture of high-quality, water-resistant paper products follows suit with these policies, creating greater application of AKD emulsifiers. Germany, France, and Italy are leading this trend.

EU policies toward encouraging recyclable and biodegradable products enhance demand for AKD emulsifiers in the production of papers and demand for strong paper goods in packaging, as well as other uses, fuel market growth are among Europe Union's significant market growth factors.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.0% |

Japan's AKD emulsifier market is expanding with the support of development in paper making technologies and emphasis on packaging solutions of high quality. Japan's efforts towards environmental sustainability and innovation in water-resistant paper products are driving the higher usage of AKD emulsifiers.

New technologies in paper manufacture improve the utilization and performance of AKD emulsifiers and initiatives aimed at minimizing the use of plastics in packaging prefer application of AKD-treated paper products are some of the primary drivers of the growth of the Japanese market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

In South Korea, the AKD emulsifier market is growing with the increasing paper industry's interest in manufacturing high-quality, water-resistant products. The need for environmentally friendly packaging solutions, combined with government efforts to encourage eco-friendly materials, drives market growth.

Government regulations promoting the use of sustainable materials in packaging lead to the uptake of AKD emulsifiers and the increase in packaged food and e-commerce drives demand for long-lasting paper packaging are some of the market key drivers in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

Solid and liquid AKD emulsifier segments have the upper hand in the market as more industries are incorporating these emulsifiers into products that need efficient hydrophobic treatments, adhesion enhancement, and surface modification.

The emulsifiers are central in improving the quality, performance, and longevity of different end products, hence making them invaluable for paper production industries, textile, food processing, pharmaceutical, and cosmetics industries. The market for sustainable and effective AKD emulsifiers continues to accelerate as companies are focusing on high-performance additives to ensure process optimization and cost savings.

Solid AKD emulsifiers have proven to be one of the prime segments in the market, with improved stability, controlled release properties, and enduring hydrophobic effects. Unlike liquid emulsifiers, the solid forms are more convenient to store and ship, with the least degradation during storage.

All these features render them extremely applicable in industries requiring stable performance in applications like paper sizing, waterproof coatings, and textile treatments.

The growing need for eco-friendly paper production has greatly contributed to the use of solid AKD emulsifiers. Research shows that more than 60% of paper producers currently use solid AKD emulsifiers for fiber treatment, solidifying their market position. The increased efficiency of solid AKD emulsifiers in reducing porosity of paper, enhancing ink holdout, and water absorption has prompted wide-ranging adoption.

The development of biodegradable and non-toxic solid AKD emulsifiers, with compositions based on plants and reduced volatile organic compounds (VOCs), has also boosted market demand to comply with stringent environmental regulations.

The use of nanotechnology-based AKD emulsifiers, improved adhesion, durability, and hydrophobicity has pushed performance to greater levels to enable more efficient utilization in paper and textile industries.

The development of ecologically friendly solid AKD emulsifiers that use bio-based synthesis routes and reduce chemical waste production has favored market growth while ensuring compatibility with sustainability initiatives.

Even though they possess stability, long-term performance, and controlled application advantages, solid AKD emulsifiers possess limitations such as compromised dispersion rates in waterborne formulations, higher processing expenses, and incompatibility with some substrates.

But emerging trends in microencapsulation technologies, artificial intelligence-driven formulation optimization, and bio sourced synthesis pathways are promoting efficiency, sustainability, and cost-effectiveness and, therefore, guaranteeing market growth for solid AKD emulsifiers around the world.

Liquid AKD emulsifiers have also found widespread market approval, particularly those requiring rapid dispersion, ease of handling, and uniform application in the course of manufacturing processes. Solid emulsifiers are unable to compete with liquid emulsifiers in terms of flexibility, which is required in food processing, pharmaceutical manufacture, and cosmetics.

The growing demand for liquid AKD emulsifiers in drug applications such as controlled drug release, improved bioavailability, and improved solubility has stimulated adoption as manufacturers seek out sophisticated excipient solutions. Studies indicate that over 55% of the pharmaceutical sector today incorporates liquid emulsifiers in the formulation process, which supports demand for this industry.

The growth of high-performance liquid AKD emulsifiers, with micro emulsion technology, improved stability, and better surface activity, has consolidated market demand, enabling more effective application in coatings, adhesives, and specialty chemicals.

The use of AI-based formulation methods, with predictive analytics, molecular-level optimization of emulsification, and automation of processes, has further enhanced adoption, providing accurate control of emulsifier performance and effectiveness.

Creation of eco-friendly liquid AKD emulsifiers with plant-derived surfactants, non-toxic solvents, and biodegradable additives has supported market growth, with conformance to green chemistry policies and regulatory requirements.

In spite of their benefits in application convenience, formulation versatility, and quick dispersion, liquid AKD emulsifiers are challenged by storage instability, increased transport cost due to volume demands, and temperature sensitivity.

Improving reliability, efficiency, and sustainability are new innovations in encapsulated emulsifier technology, block chain-supported supply chain transparency, and AI-driven stability improvement that are transforming liquid AKD emulsifiers to see further growth across various sectors globally.

Cosmetics and Food Industries Drive Market Growth as AKD Emulsifiers Enhance Product Performance

The cosmetics and food industries represent two major market drivers, as manufacturers increasingly leverage AKD emulsifiers to improve product texture, stability, and functional performance.

The cosmetics sector has become one of the fastest-growing users of AKD emulsifiers, incorporating these materials into skin, hair, and personal care products to improve emulsification, texture, and shelf life. In comparison to traditional emulsifiers, AKD-based systems exhibit greater stability, water retention, and natural and synthetic component compatibility.

