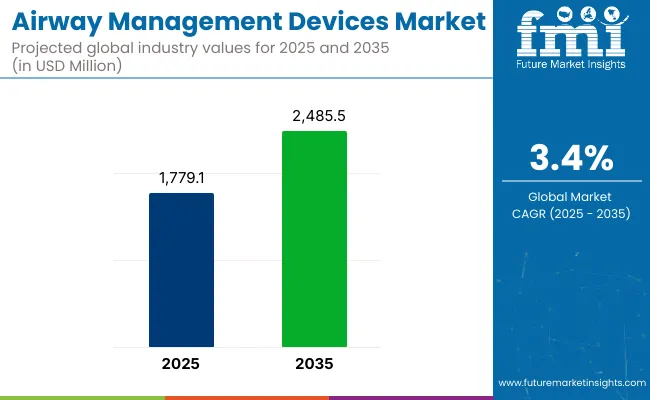

The global Airway Management Devices Market is estimated to be valued at USD 1,779.1 million in 2025 and is projected to reach USD 2485.5 million by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,779.1 Million |

| Projected Market Size in 2035 | USD 2485.5 Million |

| CAGR (2025 to 2035) | 3.4% |

The airway management devices market is undergoing steady expansion driven by the rising incidence of chronic respiratory diseases, the growing volume of surgical procedures requiring anesthesia, and the continued focus on emergency and pre-hospital care readiness.

An increased burden of obstructive sleep apnea and respiratory distress in aging populations has elevated the adoption of both invasive and non-invasive airway devices across care settings. Industry publications and annual reports have consistently highlighted that procedural standardization, improved training protocols, and technological refinements in airway visualization are reinforcing market penetration.

Moreover, global health authorities and hospital procurement strategies are prioritizing enhanced airway safety measures, creating opportunities for novel devices with integrated sensors and single-use components to mitigate cross-contamination risks.

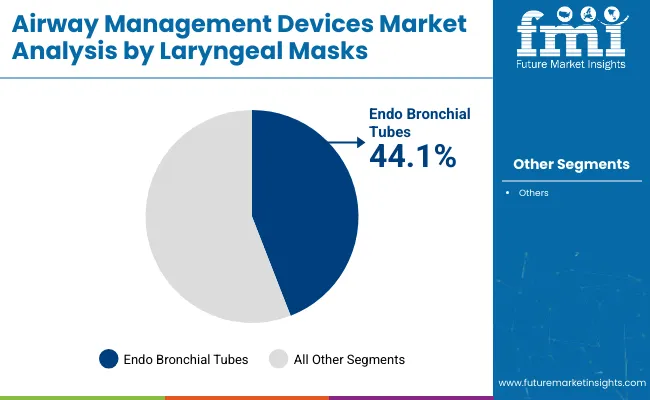

In 2025, endo bronchial tubes are expected to account for 44.1% of the airway management devices market revenue. This segment's dominance is primarily due to the increasing demand for effective airway management solutions in critical care and surgical settings.

Endo bronchial tubes are preferred for their ability to isolate the lungs during surgeries and facilitate mechanical ventilation for patients undergoing thoracic or abdominal procedures. Their ability to provide secure ventilation in patients with compromised airways, such as those with severe respiratory distress or during long-duration surgeries, has driven their widespread adoption.

Additionally, advancements in tube materials and design have improved patient comfort and ease of insertion, further promoting their use in hospitals and intensive care units. Moreover, the growing focus on patient safety and the development of more advanced and flexible devices to reduce complications has contributed to the segment’s strong market position.

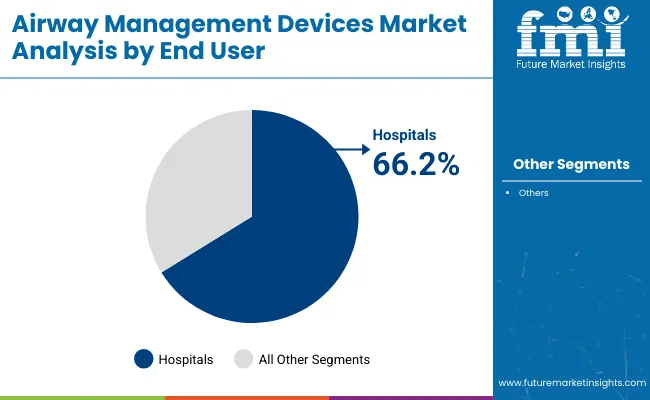

Hospitals accounted for a dominant 66.2% revenue share in 2025, positioning them as the primary end users in the airway management devices market. This leadership is attributed to the high frequency of elective and emergency procedures requiring airway control.

Adoption has been underpinned by comprehensive resuscitation capabilities, specialized anesthesiology teams, and dedicated critical care units in hospital settings. Procurement policies emphasizing readiness for airway emergencies and compliance with accreditation standards have further supported demand.

Investments in operating room infrastructure and the surge in ICU admissions for respiratory distress have necessitated consistent stocking of advanced airway devices. Additionally, hospitals have prioritized training and simulation-based skill development to maintain clinical competence, thereby strengthening reliance on a diverse portfolio of airway solutions. This trend is projected to persist as hospitals expand their procedural volumes and upgrade equipment inventories to align with international safety protocols.

Risk of infection, skill-dependent performance, and cost barriers in resource-limited settings

Technology has not yet removed the risk associated with airway management devices such as airway trauma and nosocomial infection, most commonly seen with reusable devices. Trained personnel are required for correct positioning. Consequently, usage and outcomes are skill-dependent, especially in emergencies or rural settings.

Advanced airway devices are not readily available in many low-income regions, wherein single-use devices are quite costly to curb market entry. Access to essential airway equipment and training worldwide is, according to WHO, a great advance toward universal emergency care.