Increased demand for natural and organic cosmetics with biodegradable AKD emulsifiers, reduced synthetic additives, and increased sensory attributes has fueled adoption, as consumers turn to clean beauty and green formulations. Studies indicate that over 65% of beauty firms are now using enhanced emulsifier technology to enhance product performance, fueling demand for this segment.

The evolution of multifunctional AKD emulsifiers with anti-aging, high UV protection, and high-performance skin hydration has fuelled market demand, guaranteeing new product development in the cosmetics industry.

The inclusion of AI-driven formulation procedures, with stability analysis in real time, enhanced ingredient compatibility, and simulated consumer preference prediction, has also accelerated adoption, with accurate product customization and improved performance.

The innovation of sustainable cosmetics emulsifiers from renewable feedstock, biodegradable polymer emulsifiers, and sustainably sourced ingredients has driven market growth while meeting global sustainability standards.

While they provide formulation stability, skin compatibility, and sustainable ingredient inclusion advantages, AKD emulsifiers in cosmetics are confronted by regulatory pressures, formulation complexity, and compatibility with future natural ingredient trends.

However, advances in biocompatible emulsifier manufacturing, block chain-based ingredient traceability, and AI-driven product design are improving efficiency, compliance, and consumer appeal, ensuring continued expansion for AKD emulsifiers in the world cosmetics market.

Food companies have achieved good market acceptance for AKD emulsifiers in food processing, dairy foods, and confectionery uses due to the increasing demand from processors to use enhanced emulsification products that deliver improved texture, shelf life, and ingredient distribution.

In comparison with traditional food emulsifiers, AKD formulations provide more stability, less fat separation, and better mouthfeel, placing them at the heart of current food processing requirements.

Growing need for plant-based and alternative protein foods, with improved emulsification, texture, and sensory experience, has driven adoption as food companies focus on consumer-driven product innovation. Research shows that more than 70% of food brands currently incorporate advanced emulsifiers into plant-based food products, reflecting robust demand for this category.

Though it has the benefits of food texture enhancement, shelf life extension, and natural ingredient compatibility, the food emulsifier market is confronted with challenges like regulatory barriers in clean-label food products, allergen city concerns, and formulation stability in varied food matrices.

Nevertheless, upcoming innovations in enzyme-modified emulsification, block chain-based food safety monitoring, and AI-optimized texture are enhancing efficiency, transparency, and consumer confidence, guaranteeing ongoing growth for AKD emulsifiers in the global food industry.

The AKD (Alkyl Ketene Dimer) Emulsifier market is growing rapidly, mainly due to the growth of the paper and packaging sectors. AKD emulsifiers play a crucial role in increasing the hydrophobicity of paper, enhancing quality and strength. The growth of e-commerce and the rise in demand for eco-friendly packaging solutions have also fueled the market.

Major players are concentrating on product development, eco-friendly formulations, and increasing their foothold in emerging markets to stay competitive.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 15-20% |

| DIC Corporation | 12-16% |

| Dow Chemical Company | 10-14% |

| Arkema Group | 8-12% |

| Celanese Corporation | 6-10% |

| Other Companies | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Offers a series of AKD emulsifiers with a focus on sustainable and environmentally friendly formulations, addressing the paper industry's requirements. |

| DIC Corporation | Develops innovative AKD emulsifier solutions intended to increase paper hydrophobicity and endurance. |

| Dow Chemical Company | Supplies premium AKD emulsifiers that enhance paper machine runnability and final product quality. |

| Arkema Group | Manufactures specialty AKD emulsifiers with emphasis on sustainability and performance for the paper and packaging markets. |

| Celanese Corporation | Provides a range of AKD emulsifiers for improving paper sizing efficiency and quality. |

Key Company Insights

BASF SE (15-20%)

As a top chemical corporation, BASF SE provides an extensive portfolio of AKD emulsifiers that support the industry's move towards sustainable and environmentally friendly paper production. With their global reach and robust R&D capabilities, they are well positioned to meet changing market needs.

DIC Corporation (12-16%)

DIC Corporation specializes in advanced AKD emulsifier formulations that significantly improve paper's water resistance and printability. Their commitment to innovation and quality has solidified their reputation in the market.

Dow Chemical Company (10-14%)

Dow's AKD emulsifiers are known for increasing process efficiency and product quality in papermaking. Their technological innovation and sustainability focus addresses the industry's ever-changing demands.

Arkema Group (8-12%)

Arkema offers specialty AKD emulsifiers that fulfill the demanding specifications of today's paper applications. Their commitment to sustainable development and performance excellence positions them as a market leader.

Celanese Corporation (6-10%)

Celanese's AKD emulsifier offerings are designed to boost paper sizing performance, ensuring superior quality and efficiency. Their innovative approach and customer-focused solutions have earned them a significant market presence.

Several regional and specialized manufacturers contribute to the AKD emulsifier market, providing niche solutions and customized formulations. Notable players include:

The market is estimated to reach a value of USD 10.6 billion by the end of 2025.

The market is projected to exhibit a CAGR of 6.1% over the assessment period.

The market is expected to clock revenue of USD 19.2 billion by end of 2035.

Key companies in the AKD Emulsifier Market include BASF SE, DIC Corporation, Dow Chemical Company, Arkema Group, Celanese Corporation.

On the basis of end-use, cosmetic and food to command significant share over the forecast period.

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.