Video-assisted devices, disposable innovations, and integrated airway monitoring

The airway management devices market is rapidly expanding, benefitting not only from improved view of the airway but also from the possibility of training with the device or an improved success rate at intubation. Disposable and antimicrobial-coated products for airways are emerging preferences to reduce infection risk and increase reprocessing workflow credits.

Integrated airway monitoring systems are being utilized in the intensive care units and operating rooms to enhance patient safety and ventilation control by measuring parameters such as pressure, flow, and CO₂. According to the WHO, the scaling up of airway management tools is a critical measure to strengthen surgical and emergency response systems in global health.

The market for airway management device in the United States is steadily growing on account of high surgical volume with emergency care cases and chronic respiratory conditions like COPD and sleep apnea. Hospitals and EMS providers are adopting video laryngoscopes, supraglottic airway devices, and disposable intubation aids with the intent of enhancing safety and reducing chances of infection.

By the standards set by the OECD, single-use and readily portable airway devices are in the limelight for enhancement in readiness for critical care and field scenarios in the USA. Innovation in real-time visualization and sensor-integrated airway also increased market credibility.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.6% |

Airway management devices in the UK get support from the NHS, which is focused on promoting advanced prehospital airway and anesthetic airway tools. Demand for fiberoptic and video-assisted intubation systems continues to rise in both routine and emergency settings.

NHS priorities for thromboembolism and respiratory care during pandemics, according to OECD, have accelerated procurement of flexible and hygienic airway products. New airway technologies are also being facilitated through training programs for paramedics and anesthetists.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.2% |

The EU airway management devices market is set to advance with patient safety, ICU care, and standardizing intubation practices across hospitals becoming increasingly important. Germany, France, and the Netherlands are the key supraglottic devices and hybrid laryngoscopy system adopters.

According to the UN, EU-funded health programs are increasing the benefit of respiratory innovation, especially with respect to critical care and post-operative ventilation. Increasing infection control policies and rising surgical demands within all countries are further driving the demand for single-use airway devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.4% |

The airway management devices market of Japan is experiencing some growth, although at a considerably slower rate, supported by an aging population and high demand for emergency and perioperative care. Hospitals are employing newer laryngeal mask airway and video laryngoscope technology to enhance intubation success rates for elderly patients.

The OECD states that Japan's focus on clinical innovation and hospital preparedness makes one more likely to adopt smart airway management systems. Manufacturers, on their part, are developing various devices in consideration of ergonomics and weight to meet needs in hospitals and ambulances.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

The South Korean airway management devices market is witnessing expansion with mounting investments in critical care infrastructure and trauma response systems. Portable airway kits and integrated suction-intubation systems have been deployed by leading hospitals and emergency medical services.

According to the OECD, interventions by the South Korean government are strengthening prehospital emergency care through public health initiatives and advanced clinical training, and that is providing further impetus for the demand for trustworthy airway devices. Local companies are innovating video laryngoscopes and antimicrobial-coated devices for hospital and field applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.5% |

The airway management devices market is shaped by steady technological improvements, a growing emphasis on patient safety, and rising procedural volumes in emergency and elective surgeries. Leading companies are innovating with single-use devices, video laryngoscopes, and supraglottic airway solutions to reduce infection risks and improve visualization during intubation.

The trend toward prehospital and ambulatory care settings have accelerated the demand for portable, easy-to-use devices. Companies are pursuing product portfolio expansions, regulatory clearances, and distribution partnerships to strengthen their geographic reach and respond to evolving clinical guidelines. Additionally, increasing awareness of difficult airway management protocols and training initiatives by medical societies are supporting adoption across hospitals and emergency services.

Key Development

In 2025, Asahi Kasei Medical will begin sales of AW Technologies' TrachFlush® endotracheal tube cuff inflator in Japan following its notification completion.

In 2024, ICU Medical's has issued an urgent field safety notice for a potential defect in specific Bivona neonatal/pediatric (Aire-Cuf, TTS, Uncuffed, Mid-Range) and adult (Aire-Cuf, TTS, Cuffless FlexTend, TTS FlexTend) tracheostomy tubes.

The overall market size for the airway management devices market was approximately USD 1,779.1 million in 2025.

The airway management devices market is expected to reach approximately USD 2485.5 million by 2035.

The demand for airway management devices is rising due to the increasing prevalence of respiratory disorders and advancements in airway management technologies

The top 5 countries driving the development of the airway management devices market are the United States, Germany, China, Japan, and the United Kingdom.

Supraglottic airway devices and hospital-based usage are expected to command significant shares over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Airway Catheters Market Analysis - Growth & Industry Insights 2025 to 2035

Airway Clearance Devices Market Growth - Trends & Forecast 2025 to 2035

Fairway Mowers Market

Positive Airway Pressure Devices Market Size and Share Forecast Outlook 2025 to 2035

Artificial Airway Holders Market

Tracheal Tubes and Airway Products Market Analysis - Growth & Forecast 2025 to 2035

Continuous Positive Airway Pressure (CPAP) Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

UK Continuous Positive Airway Pressure (CPAP) Market Trends – Growth, Demand & Analysis 2025-2035

India Continuous Positive Airway Pressure (CPAP) Market Trends – Size, Share & Growth 2025-2035

China Continuous Positive Airway Pressure Devices Market Outlook – Share, Growth & Forecast 2025-2035

Germany Continuous Positive Airway Pressure (CPAP) Market Insights – Size, Trends & Forecast 2025-2035

United States Continuous Positive Airway Pressure (CPAP) Market Report – Trends, Demand & Forecast 2025-2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA